Current Report Filing (8-k)

March 19 2015 - 5:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 19, 2015

THE BANK OF NEW YORK MELLON CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35651 |

|

13-2614959 |

| (State or other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| One Wall Street

New York, New York |

|

10286 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 495-1784

Not Applicable

(Former

name or former address if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On March 19, 2015, The Bank of New York Mellon Corporation (the “Company” or

“BNY Mellon”) announced that it has resolved substantially all of the foreign exchange (“FX”)-related actions currently pending against the Company, resulting in a total of $714 million in settlement payments, which are fully

covered by preexisting reserves.

The Company has reached settlements with the U.S. Department of Justice (“DOJ”) and the New York Attorney

General (“NYAG”), which fully resolve the DOJ’s and NYAG’s October 2011 lawsuits regarding standing instruction FX transactions in connection with certain custody services BNY Mellon provided prior to early 2012 to its custody

clients. Under the terms of the settlements, the Company will pay each of the DOJ and NYAG $167.5 million and provide functionality allowing customers to compare pricing for the Company’s “defined spread” and “session range”

standing instruction FX products.

In addition, the Company reached settlements with the plaintiffs in the outstanding customer class actions and the U.S.

Department of Labor (“DOL”) related to standing instruction FX transactions. Under the class action settlement, which is subject to court approval, the Company will pay $335 million. The Company will pay an additional $14 million to the

DOL.

The Company has reached a settlement in principle on a standing instruction-related matter with the Securities and Exchange Commission

(“SEC”). Under the terms of the agreement with the SEC staff, the Company will pay a $30 million penalty. This resolution is subject to approval by the Commission.

A copy of the Company’s press release relating to the settlements is attached as Exhibit 99.1 to this Current Report on Form 8-K. The contents of the

Company’s website referenced in the exhibit are not incorporated into this Current Report on Form 8-K.

The information presented in this Current

Report on Form 8-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, which may be expressed in a variety of ways, including the use of future or present tense

language, relate to, among other things, court approval. These statements are based upon current beliefs and expectations and are subject to significant risks and uncertainties (some of which are beyond BNY Mellon’s control). Factors that could

cause BNY Mellon’s results to differ materially can be found in the risk factors set forth in BNY Mellon’s Annual Report on Form 10-K for the year ended December 31, 2014 and its other filings with the Securities and Exchange

Commission. All statements in this Current Report on Form 8-K speak only as the date of this filing and BNY Mellon undertakes no obligation to update the information to reflect events or circumstances that arise after that date or reflect the

occurrence of unanticipated events, except as required by federal securities laws.

| ITEM 9.01. |

FINANCIAL STATEMENTS AND EXHIBITS. |

(d) EXHIBITS

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release dated March 19, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

The Bank of New York Mellon Corporation

(Registrant) |

|

|

|

|

| Date: March 19, 2015 |

|

|

|

By: |

|

/s/ Craig T. Beazer |

|

|

|

|

Name: |

|

Craig T. Beazer |

|

|

|

|

Title: |

|

Secretary |

EXHIBIT INDEX

|

|

|

|

|

| Number |

|

Description |

|

Method of Filing |

|

|

|

| 99.1 |

|

Press Release |

|

Filed herewith |

Exhibit 99.1

|

|

|

| News Release |

|

|

|

|

|

|

|

| Contacts: |

|

Media |

|

Analysts |

|

|

Kevin Heine |

|

Valerie Haertel |

|

|

+1 212 635 1569 |

|

+1 212 635 8529 |

|

|

kevin.heine@bnymellon.com |

|

valerie.haertel@bnymellon.com |

BNY Mellon Settles Outstanding FX-Related Actions

Fully Resolves 2011 DOJ and NYAG Lawsuits and Plaintiffs’ Customer

Class Actions; Settlements Covered by Existing Reserves

NEW YORK, March 19, 2015 – The Bank of New York Mellon Corporation (NYSE: BK) today announced that it has resolved substantially all of the foreign

exchange (FX)-related actions currently pending against the company.

The company has reached a series of settlement agreements with the U.S. Department

of Justice (DOJ), the New York Attorney General (NYAG), the U.S. Department of Labor, the U.S. Securities and Exchange Commission and private customer class actions. Collectively, these settlements fully resolve the lawsuits and enforcement matters

pursued by these parties relating to certain of the standing instruction FX services that BNY Mellon provided to its custody clients prior to early 2012.

“We are pleased to put these legacy FX matters behind us, which is in the best interest of our company and our constituents. We continue to improve our

product offerings to ensure they are meeting client demand and positioning clients to succeed in an increasingly complex financial environment,” the company said.

The company has agreed to pay a total of $714 million to resolve these matters, subject to required approvals. The total settlement amount is fully covered by

pre-existing legal reserves. The DOJ and NYAG will each receive $167.5 million. The Department of Labor will receive $14 million and the Securities and Exchange Commission, with which the company has reached a settlement in principle, will receive

$30 million. The company has agreed to pay $335 million to settle the customer class action litigation.

BNY Mellon is a global investments company

dedicated to helping its clients manage and service their financial assets throughout the investment lifecycle. Whether providing financial services for institutions, corporations or individual investors, BNY Mellon delivers informed investment

management and investment services in 35 countries and more than 100 markets. As of Dec. 31, 2014, BNY Mellon had $28.5 trillion in assets under custody and/or administration, and $1.7 trillion in assets under management. BNY Mellon can act as a

single point of contact for clients looking to create, trade, hold, manage, service, distribute or restructure investments. BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation (NYSE: BK). Additional information is available

on www.bnymellon.com, or follow us on Twitter @BNYMellon.

*****

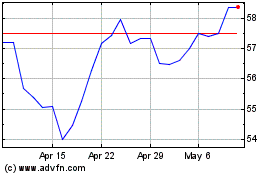

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

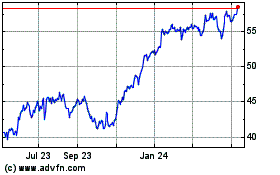

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024