Bob Diamond to Return to U.K. Banking With Panmure Gordon Buy -- Update

March 17 2017 - 4:39AM

Dow Jones News

By Ian Walker

LONDON -- Former Barclays PLC Chief Executive Bob Diamond is to

return to U.K. banking by joining forces with a Qatari investment

group to buy 140-year-old stockbroker Panmure Gordon & Co.

PLC.

Panmure on Friday said it had accepted a GBP15.5 million ($19.2

million) cash offer from Ellsworthy Ltd., an investment vehicle

formed by Mr. Diamond and Qatar investment bank QInvest LLC. The

pair will pay 100 pence a share for Panmure, of which QInvest

already owns more than 43%.

Mr. Diamond gained global recognition for building up Barclays's

investment bank, including the lender's bold purchase of parts of

Lehman Brothers at the height of the financial crisis. He became

the U.K. bank's chief executive at the start of 2011 but was forced

to resign in July 2012 amid controversy over manipulation of Libor

interest rates by traders employed by the bank.

Since then, the American investment banker has focused on

African financial group Atlas Mara Ltd., which he helped found in

2013 and floated on the London Stock Exchange, raising money to buy

banks in several African countries. However, that venture has

recently soured, with a share price decline and the departure of

its chief executive.

Panmure largely serves midcap companies listed in London, a

highly competitive market that has consolidated in recent years.

For the year ended Dec. 31, 2015 it reported a pretax loss of

GBP18.9 million and had a record 152 clients. It has since said it

expects to report a profit this year.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

March 17, 2017 04:24 ET (08:24 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

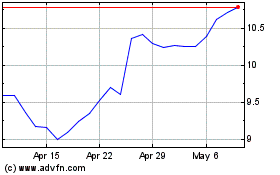

Barclays (NYSE:BCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

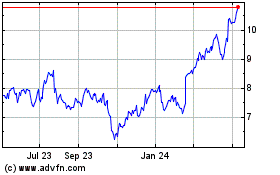

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2023 to Apr 2024