Most European Banks Survive Stress Test

July 29 2016 - 5:10PM

Dow Jones News

European regulators gave most of their banks a clean bill of

health Friday, with only a clutch of lenders struggling to ride out

an economic meltdown.

The European Banking Authority presented results of a test

showing how much capital banks would have left on their balance

sheets after a severe downturn.

At the bottom of the pack of 51 banks sat Italy's Banca Monte

dei Paschi di Siena Spa, confirming that the bank needs to raise

substantial fresh funds. Other major banks that were hard hit by

the test included, UniCredit SpA, Barclays PLC and Deutsche Bank

AG.

The stress-test outcomes didn't include a black-and-white result

for each bank, however. That is because unlike previous European

stress tests, the banks didn't have to meet a specific capital

hurdle to pass the exam. With no set, pass or fail criteria, the

EBA left it up to investors and regulators to interpret the

results.

Broadly, investors were looking for banks to maintain at least

5.5% ratio of top-quality capital on their balance sheets after the

hypothetical economic crash was applied, analysts said.

Monte dei Paschi's capital buffer was totally wiped out by the

scenario in the test. The bank had a minus 2.44% ratio of top

quality capital to total risk-adjusted assets when the economic

shock was applied. Ireland's Allied Irish Banks also came in under

the 5.5% bar with capital ratio of 4.3%. All the other banks came

in at over the 5.5% hurdle.

Of the "systemically important" European banks, Italy's

UniCredit fared the worst with a ratio of 7.1%. The bank is likely

to raise capital later this year, according to a person familiar

with the matter. Barclays, had a capital ratio of 7.3%. Deutsche

Bank AG, whose capital levels are being closely scrutinized, had a

7.8% capital level.

Regulators will use the numbers to calculate each bank's capital

requirement later in the year. Underperforming banks could be

guided to hold more capital by regulators, but authorities are

unlikely to force wide-scale recapitalizations. Alternatively,

banks could face tougher "qualitative measures" such as improving

risk controls.

The European Central Bank and the Bank of England have in the

past said that their banking systems have enough capital. In total

the banks in the test raised €180 billion ($199 billion) of capital

between the end of 2013 and the end of 2015. The issue now is how

to clear a mound of bad loans festering on bank balance sheets.

This year's stress tests didn't include struggling Greek and

Portuguese banks. Smaller lenders are being privately tested by

regulators and the results won't be made public.

Write to Max Colchester at max.colchester@wsj.com and Jenny

Strasburg at jenny.strasburg@wsj.com

(END) Dow Jones Newswires

July 29, 2016 16:55 ET (20:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

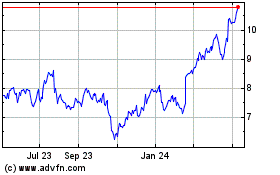

Barclays (NYSE:BCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

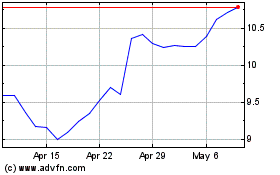

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2023 to Apr 2024