Barclays Profit Takes Hit From Asset Sales -- 2nd Update

July 29 2016 - 4:35AM

Dow Jones News

By Max Colchester

LONDON-- Barclays PLC said first-half net profit slipped nearly

a third as the bank sucked up losses selling down unwanted assets

and put aside cash to cover an uptick in bad loans.

Barclays Chief Executive Jes Staley played down fears that the

bank would be hit by Brexit, saying that he saw "no reason" to

adjust the strategy or the pace of its delivery in the wake of

Britain's vote to leave the European Union.

Shares in the bank rose more than 5% in early trading Friday, as

investors welcomed Barclays' progress in slimming down and

refocusing on its U.K. and U.S. businesses.

The process, which includes selling a stake in its African unit

and exiting much of Europe, has taken a toll on the bank's balance

sheet, generating GBP1.9 billion of pretax losses in the first six

months alone.

The so called "noncore" unit, which houses the extraneous

assets, should be closed by 2017, Mr. Staley said.

Total income was down 9% to GBP11 billion ($14.49 billion) in

the first six months of the year. Net profit fell to GBP1.1 billion

from GBP1.6 billion the year before.

The British bank's bottom line was also hit by rising

impairments in its credit card business and lending to oil and gas

companies. The bank tweaked the way its credit card models

impairments, which resulted in a 36% rise in impairments at its

Barclaycard unit. The bank put aside an extra GBP400 million to

compensate customers sold insurance products they didn't need.

Income at its U.K. retail business was flat for the year, with a

growth in personal banking hit by falling revenue at its profit

engine credit card business. Barclays' corporate and investment

bank saw profit before tax down 16% as revenue in equities slumped

and costs increased.

Nevertheless the investment bank held up better than many

analysts expected and the corporate and international unit beat

analysts' expectations.

The bank has been touted as a major loser from the Brexit vote

as its retail operations could come under pressure from a slowing

economy and it may have to shuffle its investment bank to service

some European clients.

Mr. Staley played down those worries, saying that dealing with a

rule forcing the segregation of investment and retail banking was

far more onerous than having to move operations to a subsidiary in

the EU. Nevertheless the bank raised a number of concerns including

a bigger risk of recession, higher trading volatility and fear that

leaving the EU could curtail the bank's access to the continent's

"talent pool." Demand for loans fell after the vote, Mr. Staley

said. "There has been a shock in demand for credit," he said.

"Let's see how it plays out over the next couple of months"

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

July 29, 2016 04:20 ET (08:20 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

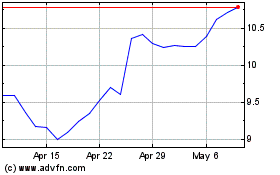

Barclays (NYSE:BCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

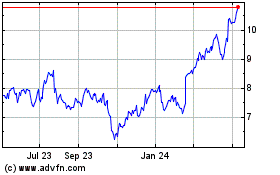

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2023 to Apr 2024