Oil Down on Bearish Outlook

July 25 2016 - 7:00AM

Dow Jones News

Oil prices gave up ground on Monday, dragged lower by a more

bearish supply and demand outlook.

The global benchmark, Brent, fell 0.5% to $45.45 a barrel. Its

U.S. counterpart, West Texas Intermediate, shed 0.35% to $44.04 a

barrel.

A buildup in oil products stockpiles has helped drag prices

below $45 a barrel. Demand from the traditional centers in Asia is

waning, as domestic production in China increases.

"Market sentiment is gloomy," according to Germany-based

Commerzbank. "Financial investors are continuing to retreat from

the oil market and in so doing are generating increased selling

pressure."

Global oil demand for the third quarter of this year is 66%

lower than it was in the third quarter of 2015, according to

London-based Barclays bank. Slower economic growth has been the

major contributor.

On the supply side, active oil rigs in the U.S. are climbing,

spurring market concerns over the resilience of shale oil. On

Friday, industry group Baker Hughes Inc. reported that the U.S. oil

rig count climbed by 14 to 371, marking a fourth straight weekly

increase.

Over the weekend, Iran began drawing on its floating storage

crude reserves of around 35 million barrels, indicating that supply

in the country is beginning to draw down. Gasoline consumption hit

monthly highs in July, increasing the demand for crude in Iranian

refineries.

But elsewhere, the picture is more bearish. U.S. gasoline stocks

grew 900,000 barrels last week while China's exports of gasoline in

June surged to a historical high.

"[The growth in distillate] was to be expected as many refiners

were producing in a full swing while we are coming to the end of

the driving season," said Avtar Sandhu, Asian commodities analysts

at Phillip Futures, who suggests prices could test support at

around the $41 level.

Investors this week will be keeping a close eye on two major

central banks—the Bank of Japan and the U.S. Federal Reserve—for

their decisions on interest rates and outlooks on their respective

countries.

The U.S. Federal Open Market Committee will meet on July 26 to

27, followed by the Bank of Japan's policy meeting on July 28 and

29.

Kevin Baxter contributed to this article.

Write to Miriam Malek at Miriam.Malek@wsj.com and Jenny W. Hsu

at jenny.hsu@wsj.com

(END) Dow Jones Newswires

July 25, 2016 06:45 ET (10:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

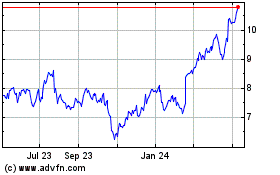

Barclays (NYSE:BCS)

Historical Stock Chart

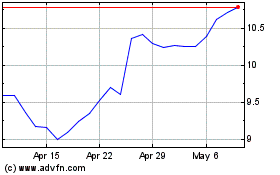

From Mar 2024 to Apr 2024

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2023 to Apr 2024