China's Uber Rival Didi Scores $7 Billion in Fundraising

June 15 2016 - 7:00AM

Dow Jones News

HONG KONG—China's homegrown competitor to Uber Technologies Inc.

has raised $7 billion in its latest fundraising effort, giving it a

host of powerful allies including Apple Inc. to fend off the global

ride-hailing champion locally.

Didi Chuxing Technology Co., the country's biggest ride-sharing

company, closed a $4.5 billion fundraising round that attracted $1

billion from Apple and $600 million from China's top life insurer,

according to people familiar with the situation. The round values

the company at more than $25 billion, they said.

In addition, Didi has secured a $2.5 billion debt package from

China Merchants Bank Co., according to one of the people.

The fundraising will leave Didi flush with cash to help it

battle Uber in China's competitive ride-hailing market. The

ride-sharing company will now have more than $10 billion in cash on

hand following the new fundraising round through equity and debt,

according to one of the people.

Uber and Didi are duking it out for China's potentially

lucrative ride-sharing market by spending huge sums to attract

drivers and passengers to their competing services. The battle

between Uber and Didi for global investment allies has only

intensified in recent months. Uber raised $3.5 billion from the

investment arm of Saudi Arabia earlier this month as part of a $5

billion financing round, the largest to date raised by a private,

venture-backed company.

Uber is separately turning to the so-called leveraged-loan

market for the first time to raise as much as $2 billion, The Wall

Street Journal reported. Uber has hired Morgan Stanley and Barclays

PLC to sell a so-called leveraged loan of $1 billion to $2 billion

to institutional investors in the coming weeks, according to people

familiar with the matter.

While Uber's business in China has expanded rapidly over the

past year, the company still faces an uphill battle against Didi,

which not only has a larger share of the private car-hailing market

where Uber competes, but also dominates the country's taxi-hailing

segment.

Didi, which was formed last year by the merger of two rival

Chinese taxi-hailing apps, is backed by powerful domestic and

foreign investors. Its lengthening list of investors includes two

of China's biggest internet companies—e-commerce company Alibaba

Group Holding Ltd. and social-network company Tencent Holdings

Ltd., as well as Apple. Tencent and Alibaba both put additional

money into the latest fundraising round, according to people

familiar with the situation, without disclosing the exact

amount.

Other big investors in the round included several Chinese banks

and insurance companies that made investments of more than $100

million each, according to one of the people.

As the two biggest ride-hailing companies scour the globe for

capital, a few of the same investors are putting money into both

companies.

China Life Insurance Co., the state-owned insurer that this

month invested in Didi, had already invested in San Francisco-based

Uber last year. China-based investment firm Hillhouse Capital Group

was an early investor in Didi but also led a convertible-bond deal

to invest in Uber's global operations. Similarly, Tiger Global

Management LLC has backed Didi in China and has invested in Uber's

global operations.

Competing startups dislike overlapping shareholder bases because

the companies often share confidential strategy and financial

results with investors. It is unclear what arrangements Didi and

Uber have made for those investors.

Write to Juro Osawa at juro.osawa@wsj.com and Rick Carew at

rick.carew@wsj.com

(END) Dow Jones Newswires

June 15, 2016 06:45 ET (10:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

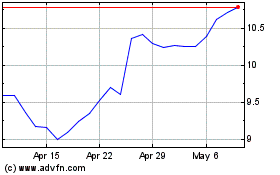

Barclays (NYSE:BCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

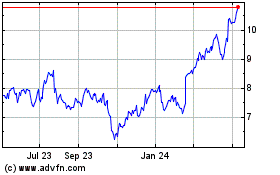

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2023 to Apr 2024