Credit Suisse, Barclays to Settle 'Dark Pool' Investigations -- 3rd Update

January 31 2016 - 2:19PM

Dow Jones News

By Bradley Hope and Jenny Strasburg

Credit Suisse Group AG and Barclays PLC are set to agree to pay

$154.3 million combined to settle investigations by regulators into

their "dark pools," officials said.

The record settlements are with the Securities and Exchange

Commission and New York Attorney General. A news conference is

scheduled for Monday.

"These cases mark the first major victory in the fight against

fraud in dark-pool trading that began when we first sued Barclays:

coordinated and aggressive government action, admissions of

wrongdoing, and meaningful reforms to protect investors from

predatory, high-frequency traders," said Eric T. Schneiderman, the

New York Attorney General, in a statement issued after The Wall

Street Journal published a report about the planned

announcement.

"We will continue to take the fight to those who aim to rig the

system and those who look the other way."

Representatives of the SEC, Barclays and Credit Suisse declined

to comment.

The agreements are the biggest and second-biggest settlements

related to dark pools, which are privately run stock-trading venues

that have come under greater scrutiny in the past several years.

Regulators and other critics have accused dark pools of providing

unfair advantages to professional traders at the expense of big

institutions.

The biggest settlement thus far is the $20.3 million New York

brokerage Investment Technology Group Inc. agreed to pay the SEC in

August. ITG admitted wrongdoing in its case.

Both banks made "false statements and omissions in connection

with the marketing of their respective dark pools and other

high-speed electronic equities trading services," the New York

Attorney General said in his press release.

Under the settlement, Credit Suisse will pay a total of about

$85 million--$30 million to each of the SEC and New York Attorney

General and $24.3 million in disgorged profits.

The settlement comes less than a month after Daniel Mathisson,

Credit Suisse's U.S. head of stock trading, said he was leaving the

firm. His group oversaw the bank's dark pools.

Barclays will pay about $70 million to settle charges that

include those brought in a high-profile fraud case by the New York

Attorney General against Barclays in connection with its dark pools

in June 2014. In that case, the New York Attorney General alleged

Barclays misled clients about the extent of high-frequency trading

in its dark pool, called LX.

Barclays admitted to misleading investors and violating

securities laws, and agreed to have an independent monitor review

operations of its electronic-trading division, according to the New

York Attorney General.

Both cases center in part on whether the banks misled some

clients about how the bank-owned trading venues prioritized certain

buy and sell orders, including whether they withheld information

that might have led clients to route orders elsewhere, people

familiar with the probes said.

Wall Street firms have competed fiercely for market share in

stock trading, which generates fees and helps banks garner

information about the markets and sell other products to

clients.

Issues of disclosure and whether shares were priced according to

stock-market regulations factored into the regulators'

investigations, the people said.

Dark pools originally were created to help buyers and sellers

swap shares with greater anonymity--and sometimes in greater

size--than they could on the stock market. They also help banks cut

costs because they don't have to pay fees to stock exchanges when

trades are executed in their own dark pools.

Aruna Viswanatha and Christopher M. Matthews contributed to this

article.

Write to Bradley Hope at bradley.hope@wsj.com and Jenny

Strasburg at jenny.strasburg@wsj.com

(END) Dow Jones Newswires

January 31, 2016 14:04 ET (19:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

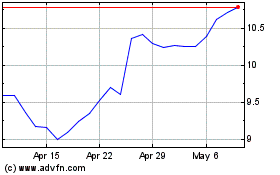

Barclays (NYSE:BCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

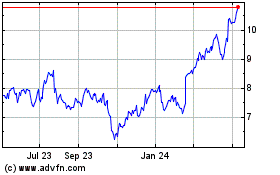

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2023 to Apr 2024