Barclays Suggests 2016 Returns Will Be Mediocre and Recommends Investors Stay Neutral on Risk Assets

November 12 2015 - 8:30AM

Business Wire

Global Outlook report sees elevated valuations as priced for a

benign financial environment, which could turn more challenging as

the year progresses

Growth in advanced economies is on solid ground, albeit

disappointing by historical standards, and the likelihood of a

major blow to risk assets in the near term is limited, according to

Barclays’ latest flagship quarterly research publication Global

Outlook: Curb your enthusiasm. However, elevated asset prices imply

modest potential upside, especially as the current benign

environment is unlikely to persist as 2016 progresses.

“We do not expect the early stages of the Fed hiking cycle to

disrupt global interest rate or equity markets,” said Ajay

Rajadhyaksha, Head of Macro Research. “However, financial markets

are priced for a benign financial environment – steady growth, low

inflation and loose monetary policy. This is unlikely to persist as

2016 progresses. We suggest that investors start the year neutral

on risk assets, but recommend keeping some powder dry to take

advantage of possible risk-off episodes, such as the China-linked

sell-off we saw in August.”

The likelihood of a cyclical recovery in corporate earnings

appears higher in continental Europe than in the more cyclically

advanced US, UK and Japan. But outperformance in European equities

will likely be offset by local currency weakness. Moreover, it may

be too early to forecast a definitive end to Emerging Market equity

underperformance.

With fixed income returns challenged by the start of Fed rate

hikes, the belly of the risk curve offers the most attractive

opportunities. Investment grade credit appears priced for too

pessimistic an outcome and offers the most attractive risk-return

trade-off. While Emerging Market credit as an asset class will be

challenged by rising defaults and worsening technical conditions,

there may be opportunities in select US dollar Emerging Market

credit.

Other recommendations in the Global Outlook include:

- The US dollar is likely to have another

strong year, as policy divergence between the Fed and other central

banks increases. The Euro and many Emerging Market currencies are

likely to weaken against the US dollar, but not the Japanese

yen.

- Safe-haven duration markets are likely

to remain range-bound; we expect the 10-year Treasury to trade

between 2.1% and 2.6%, and 10-year bunds between 0.4% and

0.9%.

- Despite fears expressed by some

investors, a global recession remains unlikely, given the continued

tailwinds behind the global consumer – low inflation, easy

financial conditions and tighter labor markets.

Barclays’ Global Outlook report, published quarterly, provides

an assessment of all major economies and markets, and outlines

recommendations for investors.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151112005748/en/

BarclaysJames White, +44 (0) 20 7773

1782james.xa.white@barclays.comorAndrew Smith, +1 212 412

7521andrew.x.smith@barclays.com

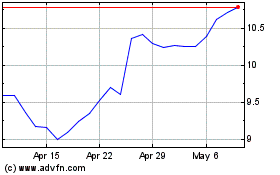

Barclays (NYSE:BCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

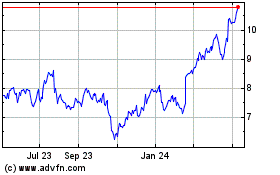

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2023 to Apr 2024