By Paul Ziobro

Best Buy Co. posted results for the latest quarter that suggest

it halted a long sales slump, easing fears about its ability to

lure shoppers amid a long battle with Amazon.com Inc. and other

online rivals.

On Tuesday, the Richfield, Minn.-based retailer posted a 24%

increase in domestic online sales for the second straight quarter,

helping nudge up overall revenue in the quarter ended July 30.

Investors cheered, sending shares up 20% to $39.23, their highest

close since March 2015.

While shoppers aren't flocking to its stores for CDs and

flat-screen televisions like they once did, the electronics

retailer has begun a long-promised turnaround by closing

underperforming stores and capturing more business that shifted

online.

Unlike Macy's Inc. or Wal-Mart Stores Inc., which are now

feeling the pinch of clothing and food sales moving online, Best

Buy long ago ceded a large chunk of sales to e-commerce rivals. Its

comeback is built on a lift from fewer store-based rivals, higher

demand for gadgets like Fitbit trackers and replacement sales of

expensive items like refrigerators and washing machines.

The gains came despite a weak period for consumer electronics.

The Commerce Department reported sales at electronics and appliance

stores fell 3.9% in the second quarter, and retailers including

Target Corp. said their electronics businesses were weak.

Best Buy's fiscal second quarter profit jumped 20% to $198

million as revenue edged up a fraction to $8.53 billion. It also

raised its full-year sales outlook to an increase of up to 1%, from

flat.

Sales remain 20% below their 2010 peak of $49 billion, as the

company has retreated from Europe and struggled to get customers

into its U.S. stores. But while store sales have been shrinking,

Best Buy has carved web sales inroads.

Mark Huron, a retired electrical engineer from Arlington

Heights, Ill., uses Bestbuy.com for smaller items like cable modems

and routers. Recently, he bought an Apple TV streaming device on

the site. He still heads to his local store for big-ticket items,

like a 75-inch Sony television. "If there's a situation where I

want to see it or have a question, I'll go" to the store, the

60-year-old said.

Chief Executive Hubert Joly, who joined Best Buy four years ago

from a hotel and travel company, said the retailer has begun

regaining lost business by offering free two-day shipping on orders

of more than $35 and by improving its online product reviews.

"We don't see it as a zero-sum game," Mr. Joly said of the trade

off between online and in-store sales. Both allow the company a

chance to sell installation services, he said. Best Buy said it

logged more visits to its website last quarter, and the average

size of its online orders rose.

Analysts said the company is benefiting from improvements to its

website and smartphone app, including speeding the checkout process

and offering to match competitors' prices. "It's a combination of

having a big market along with making some strides in e-commerce,"

said UBS analyst Michael Lasser.

The chain gets about 11% of its domestic revenue, or $4 billion

last year, from online sales -- an amount dwarfed by Amazon, which

sells a wider assortment and had about $100 billion from its

e-commerce business last year.

Other large store chains are grappling with a slowdown in their

e-commerce operations. Target's digital sales rose 16% last

quarter, down from 30% a year earlier. At Wal-Mart, global

e-commerce growth slowed for nine straight quarters before

delivering last quarter's 12% gain. The company hopes to better

that with a deal to buy discount retailer Jet.com Inc. for $3.3

billion.

One change in the latest quarter was Best Buy's decision to

narrow the delivery window for major appliances to four hours, down

from 12 hours. "Who wants to sit around and wait for the entire day

for the appliance to show up?" Mr. Joly said, though the change

caused some disruptions in the quarter.

Domestic appliance sales rose 8.2% on a comparable-store basis,

the strongest category for the company. Home Depot Inc. and other

chains also posted strong appliance sales recently as Americans

update their homes, and the category has attracted new entrants

like J.C. Penney & Co.

Best Buy forecasts revenue will grow slightly in the second half

of the year, helped by new products such as the latest Apple Inc.

iPhone. Last fiscal year, Best Buy's revenue fell 2% to $39.53

billion, its sixth straight year of declines.

Chief Financial Officer Corie Barry said declines in tablet

computers and mobile phones weren't as bad as initially projected

for the period. Executives also played down fears that rapid price

declines for ultra high resolution televisions and more selection

at retailers like Target and Wal-Mart would hurt Best Buy.

Mr. Joly said wider product assortment, close partnership with

vendors and better store displays for home theaters should help it

outrun the competition. Plus, prices for so-called 4K TVs have been

falling for some time, as is typical with new technologies.

"There's nothing new here," Mr. Joly said.

Joshua Jamerson contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

August 23, 2016 20:01 ET (00:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

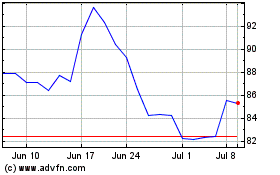

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

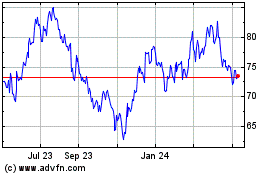

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024