Best Buy Doesn't Live Up to Its Name -- Ahead of the Tape

May 23 2016 - 2:50PM

Dow Jones News

By Steven Russolillo

In the latest retail rout, Best Buy Co. has held up better than

most. But don't expect it to last.

Shares of the electronics retailer are up roughly 9% this year,

far outpacing the S&P 500's small gain. Perhaps most

surprising, Best Buy's stock has been steady over the past few

weeks even as a slew of apparel retailers and department-store

chains, including Macy's Inc., Target Corp. and Kohl's Corp., have

tumbled following disappointing results.

The good times will be tested when Best Buy releases fiscal

first-quarter results Tuesday. The retailer already warned they may

be ugly due to slow demand for mobile phones and tablets. Analysts

polled by FactSet forecast earnings of 35 cents a share, down 6%

from a year ago. Revenue is expected to have dropped 3%.

The question is how much weakness is priced into today's share

price and whether its woes are transitory.

For now, at least, the market appears too optimistic. Chief

Hubert Joly warned the smartphone market was approaching a

saturation point. It is tough to see how sales of appliances and

other big-ticket gadgets will be able to offset weakness in

personal electronics.

It might be tempting to dismiss the fact that Best Buy's shares

appear to have been defying gravity recently. True, they are still

well off last year's highs north of $40 and essentially unchanged

over the past five years. Fetching roughly 11 times projected

earnings over the next 12 months, the stock is relatively cheap.

But it is cheap for a reason.

Consider the broader backdrop: Sales at electronics and

appliance stores dropped 2.4% in the first quarter from a year

before, according to the Census Bureau. And that followed a 3.6%

decline in the fourth quarter, the worst performance since

2009.

Rival home-electronics and appliance retailer HHGregg Inc.

warned last week that its consumer electronics business faces heavy

competitive pressure and will continue to be challenged "for the

foreseeable future." And of course online retailers, notably

Amazon.com Inc., are stealing market share.

In this difficult macro environment, Best Buy's shares have been

among the best of a rotten bunch. It may soon rejoin the pack.

(END) Dow Jones Newswires

May 23, 2016 14:35 ET (18:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

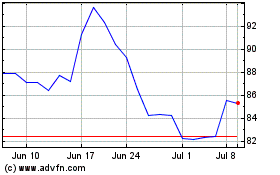

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

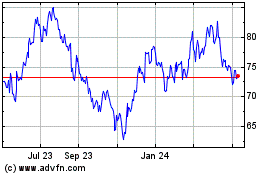

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024