GoPro Reports Loss, Predicts Declining Sales

February 03 2016 - 5:30PM

Dow Jones News

GoPro Inc. swung to a surprise loss in its fourth quarter and

gave disappointing revenue forecasts for its new fiscal year, fresh

signs of trouble for the company as it struggles with weak sales of

its latest wearable camera.

GoPro has been pummeled recently by concerns that the market for

action cameras has peaked and questions over its ability to

diversify into other revenue streams, such as consumer drones.

In the holiday quarter, GoPro also was hurt by disappointing

sales of its latest wearable camera: the Hero 4 Session, an

ice-cubed sized camera it launched in July. The camera didn't sell

well, and by December two rounds of price cuts had reduced its

retail price to $199, half the initial $400 price.

"Growth slowed in the second half of the year, and we recognize

the need to develop software solutions that make it easier for our

customers to offload, access and edit their GoPro content," Chief

Executive Nicholas Woodman said in a news release.

GoPro had said in January that it would book special charges in

the fourth quarter related to the price cuts for Hero 4 and excess

inventory and parts. But the size of the charges were about $20

million higher than its initial projections after GoPro decided to

simplify its Hero 4 product offerings.

Those charges helped drive GoPro to a loss of $34.5 million, or

25 cents a share, from a year-ago profit of $122.3 million, or 83

cents a share. Excluding special items, the company's adjusted

per-share loss was eight cents a share. Analysts had expected flat

adjusted earnings.

Revenue fell 31% to $436.6 million. GoPro in January had

forecast revenue of $435 million, well below its October guidance

for revenue of $500 million to $550 million.

For the current quarter, GoPro forecast revenue of $160 million

to $180 million. Analysts had forecast revenue of $298 million. It

expects full-year revenue of $1.35 billion to $1.5 billion, below

the $1.61 billion analysts had forecast.

Shares were halted in after-hours trading after rising 4.6% to

$10.71 in regular trading Wednesday.

Mr. Woodman started GoPro in 2004 so he and other surfers could

photograph their most outrageous stunts. He assembled a prototype

with hot glue and plastic, using rubber bands and a Velcro

surfboard leash to attach it to his wrist. Mr. Woodman landed his

first big retailer, Best Buy Co., six years later.

Amid the concerns over a slowing market for wearables, the

company plans to release a consumer drone later this year, and last

year it began licensing content shot on its cameras to media

companies—an early step toward nascent plans to become a media

company. But neither of those pursuits has yet generated meaningful

revenue.

GoPro also faces mounting competition from overseas

manufacturers and improving smartphone camera technology. Last

month, the company said it would cut about 7% of its workforce and

reduced its revenue forecast for the fourth quarter.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

February 03, 2016 17:15 ET (22:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

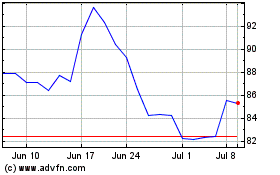

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

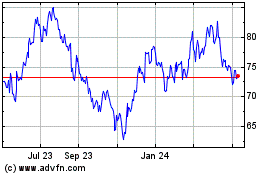

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024