The Tricky Math Of Black Friday Bargains

November 24 2015 - 3:03AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 11/24/15)

By Suzanne Kapner

Shoppers already are scouring stores for the best holiday deals,

but finding true bargains this season has gotten a lot more

complicated.

The layers of discounts, flash promotions and store coupons are

testing consumers' math skills -- and patience. Nancy Haas, of

Lockport, N.Y., says when retailers pile one deal on top of another

it drives her batty. "I'll get to the register and think I'm

getting a certain discount, and realize, no, that's not what it

is," says the 57-year-old substitute teacher, who has taken to

carrying a calculator, pencil and paper with her.

Deep promotions once reserved solely for the holiday season have

become commonplace year-round as retailers battle to attract

shoppers who are still thrifty six years after the recession.

Consumers have become so accustomed to discounts they are reluctant

to shop without them. America's Research Group found that more than

three-quarters of shoppers want discounts of 60% off before making

a purchase.

This Black Friday, the stakes are even higher. Sluggish retail

sales throughout the fall have left excess goods on store shelves

and forced retailers to ramp up promotions beyond what they had

planned.

"The more prices become convoluted, the less retailers will have

to match lower prices offered by their rivals," said Simeon Siegel,

an analyst with Nomura Holdings Inc.

And price has become a moving target. Amazon changed prices 666

times on 180 popular products sold from Nov. 1 through Nov. 19,

according to Market Track, a price-tracking firm. That is a 51%

increase in price volatility compared with similar products sold

during the same period a year earlier. Wal-Mart Stores Inc.'s

prices changed 631 times and Best Buy Co.'s prices changed 263

times on similar products sold during the same period this

year.

Market Track expects fluctuations to speed up through the

holidays. "We're not at the pinnacle of this volatility yet," said

Traci Gregorski, the firm's vice president of marketing. "It will

get even crazier."

Retailers also use a tactic called stackable promotions, where

more than one discount can be applied to the same item, such as

when a $100 sweater is marked 20% off and then an additional 25%

off. People tend to buy more when promotions are layered, because

they often mistakenly think they are getting a better deal. They

add the two discounts together, rather than taking the second

discount off the reduced price, according to Akshay Rao, a

marketing professor at the University of Minnesota. For that $100

sweater, the discount is 40% off, not 45%.

Stackable deals during last year's Black Friday were up about

30% compared with 2013, according to a database of more than

500,000 coupons compiled by website RetailMeNot Inc. Yet, the

stackable deals didn't provide greater savings. Both the layered

deals and the flat deals worked out to discounts of roughly

40%.

Shoppers also have a tendency to get confused over whether a

dollar amount versus a percentage off is the better deal.

Citi Retail Services, a unit of Citigroup that provides

private-label credit cards to retailers, tested two offers this

year with thousands of customers. One gave a fixed $20 off the

first purchase made with a credit card. The other gave 30% off.

Most customers chose the fixed $20 off, even though the 30%

discount provided greater savings because most first purchases

exceed $100, according to Leslie McNamara, Citi Retail Services'

managing director.

Some retailers have been accused of pushing the envelope on the

way they price products. J.C. Penney Co. and Michael Kors Holdings

Ltd. both recently agreed to settle class-action lawsuits that

accused them of using higher base prices to inflate their

discounts. In January, four members of Congress asked the Federal

Trade Commission to investigate potentially deceptive pricing by

outlet stores.

In the case against Penney, lead plaintiff Cynthia Spann claimed

the 40% discount she received on three blouses she bought at $17.99

a piece was misleading because none of them had sold for the

regular retail price of $30 in the preceding three months.

According to the Federal Trade Commission, retailers are

supposed to offer items at regular prices "for a reasonably

substantial period of time" before marking them down. Penney denies

the allegations but earlier this month agreed to settle the case

for $50 million to eliminate the uncertainties and expense of

further litigation.

In September, Michael Kors agreed to pay $4.9 million to settle

claims it used fake manufacturer's suggested retail prices at its

outlet stores to make the discounts appear deeper than they

actually were. The lawsuit contended that many products were made

exclusively for the outlet stores and were never sold at the list

price. Michael Kors says its pricing isn't deceptive.

TJX Cos., Amazon.com Inc., Kohl's Corp. and Nordstrom Inc. are

facing similar lawsuits. A Nordstrom spokeswoman said the lawsuit

had no merit. She said the company is committed to "pricing

integrity" and that items sold at its off-price Nordstrom Rack

stores "are not lesser quality versions of original items."

Representatives for Amazon and Kohl's declined to comment.

A TJX spokeswoman declined to comment on the litigation, but

said the company explains its pricing at its stores and on its

website this way: "Our 'compare at' price is based on our buying

staff's estimate of the regular, retail price at which a comparable

item in finer catalogs, specialty or department stores may have

been sold."

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 24, 2015 02:48 ET (07:48 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

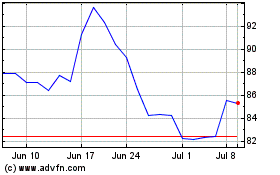

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

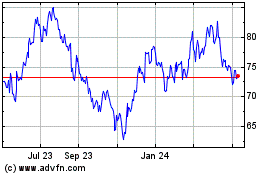

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024