UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) March 28, 2015

BEST BUY CO., INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Minnesota | | 1-9595 | | 41-0907483 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

7601 Penn Avenue South | | |

Richfield, Minnesota | | 55423 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (612) 291-1000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 2.05 | Costs Associated With Exit or Disposal Activities. |

On March 28, 2015, Best Buy Canada, Ltd. ("Best Buy Canada"), a wholly owned subsidiary of Best Buy Co., Inc. ("Best Buy" or the "registrant") announced it is consolidating Future Shop and Best Buy stores and websites under the Best Buy brand. As a result, 66 Future Shop locations will permanently close. In addition, 65 Future Shop stores will be temporarily closed for one week as they begin the transition to the Best Buy brand.

The costs of implementing these changes primarily consist of lease exit costs, employee severance and transition costs, and asset impairments. The registrant expects to incur total pre-tax restructuring charges and non-restructuring impairments in the range of C$250 million to C$350 million (approximately US$200 million to US$280 million), or GAAP diluted earnings per share of US$0.41 to US$0.58. The registrant expects that the majority of these charges will be recorded in the first quarter of fiscal 2016. The total charges include between C$175 million and C$225 million (approximately US$140 million to US$180 million) of cash charges – primarily related to future rent obligations and severance – that will be paid over the next 5 years.

The registrant also expects its GAAP and non-GAAP diluted earnings per share to be negatively impacted in fiscal 2016 in the range of US$0.10 to US$0.20 due primarily to a temporary increase in operational expenses associated with consolidation activities and store disruptions resulting from our investments to support the Best Buy multi-channel customer experience. Due to the transitional nature of the majority of these costs, the registrant does not expect this negative earnings per share impact to continue into future years.

The amount of the restructuring charges noted above are estimates, and the actual charges could vary materially based on a number of factors, including but not limited to the following: foreign currency exchange rate fluctuations, the level of employee terminations; factors relating to real estate, such as sale proceeds and the timing and amount of sublease income and other related expenses; and changes in management’s assumptions.

| |

Item 7.01 | Regulation FD Disclosure. |

On March 28, 2015, Best Buy issued a news release announcing the events described in Item 2.05 above, as well as plans for Best Buy Canada to invest up to C$200 million (approximately US$160 million) to build a leading multi-channel customer experience.

The news release issued on March 28, 2015, is furnished as Exhibit 99 to this Current Report on Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability of that Section unless the registrant specifically incorporates it by reference in a document filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Best Buy’s Annual Report to Shareholders and its reports on Forms 10-K, 10-Q, and 8-K, and other publicly available information should be consulted for other important information about the registrant.

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

The following is furnished as an Exhibit to this Current Report on Form 8-K.

|

| | |

Exhibit No. | | Description of Exhibit |

99 | | News release issued March 28, 2015. Any internet address provided in this release is for information purposes only and is not intended to be a hyperlink. Accordingly, no information at any internet address is included herein. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | BEST BUY CO., INC. |

| | (Registrant) |

| | |

Date: March 30, 2015 | By: | /s/ KEITH J. NELSEN |

| | Keith J. Nelsen |

| | Executive Vice President, General Counsel and Secretary |

Exhibit 99

Best Buy Canada announces the consolidation of Future Shop and Best Buy

stores and websites under the Best Buy brand and a plan to invest up to $200 million to

build a leading multi-channel customer experience

Burnaby BC - March 28, 2015 - To strengthen its position as Canada’s leading provider of consumer electronics products, services and solutions, Best Buy Canada, a subsidiary of Best Buy Co. Inc. (NYSE:BBY) – which owns and operates both Best Buy and Future Shop stores – today announced it is consolidating the Future Shop and Best Buy stores and websites under the Best Buy brand and unveiled an ambitious plan to build a leading multi-channel customer experience.

Best Buy Canada also announced today it has reviewed its real estate footprint to address the fact that a significant number of its Future Shop and Best Buy stores are located adjacent to each other, often in the same parking lot. The result of this review is the closure of 66 Future Shop locations, effective today. Concurrently, an additional 65 Future Shop stores will be temporarily closed for one week as they begin their transition to the Best Buy brand. The company will now have a total of 192 locations across Canada, including 136 large-format stores and 56 Best Buy Mobile stores.

“Currently, 80 per cent of our customers are within a 15 minute drive to a store and, this won’t change.” said Ron Wilson, President and COO of Best Buy Canada. “We will continue to have a strong store presence in all major markets in Canada.”

As a result of this consolidation, approximately 500 full-time and 1,000 part-time positions will be eliminated. The affected employees will receive severance, employee assistance and outplacement support.

“Any decisions that impact our people are never taken lightly; our first priority is to support them through this change,” added Wilson. “I want to express my appreciation to the employees who are leaving for their contributions to Best Buy Canada.”

Providing a seamless customer experience to all Future Shop and Best Buy customers is a key focus throughout this transition. All Future Shop gift cards will be accepted at any Best Buy Canada location and at BestBuy.ca. Existing product orders, service appointments and warranties will continue to be honoured and Future Shop purchases to be returned or exchanged will also be accepted at any Best Buy. For information on store changes and opening dates, customers are encouraged to visit our store locator. Customers with any questions can visit BestBuy.ca/questions or call 1-866-BEST-BUY (1-866-237-8289). Customers who visit FutureShop.ca will be guided to BestBuy.ca.

Looking ahead, investments of up to $200 million dollars will be made in Best Buy stores and BestBuy.ca, to build a leading multi-channel customer experience. This multi-faceted strategy will include: (1) launching major home appliances in all stores; (2) working with our vendor partners to bring their products to life in a more compelling way; (3) increasing our staffing levels to better serve our customers; (4) investing in the online shopping experience, for example by expanding in-store pick-up areas for online customers and launching a ship-from-store program, making in-store inventory available to online customers across the country.

Investor Financial Update

As a result of today’s announcements, Best Buy Co., Inc. expects to increase its capital spending by up to C$200 million (approximately US$160 million) over the next 12 to 24 months. In addition, the Company expects to record restructuring charges and non-restructuring impairments in the range of C$250 to C$350 million (approximately US$200 to US$280 million), or GAAP diluted earnings per share of US$0.41 to US$0.58. This includes C$175 to C$225 million (approximately US$140 to US$180 million) of cash charges – primarily related to future rent obligations and severance – that will be paid over the next 5 years.

The Company also expects its GAAP and non-GAAP diluted earnings per share to be negatively impacted in FY16 in the range of US$0.10 to US$0.20 due primarily to a temporary increase in operational expenses associated with consolidation activities and store disruptions resulting from our investments to support the Best Buy multi-channel customer experience. Due to the transitional nature of the majority of these costs, the Company does not expect this negative EPS impact to continue into future years.

Forward-Looking and Cautionary Statements: This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that reflect management’s current views and estimates regarding future market conditions, company performance and financial results, business prospects, new strategies, the competitive environment and other events. You can identify these statements by the fact that they use words such as “anticipate,” “believe,” ”assume,” “estimate,” “expect,” “intend,” “project,” “guidance,” “plan,” “outlook,” and other words and terms of similar meaning. These statements involve a number of risks and uncertainties that could cause actual results to differ materially from the potential results discussed in the forward-looking statements. Among the factors that could cause actual results and outcomes to differ materially from those contained in such forward-looking statements are the following: macro-economic conditions (including fluctuations in housing prices, oil markets, jobless rates and other indicators), credit market changes and constraints, foreign currency fluctuation, the company’s ability to manage its property portfolio, the impact of labor markets, failure to effectively manage costs or achieve anticipated expense and cost reductions, and disruptions in our supply chain or information technology systems. A further list and description of these risks, uncertainties and other matters can be found in the company’s annual report and other reports filed from time to time with the Securities and Exchange Commission (“SEC”), including, but not limited to, Best Buy’s Annual Report on Form 10-K filed with the SEC on March 28, 2014. Best Buy cautions that the foregoing list of important factors is not complete, and any forward-looking statements speak only as of the date they are made, and Best Buy assumes no obligation to update any forward-looking statement that it may make.

Canada Media Contact:

Elliott Chun, 905-494-7114

Public Relations

echun@bestbuycanada.ca

Or

U.S. Media Contact:

Jeff Shelman, 612-859-4632

Public Relations

Jeffrey.shelman@bestbuy.com

Best Buy Co., Inc.

Investor Contact:

Mollie O’Brien, 612-291-7735

Investor Relations

Mollie.obrien@bestbuy.com

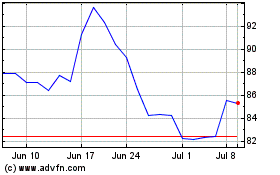

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

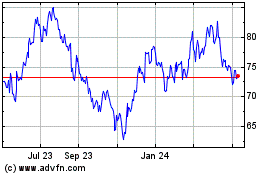

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024