Chicagoland Small Business Owners Feeling

Optimistic About the Year Ahead, Planning for a Robust 2016

Small business owners in the Chicago area are feeling

increasingly optimistic, according to the fall 2015 Bank of America

Small Business Owner Report, a semi-annual study exploring the

concerns, aspirations and perspectives of small business owners in

the Chicago area and around the country.

The report found that 67 percent of Chicago small business

owners expect revenue to increase over the next 12 months, compared

to 61 percent last year. In addition, 60 percent plan to hire in

the coming year, a 12 percentage point increase from just one year

ago.

“Small businesses continue to drive economic growth in our great

city,” said Jim Holmes, Chicago small business banker manager for

Bank of America. “It’s encouraging to see confidence among

Chicago-area entrepreneurs so high, especially when it comes to

hiring and the strength of the economy. We’re looking forward to an

exciting year ahead.”

Not surprisingly, this expected growth demands more capital.

Twenty-eight percent of Chicago small business owners plan to apply

for a loan in 2016, compared to just 18 percent a year ago.

Economic confidence is on the rise, despite lingering

concernsIn addition to confidence in their businesses, Chicago

entrepreneurs have increased assurance in the economy: Half (50

percent) predict the local and national economies will improve over

the next year (compared to 42 and 48 percent a year ago,

respectively), and 39 percent are optimistic about global economic

improvement (versus 32 percent a year ago).

When asked about their top concerns, Chicago small business

owners believe the following factors could potentially impact their

businesses over the next 12 months:

- The possibility of future interest rate

hikes (38 percent).

- The upcoming U.S. presidential election

(37 percent).

- Financial crises in countries abroad

[i.e., China and Greece] (33 percent).

- The possibility of a rising minimum

wage (31 percent).

Chicago entrepreneurs bolstering business with

technologyChicagoland entrepreneurs are not afraid of change,

especially when it comes to new technology. Most (91 percent)

Chicago small business owners think technology has helped their

business, and 83 percent are willing to adopt new technologies into

their businesses.

In recent years, small business owners have adopted new

technology to do the following:

- Accept payments (55 percent).

- Connect with employees (52

percent).

- Optimize websites (45 percent).

- Track inventory (39 percent).

- Create apps for customers (24

percent).

When it comes to cybersecurity concerns, 11 percent of Chicago

small business owners have been a victim of a cybersecurity breach.

In order to better protect themselves and their customers, more

than two-thirds (68 percent) are upgrading their technology at

least once a year. As a result, 59 percent of local business owners

feel prepared for a cybersecurity breach.

Chicago small business owners embrace workplace

2.0Chicago workplace cultures have become more technology and

teamwork focused, with 44 percent saying their workplace has become

more tech savvy and 39 percent saying it has become more

collaborative. However, Chicago small business owners are some of

the least likely to offer telecommuting to employees (41 percent,

versus 47 percent nationally).

Telecommuting aside, Chicago small business owners do offer a

variety of other perks and benefits to their employees including

flexible hours (56 percent) or salary bonuses (50 percent). They

also provide many nontraditional perks, including areas to relax or

unwind, such as nap pods or game rooms (19 percent), office happy

hours (17 percent) or pet-friendly work environments (11

percent).

Chicagoans feeling the holiday spiritChicago small

business owners take care of their people around the holidays. Out

of the nine markets we survey, they are the most likely to close

the office during the holiday season (50 percent, versus 44 percent

nationally), and are more likely to hold holiday parties than most

of their national counterparts (48 percent, versus 45 percent

nationally). Additionally, 45 percent of local business owners

offer flexible hours or vacation time around the holidays to

employees – 12 percent more than their national counterparts.

When it comes to holiday shopping milestones, Black Friday and

Cyber Monday are not significant revenue drivers for Chicago small

business owners. More than half (57 percent) feel that Black Friday

has no impact on their business’ bottom line and 62 percent feel

similarly about Cyber Monday, saying that it is overhyped and has

no impact on their bottom line. These numbers are nearly identical

to the 2014 holiday season.

For an in-depth look at the attributes of the nation’s small

business owners, read the full fall 2015 Bank of America Small

Business Owner Report, and for additional insights from small

business owners in Chicago and across the country, download the

Small Business Owner Report local insights infographic here.

About the Bank of America Small Business Owner ReportBraun

Research, Inc. conducted the Bank of America Small Business Owner

Report survey by phone from August 21 through September 22, 2015,

on behalf of Bank of America. Braun contacted a nationally

representative sample of 1,001 small business owners in the United

States with annual revenue between $100,000 and $4,999,999 and

employing between 2 and 99 employees. In addition, 300 small

business owners were surveyed in each of nine target markets: Los

Angeles, Dallas, Washington, D.C., New York, Boston, Chicago, San

Francisco, Atlanta and Miami. The margin of error for the national

sample is +/- 3.1 percent; the margin of error for the oversampled

markets is +/- 5.7 percent, reported at a 95 percent confidence

level.

The Braun Research survey results conducted on behalf and for

the exclusive use of Bank of America and interpretations in this

release are not intended, nor implied, to be a substitute for the

professional advice received from a qualified accountant, attorney

or financial advisor. Always seek the advice of an accountant,

attorney or financial advisor with any questions you may have

regarding the decisions you undertake as a result of reviewing the

information contained herein. Nothing in this report should be

construed as either advice or legal opinion.

Bank of AmericaBank of America is one of the world's leading

financial institutions, serving individual consumers, small and

middle-market businesses and large corporations with a full range

of banking, investing, asset management and other financial and

risk management products and services. The company provides

unmatched convenience in the United States, serving approximately

47 million consumer and small business relationships with

approximately 4,700 retail financial centers, approximately 16,100

ATMs, and award-winning online banking with 32 million active users

and more than 18 million mobile users. Bank of America is among the

world's leading wealth management companies and is a global leader

in corporate and investment banking and trading across a broad

range of asset classes, serving corporations, governments,

institutions and individuals around the world. Bank of America

offers industry-leading support to approximately 3 million small

business owners through a suite of innovative, easy-to-use online

products and services. The company serves clients through

operations in all 50 states, the District of Columbia, the U.S.

Virgin Islands, Puerto Rico and more than 35 countries. Bank of

America Corporation stock (NYSE: BAC) is listed on the New York

Stock Exchange.

Visit the Bank of America newsroom for more Bank of America

news.

www.bankofamerica.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151117006604/en/

Reporters May Contact:Diane Wagner, Bank of America,

1.312.992.2370diane.wagner@bankofamerica.com

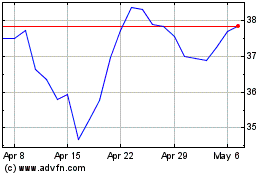

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

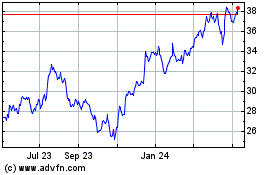

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024