Merrill Lynch Building Up Broker-Training Program

February 03 2010 - 3:48PM

Dow Jones News

Bank of America Corp.'s (BAC) Merrill Lynch plans to inject some

new blood into its brokerage force with hundreds of rookies this

year.

With a new head of its financial adviser-training program,

Practice Management Development, or PMD, Merrill is ramping up its

pipeline for new talent, amid a potential boost in its overall

broker headcount.

The Financial Times reported Wednesday that Bank of America is

targeting a 2,000-broker increase at Merrill's thundering herd of

15,000 advisers. Such a boost would bring Merrill closer to its

main rival, Morgan Stanley Smith Barney, which boasts some 18,100

advisers.

A Merrill Lynch spokeswoman declined to comment specifically on

the reported plan to increase Merrill's broker count, saying "the

bulk of our investments in our business are in capabilities for

clients and existing advisers." She added that the firm looks to

"add quality advisers and bankers, in particular through our

training program."

It's likely that any increase in Merrill's headcount would come

from adding not only trainees, but experienced advisers, which the

firm has actively courted again since last spring. The firm offers

some top-tier brokers 120% of their annual production to join

Merrill Lynch from a rival.

Still, for Merrill and its brokerage rivals, training programs

are launching pads for many advisers, some of whom will become

top-producers in the future.

"Of all the firms, Merrill has been the most organically grown,"

said Bill Willis, chief executive of Willis Consulting, a

recruiting firm focused on the financial services industry.

Mark Benson, head of the U.S. Advisory Practice Management

Development program for Merrill Lynch, said in an interview, "if

you look at the revenue for the advisory force, 80% is from

financial advisers who were trained or hired at the firm."

Benson became head of PMD in August, after a nine-year career at

Bank of America. He recently was head of Bank of America Investment

Services, which was integrated with Merrill Lynch at the end of

October.

Benson says PMD is well regarded throughout the brokerage

industry as it's "the longest running training program on Wall

Street, since the 1940s."

Advisers in PMD must complete a roughly 42-month program, in

which they take part in various online courses and webinars as well

as in-house training. Within that time, brokers spend 36 months in

a production phase, where they are evaluated, in part, on how much

they produce.

Merrill has shortened the duration of the overall program,

Benson says, but at the same time, increased its content. This

change gives trainees more time to complete additional testing and

other assessments, he said.

The increased focus on trainees at Merrill is in sharp contrast

to the hard times that rookie brokers faced in the industry in late

2008. A plunging stock market made it difficult for these advisers

to meet production goals, and many were laid off as their firms cut

costs.

Benson says Merrill is committed to giving trainees, many of

whom are second-career professionals, the best chance to succeed

from "peer-to-peer mentoring" with experienced advisers. Rookie

brokers also have the option to join a team of veterans, which

eases in their transition to the industry.

In additional to Merrill, other firms, including Wells Fargo

& Co. (WFC), are putting a renewed focus on training and

developing new advisers.

A Wells Fargo Advisors spokeswoman says the firm is expecting

40% of the new advisers to be hired to join teams and 60% to build

their own book, adding, "our average trainee has 16 years of

professional experience."

She says Wells Fargo added 1,240 new financial advisers, or

those with under five years of experience, in the last five

years.

A Morgan Stanley Smith Barney spokeswoman reiterated comments

from Morgan Stanley (MS) Chief Executive James Gorman at an

investor presentation Wednesday. Gorman said the brokerage expects

to have 17,500 to 18,500 brokers this year, with a training program

to support that range.

A UBS AG (UBS) spokesman declined to comment for this story. The

firm's new head of Wealth Management Americas, Robert McCann,

recently named a leadership team and is expected to design a plan

to return the brokerage to profitability.

-By Brett Philbin, Dow Jones Newswires; 212-416-2173;

brett.philbin@dowjones.com

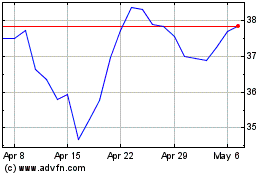

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

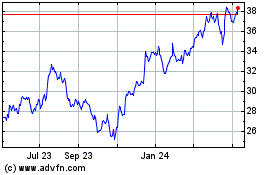

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024