By Robert Wall

HAMBURG, GERMANY--Airbus is studying whether to upgrade its new

A330neo jetliner to blunt the range advantage of a rival plane

built by Boeing Co.

The step is the latest in the move, countermove chess match

between the two biggest plane makers as they jostle for sales in

the highly lucrative market for widebody airplanes. Boeing has

traditionally dominated the high-end of the long-range plane

market.

John Leahy, Airbus's chief operating officer for customers, on

Tuesday said the enhancement to the plane that is also called the

A330-900 would allow airlines to carry more fuel to allow the plane

to fly farther or carry more load at the current range. The effort

is still in the design stage, he said, with no decision made on

pursuing the upgrade.

Mr. Leahy said the upgrade of the A330-900 would help reduce a

range advantage Boeing's 787-9 Dreamliner currently has on the

European plane maker's product. Airbus estimates the Boeing plane

as offering 1,473 miles (2,370 kilometers) of greater range,

although Mr. Leahy said the A330 is far less costly.

The A330-900 is due to enter service at the end of next

year.

Airbus designers are assessing whether they can upgrade the A330

to carry more weight with minimal design changes, Mr. Leahy said.

The company wants to avoid major structural changes, such as adding

a much larger landing gear, which can make changes costly. The

Rolls-Royce Holdings PLC engine to power the plane should be able

to handle the higher weight, he said.

Airbus and Boeing are trying to prioritize modifications to

existing planes to enhance their competitiveness while avoiding

costly new development programs, which also carry high execution

risks. "Our incremental development strategy is taking shape," said

Fabrice Brégier, chief executive of Airbus's plane-making unit.

As part of the continuous back and forth on product

developments, Airbus also continues to study whether it should

launch a bigger version of its largest twin-engine, long-haul

plane, the A350-1000, to take on the Boeing's 777X. The

Chicago-based plane maker's jetliner, which is still in

development, seats more than 400 people or around 40 more than the

model Airbus currently sells.

But a dearth of orders for Boeing's big plane since an initial

flurry of deals has Airbus wondering whether there is sufficient

market potential left to build a more direct competitor. Developing

a larger A350 would cost several billion dollars, Mr. Leahy

said.

"We are convinced we can do the job, but we are not convinced we

should launch it," Mr. Brégier said, because of questions about the

market's size. The company also wants to avoid a new plane

cannibalizing orders for its other models.

The product competition also is playing out at the lower end of

the plane market, where Boeing is assessing changes to its 737 Max

single-aisle product lineup to more forcefully compete against

Airbus's A320neo narrowbodies, which have won a greater share of

orders. Boeing has yet to announce exactly how the single-aisle

family may change.

The efforts by both plane makers to refine their products to win

orders comes as the pace of deals has slowed.

Airbus booked more than 1,000 plane orders in each of the past

three years but has secured only 92 net orders in the first four

months of 2016, feeding investor concern that the boom times for

plane makers are over. Rival Boeing, the world's largest plane

maker by deliveries, has secured 265 net orders this year through

May 24.

Mr. Brégier said its target of order intake at Airbus to be

roughly on par with planes delivered this year was "achievable."

Airbus has committed to shipping a company record of 650 airliners

in 2016. The plane-purchase market remained strong, he said.

One of Airbus's biggest deals announced this year, the sale of

118 jetliners to Iran including 12 A380 superjumbos, is yet to be

completed. Mr. Brégier said the company was making progress

securing the financing and export licenses for the deal, but that

more work needed to be done. He remained optimistic the deal would

be completed this year.

Airbus has been hit by a lack of support from export credit

agencies from the U.K., Germany and France since April after it

submitted flawed documents that failed to disclose the use of some

intermediaries. The issue is under review by the U.K. Serious Fraud

Office.

Mr. Brégier said he was hopeful export credit would be restored

this year. The strong commercial aircraft-financing market is

mitigating any adverse impact on the plane maker, he said.

Airbus's backlog of planes ordered but not yet delivered is

above 6,700 aircraft. That backlog underpins Airbus's plan to boost

production, especially of its popular A320 single-aisle plane.

Airbus is ramping up output to 60 narrow body planes a month in

2019 from the mid-40s today. Mr. Leahy said there was scope to go

even higher, although others at Airbus are urging caution.

Mr. Leahy played down the threat from the newcomer to the

single-aisle market, Canada's Bombardier Inc. which recently won a

landmark order for its CSeries aircraft from Delta Air Lines Inc.

The U.S. carrier in April said it would take 75 of the planes with

options for 50 more, a breakout order for Bombardier that had

struggled to gain wide market acceptance from well-known

airlines.

The pricing the Canadian plane maker offered the U.S. carrier is

unsustainable, Mr. Leahy said.

Bombardier announced a $500 million provision alongside the

Delta deal. It said the provision took into account the sales price

and the production costs. Bombardier said such provisions are

typical meeting early orders for a new jet.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

May 31, 2016 08:51 ET (12:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

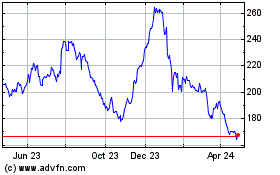

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

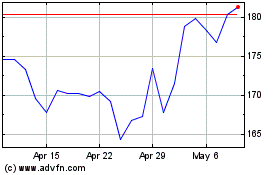

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024