Ahead of the Tape: AutoZone's Slump Won't Last -- WSJ

September 22 2016 - 3:02AM

Dow Jones News

By Steven Russolillo

AutoZone Inc. finds itself in an unusual position: the red

zone.

A summer slump pushed the car-parts retailer's stock into

negative territory for the year as recently as last week. That is

an anomaly: AutoZone shares haven't had a down year since 2002.

They have finished a year in the red only five times since going

public in 1991, surging some 70-fold over that span.

Amid a dearth of buying opportunities in recent years, one might

present itself now ahead of Thursday's fiscal fourth-quarter

results. AutoZone has an impeccable track record and a low bar to

clear. Analysts expect earnings of $14.25 per share for the period

ended in August, up 12% from a year earlier. This estimate was

$14.41 as recently as March. Revenue is expected to have increased

4% to $3.4 billion. And AutoZone has only missed analyst forecasts

once in the past five years, according to FactSet.

Part of the stock's 9% drop since late July appears

macro-driven. AutoZone gets the bulk of its sales from the

"do-it-yourself" market, including many lower-income consumers.

Weak results from the nation's two biggest dollar-store chains --

Dollar General Corp. and Dollar Tree Inc. -- stoked concerns about

spending pressures facing that demographic, which theoretically

would also hurt AutoZone. Increasing online competition and

unfavorable weather also weighed on the stock.

But AutoZone might be entering a cyclical sweet spot. U.S. auto

sales decelerated sharply last month. Auto-parts retailers tend to

benefit when people stop buying new cars and keep their existing

vehicles longer, requiring more repairs. That is particularly true

of lower-income consumers who have enjoyed a credit-driven buying

boom lately. Over the past decade, AutoZone's same-store sales had

its best years in 2009 through 2011, which occurred after new-car

sales slumped. It had flat years in 2007 and 2013 following robust

auto sales.

And considering Autozone's methodical buying of its own stock,

the selloff may be opportune. Since implementing its first

repurchase plan in 1998, AutoZone has bought about $15.3 billion

worth of its own stock, or about 1.4 times its net income over that

span, according to FactSet.

This stock should ultimately find its way back to cruise

control.

(END) Dow Jones Newswires

September 22, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

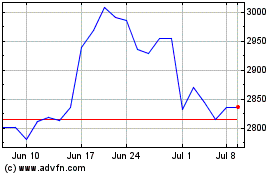

AutoZone (NYSE:AZO)

Historical Stock Chart

From Mar 2024 to Apr 2024

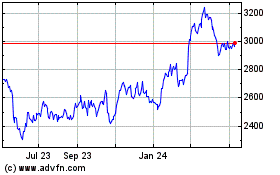

AutoZone (NYSE:AZO)

Historical Stock Chart

From Apr 2023 to Apr 2024