AutoZone Results Top Expectations, Sales Rise -- Update

September 22 2015 - 1:38PM

Dow Jones News

By Lisa Beilfuss

AutoZone Inc. reported better-than-expected profit growth in its

latest quarter, driven by higher sales that were bolstered by

efforts to improve inventory and distribution.

For the Memphis, Tenn., replacement-part retailer, sales at

domestic stores open at least a year rose 4.5%. Steadily lower

gasoline prices as well as consistent weather across much of the

country helped bolster sales, Chief Executive Bill Rhodes said on a

call with analysts.

The company has worked on increasing its inventory levels and

selection, and efforts have included the opening of mega hub

locations and more frequent deliveries to stores. On Tuesday, Mr.

Rhodes said the testing of several inventory initiatives has

concluded and will result in the company's implementation of its

new supply chain strategy over the next few years.

AutoZone expects that its initiatives will eventually result in

a roughly $1,000 to $1,500 a week lift in weekly revenue per store.

In the latest period, AutoZone opened 72 stores to bring its tally

to 5,141.

Meanwhile, inventory per store increased 4.8% from a year

earlier, while overall inventory jumped 9% because of increased

product placement, new stores and last year's acquisition of

import-parts distributor Interamerican Motor Corporation.

Despite higher costs stemming from infrastructure investments,

AutoZone's gross margin edged up modestly to 52.5% from 52.3% a

year earlier. Deutsche Bank analyst Mike Baker noted this week that

the company's margins had been down in four of the last six

quarters leading up to the most recent period, as the company has

invested in needed infrastructure improvements around delivery

frequency and parts coverage.

In all, the company reported a profit of $401.1 million, or

$12.75 a share, up from $373.7 million, or $11.28 a share, a year

earlier. Revenue grew 7.9% to $3.29 billion.

Analysts projected $12.69 in per-share profit of $3.25 billion

in sales, according to Thomson Reuters.

Looking to 2016, Mr. Rhodes said the continued aging of the car

population bodes well for the company's performance, though he

cautioned that headwinds from infrastructure investments in

addition to faster growth in its lower-margin commercial business

would pressure gross margin.

Shares in the company, up about 19% this year, rose 1.9% to

$742.32 in recent trading.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 22, 2015 13:23 ET (17:23 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

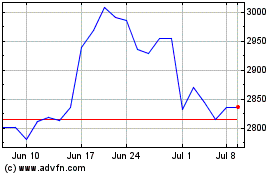

AutoZone (NYSE:AZO)

Historical Stock Chart

From Mar 2024 to Apr 2024

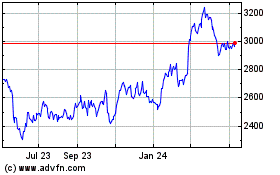

AutoZone (NYSE:AZO)

Historical Stock Chart

From Apr 2023 to Apr 2024