U.S. Finance Executives Lead Global

Expectations for “Substantial” Economic Expansion; North America

Leads Forecast for Anticipated Hiring

U.S. finance executives lead in global rankings on economic

optimism, according to a new survey from American Express

(NYSE:AXP) and Institutional Investor Thought Leadership Studio.

Across the globe, expectations for “substantial” economic expansion

have hit a 10-year high (38%), indicating a surge in optimism. U.S.

expectations for substantial economic expansion lead the world by a

wide margin (69%, up from 23% last year). Seventy percent of

executives worldwide anticipate either “modest” or “substantial”

growth this year, up from 64% last year.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170315005070/en/

With this indication of improving global business prospects,

companies’ spending is forecast to increase in the coming year. The

number of respondents overall anticipating moderate spending and

investment (76%) was up substantially from last year (55%).

Moreover, the proportion of respondents anticipating tightly

controlled spending and investment dropped, from 26% in 2016 to

only 6% in 2017.

The findings in the 2017 Global Business & Spending Outlook

by American Express and Institutional Investor¹ are based on a

sampling of 650 senior finance and other corporate executives of

firms with annual revenues of $500 million or more, located in

North America, Europe, Latin America², Asia and Australia.

Responses were gathered in late November and early December 2016.

The results of this cross-industry study were issued today by

American Express.

“After years of embracing a do-more-with-less mantra, many large

and global companies are ready to shift into growth mode,” said

Brendan Walsh, Executive Vice President, American Express Global

Commercial Payments. “Companies are loosening their purse strings

to take advantage of improved opportunities, while at the same time

focusing on top-line growth, on continuing to improve profitability

and on ensuring they remain competitive.”

Staying Competitive, Factors for Success

Large companies are competing on a highly competitive playing

field that will require a new level of technological and managerial

savvy. More than half (53%) of all finance executives surveyed

identify remaining competitive with other companies as among their

top business goals for 2017, followed by better meeting customer

needs (48%). To stay competitive, the overall polled group of

businesses will focus on a number of areas including:

- Customer Service

- 50% say pressure on their companies to

compete on the basis of customer service has increased

substantially in recent years

- 81% anticipate spending more to improve

customer service over the next year

- Environmental, Social and Governance

- 50% strongly agree that sustainable,

ethical and transparent business practices will be an important

basis for competition in their industries in the near future

- Sophisticated Data Analytics

- 90% agree that sophisticated data

analytics have become a more important basis for decision-making at

their companies in recent years

- 89% say they will spend at least

somewhat more time, attention and money on improving analytics

capabilities over the next year

- 58% say their companies will spend much

more of these resources on improving analytics capabilities over

the next year

Majority Anticipate Increased Workforce, Tap into ‘Gig

Economy’

As companies worldwide increase spending with an eye towards

sustained and profitable growth, they will seek to employ more

workers in 2017. Eighty-five percent of all survey respondents

anticipate an increase in their companies’ number of employees in

the coming year (vs. 75% last year). The percentage of respondents

anticipating that their companies’ employee count will stay the

same or decrease has correspondingly dropped, from 25% last year to

only 15% this year. On average, finance executives expect headcount

to increase by 7% for 2017. (See Expected Employment Increase by

Country Chart for Individual Country Results)

Respondents’ highest priority for hiring is in finance talent

(21%), followed closely by general admin/support staff (19%).

Companies also recognize that difficulty hiring and retaining sales

and support staff is impeding their ability to meet performance

goals (93%).

The gig economy continues to be a major force in the global

labor market:

- 63% say they’re likely to make greater

use of temporary or contract workers in order to meet staffing

needs for the coming year

- 70% confirm that the use of independent

contractors or temporary workers is central to or an important part

of their companies’ employment practices (up from 60% in 2016)

Snapshots by region

North America Most Strongly Optimistic Region in the World:

Most Likely to Plan Increased Hiring

North America now has the most optimistic outlook on economic

prospects worldwide. The percentage of respondents in North America

anticipating substantial economic expansion is at its highest level

(67%) for any region since this study began in 2008 (see

“Expectations for Substantial Economic Growth by Region, 2008-17”

chart). Canadian finance executives are nearly as optimistic about

their economy as their American counterparts. Ninety-three percent

of Canadian respondents expect either “substantial” or “modest”

expansion, up from 63% last year. In the U.S., 95% of respondents

anticipate “substantial” or “modest” growth, compared with 73% last

year.

On average, North American respondents expect their companies’

planned levels of spending and investment for the coming year to

increase by 9% (vs. 13% last year). At the country level within

North America, the U.S. averages at 9%, compared with the 14%

response for 2016. The Canadian average is 8%, vs. 11% in 2016.

American finance executives are most likely to anticipate

increased spending on production inputs (37% of U.S. respondents).

Spending in other categories tied to production and service

delivery, including labor/headcount (32%), is also likely to

increase among U.S. companies. A substantial number of U.S.

respondents also anticipate increased spending on financial

reporting and compliance (30%). Canadian respondents are

particularly likely to expect increased spending in IT categories

including mobile technology (30%) and hardware/IT infrastructure

(27%). Like their U.S. counterparts, Canadian companies also

anticipate increased spending on production inputs (27%) and

labor/headcount (27%).

In North America, finance executives anticipate hiring to

increase by 9% (vs.12% last year), the highest average forecast of

any region. The U.S. (9%, vs. 13% in 2016) and Canada (9%,

unchanged from 2016) are among those countries at the top of the

list predicting an uptick in hiring. Both American (96%) and

Canadian companies (93%) say their performance goals have been

affected most by difficulty in hiring sales and marketing

personnel. In order to address their hiring challenges, both

Canadian and U.S. companies will make greater use of temporary or

contract workers (59% U.S. and 53% Canada) and plan to onshore

positions (58% U.S. and 53% Canada).

European Economic Expansion Plans on the Decline: U.K. Least

Optimistic, Optimism Also Erodes in France and Germany

In Europe, expectations for economic expansion have declined

year over year, with 33% of respondents expressing optimism, down

from 62% in 2016. The U.K. while most positive in the region,

experienced the greatest drop in optimism, with one-third (33%,

down from 75% in 2016) expecting economic expansion. Optimism also

eroded in Germany, where 30% of respondents anticipated economic

growth (down from 57% last year), as well as in France (30%, down

from 47% last year) and Russia (30%, down from 44% last year).

Uncertainty around Brexit’s knock-on effects and upcoming

European elections likely underlie these results.

Germany Plans Greatest Increase in Hiring

in Europe

On average, respondents in Europe expect to see an increase in

hiring of 7% (compared with 6% last year). Finance executives in

Germany are most likely to plan to hire (9%), among the highest in

the world, followed by Russia (7%), France (7%), and the U.K. (6%).

Regardless of country, European companies are in agreement that

there is difficulty hiring sales and marketing staff. In Russia

(100%), the U.K. and Germany (each, 97%) and France (85%),

companies say their performance goals have been affected by

difficulty in hiring sales and marketing staff. To combat their

hiring challenges, companies in Russia (70%) and the U.K. (65%)

will make greater use of temporary or contract workers, and in

France (70%) and Germany (67%) they will make greater use of

offshoring or outsourcing.

Asia/Australia: Majority Predict Economic Expansion, Optimism

in Japan Rebounds

In Asia/Australia, a majority of respondents (84%, up from 58%

last year) anticipate economic expansion over the next year.

Optimism in Japan has rebounded (97% choosing substantial or modest

economic expansion, nearly double 50% in 2016). China has also seen

a sharp rebound in optimism (87%, up from 58% in 2016), helping to

buoy prospects across the region. Australia has seen a rise in

optimism as well (83%, up from 65% last year). India has a less

positive outlook, where optimism has eroded (77%, down from 86%

last year).

India Predicts Greatest Increase in Hiring

Regionally

On average, respondents in Asia/Australia expect to see hiring

increase by 6% (compared to 8% last year). Indian and Chinese

companies plan the greatest increase in hiring (each, 7%), followed

by Australia, Hong Kong and Singapore (each 6%) and Japan (5%).

Executives across Asia/Australia say their performance goals

have been affected by difficulty in filling sales and marketing

positions: Hong Kong (100%), China and Japan (each, 97%) and

Australia and India (each, 83%). In order to address their hiring

challenges, companies in Australia (80%), China (ex-Hong Kong),

Hong Kong, and India, (each, 63%) are particularly likely to make

greater use of temporary or contract workers. Companies in Japan

(63%) are especially likely to move positions from overseas to

domestic locations.

Latin America: Uptick in Economic Confidence

In Latin America, eight-in-ten respondents (80%, up from 73%

last year) anticipate expansion in 2017. Optimism in Argentina

increased by a substantial margin for the second year in a row

(94%, up from 73% last year). Brazil showed a more modest increase,

with 73% of respondents expecting expansion over the next year

(compared with 67% last year). The relatively modest improvement is

likely a reflection of political uncertainty. Optimism in Mexico

eroded slightly, with 73% of respondents anticipating expansion

(down from 79% last year), most likely related to uncertainty

regarding trade relationships and agreements.

Argentina Anticipates Greatest Increase in

Hiring Regionally

In Latin America, Argentina and Brazil are most likely to

anticipate an increase in hiring (with each anticipating an 8%

increase) followed by Mexico (anticipating a 4% increase). Although

respondents in Latin America seem to feel the shortage of sales and

marketing talent slightly less acutely than respondents in other

regions, finance executives across the region most often say that

difficulty hiring sales and marketing talent is impeding their

companies’ ability to achieve their performance goals: Argentina

(94%), Brazil and Mexico (each, 85%). To combat their hiring

challenges, companies across the region will make greater use of

temporary or contract workers: Mexico (70%), Argentina (68%) and

Brazil (67%).

Expected Employment Increase by

Selected Countries:

Country Change Germany

9% Canada

9% U.S. 9% Argentina

8% Brazil 8% India

7% China (ex-Hong Kong)

7% Russia 7% France

7% Hong Kong 6%

U.K. 6% Australia

6% Singapore 6% Japan

5% Mexico 4%

For the full Global Business & Spending Outlook by American

Express and Institutional Investor Research, visit

http://about.americanexpress.com/news/.

Methodology

The 2017 Global Business & Spending Outlook was conducted by

Institutional Investor Thought Leadership Studio1 (IITLS) and is

based on a survey of 650 senior finance executives from companies

around the world with annual revenues of $500 million or more. All

survey responses were gathered after the 2016 U.S. election, in

late November and early December 2016. IITLS estimates the margin

of error for this population to be approximately +/-3.8% at a 95%

level of confidence.

About American Express Global

Commercial Payments

Through its Global Commercial Payments division, American

Express offers a suite of payment and lending products that

help businesses and organizations of all sizes gain financial

savings, control and efficiency. Global Commercial Payments

provides solutions for travel and everyday business spending, cross

border payments, global currency solutions, and business

financing.

To learn more about Global Commercial Payments visit

business.americanexpress.com

To learn more about American Express OPEN, which provides

products and services for small businesses and entrepreneurs in the

United States, visit www.OPEN.com

About American Express

American Express is a global services company, providing

customers with access to products, insights and experiences that

enrich lives and build business success. Learn more

at americanexpress.com and connect with us

on facebook.com/americanexpress,

foursquare.com/americanexpress, linkedin.com/company/american-express,

twitter.com/americanexpress,

and youtube.com/americanexpress.

Key links to products, services and corporate responsibility

information: charge and credit cards, business credit cards, Plenti

rewards program, travel services, gift cards, prepaid cards,

merchant services, Accertify, corporate card, business travel

and corporate responsibility.

About Institutional

Investor

Institutional Investor is among the world’s leading investment

information brands. Its highly regarded content reaches a globally

influential audience across an array of media platforms,

conferences, seminars, training courses, capital markets databases

and emerging markets information service. Institutional Investor’s

Thought Leadership Studio works closely with its clients to design,

execute, and publish independent primary research projects on

topics of interest to its audience.

For more information on II’s custom research capabilities,

contact Sam Knox, managing director of custom research, at

sam.knox@institutionalinvestor.com.

_______________________________

1 From 2008 to 2016, CFO Research, a unit of CFO Publishing LLC,

conducted this annual study in collaboration with American Express.

All survey data prior to 2017 cited in this report was gathered and

verified by CFO Research. ²In the Global Business & Spending

Outlook, Mexico is grouped with the Latin American economic region

due to economic similarities, rather than with the United States

and Canada.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170315005070/en/

M BoothAlex Della Rocca, 212-539-3203Alexd@mbooth.comorAmerican ExpressMelissa Filipek,

212-640-8658melissa.j.filipek@aexp.com

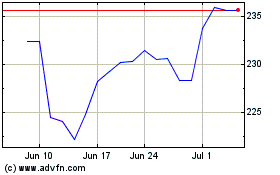

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

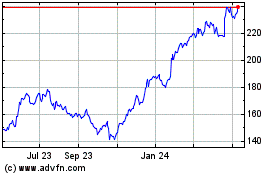

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024