Current Report Filing (8-k)

August 10 2015 - 8:50AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 10, 2015

American Water Works Company, Inc.

(Exact name of registrant as specified in its charter)

Commission

File Number: 001-34028

|

|

|

| Delaware |

|

51-0063696 |

(State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification No.) |

1025 Laurel Oak Road

Voorhees, NJ 08043

(Address of principal executive offices, including zip code)

(856) 346-8200

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Each of American Water Works Company, Inc.’s and American Water

Capital Corp.’s Computation of the Ratio of Earnings to Fixed Charges and Preferred Stock Dividends for the fiscal years ended December 31, 2010, December 31, 2011, December 31, 2012, December 31, 2013 and

December 31, 2014 and the six months ended June 30, 2015, is attached hereto as Exhibit 99.1 hereto and is incorporated by reference into this Current Report on Form 8-K.

| Item 9.01. |

Financial Statements and Exhibits. |

The following exhibit has been filed herewith:

|

|

|

| Exhibit No. |

|

Description of Exhibit |

|

|

| 99.1 |

|

Computation of Ratio of Earnings to Fixed Charges and Preferred Stock Dividends. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN WATER WORKS COMPANY, INC. |

|

|

|

|

| Dated: August 10, 2015 |

|

|

|

By: |

|

/s/ Linda G. Sullivan |

|

|

|

|

|

|

|

|

Linda G. Sullivan |

|

|

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description of Exhibit |

|

|

| 99.1 |

|

Computation of Ratio of Earnings to Fixed Charges and Preferred Stock Dividends. |

Exhibit 99.1

American Water Works Company, Inc.

Computation of

Ratio of Earnings to Fixed Charges and Preferred Stock Dividends

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2010 |

|

|

2011 |

|

|

2012 |

|

|

2013 |

|

|

2014 |

|

|

For the six

months ended

June 30, 2015 |

|

| Income from continuing operations before income taxes |

|

$ |

430,253 |

|

|

$ |

502,185 |

|

|

$ |

630,389 |

|

|

$ |

607,937 |

|

|

$ |

709,814 |

|

|

$ |

337,129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fixed Charges: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest, dividend on mandatory redeemable preferred shares and amortization of debt discount and expenses and premium on all

indebtedness |

|

|

325,134 |

|

|

|

321,685 |

|

|

|

316,889 |

|

|

|

314,908 |

|

|

|

304,866 |

|

|

|

154,747 |

|

| Interest factor in rentals |

|

|

12,231 |

|

|

|

11,017 |

|

|

|

9,222 |

|

|

|

7,706 |

|

|

|

7,222 |

|

|

|

3,439 |

|

| Interest costs from discontinued operations |

|

|

1,319 |

|

|

|

2,266 |

|

|

|

277 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total fixed charges |

|

|

338,684 |

|

|

|

334,968 |

|

|

|

326,388 |

|

|

|

322,614 |

|

|

|

312,088 |

|

|

|

158,186 |

|

| Income from continuing operations plus fixed charges |

|

|

768,937 |

|

|

|

837,153 |

|

|

|

956,777 |

|

|

|

930,551 |

|

|

|

1,021,902 |

|

|

|

495,315 |

|

| Preferred dividend requirements |

|

|

224 |

|

|

|

224 |

|

|

|

153 |

|

|

|

19 |

|

|

|

— |

|

|

|

— |

|

| Ratio of pre-tax income to net income |

|

|

1.68 |

|

|

|

1.65 |

|

|

|

1.69 |

|

|

|

1.64 |

|

|

|

1.65 |

|

|

|

1.66 |

|

| Preferred dividend factor |

|

|

377 |

|

|

|

371 |

|

|

|

258 |

|

|

|

31 |

|

|

|

— |

|

|

|

— |

|

| Total fixed charges |

|

|

338,684 |

|

|

|

334,968 |

|

|

|

326,388 |

|

|

|

322,614 |

|

|

|

312,088 |

|

|

|

158,186 |

|

| Total fixed charges and preferred dividends |

|

|

339,061 |

|

|

|

335,339 |

|

|

|

326,646 |

|

|

|

322,645 |

|

|

|

312,088 |

|

|

|

158,186 |

|

| Ratio of earnings to combined fixed charges and preferred dividends |

|

|

2.27 |

|

|

|

2.50 |

|

|

|

2.93 |

|

|

|

2.88 |

|

|

|

3.27 |

|

|

|

3.13 |

|

American Water Capital Corp.

Computation of Ratio of Earnings to Fixed Charges and Preferred Stock Dividends

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2010 |

|

|

2011 |

|

|

2012 |

|

|

2013 |

|

|

2014 |

|

|

For the six

months ended

June 30, 2015 |

|

| Income (loss) before income taxes |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Fixed Charges: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest, dividend on mandatory redeemable preferred shares and amortization of debt discount and expenses and premium on all

indebtedness |

|

|

206,010 |

|

|

|

211,982 |

|

|

|

213,835 |

|

|

|

225,511 |

|

|

|

215,272 |

|

|

|

110,576 |

|

| Total fixed charges |

|

|

206,010 |

|

|

|

211,982 |

|

|

|

213,835 |

|

|

|

225,511 |

|

|

|

215,272 |

|

|

|

110,576 |

|

| Income (loss) plus fixed charges |

|

|

206,010 |

|

|

|

211,982 |

|

|

|

213,835 |

|

|

|

225,511 |

|

|

|

215,272 |

|

|

|

110,576 |

|

| Total fixed charges |

|

|

206,010 |

|

|

|

211,982 |

|

|

|

213,835 |

|

|

|

225,511 |

|

|

|

215,272 |

|

|

|

110,576 |

|

| Total fixed charges and preferred dividends(a) |

|

|

206,010 |

|

|

|

211,982 |

|

|

|

213,835 |

|

|

|

225,511 |

|

|

|

215,272 |

|

|

|

110,576 |

|

| Ratio of earnings to combined fixed charges and preferred dividends |

|

|

1.00 |

|

|

|

1.00 |

|

|

|

1.00 |

|

|

|

1.00 |

|

|

|

1.00 |

|

|

|

1.00 |

|

| (a) |

American Water Capital Corp. had no preferred stock outstanding for any period presented, and, accordingly, the ratio of earnings to combined fixed charges and preferred stock dividends is the same as the ratio of

earnings to fixed charges. |

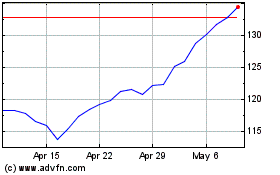

American Water Works (NYSE:AWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

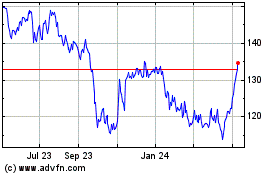

American Water Works (NYSE:AWK)

Historical Stock Chart

From Apr 2023 to Apr 2024