UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 6, 2015

American Water Works Company, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-34028

|

Delaware |

51-0063696 |

|

(State or other jurisdiction

of incorporation) |

(IRS Employer

Identification No.) |

1025 Laurel Oak Road

Voorhees, NJ 08043

(Address of principal executive offices, including zip code)

(856) 346-8200

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On May 6, 2015, American Water Works Company, Inc. issued a press release announcing its financial results for the first quarter ended March 31, 2015. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information in this Current Report, including Exhibit 99.1, is being furnished and shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit |

|

Description |

|

99.1 |

|

Press Release, dated May 6, 2015, issued by American Water Works Company, Inc. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

AMERICAN WATER WORKS COMPANY, INC. |

|

|

|

|

|

|

Dated: May 6, 2015 |

|

By: |

/s/ Linda G. Sullivan |

|

|

|

|

Linda G. Sullivan |

|

|

|

|

Senior Vice President, Chief Financial Officer |

Exhibit 99.1

|

May 6, 2015 |

|

Edward Vallejo |

|

|

|

Vice President, Investor Relations |

|

|

|

856-566-4005 |

|

|

|

edward.vallejo@amwater.com |

|

|

|

|

|

|

Maureen Duffy |

|

|

|

Vice President, Communications |

|

|

|

856-309-4546 |

|

|

|

maureen.duffy@amwater.com |

AMERICAN WATER REPORTS SOLID 2015 FIRST QUARTER RESULTS

|

• |

|

Company had solid financial performance with revenue up 2.8 percent to $698.1 million and income from continuing operations up 15.8 percent to $80.0 million or $0.44 per diluted common share. Adjusted earnings per share from continuing operations (a non-GAAP financial measure) increased 7.3 percent over same period last year. |

|

• |

|

Company increased dividend by approximately 10 percent to $0.34 per diluted common share. |

|

• |

|

Company affirmed 2015 earnings guidance from continuing operations in the range of $2.55 to $2.65 per diluted share. |

VOORHEES, N.J., May 6, 2015 – American Water Works Company, Inc. (NYSE: AWK), the largest and most geographically diverse publicly traded U.S. water and wastewater utility company, today reported solid results for the first quarter ended March 31, 2015.

“While this past winter’s weather proved challenging for some of our states, the employees of American Water delivered another quarter of high-quality customer service and solid financial performance,” said Susan Story, president and CEO of American Water. “Recognizing our increases in revenue and net income, and ongoing improvement in our operational efficiency, our board of directors approved an approximate 10 percent increase to our cash dividend in April. This is the third consecutive year of double-digit increases in our dividend payouts, which are an important part of our ability to attract capital for investment to ensure safe, clean and reliable water services for our customers.”

Continuing Operations

For the first quarter of 2015, the company reported income from continuing operations of $80.0 million, or $0.44 per diluted common share, compared with income from continuing operations of $69.1 million, or $0.39 per diluted common share, in the first quarter of 2014. Excluding the impact of the Freedom Industries chemical spill in West Virginia of $0.02 per diluted share in 2014, adjusted earnings per share from continuing operations (a non-GAAP financial measure) increased by 7.3 percent from $0.41 per diluted share in 2014. This increase was mainly due to continued revenue growth in the Regulated Businesses, lower operating and maintenance expenses and the finalization of the company’s general rate case in California.

The company made capital investments during the quarter of approximately $167.3 million to continue to provide reliable service to customers. American Water plans to invest $1.2 billion in 2015 to improve its water and wastewater systems, with approximately $0.1 billion allocated to acquisitions and strategic investments.

Regulated Operations

For the quarter, American Water’s Regulated Businesses’ revenues increased by $7.8 million, or 1.3 percent, compared to the same quarter in 2014. The increase in revenues was primarily due to rate authorizations and infrastructure charges. The increases were partially offset by lower demand.

|

PRESS RELEASE |

1 |

www.amwater.com |

AMERICAN WATER REPORTS 2015 FIRST QUARTER RESULTS

The Regulated Businesses’ operation and maintenance (O&M) expense decreased $11.5 million, or 4.1 percent, for the first quarter of 2015. The decreased costs were primarily due to lower production and operating supplies and services costs, partly due to higher costs incurred in 2014 from the Freedom Industries chemical spill, as well as the 2015 California rate case settlement adjustments.

As of May 6, 2015, the company received approximately $27.7 million in additional annualized revenues from general rate cases and infrastructure charges for 2015. This includes a rate authorization in Indiana for additional annualized revenues of $5.1 million, and a settlement in the company’s general rate case in California providing additional annualized revenues of $5.2 million.

As of May 6, 2015, the company was awaiting final orders and/or proposed settlements for general rate cases in four states, requesting approximately $102.4 million in total additional revenues and $4.4 million in infrastructure charges in three states. The extent to which requested rate increases will be granted by the applicable regulatory agencies will vary. All revenue amounts are based on current usage.

American Water continued its focus on operational efficiencies to maintain the reliability of water services through needed capital investment while at the same time limiting the impact on customer bills. For the 12-month period ended March 31, 2015, the O&M efficiency ratio (a non-GAAP measure) improved to 36.3 percent, compared to 38.0 percent for the previous 12 months.

“Our efforts to control costs while ensuring high-quality service and reliability go hand-in-hand to deliver the best value for our customers. Our capital expenditure strategy allows us to make needed investments that translate into excellent service and improved infrastructure reliability,” said Story. “This is the time of year when we provide our annual water quality reports to customers and once again, American Water scored over 99 percent for meeting or surpassing federal drinking water regulations across our footprint. This exceptional water quality record is 20 times better than the industry average for meeting the Environmental Protection Agency’s safe drinking water requirements, and this is directly attributable to the dedication and expertise of our people and the investments we make into our systems.”

Market-Based Operations

For the quarter, Market-Based revenues increased by $11.6 million, or 15.3 percent, as compared to the first quarter of 2014. The increase was mainly due to increased construction activities and the addition of two new contracts in the company’s Military Services Group, combined with continued growth in the homeowner services business.

The Market-Based Businesses’ O&M expense increased by $11.8 million, or 19.1 percent, for the first quarter 2015 as compared to the same quarter in 2014. Higher costs were mainly due to an increase in construction projects for military contracts, as well as costs associated with the addition of two military contracts, corresponding to the higher revenues. Higher claims expenses in the company’s homeowner services business also contributed to the increase.

American Water’s Market-Based Businesses continued to grow. The company’s homeowner services business, American Water Resources, recently launched its exclusive partnership with the Orlando Utilities Commission to offer home warranty protection programs to more than 200,000 residential customers.

Quarterly Dividend

On April 28, 2015, American Water’s board of directors increased the company’s quarterly cash dividend payment from $0.31 to $0.34 per share, in recognition of the company’s performance. The increased dividend will be payable on June 1, 2015, to all shareholders of record as of May 11, 2015.

On Dec. 12, 2014, the board of directors had declared a quarterly cash dividend payment of $0.31 per share, which was paid on March 2, 2015, to all shareholders of record as of Feb. 9, 2015.

2015 Earnings Guidance

American Water affirmed its 2015 earnings guidance from continuing operations to be in the range of $2.55 to $2.65 per diluted share. The company’s earnings forecasts are subject to numerous risks and uncertainties, including, without limitation, those described under “Forward-Looking Statements” below and under “Risk Factors” in its annual and quarterly reports filed with the Securities and Exchange Commission (SEC).

Non-GAAP Financial Measures

This press release includes a presentation of adjusted earnings per share (EPS) from continuing operations. This item is derived from American Water’s consolidated financial information but is not presented in its financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Adjusted EPS from continuing operations is defined as GAAP diluted earnings per common share from

|

PRESS RELEASE |

2 |

www.amwater.com |

AMERICAN WATER REPORTS 2015 FIRST QUARTER RESULTS

continuing operations excluding the one-time impact of the Freedom Industries chemical spill in West Virginia in 2014. This item constitutes a “non-GAAP financial measure” under SEC rules. This non-GAAP financial measure supplements the company’s GAAP disclosures and should not be considered an alternative to the GAAP measure.

Management believes that this adjustment provides the company and its investors with an indication of American Water’s baseline performance excluding items that are not considered to be reflective of ongoing results. Management does not intend results excluding the adjustment to represent results as defined by GAAP, and the reader should not consider it as an alternative measurement calculated in accordance with GAAP, or as an indicator of the company’s performance. Accordingly, the measurements have limitations depending on their use.

This press release also includes a presentation of adjusted O&M efficiency ratio, which excludes from its calculation estimated purchased water revenues and purchased water expenses, and the allocable portion of non-O&M support services costs, mainly depreciation and general taxes, and the impact of the Freedom Industries chemical spill as well as the estimated impact of weather. This item is derived from American Water’s consolidated financial information but is not presented in its financial statements prepared in accordance with GAAP. The item constitutes a “non-GAAP financial measure” under SEC rules. This non-GAAP financial measure supplements the company’s GAAP disclosures and should not be considered an alternative to the GAAP measure.

Management believes that the presentation of this measure is useful to investors because it provides a means of evaluating the company’s operating performance without giving effect to estimated purchased water revenues and purchased water expenses as well as the allocable portion of non-O&M support services costs, mainly depreciation and general taxes, and the impact of the Freedom Industries chemical spill and weather, which involve items that are not reflective of management’s ability to increase efficiency of the company’s regulated operations. In preparing operating plans, budgets and forecasts, and in assessing historical performance, management relies, in part, on trends in the company’s historical results, exclusive of estimated revenues and expenses related to purchased water and the allocable portion of non-O&M support services costs.

Set forth below are tables that reconcile the non-GAAP financial measures to the most directly comparable GAAP financial measures.

2015 First Quarter Earnings Conference Call

The 2015 first quarter earnings conference call will take place on Thursday, May 7, 2015, at 9 a.m. Eastern Daylight Time. Interested parties may listen over the Internet by logging on to the Investor Relations page of the company’s website at www.amwater.com. Presentation slides that will be used in conjunction with the earnings conference call are also available online at http://ir.amwater.com.

Following the earnings conference call, an audio archive of the call will be available through May 14, 2015, by dialing 412-317-0088 for U.S. and international callers. The access code for replay is 10063598. The online archive of the webcast will be available through June 8, 2015, by accessing the Investor Relations page of the company’s website located at www.amwater.com.

About American Water

Founded in 1886, American Water (NYSE: AWK) is the largest publicly traded U.S. water and wastewater utility company. With headquarters in Voorhees, N.J., the company employs 6,400 dedicated professionals who provide regulated and market-based drinking water, wastewater and other related services to an estimated 15 million people in 47 states and Ontario, Canada. More information can be found at www.amwater.com.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this press release including, without limitation, 2015 earnings guidance and estimated revenues from rate cases and other government agency authorizations, are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are predictions based on American Water’s current expectations and assumptions regarding future events. Actual results could differ materially because of factors such as the decisions of governmental and regulatory bodies, including decisions to raise or lower rates; the timeliness of regulatory commissions’ actions concerning rates; changes in laws, governmental regulations and policies, including environmental, health and water quality, and public utility regulations and policies; the outcome of litigation and government action including as related to the Freedom Industries chemical spill in West Virginia; weather conditions, patterns or events, including drought or abnormally high rainfall, strong winds and coastal, intercoastal flooding and cooler than normal temperatures; changes in customer demand for, and patterns of use of, water, such as may result from conservation efforts; its ability to appropriately maintain current infrastructure, including its technology systems, and manage the expansion of its business; its ability to obtain permits and other approvals for projects; changes in its capital requirements; its ability to control operating expenses and to achieve efficiencies in its operations; the intentional or unintentional acts of a third party, including contamination of its water supplies and attacks on its computer systems; its ability to obtain adequate and cost-effective supplies of chemicals, electricity, fuel, water and other raw materials that are needed for its operations; its ability to successfully acquire and integrate water and wastewater systems that are complementary to its operations; its ability to successfully expand its business, including, concession arrangements and agreements for the provision of water services in shale regions for exploration and production; cost overruns relating to improvements or the expansion of its operations; changes in general economic, business and financial market

|

PRESS RELEASE |

3 |

www.amwater.com |

AMERICAN WATER REPORTS 2015 FIRST QUARTER RESULTS

conditions; access to sufficient capital on satisfactory terms; fluctuations in interest rates; the effect of restrictive covenants or changes to credit ratings on the company’s current or future debt that could increase its financing costs or affect its ability to borrow, make payments on debt or pay dividends; fluctuations in the value of benefit plan assets and liabilities that could increase financing costs and funding requirements; migration of customers into or out of its service territories and the condemnation of its systems by municipalities using the power of eminent domain; difficulty in obtaining insurance at acceptable rates and on acceptable terms and conditions; its ability to retain and attract qualified employees; labor actions including work stoppages and strikes; the incurrence of impairment charges; and civil disturbance, terrorist threats or acts, or public apprehension about future disturbances or terrorist threats or acts.

For further information regarding risks and uncertainties associated with American Water’s business, please refer to American Water’s annual and quarterly SEC filings. The company undertakes no duty to update any forward-looking statement, except as otherwise required by the federal securities laws.

|

PRESS RELEASE |

4 |

www.amwater.com |

AMERICAN WATER REPORTS 2015 FIRST QUARTER RESULTS

American Water Works Company, Inc. and Subsidiary Companies

Consolidated Statements of Income (Unaudited)

In thousands except per share data

|

|

For the Three Months Ended March 31, |

|

|

|

2015 |

|

|

2014 |

|

|

Operating revenues |

$ |

698,078 |

|

|

$ |

679,003 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

Operation and maintenance |

|

323,832 |

|

|

|

325,180 |

|

|

Depreciation and amortization |

|

107,377 |

|

|

|

105,924 |

|

|

General taxes |

|

63,696 |

|

|

|

60,667 |

|

|

Gain on asset dispositions and purchases |

|

(1,128 |

) |

|

|

(210 |

) |

|

Total operating expenses, net |

|

493,777 |

|

|

|

491,561 |

|

|

Operating income |

|

204,301 |

|

|

|

187,442 |

|

|

Other income (expenses) |

|

|

|

|

|

|

|

|

Interest, net |

|

(75,673 |

) |

|

|

(73,560 |

) |

|

Allowance for other funds used during construction |

|

2,360 |

|

|

|

2,201 |

|

|

Allowance for borrowed funds used during construction |

|

2,522 |

|

|

|

1,483 |

|

|

Amortization of debt expense |

|

(1,764 |

) |

|

|

(1,673 |

) |

|

Other, net |

|

1,756 |

|

|

|

(1,541 |

) |

|

Total other income (expenses) |

|

(70,799 |

) |

|

|

(73,090 |

) |

|

Income from continuing operations before income taxes |

|

133,502 |

|

|

|

114,352 |

|

|

Provision for income taxes |

|

53,459 |

|

|

|

45,239 |

|

|

Income from continuing operations |

|

80,043 |

|

|

|

69,113 |

|

|

Loss from discontinued operations, net of tax |

|

— |

|

|

|

(990 |

) |

|

Net income |

$ |

80,043 |

|

|

$ |

68,123 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share: |

|

|

|

|

|

|

|

|

Income from continuing operations |

$ |

0.45 |

|

|

$ |

0.39 |

|

|

Loss from discontinued operations, net of tax |

$ |

0.00 |

|

|

$ |

(0.01 |

) |

|

Net income |

$ |

0.45 |

|

|

$ |

0.38 |

|

|

Diluted earnings per share: |

|

|

|

|

|

|

|

|

Income from continuing operations |

$ |

0.44 |

|

|

$ |

0.39 |

|

|

Loss from discontinued operations, net of tax |

$ |

0.00 |

|

|

$ |

(0.01 |

) |

|

Net income |

$ |

0.44 |

|

|

$ |

0.38 |

|

|

Average common shares outstanding during the period |

|

|

|

|

|

|

|

|

Basic |

|

179,458 |

|

|

|

178,539 |

|

|

Diluted |

|

180,295 |

|

|

|

179,457 |

|

|

Dividends declared per common share |

$ |

— |

|

|

$ |

— |

|

|

PRESS RELEASE |

5 |

www.amwater.com |

AMERICAN WATER REPORTS 2015 FIRST QUARTER RESULTS

American Water Works Company, Inc. and Subsidiary Companies

Condensed Consolidated Balance Sheet Information (Unaudited)

In thousands

|

|

March 31, |

|

|

December 31, |

|

|

|

2015 |

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

24,294 |

|

|

$ |

23,080 |

|

|

Other current assets |

|

704,725 |

|

|

|

638,289 |

|

|

Total property, plant and equipment |

|

13,098,567 |

|

|

|

13,029,296 |

|

|

Total regulatory and other long-term assets |

|

2,435,945 |

|

|

|

2,440,291 |

|

|

Total Assets |

$ |

16,263,531 |

|

|

$ |

16,130,956 |

|

|

|

|

|

|

|

|

|

|

|

Short-term debt |

$ |

544,531 |

|

|

$ |

449,959 |

|

|

Current portion of long-term debt |

|

61,149 |

|

|

|

61,132 |

|

|

Other current liabilities |

|

621,868 |

|

|

|

729,907 |

|

|

Long-term debt |

|

5,443,197 |

|

|

|

5,448,245 |

|

|

Total regulatory and other long-term liabilities |

|

3,518,588 |

|

|

|

3,451,250 |

|

|

Contributions in aid of construction |

|

1,081,260 |

|

|

|

1,074,872 |

|

|

Total stockholders' equity |

|

4,992,938 |

|

|

|

4,915,591 |

|

|

Total Capitalization and Liabilities |

$ |

16,263,531 |

|

|

$ |

16,130,956 |

|

American Water Works Company, Inc. and Subsidiary Companies

Adjusted Earnings Per Share from Continuing Operations (A Non-GAAP, unaudited measure)

|

|

For the Three Months Ended March 31, |

|

|

|

2015 |

|

|

2014 |

|

|

Income from continuing operations per diluted common share |

$ |

0.44 |

|

|

$ |

0.39 |

|

|

Add: |

|

|

|

|

|

|

|

|

After-tax impact of West Virginia Freedom Industries Chemical Spill |

|

0.00 |

|

|

|

0.02 |

|

|

Adjusted income from continuing operations per diluted common share |

$ |

0.44 |

|

|

$ |

0.41 |

|

|

PRESS RELEASE |

6 |

www.amwater.com |

AMERICAN WATER REPORTS 2015 FIRST QUARTER RESULTS

American Water Works Company, Inc. and Subsidiary Companies

Adjusted Regulated Operations and Maintenance Efficiency Ratio (A Non-GAAP, unaudited measure)

In thousands

|

|

For the Twelve Months Ended March 31, |

|

|

|

2015 |

|

|

2014 |

|

|

|

|

|

|

Total Operation and Maintenance Expense |

$ |

1,348,516 |

|

|

$ |

1,306,962 |

|

|

Less: |

|

|

|

|

|

|

|

|

Operation and maintenance expense—Market-Based Operations |

|

301,183 |

|

|

|

248,032 |

|

|

Operation and maintenance expense—Other |

|

(52,677 |

) |

|

|

(55,399 |

) |

|

Total Regulated Operation and Maintenance Expense |

|

1,100,010 |

|

|

|

1,114,329 |

|

|

Less: |

|

|

|

|

|

|

|

|

Regulated purchased water expense |

|

120,590 |

|

|

|

114,217 |

|

|

Allocation of non-operation and maintenance expense |

|

39,855 |

|

|

|

35,073 |

|

|

Impact of West Virginia Freedom Industries chemical spill |

|

5,797 |

|

|

|

4,861 |

|

|

Estimated impact of weather (mid-point of range) |

|

(1,762 |

) |

|

|

(1,687 |

) |

|

Adjusted Regulated Operation and Maintenance Expense (a) |

$ |

935,530 |

|

|

$ |

961,865 |

|

|

|

|

|

|

|

|

|

|

|

Total Operating Revenues |

$ |

3,030,403 |

|

|

$ |

2,926,000 |

|

|

Less: |

|

|

|

|

|

|

|

|

Operating revenues—Market-Based Operations |

|

366,296 |

|

|

|

315,259 |

|

|

Operating revenues—Other |

|

(17,988 |

) |

|

|

(17,583 |

) |

|

Total Regulated Operating Revenues |

|

2,682,095 |

|

|

|

2,628,325 |

|

|

Less: |

|

|

|

|

|

|

|

|

Regulated purchased water expense* |

|

120,590 |

|

|

|

114,217 |

|

|

Plus: |

|

|

|

|

|

|

|

|

Impact of West Virginia Freedom Industries chemical spill |

|

— |

|

|

|

1,012 |

|

|

Estimated impact of weather (mid-point of range) |

|

16,785 |

|

|

|

15,625 |

|

|

Adjusted Regulated Operating Revenues (b) |

$ |

2,578,290 |

|

|

$ |

2,530,745 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted Regulated Operation and Maintenance Efficiency Ratio (a)/(b) |

|

36.3 |

% |

|

|

38.0 |

% |

|

|

|

|

|

|

|

|

|

|

* Calculation assumes purchased water revenues approximate purchased water expenses. |

|

|

|

|

|

|

|

|

PRESS RELEASE |

7 |

www.amwater.com |

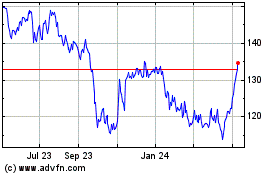

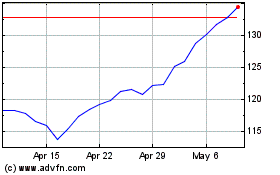

American Water Works (NYSE:AWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Water Works (NYSE:AWK)

Historical Stock Chart

From Apr 2023 to Apr 2024