By Kathy Chu

LONG AN, Vietnam--This rural expanse of pineapple fields and

mango trees south of Ho Chi Minh City is a good place to see how

the winds of global trade are shifting.

Already, massive factories have sprung up here to make goods for

Western companies such as sportswear maker Nike Inc., taking

advantage of Vietnam's young workforce and wages that are roughly

half those in China.

This largely agricultural province, located near Vietnam's most

populous city, now has more than a dozen industrial parks, and is

playing host to an increasing amount of manufacturing. By May, it

had attracted pledges of $3.67 billion for foreign investment,

about 40% of it for the garment and textile industry.

Economists say this growth could accelerate if the U.S. and 11

other Pacific Rim nations ratify the Trans-Pacific Partnership

agreement, a landmark trade deal concluded earlier this month. The

deal would eliminate certain tariffs between members, mostly

benefiting developing nations such as Vietnam and Malaysia, whose

growth depends heavily on exports.

The trade agreement would be "fantastic if it happened," says

Frank Smigelski, a vice president at Avery Dennison Corp., one of

the world's biggest makers of clothing labels and tags. In July,

the company, which is based in Glendale, Calif., opened a

300,000-square-foot facility in Long An. Inside,

sewing-machine-like contraptions print tags for Japanese clothing

brand Uniqlo, while workers pour red ink into giant machines that

print the labels sewn into North Face outdoor-sports clothes.

The TPP "would encourage more garment manufacturers to push

volume here, " says Mr. Smigelski. "The more they come, the more

we'd benefit."

Skyrocketing wages and a growing labor shortage in China are

heightening Vietnam's appeal. The country's growth has waxed and

waned since the 1980s, when its leaders ushered in an era of

market-oriented reforms.

Last year, foreign direct investment into Vietnam totaled $12.4

billion, up nearly a quarter from 2009. One of the biggest

investors is South Korea's Samsung Electronics Co., which plans to

nearly double its current $4.5 billion investment in manufacturing

electronics in the country.

If the trade deal goes through, Vietnam's economy would be the

single largest beneficiary, because it would gain much greater

access to large consumer markets, according to the Peterson

Institute for International Economics, a Washington-based think

tank.

The pact "gives those inside privileged access to the U.S. and

Japan," said Chris Clague, a senior consultant at the Economist

Intelligence Unit.

The Vietnamese government estimates that TPP could boost

Vietnam's economy by $33.5 billion during the next decade, roughly

a fifth of the country's current gross domestic product. Exports

from its key garment and footwear industry, one of the biggest TPP

beneficiaries, could jump 46% to $165 billion by 2025 as tariffs

gradually fall to zero, the Peterson Institute says.

Money pouring into the Southeast Asian economy could make

Vietnam one of the world's two fastest-growing large economies

between now and 2050, along with Nigeria, if overall trade

restrictions continue to lift, according to consulting firm

PricewaterhouseCoopers.

In Long An province, Avery Dennison's gleaming three-story

factory, located in an industrial park dominated by Japanese and

Korean investors, is preparing for a surge in orders for

garment-care tags, labels and price tags.

Down the street, dozens of concrete homes for factory workers

are sprouting among the tall weeds that still cover parts of the

area, a sign that other manufacturers are coming here too.

The Long An facility should give Avery Dennison room to grow

through 2020, but the company will consider expanding if apparel

production surges because of the trade deal, Mr. Smigelski

says.

How much Avery Dennison and others in Vietnam's apparel industry

benefit from the trade deal will depend on the final details.

Many analysts expect the deal to require that everything from

yarn to the final garment itself come from member countries in

order to qualify for the elimination of tariffs, a stipulation

favored by U.S. yarn and textile producers.

Such a rule could leave manufacturers scrambling to comply since

Vietnam imports most yarn and fabrics from China and other

countries that aren't part of the pact. In the long term though, a

strict local-content rule could push even more apparel-making

business to Vietnam if yarn and fabric weavers are forced to set up

in the country, Mr. Smigelski says.

Avery Dennison has begun to do more sophisticated manufacturing

in Vietnam, using giant looms to produce Nike's lightweight shoe

uppers. A machine with yellow and green harnesses holding spools of

yarn makes a deafening click-clack sound as it rapidly imprints a

silhouette of a leaping Michael Jordan on the high-end shoes, which

retail for about $200 a pair.

The skills of Vietnamese workers are increasing exponentially

every year, and the country is able to accommodate ever more

complex production, according to Avery Dennison.

"What took 30 years in China is taking 10 years in Vietnam to

happen," said Mr. Smigelski. That is why "more and more companies

are making bets on Vietnam."

Vu Trong Khanh in Hanoi contributed to this article.

(END) Dow Jones Newswires

October 18, 2015 20:01 ET (00:01 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

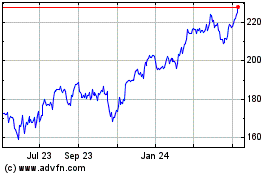

Avery Dennison (NYSE:AVY)

Historical Stock Chart

From Mar 2024 to Apr 2024

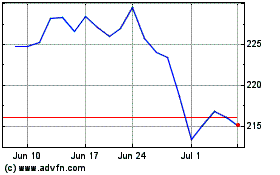

Avery Dennison (NYSE:AVY)

Historical Stock Chart

From Apr 2023 to Apr 2024