UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

October

29, 2015

Date

of Report (Date of earliest event reported)

AptarGroup,

Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

1-11846

|

36-3853103

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

475 West Terra Cotta Avenue, Suite E, Crystal Lake, Illinois

60014

|

|

(Address

of principal executive offices)

|

Registrant’s

telephone number, including area code: 815-477-0424.

|

N/A

|

|

(Former name or former address, if changed since last report)

|

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02 Results of Operations and

Financial Condition.

On October 29, 2015, AptarGroup, Inc. announced certain information

related to its results of operations for the quarter and nine months

ended September 30, 2015. The press release regarding this announcement

is furnished as Exhibit 99.1 hereto.

The information in Item 2.02 of this Form 8-K and the Exhibits attached

hereto shall not be deemed "filed" for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended, nor shall they be deemed

incorporated by reference in any filing under the Securities Act of

1933, except as shall be expressly set forth by specific reference in

such filing.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits

99.1 Press release issued by AptarGroup, Inc. dated October 29,

2015.

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

|

|

AptarGroup, Inc.

|

|

|

|

|

|

|

|

Date:

|

October 29, 2015

|

By:

|

/s/ Robert W. Kuhn

|

|

|

|

|

|

Robert W. Kuhn

|

|

|

|

|

Executive Vice President,

|

|

|

|

|

Chief Financial Officer and Secretary

|

Exhibit Index

|

99.1

|

Press Release issued by AptarGroup, Inc. dated October 29, 2015.

|

3

Exhibit 99.1

AptarGroup

Reports Strong Operating Results with Record Third Quarter Earnings

CRYSTAL LAKE, Ill.--(BUSINESS WIRE)--October 29, 2015--AptarGroup, Inc.

(NYSE:ATR) today reported record third quarter net income and earnings

per share.

Third Quarter 2015 Summary

-

Strong operating results across each business segment drove the

consolidated operating income margin to 15% compared to 12% in the

prior year

-

Record third quarter earnings per share of $0.83 rose 30% when

compared to currency-adjusted prior year earnings per share of $0.64,

and rose 14% when compared to reported prior year earnings per share

of $0.73

-

Core sales, which exclude currency translation effects, increased

approximately 3% (reported sales decreased 10%)

THIRD QUARTER RESULTS

For the quarter ended September 30, 2015, reported sales decreased 10%

to $586 million from $652 million a year ago. Core sales, which exclude

the negative impact from changes in currency exchange rates, increased

by approximately 3%.

|

Third Quarter Segment Sales Analysis

(Change Over Prior Year)

|

|

|

|

|

Beauty +

|

|

|

|

|

|

Food +

|

|

|

|

Total

|

|

|

|

|

Home

|

|

|

Pharma

|

|

|

Beverage

|

|

|

|

AptarGroup

|

|

Sales Growth Before Currency Effects (Core Sales)

|

|

|

(1%)

|

|

|

10%

|

|

|

3%

|

|

|

|

3%

|

|

Currency Effects (1)

|

|

|

(14%)

|

|

|

(12%)

|

|

|

(8%)

|

|

|

|

(13%)

|

|

Total Reported Sales Growth

|

|

|

(15%)

|

|

|

(2%)

|

|

|

(5%)

|

|

|

|

(10%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) - Currency effects are approximated by translating last year's

amounts at this year's foreign exchange rates.

|

Commenting on the quarter, Stephen Hagge, President and CEO, said, “This

was an excellent quarter and quite similar to our second quarter record

performance. Our Beauty + Home segment performed very well operationally

despite continued softness in the personal care and beauty markets, a

challenging foreign currency environment and a general deceleration in

the developing regions. Our Pharma and Food + Beverage segments each had

outstanding quarters as well, with broad-based demand for our innovative

dispensing solutions. Food + Beverage’s core sales growth was negatively

impacted by decreased tooling sales and the passing through of resin

cost decreases. Excluding resin and tooling effects, Food + Beverage

core product sales increased approximately 13%. Operating profit margins

improved at each segment compared to the prior year and I’m pleased to

see the impact of our cost saving efforts across the company.”

AptarGroup reported earnings per share of $0.83 compared to $0.73 per

share a year ago. Assuming a comparable foreign currency exchange

environment, comparable earnings per share for the prior year were

approximately $0.64.

YEAR-TO-DATE RESULTS

For the nine months ended September 30, 2015, reported sales decreased

11% to approximately $1.8 billion from approximately $2.0 billion a year

ago. Core sales, which exclude the negative impact from changes in

currency exchange rates, increased by approximately 1%.

|

Nine Months Year-to-Date Segment Sales Analysis

(Change Over Prior Year)

|

|

|

|

|

Beauty +

|

|

|

|

|

|

Food +

|

|

|

|

Total

|

|

|

|

|

Home

|

|

|

Pharma

|

|

|

Beverage

|

|

|

|

AptarGroup

|

|

Sales Growth Before Currency Effects (Core Sales)

|

|

|

(3%)

|

|

|

8%

|

|

|

3%

|

|

|

|

1%

|

|

Currency Effects (1)

|

|

|

(13%)

|

|

|

(14%)

|

|

|

(7%)

|

|

|

|

(12%)

|

|

Total Reported Sales Growth

|

|

|

(16%)

|

|

|

(6%)

|

|

|

(4%)

|

|

|

|

(11%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) - Currency effects are approximated by translating last year's

amounts at this year's foreign exchange rates.

|

Hagge commented on the year-to-date results, “Currency translation

headwinds significantly affected our year-to-date reported results

compared to the prior year. Despite softness in certain markets and the

passing through of resin cost decreases, our core sales improved over

the prior year. We continue to focus on cost containment while we grow

in the various markets we serve and this approach, along with a

favorable mix of business, drove our strong operating results through

the first nine months of this year.”

AptarGroup reported earnings per share of $2.41 compared to $2.21 a year

ago. Excluding the effect of a change in inventory valuation methods

made in the second quarter (approximately $0.08 per share), adjusted

earnings per share for the nine months year-to-date were $2.33. Assuming

a comparable foreign currency exchange environment, comparable earnings

per share for the prior year were approximately $1.90.

OUTLOOK

Commenting on AptarGroup’s outlook, Hagge said, “Currency exchange rates

will continue to be a significant headwind on our translated results

compared to the prior year at least until early next year. We don’t see

any significant changes in the macroeconomic conditions that are

currently affecting our business, including selected softness in certain

markets. Also, we anticipate that certain customers may choose to reduce

inventory levels at year end as we have seen in recent years. Despite

these near-term issues, we expect fourth quarter earnings on a

comparable currency basis to improve over the prior year. In addition,

we are optimistic about the future and we remain committed to our

market-focused strategy, investing in research and development, and

positioning the company for long-term growth.”

AptarGroup expects earnings per share for the fourth quarter, assuming a

comparable effective tax rate as the prior year fourth quarter, to be in

the range of $0.61 to $0.66 per share compared to $0.63 per share

reported in the prior year. Assuming a comparable foreign currency

exchange rate environment, comparable earnings per share for the prior

year were approximately $0.58.

SHARE REPURCHASE PROGRAM AND INCREASED CASH DIVIDEND

As planned, AptarGroup concluded a previously announced $250 million

accelerated share repurchase program near the end of the third quarter

and received approximately 720,000 additional shares. This brings the

total amount of shares repurchased under the program to approximately

3,853,000 shares. Also, as previously announced, AptarGroup increased

the quarterly cash dividend by 7% to $0.30 per share. The payment date

is November 25, 2015, to shareholders of record as of November 4, 2015.

Hagge stated, “Our strong financial condition allows us to continue to

invest in our business and return value to shareholders through share

repurchases and increased cash dividends.”

OPEN CONFERENCE CALL

There will be a conference call on Friday, October 30, 2015 at 8:00 a.m.

Central Time (9:00 a.m. Eastern Time) to discuss AptarGroup’s third

quarter results for 2015. The call will last approximately one hour.

Interested parties are invited to listen to a live webcast by visiting

the Investor Relations page at www.aptar.com. Replay of the

conference call can also be accessed for a limited time on the Investor

Relations page of the website.

AptarGroup, Inc. is a leading global supplier of a broad range of

innovative dispensing solutions for the beauty, personal care, home

care, prescription drug, consumer health care, injectables, food, and

beverage markets. AptarGroup is headquartered in Crystal Lake, Illinois,

with manufacturing facilities in North America, Europe, Asia and South

America. To learn more, visit www.aptar.com.

This press release contains forward-looking statements. Words such as

“expects,” “anticipates,” “believes,” “estimates,” and other similar

expressions or future or conditional verbs such as “will,” “should,”

“would” and “could” are intended to identify such forward-looking

statements. Forward-looking statements are made pursuant to the safe

harbor provisions of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934 and are based on

management’s beliefs as well as assumptions made by and information

currently available to management. Accordingly, AptarGroup’s actual

results may differ materially from those expressed or implied in such

forward-looking statements due to known or unknown risks and

uncertainties that exist including, but not limited to, economic

conditions worldwide as well as potential deflationary conditions in

regions we rely on for growth; political conditions worldwide;

significant fluctuations in foreign currency exchange rates; changes in

customer and/or consumer spending levels; financial conditions of

customers and suppliers; consolidations within our customer or supplier

bases; fluctuations in the cost of raw materials, components and other

input costs; the availability of raw materials and components; our

ability to increase prices, contain costs and improve productivity;

changes in capital availability or cost, including interest rate

fluctuations; volatility of global credit markets; cybersecurity threats

that could impact our networks and reporting systems; fiscal and

monetary policies and other regulations, including changes in tax rates;

direct or indirect consequences of acts of war or terrorism; work

stoppages due to labor disputes; and competition, including

technological advances. For additional information on these and other

risks and uncertainties, please see AptarGroup’s filings with the

Securities and Exchange Commission, including its Form 10-Ks and Form

10-Qs. AptarGroup undertakes no obligation to update any forward-looking

statements, whether as a result of new information, future events or

otherwise.

|

|

|

|

|

APTARGROUP, INC.

|

|

Condensed Consolidated Financial Statements (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In Thousands, Except Per Share Data)

|

|

CONSOLIDATED STATEMENTS OF INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

Nine Months Ended

|

|

|

|

|

|

September 30,

|

|

|

|

September 30,

|

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales

|

|

|

|

$

|

586,290

|

|

|

|

$

|

651,942

|

|

|

|

|

$

|

1,770,376

|

|

|

|

$

|

1,998,624

|

|

|

Cost of Sales (exclusive of depreciation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

shown below)

|

|

|

|

|

381,424

|

|

|

|

|

443,520

|

|

|

|

|

|

1,142,681

|

|

|

|

|

1,347,982

|

|

|

Selling, Research & Development and

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative

|

|

|

|

|

81,370

|

|

|

|

|

91,649

|

|

|

|

|

|

266,869

|

|

|

|

|

294,809

|

|

|

Depreciation and Amortization

|

|

|

|

|

35,439

|

|

|

|

|

38,158

|

|

|

|

|

|

103,664

|

|

|

|

|

113,871

|

|

|

Operating Income

|

|

|

|

|

88,057

|

|

|

|

|

78,615

|

|

|

|

|

|

257,162

|

|

|

|

|

241,962

|

|

|

Other Income/(Expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense

|

|

|

|

|

(8,948

|

)

|

|

|

|

(5,332

|

)

|

|

|

|

|

(25,446

|

)

|

|

|

|

(15,459

|

)

|

|

Interest Income

|

|

|

|

|

1,762

|

|

|

|

|

1,386

|

|

|

|

|

|

4,598

|

|

|

|

|

3,449

|

|

|

Equity in results of affiliates

|

|

|

|

|

(209

|

)

|

|

|

|

(124

|

)

|

|

|

|

|

(735

|

)

|

|

|

|

(1,868

|

)

|

|

Miscellaneous, net

|

|

|

|

|

(1,285

|

)

|

|

|

|

(429

|

)

|

|

|

|

|

(2,752

|

)

|

|

|

|

(582

|

)

|

|

Income before Income Taxes

|

|

|

|

|

79,377

|

|

|

|

|

74,116

|

|

|

|

|

|

232,827

|

|

|

|

|

227,502

|

|

|

Provision for Income Taxes

|

|

|

|

|

26,115

|

|

|

|

|

25,496

|

|

|

|

|

|

76,925

|

|

|

|

|

77,390

|

|

|

Net Income

|

|

|

|

$

|

53,262

|

|

|

|

$

|

48,620

|

|

|

|

|

$

|

155,902

|

|

|

|

$

|

150,112

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Income)/Loss Attributable to Noncontrolling Interests

|

|

|

|

|

(15

|

)

|

|

|

|

(25

|

)

|

|

|

|

|

55

|

|

|

|

|

(52

|

)

|

|

Net Income Attributable to AptarGroup, Inc.

|

|

|

|

$

|

53,247

|

|

|

|

$

|

48,595

|

|

|

|

|

$

|

155,957

|

|

|

|

$

|

150,060

|

|

|

Net Income Attributable to AptarGroup, Inc. Per Common Share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

$

|

0.85

|

|

|

|

$

|

0.75

|

|

|

|

|

$

|

2.49

|

|

|

|

$

|

2.30

|

|

|

Diluted

|

|

|

|

$

|

0.83

|

|

|

|

$

|

0.73

|

|

|

|

|

$

|

2.41

|

|

|

|

$

|

2.21

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Numbers of Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

|

62,885

|

|

|

|

|

64,886

|

|

|

|

|

|

62,627

|

|

|

|

|

65,225

|

|

|

Diluted

|

|

|

|

|

64,454

|

|

|

|

|

66,845

|

|

|

|

|

|

64,609

|

|

|

|

|

67,761

|

|

|

|

|

|

|

APTARGROUP, INC.

|

|

Condensed Consolidated Financial Statements (Unaudited)

|

|

(continued)

|

|

(In Thousands)

|

|

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2015

|

|

|

|

December 31, 2014

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Equivalents

|

|

|

|

$

|

434,059

|

|

|

|

$

|

399,762

|

|

Short-term Investments

|

|

|

|

|

67,053

|

|

|

|

|

-

|

|

Total Cash and Equivalents, and Short-term Investments

|

|

|

|

|

501,112

|

|

|

|

|

399,762

|

|

Receivables, net

|

|

|

|

|

422,895

|

|

|

|

|

406,976

|

|

Inventories

|

|

|

|

|

310,844

|

|

|

|

|

311,072

|

|

Other Current Assets

|

|

|

|

|

97,651

|

|

|

|

|

96,128

|

|

Total Current Assets

|

|

|

|

|

1,332,502

|

|

|

|

|

1,213,938

|

|

Net Property, Plant and Equipment

|

|

|

|

|

773,203

|

|

|

|

|

811,655

|

|

Goodwill, net

|

|

|

|

|

316,382

|

|

|

|

|

329,741

|

|

Other Assets

|

|

|

|

|

69,665

|

|

|

|

|

81,856

|

|

Total Assets

|

|

|

|

$

|

2,491,752

|

|

|

|

$

|

2,437,190

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-Term Obligations

|

|

|

|

$

|

72,748

|

|

|

|

$

|

251,976

|

|

Accounts Payable and Accrued Liabilities

|

|

|

|

|

365,460

|

|

|

|

|

352,762

|

|

Total Current Liabilities

|

|

|

|

|

438,208

|

|

|

|

|

604,738

|

|

Long-Term Obligations

|

|

|

|

|

763,731

|

|

|

|

|

588,892

|

|

Deferred Liabilities

|

|

|

|

|

129,909

|

|

|

|

|

139,644

|

|

Total Liabilities

|

|

|

|

|

1,331,848

|

|

|

|

|

1,333,274

|

|

|

|

|

|

|

|

|

|

|

|

AptarGroup, Inc. Stockholders' Equity

|

|

|

|

|

1,159,606

|

|

|

|

|

1,103,407

|

|

Noncontrolling Interests in Subsidiaries

|

|

|

|

|

298

|

|

|

|

|

509

|

|

Total Equity

|

|

|

|

|

1,159,904

|

|

|

|

|

1,103,916

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Equity

|

|

|

|

$

|

2,491,752

|

|

|

|

$

|

2,437,190

|

|

|

|

|

|

APTARGROUP, INC.

|

|

Condensed Consolidated Financial Statements (Unaudited)

|

|

(continued)

|

|

(In Thousands)

|

|

SEGMENT INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

|

|

|

September 30,

|

|

|

September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

|

2015

|

|

2014

|

|

NET SALES

|

|

|

|

|

|

|

|

|

|

|

|

Beauty + Home

|

|

|

$

|

321,638

|

|

|

$

|

378,905

|

|

|

|

$

|

970,176

|

|

|

$

|

1,155,367

|

|

|

Pharma

|

|

|

|

175,427

|

|

|

|

179,191

|

|

|

|

|

537,396

|

|

|

|

569,230

|

|

|

Food + Beverage

|

|

|

|

89,225

|

|

|

|

93,846

|

|

|

|

|

262,804

|

|

|

|

274,027

|

|

|

Total Net Sales

|

|

|

$

|

586,290

|

|

|

$

|

651,942

|

|

|

|

$

|

1,770,376

|

|

|

$

|

1,998,624

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT INCOME (1)

|

|

|

|

|

|

|

|

|

|

|

|

Beauty + Home

|

|

|

$

|

27,961

|

|

|

$

|

25,399

|

|

|

|

$

|

78,529

|

|

|

$

|

80,378

|

|

|

Pharma

|

|

|

|

52,941

|

|

|

|

49,314

|

|

|

|

|

160,404

|

|

|

|

154,589

|

|

|

Food + Beverage

|

|

|

|

13,236

|

|

|

|

11,713

|

|

|

|

|

37,277

|

|

|

|

33,209

|

|

|

Corporate and Other

|

|

|

|

(7,575

|

)

|

|

|

(8,364

|

)

|

|

|

|

(22,535

|

)

|

|

|

(28,664

|

)

|

|

Total Income Before Interest and Taxes

|

|

|

$

|

86,563

|

|

|

$

|

78,062

|

|

|

|

$

|

253,675

|

|

|

$

|

239,512

|

|

|

Interest Expense, Net

|

|

|

|

(7,186

|

)

|

|

|

(3,946

|

)

|

|

|

|

(20,848

|

)

|

|

|

(12,010

|

)

|

|

Income before Income Taxes

|

|

|

$

|

79,377

|

|

|

$

|

74,116

|

|

|

|

$

|

232,827

|

|

|

$

|

227,502

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT INCOME AS % OF NET SALES

|

|

|

|

|

|

|

|

|

|

|

|

Beauty + Home

|

|

|

|

8.7

|

%

|

|

|

6.7

|

%

|

|

|

|

8.1

|

%

|

|

|

7.0

|

%

|

|

Pharma

|

|

|

|

30.2

|

%

|

|

|

27.5

|

%

|

|

|

|

29.8

|

%

|

|

|

27.2

|

%

|

|

Food + Beverage

|

|

|

|

14.8

|

%

|

|

|

12.5

|

%

|

|

|

|

14.2

|

%

|

|

|

12.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to Condensed Consolidated Financial Statements:

|

|

|

(1) - The Company evaluates performance of its business units and

allocates resources based upon segment income defined as earnings

before net interest expense, certain corporate expenses and income

taxes.

|

CONTACT:

AptarGroup, Inc.

Matthew DellaMaria

815-477-0424

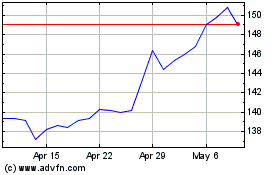

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Mar 2024 to Apr 2024

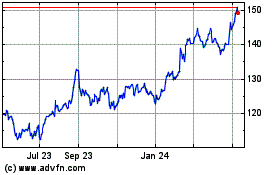

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Apr 2023 to Apr 2024