UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

April

30, 2015

Date

of Report (Date of earliest event reported)

AptarGroup,

Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

1-11846

|

36-3853103

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

475 West Terra Cotta Avenue, Suite E, Crystal Lake, Illinois

60014

|

|

(Address

of principal executive offices)

|

Registrant’s

telephone number, including area code: 815-477-0424.

|

N/A

|

|

(Former name or former address, if changed since last report)

|

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On April 30, 2015, AptarGroup, Inc. (“AptarGroup”) announced certain

information related to its results of operations for the quarter ended

March 31, 2015. The press release regarding this announcement is

furnished as Exhibit 99.1 hereto.

The information in Item 2.02 of this Form 8-K and the Exhibits attached

hereto shall not be deemed "filed" for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended, nor shall they be deemed

incorporated by reference in any filing under the Securities Act of

1933, except as shall be expressly set forth by specific reference in

such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press release issued by AptarGroup, Inc. dated April

30, 2015.

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

|

|

AptarGroup, Inc.

|

|

|

|

|

|

|

|

Date:

|

April 30, 2015

|

By:

|

/s/ Robert W. Kuhn

|

|

|

|

|

|

Robert W. Kuhn

|

|

|

|

|

Executive Vice President,

|

|

|

|

|

Chief Financial Officer and Secretary

|

Exhibit Index

|

99.1

|

Press Release issued by AptarGroup, Inc. dated April 30, 2015.

|

3

Exhibit 99.1

AptarGroup

Posts Strong Earnings Per Share Growth on a Comparable Currency Basis

CRYSTAL LAKE, Ill.--(BUSINESS WIRE)--April 30, 2015--AptarGroup, Inc.

(NYSE:ATR) today reported first quarter sales and earnings per share.

Excluding currency effects, comparable earnings per share increased

significantly over the prior year despite a slight decline in sales.

First Quarter 2015 Summary

-

Excluding currency translation effects, core sales declined 1%

-

Earnings per share reached $0.70, a 17% increase over the prior

year currency-adjusted earnings per share of $0.60

-

Reported sales and earnings per share were negatively impacted by

weak foreign currencies, primarily the Euro

-

Reported sales decreased 13% to $590 million and reported earnings

per share decreased 1% to $0.70 per share from $0.71 per share

reported in the prior year

-

Pharma segment delivered excellent results with core sales growth

in each market

-

Each business segment achieved operating profit margins equal to or

above the prior year’s levels

FIRST QUARTER RESULTS

For the quarter ended March 31, 2015, reported sales decreased 13% to

$590 million from $676 million a year ago. Excluding the negative impact

from changes in currency exchange rates, core sales decreased by 1%.

|

First Quarter Segment Sales Analysis

|

|

(Change Over Prior Year)

|

|

|

|

Beauty +

|

|

|

|

Food +

|

|

Total

|

|

|

|

Home

|

|

Pharma

|

|

Beverage

|

|

AptarGroup

|

|

Sales Growth Before Currency Effects (Core Sales)

|

|

(4%)

|

|

7%

|

|

(4%)

|

|

(1%)

|

|

Currency Effects (1)

|

|

(12%)

|

|

(15%)

|

|

(6%)

|

|

(12%)

|

|

Total Reported Sales Growth

|

|

(16%)

|

|

(8%)

|

|

(10%)

|

|

(13%)

|

(1) - Currency effects are determined by translating last year's amounts

at this year's foreign exchange rates.

Commenting on the quarter, Stephen Hagge, President and CEO, said, “I am

pleased that we were able to achieve strong earnings per share growth on

a comparable currency-adjusted basis despite softness in certain

markets. Our results were primarily driven by another excellent quarter

for our Pharma segment that grew cores sales in each of its markets. We

also benefited from cost containment efforts and lower raw material

costs across each business segment. We are on the right track toward

improving the margin profile of our Beauty + Home segment and while we

are in the early stages, I think this quarter’s result was a good start.

In addition, after a slow start to the quarter, our Food + Beverage

segment’s sales gained momentum as the quarter progressed.”

AptarGroup reported earnings per share of $0.70 compared to $0.71 per

share a year ago. Assuming a comparable foreign currency exchange rate

environment, comparable earnings per share for the prior year were

approximately $0.60.

OUTLOOK

Commenting on AptarGroup’s outlook, Hagge said, “As we look forward to

the second quarter, we are expecting another quarter of solid earnings

growth on a comparable currency-adjusted basis. The weak foreign

currency environment should continue to be a significant headwind on our

translated results. Recent near-term macro-economic forecasts point to

deceleration in the developing regions and there remains some

uncertainty around the pace of growth in the US and Europe. However, our

level of project dialog with customers is good and we are optimistic

that we will continue to drive growth through our targeted market

approach with the industry’s broadest product portfolio. We will also

continue to focus on cost containment as we create affordable innovation

for our customers and consumers.”

AptarGroup expects earnings per share for the second quarter to be in

the range of $0.73 to $0.78 per share compared to $0.79 per share

reported in the prior year. Assuming a comparable foreign currency

exchange rate environment, comparable earnings per share for the prior

year were approximately $0.66.

CASH DIVIDEND

As previously reported, the Board of Directors declared a quarterly cash

dividend of $0.28 per share. The payment date is May 20, 2015, to

stockholders of record as of April 29, 2015.

OPEN CONFERENCE CALL

There will be a conference call on Friday, May 1, 2015 at 8:00 a.m.

Central Time to discuss AptarGroup’s first quarter results for 2015. The

call will last approximately one hour. Interested parties are invited to

listen to a live webcast by visiting the Investor Relations page at www.aptar.com.

Replay of the conference call can also be accessed on the Investor

Relations page of the website.

AptarGroup, Inc. is a leading global supplier of a broad range of

innovative dispensing solutions for the beauty, personal care, home

care, prescription drug, consumer health care, injectables, food, and

beverage markets. AptarGroup is headquartered in Crystal Lake, Illinois,

with manufacturing facilities in North America, Europe, Asia and South

America. For more information, visit www.aptar.com.

This press release contains forward-looking statements. Words such as

“expects,” “anticipates,” “believes,” “estimates,” and other similar

expressions or future or conditional verbs such as “will,” “should,”

“would” and “could” are intended to identify such forward-looking

statements. Forward-looking statements are made pursuant to the safe

harbor provisions of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934 and are based on

management’s beliefs as well as assumptions made by and information

currently available to management. Accordingly, AptarGroup’s actual

results may differ materially from those expressed or implied in such

forward-looking statements due to known or unknown risks and

uncertainties that exist including, but not limited to, economic,

environmental or political conditions in the various markets and

countries in which AptarGroup operates; changes in customer and/or

consumer spending levels; financial conditions of customers and

suppliers; consolidations within our customer or supplier bases;

fluctuations in the cost of raw materials, components and other input

costs; the Company’s ability to increase prices, contain costs and

improve productivity; changes in capital availability or cost, including

interest rate fluctuations; the competitive marketplace; fiscal and

monetary policies and other regulations; inflationary pressures and

changes in foreign currency exchange rates; direct or indirect

consequences of acts of war or terrorism; and labor relations. For

additional information on these and other risks and uncertainties,

please see AptarGroup’s filings with the Securities and Exchange

Commission, including its Form 10-K’s and Form 10-Q’s. Readers are

cautioned not to place undue reliance on forward-looking statements.

AptarGroup undertakes no obligation to update any forward-looking

statements, whether as a result of new information, future events or

otherwise.

|

APTARGROUP, INC.

|

|

Condensed Consolidated Financial Statements (Unaudited)

|

|

|

|

|

|

|

|

(In Thousands, Except Per Share Data)

|

|

CONSOLIDATED STATEMENTS OF INCOME

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

March 31,

|

|

|

|

|

2015

|

|

|

|

2014

|

|

|

|

|

|

|

|

|

Net Sales

|

|

$

|

589,811

|

|

|

$

|

676,051

|

|

|

Cost of Sales (exclusive of depreciation shown below)

|

|

|

385,979

|

|

|

|

453,411

|

|

|

Selling, Research & Development and Administrative

|

|

|

96,187

|

|

|

|

106,674

|

|

|

Depreciation and Amortization

|

|

|

34,060

|

|

|

|

37,247

|

|

|

Operating Income

|

|

|

73,585

|

|

|

|

78,719

|

|

|

Other Income/(Expense):

|

|

|

|

|

|

Interest Expense

|

|

|

(7,303

|

)

|

|

|

(4,881

|

)

|

|

Interest Income

|

|

|

1,731

|

|

|

|

1,016

|

|

|

Equity in income of affiliates

|

|

|

(119

|

)

|

|

|

(1,546

|

)

|

|

Miscellaneous, net

|

|

|

(199

|

)

|

|

|

372

|

|

|

Income before Income Taxes

|

|

|

67,695

|

|

|

|

73,680

|

|

|

Provision for Income Taxes

|

|

|

22,596

|

|

|

|

25,272

|

|

|

Net Income

|

|

$

|

45,099

|

|

|

$

|

48,408

|

|

|

|

|

|

|

|

|

Net Loss/(Income) Attributable to Noncontrolling Interests

|

|

|

72

|

|

|

|

(19

|

)

|

|

Net Income Attributable to AptarGroup, Inc.

|

|

$

|

45,171

|

|

|

$

|

48,389

|

|

|

Net Income Attributable to AptarGroup, Inc. Per Common Share:

|

|

|

|

|

|

Basic

|

|

$

|

0.73

|

|

|

$

|

0.74

|

|

|

Diluted

|

|

$

|

0.70

|

|

|

$

|

0.71

|

|

|

|

|

|

|

|

|

Average Numbers of Shares Outstanding:

|

|

|

|

|

|

Basic

|

|

|

62,292

|

|

|

|

65,468

|

|

|

Diluted

|

|

|

64,494

|

|

|

|

68,232

|

|

|

APTARGROUP, INC.

|

|

Condensed Consolidated Financial Statements (Unaudited)

|

|

(continued)

|

|

(In Thousands)

|

|

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

March 31, 2015

|

|

December 31, 2014

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Equivalents

|

|

$

|

385,693

|

|

$

|

399,762

|

|

Receivables, net

|

|

|

421,560

|

|

|

406,976

|

|

Inventories

|

|

|

284,579

|

|

|

311,072

|

|

Other Current Assets

|

|

|

103,494

|

|

|

96,128

|

|

Total Current Assets

|

|

|

1,195,326

|

|

|

1,213,938

|

|

Net Property, Plant and Equipment

|

|

|

756,488

|

|

|

811,655

|

|

Goodwill, net

|

|

|

309,396

|

|

|

329,741

|

|

Other Assets

|

|

|

73,816

|

|

|

81,856

|

|

Total Assets

|

|

$

|

2,335,026

|

|

$

|

2,437,190

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

Short-Term Obligations

|

|

$

|

22,587

|

|

$

|

251,976

|

|

Accounts Payable and Accrued Liabilities

|

|

|

340,334

|

|

|

352,762

|

|

Total Current Liabilities

|

|

|

362,921

|

|

|

604,738

|

|

Long-Term Obligations

|

|

|

812,232

|

|

|

588,892

|

|

Deferred Liabilities

|

|

|

133,075

|

|

|

139,644

|

|

Total Liabilities

|

|

|

1,308,228

|

|

|

1,333,274

|

|

|

|

|

|

|

|

AptarGroup, Inc. Stockholders' Equity

|

|

|

1,026,361

|

|

|

1,103,407

|

|

Noncontrolling Interests in Subsidiaries

|

|

|

437

|

|

|

509

|

|

Total Equity

|

|

|

1,026,798

|

|

|

1,103,916

|

|

|

|

|

|

|

|

Total Liabilities and Equity

|

|

$

|

2,335,026

|

|

$

|

2,437,190

|

|

APTARGROUP, INC.

|

|

Condensed Consolidated Financial Statements (Unaudited)

|

|

(continued)

|

|

(In Thousands)

|

|

SEGMENT INFORMATION

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

March 31,

|

|

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

NET SALES

|

|

|

|

|

|

Beauty + Home

|

|

$

|

329,414

|

|

|

$

|

391,236

|

|

|

Pharma

|

|

|

178,669

|

|

|

|

194,349

|

|

|

Food + Beverage

|

|

|

81,728

|

|

|

|

90,466

|

|

|

Total Net Sales

|

|

$

|

589,811

|

|

|

$

|

676,051

|

|

|

|

|

|

|

|

|

SEGMENT INCOME (1)

|

|

|

|

|

|

Beauty + Home

|

|

$

|

23,375

|

|

|

$

|

27,781

|

|

|

Pharma

|

|

|

52,001

|

|

|

|

52,482

|

|

|

Food + Beverage

|

|

|

9,050

|

|

|

|

9,080

|

|

|

Corporate and Other

|

|

|

(11,159

|

)

|

|

|

(11,798

|

)

|

|

Total Income Before Interest and Taxes

|

|

$

|

73,267

|

|

|

$

|

77,545

|

|

|

Interest Expense, Net

|

|

|

(5,572

|

)

|

|

|

(3,865

|

)

|

|

Income before Income Taxes

|

|

$

|

67,695

|

|

|

$

|

73,680

|

|

|

|

|

|

|

|

|

SEGMENT INCOME AS % OF NET SALES

|

|

|

|

|

|

Beauty + Home

|

|

|

7.1

|

%

|

|

|

7.1

|

%

|

|

Pharma

|

|

|

29.1

|

%

|

|

|

27.0

|

%

|

|

Food + Beverage

|

|

|

11.1

|

%

|

|

|

10.0

|

%

|

|

Notes to Condensed Consolidated Financial Statements:

|

|

(1) - The Company evaluates performance of its business units and

allocates resources based upon segment income defined as earnings

before net interest expense, certain corporate expenses, and income

taxes.

|

CONTACT:

AptarGroup, Inc.

Matthew DellaMaria, 815-477-0424

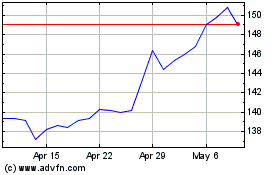

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Mar 2024 to Apr 2024

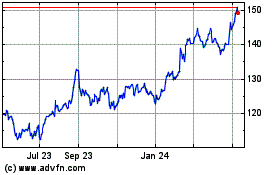

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Apr 2023 to Apr 2024