UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED]

|

FOR THE PERIOD ENDED NOVEMBER 30, 2015

|

|

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 [NO FEE REQUIRED]

|

FOR THE TRANSITION PERIOD FROM

TO

COMMISSION FILE NUMBER 1-12001

TDY INDUSTRIES, INC. 401(K) PROFIT SHARING PLAN

FOR CERTAIN EMPLOYEES OF METALWORKING PRODUCTS

(Title of Plan)

ALLEGHENY TECHNOLOGIES INCORPORATED

(Name of Issuer of securities held pursuant to the Plan)

1000 Six PPG Place, Pittsburgh, Pennsylvania 15222-5479

(Address of Plan and principal executive offices of Issuer)

F

INANCIAL

S

TATEMENTS

AND

S

UPPLEMENTAL

S

CHEDULE

TDY Industries, Inc. 401(k) Profit Sharing Plan for Certain Employees of

Metalworking Products

As of November 30, 2015 and December 31,

2014

and for the Period Ended November 30, 2015

Financial Statements

And Supplemental Schedule

TDY Industries, Inc. 401(k) Profit Sharing Plan for

Certain Employees of Metalworking Products

As of November 30, 2015 and December 31,

2014

and for the Period Ended November 30, 2015

(Unaudited)

Contents

|

|

|

|

|

|

Financial Statements (Unaudited)

|

|

|

Statements of Net Assets Available for Benefits

|

|

|

Statement of Changes in Net Assets Available for Benefits

|

|

|

Notes to Financial Statements

|

|

TDY Industries, Inc. 401(k) Profit Sharing Plan for

Certain Employees of Metalworking Products

Statements of Net Assets Available for Benefits

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

November 30

|

|

December 31

|

|

|

|

2015

|

|

2014

|

|

|

|

(Liquidation basis)

|

|

(Accrual basis)

|

|

Investments at fair value:

|

|

|

|

|

|

Interest in Allegheny Technologies Incorporated Master Trust

|

|

$

|

—

|

|

|

$

|

1,198,096

|

|

|

Total investments at fair value

|

|

—

|

|

|

1,198,096

|

|

|

Investments at contract value:

|

|

|

|

|

|

Interest in Allegheny Technologies Incorporated Master Trust

|

|

—

|

|

|

274,089

|

|

|

Total investments at contract value

|

|

—

|

|

|

274,089

|

|

|

Net assets available for benefits

|

|

$

|

—

|

|

|

$

|

1,472,185

|

|

See accompanying notes.

TDY Industries, Inc. 401(k) Profit Sharing Plan for

Certain Employees of Metalworking Products

Statement of Changes in Net Assets Available for Benefits

(Unaudited)

|

|

|

|

|

|

|

|

|

Period Ended

|

|

|

November 30, 2015

|

|

|

(Liquidation basis)

|

|

Interest income on notes receivable from participants

|

$

|

862

|

|

|

Investment loss:

|

|

|

Net investment loss from Plan interest in Allegheny Technologies Incorporated Master Trust

|

(114,728

|

)

|

|

|

(113,866

|

)

|

|

Other

|

22,053

|

|

|

Net decrease in net assets available for benefits prior to transfer

|

(91,813

|

)

|

|

Transfers out of plan

|

(1,380,372

|

)

|

|

Net decrease in net assets available for benefits

|

(1,472,185

|

)

|

|

Net assets available for benefits at beginning of year

|

1,472,185

|

|

|

Net assets available for benefits at end of year

|

$

|

—

|

|

See accompanying notes.

TDY Industries, Inc. 401(k) Profit Sharing Plan for

Certain Employees of Metalworking Products

Notes to Financial Statements

November 30, 2015

1. Description of the Plan

The TDY Industries, Inc. 401(k) Profit Sharing Plan for Certain Employees of Metalworking Products (the Plan) is a defined contribution plan and is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA). The Plan’s sponsor is Allegheny Technologies Incorporated (ATI, the Plan Sponsor). Further information about the Plan, including eligibility, vesting, contributions, and withdrawals, is contained in the plan documents. Copies of these documents are available from the Plan Sponsor. This Plan was terminated effective November 30, 2015 as a result of the transfer of all participants into the ATI 401(k) Savings Plan.

Separate accounts were maintained by the Plan Sponsor for each participating employee. Trustee fees and asset management fees charged by the Plan’s trustee, Mercer Trust Company, for the administration of all funds were charged against net assets available for benefits of the respective fund. Certain other expenses of administering the Plan were paid by the Plan Sponsor.

Participants were permitted to make “in-service” and hardship withdrawals as outlined in the Plan document.

2. Significant Accounting Policies

Use of Estimates and Basis of Accounting

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements, accompanying notes and supplemental schedules. Actual results could differ from those estimates. For the period January 1, 2015 to November 30, 2015, the financial statements were prepared using the liquidation basis of accounting. For the year ended December 31, 2014, the Plan used the accrual basis of accounting.

Investment Valuation

Certain assets of the Plan were commingled in the Allegheny Technologies Incorporated Master Trust (the Master Trust) with the assets of various ATI sponsored defined contribution plans for investment and administrative purposes. The investment in the Master Trust represented the Plan’s interest in the net assets of the Master Trust, and is stated at fair value or for fully benefit-responsive investments, at contract value. Contract value is the relevant measurement attributable to fully benefit-responsive contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. The contract value represents contributions plus earnings, less participant withdrawals and administrative expenses.

Master Trust assets as well as income/losses are allocated among the participating plans by assigning to each plan those transactions (primarily contributions, benefit payments, and plan-specific expenses) that can be specifically identified and by allocating among all plans, in proportion to the fair value of the assets assigned to each plan, income and expenses resulting from the collective investment of the assets of the Master Trust.

Payment of Benefits

Benefits are recorded when paid.

Recent Accounting Pronouncements

In May 2015, the FASB issued ASU 2015-07, “Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent).” This FASB pronouncement removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share as a practical expedient. ASU 2015-07 also removes the requirement to make certain disclosures for all investments that are eligible to be measured at fair value using the net asset value per share as a practical expedient, and is effective for public businesses beginning after December 15, 2015, with early adoption permitted. ASU 2015-07 requires retrospective application by removing investments measured using net asset value as a practical expedient from the fair value hierarchy in all periods presented. The Plan has elected to early adopt this ASU in the current year and as such, these financial statements have revised disclosures to reflect this adoption.

In July 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2015-12, “Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): (Part I) Fully Benefit-Responsive Investment Contracts, (Part II) Plan Investment Disclosures, (Part III) Measurement Date Practical Expedient (consensuses of the Emerging Issues Task Force).” These FASB pronouncements attempt to reduce complexity in employee benefit plan accounting. Such changes include: (1) measuring and presenting fully benefit responsive investment contracts at contract value; (2) eliminating various requirements for plan investment disclosures, such as net appreciation/depreciation by general investment by type and individual investments that represent 5% or more of net assets; and (3) a practical expedient that permits a plan to measure investments as of a month-end date closest to the plan's fiscal year-end. ASU 2015-12 is effective for the Plan beginning after December 15, 2015, with early adoption permitted and retrospective application required. The Plan has elected to early adopt Parts I and II of this ASU in the current year and as such, these financial statements reflect this adoption.

3. Investments

The Plan was terminated and was no longer part of the Master Trust effective November 30, 2015. In 2014, certain assets of the Plan along with the assets of various other ATI sponsored plans were part of the Master Trust. The Plan’s interest in the net assets of the Master Trust was

<1%

at

December 31, 2014

. The Plan also permitted self-directed investments in registered investment companies that were maintained in accounts separate from the Master Trust.

None of the Plan’s share of the various investment types at fair value or contract value held by the Master Trust at

December 31, 2014

were greater than 1% of the Master Trusts assets.

The following table is a summary, at fair value, of the net assets of the Master Trust by investment type as of

December 31, 2014

:

|

|

|

|

|

|

|

|

|

2014

|

|

Common collective trusts

|

$

|

426,729,102

|

|

|

Registered investment companies

|

287,768,013

|

|

|

Corporate common stocks

|

79,471,712

|

|

|

Other

|

1,018,588

|

|

|

Total investments held by the Master Trust at fair value

|

$

|

794,987,415

|

|

The following table is a summary, at contract value, of the net assets of the Master Trust by investment type as of

December 31, 2014

:

|

|

|

|

|

|

|

|

|

2014

|

|

Synthetic investment contracts

|

$

|

165,415,452

|

|

|

Guaranteed investment contracts

|

36,938,462

|

|

|

Total investments held by the Master Trust at contract value

|

$

|

202,353,914

|

|

Investment income (loss) attributable to the Mater Trust for the period ended November 30, 2015 was as follows:

|

|

|

|

|

|

|

|

Net depreciation in fair value of investments

|

$

|

(35,039,223

|

)

|

|

Income from investments at contract value

|

4,077,766

|

|

|

Expenses

|

|

|

Administrative expenses and other, net

|

(1,635,038

|

)

|

|

Total investment loss

|

$

|

(32,596,495

|

)

|

The BNY Mellon Stable Value Fund (the Fund) investment alternative invests in guaranteed investment contracts (GICs), a pooled separate account, actively managed structured or synthetic investment contracts (SICs), and a common collective trust (CCT). The GICs are promises by a bank or insurance company to repay principal plus a fixed rate of return through contract maturity. SICs differ from GICs in that there are specific assets supporting the SICs and these assets are owned by the Plan. The bank or insurance company issues a wrapper contract that allows participant-directed transactions to be made at contract value. The assets supporting the SICs are comprised of government agency bonds, corporate bonds, residential mortgage backed securities, asset-backed securities (ABOs), common collective trusts (CCT), and collateralized mortgage obligations (CMOs).

Interest crediting rates on the GICs in the Fund are determined at the time of purchase. Such interest rates are reviewed and may be reset on a quarterly basis. Interest crediting rates on the SICs are either: (1) set at the time of purchase for a fixed term

and crediting rate, (2) set at the time of purchase for a fixed term and variable crediting rate, or (3) set at the time of purchase and reset monthly within a “constant duration.” A constant duration contract may specify a duration of 2.5 years, and the crediting rate is adjusted monthly based upon quarterly rebalancing of eligible 2.5 year duration investment instruments at the time of each resetting; in effect the contract never matures.

Although it is management’s intention to hold the investment contracts in the Fund until maturity, certain investment contracts provide for adjustments to contract value for withdrawals made prior to maturity. If the Plan was deemed to be in violation of ERISA or lose its tax exempt status, among other events, the issuers of the fully responsive investment contracts would have the ability to terminate the contracts and settle at an amount different from contract value.

Certain investments are subject to restrictions or limitations if the Plan Sponsor decided to entirely exit an investment. Investments in registered investment companies and the Fund may require at least 30 days prior notice to completely withdraw from the investments. The targeted date fund investments held in common collective trusts currently do not require the prior approval of the investment manager if the Plan Sponsor decides to entirely exit these investments, but prior trade date notification is necessary to effect timely securities settlement or delivery of an investment’s liquidation and transfer to another investment.

4. Fair Value Measurement

In accordance with accounting standards, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The accounting standards establish a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date.

Determination of Fair Value

Fair value is based upon quoted market prices, where available. If listed prices or quotes are not available, fair value is based upon models that primarily use, as inputs, market-based or independently sourced market parameters, including yield curves, interest rates, volatilities, equity or debt prices, foreign exchange rates and credit curves. In addition to market information, models may also incorporate transaction details, such as maturity. Valuation adjustments, such as liquidity valuation adjustments, may be necessary when the Plan is unable to observe a recent market price for a financial instrument that trades in inactive (or less active) markets. Liquidity adjustments are not taken for positions classified within Level 1 (as defined below) of the fair value hierarchy.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different estimate of fair value at the reporting date. There were no changes in the methodologies used at

December 31, 2014

.

Valuation Hierarchy

The three levels of inputs to measure fair value are as follows:

Level 1 – Quoted prices in active markets for identical assets and liabilities.

Level 2 – Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical assets and liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets and liabilities. This includes certain pricing models, discounted cash flow methodologies and similar techniques that use significant unobservable inputs.

A financial instrument’s categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

Valuation Methodologies

The valuation methodologies used for assets and liabilities measured at fair value, including their general classification based on the fair value hierarchy, include the following:

|

|

|

|

•

|

Cash and cash equivalents – Where the net asset value (NAV) is a quoted price in a market that is active, it is classified within Level 1 of the valuation hierarchy. In certain cases, NAV is a quoted price in a market that is not active, or is based

|

on quoted prices for similar assets and liabilities in active markets, and these investments are classified within Level 2 of the valuation hierarchy.

|

|

|

|

•

|

Corporate common stocks – These investments are valued at the closing price reported on the major market on which the individual securities are traded. Common stock is classified within Level 1 of the valuation hierarchy.

|

|

|

|

|

•

|

Common collective trust funds – These investments are investment vehicles valued using the NAV, as a practical expedient, provided by the administrator of the fund. The NAV is based on the value of the underlying assets owned by the fund, minus its liabilities, and then divided by the number of shares outstanding.

|

|

|

|

|

•

|

Registered investment companies – These investments are public investment vehicles valued using the NAV provided by the administrator of the fund. The NAV is based on the value of the underlying assets owned by the fund, minus its liabilities, and then divided by the number of shares outstanding. Where the NAV is a quoted price in a market that is active, it is classified within Level 1 of the valuation hierarchy.

|

The following table presents the financial instruments of the Master Trust at fair value by caption on the statements of net assets available for benefits and by category of the valuation hierarchy (as described above) as of

December 31, 2014

. The Master Trust had no assets classified within Level 3 of the valuation hierarchy. There were no reclassifications of assets between levels of the fair value hierarchy for the period presented.

Master Trust assets measured at fair value on a recurring basis:

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2014

|

|

Level 1

|

|

Total

|

|

Interest in registered investment companies

|

|

$

|

287,768,013

|

|

|

$

|

287,768,013

|

|

|

Corporate common stock

|

|

79,471,712

|

|

|

79,471,712

|

|

|

Other

|

|

1,018,588

|

|

|

1,018,588

|

|

|

Other investments measured at net asset value (a)

|

|

—

|

|

|

426,729,102

|

|

|

|

|

$

|

368,258,313

|

|

|

$

|

794,987,415

|

|

(a) In accordance with ASU 2015-07, certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in Note 3 and to the statement of assets available for benefits.

5. Income Tax Status

The Plan has received a determination letter from the Internal Revenue Service (IRS) dated December 16, 2010, stating that the Plan is qualified under Section 401(a) of the Code and, therefore, the related trust is exempt from taxation. Subsequent to this issuance of the determination letter, the Plan was amended. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. The plan administrator believes the Plan was operated in compliance with the applicable requirements of the Code and, therefore, believes that the Plan, as amended, was qualified and the related trust was tax-exempt until its termination.

The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of November 30, 2015 and December 31, 2014, there are no uncertain positions taken or expected to be taken. The earliest tax year open to U.S. Federal examination is 2012.

6. Plan Termination

The employing companies had the right under the Plan to discontinue their contributions at any time and to terminate their respective participation in the Plan subject to the provisions of ERISA.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the administrators of the Plan have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLEGHENY TECHNOLOGIES INCORPORATED

|

|

|

|

|

|

|

|

|

|

TDY INDUSTRIES, INC. PROFIT SHARING

PLAN FOR CERTAIN EMPLOYEES OF

METALWORKING PRODUCTS

|

|

|

|

|

|

|

Date:

|

May 26, 2016

|

|

|

By:

|

|

/s/ Karl D. Schwartz

|

|

|

|

|

|

|

|

Karl D. Schwartz

|

|

|

|

|

|

|

|

Vice President, Controller and Chief Accounting Officer

|

|

|

|

|

|

|

|

(Principal Accounting Officer and Duly Authorized Officer)

|

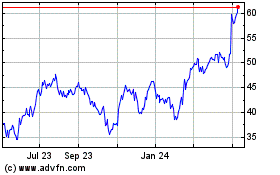

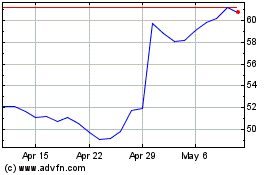

ATI (NYSE:ATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024