U.S. Hot Stocks: Hot Stocks to Watch

April 19 2016 - 9:37AM

Dow Jones News

Among the companies with shares expected to trade actively in

Tuesday's session are Philip Morris International Inc. (PM),

Johnson & Johnson (JNJ) and Harley-Davidson Inc. (HOG).

Philip Morris International Inc. boosted its profit forecast for

the year as it sees currency headwinds waning, as the cigarette

giant Tuesday reported weaker-than-expected first-quarter results.

Shares were down 2.09% to $98.50 in premarket trading.

Johnson & Johnson raised its guidance for the year as the

health-care giant beat earnings expectations in the first quarter

despite foreign exchange rates dragging revenue growth. Shares were

up 0.29% to $111.25 premarket.

Harley-Davidson Inc. said profit fell less than expected in the

first quarter, buoyed by higher motorcycle sales that the company

attributed to newer products and a ramped-up marketing campaign.

Shares were up 2.77% to $48.25 premarket.

Goldman Sachs Group Inc. (GS) said its quarterly earnings

tumbled as rocky markets weighed on many of the firm's main

businesses. Shares fell 1.03% to $157.38 premarket.

UnitedHealth Group Inc. (UNH) on Tuesday raised its guidance for

the year as the biggest U.S. health insurer revised its estimates

on income taxes and amortization and reported better-than-expected

earnings in the first quarter. Shares rose 1.64% to $129.90

premarket.

TD Ameritrade Holding Corp. (AMTD) said Tuesday that its

second-quarter profit climbed 8.5%, in line with Wall Street's

estimates, as revenue at the brokerage rose amid increased client

trading activity. Shares fell 0.16% to $31.60 premarket.

Rambus Inc. (RMBS) reported lower revenue and profit in the

first quarter and projects revenue below Wall Street estimates for

the current period. Rambus expects second-quarter revenue of $72

million to $77 million, while analysts polled by Thomson Reuters

expect $79 million.

Nordstrom Inc. (JWN), which faces headwinds as it competes

online with retailers such as Amazon.com, said Monday that it would

cut 350 to 400 jobs in an effort to "ensure it is best positioned

to respond to the current business environment." The job cuts would

represent less than 1% of the company's 72,500 employees and would

mostly be focused at Nordstrom's corporate center and regional

support teams.

Celanese Corp. (CE) said Monday that it posted

better-than-expected adjusted profit during its first quarter, in

part due to a 4.2% rise in sales from its total materials solutions

business. Though total revenue for the quarter declined, the top

line exceeded the expectations of Wall Street.

Allegheny Technologies Inc. (ATI) said its plans to reduce the

salaried work force in its flat rolled products business by a

third, or more than 250 positions, by the end of the current

quarter.

Write to Chris Wack at chris.wack@wsj.com or Ezequiel Minaya at

Ezequiel.Minaya@wsj.com

(END) Dow Jones Newswires

April 19, 2016 09:22 ET (13:22 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

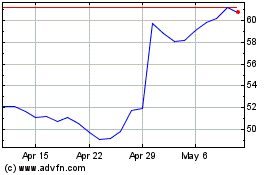

ATI (NYSE:ATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

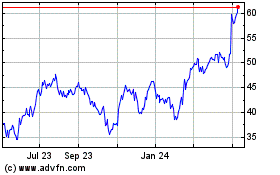

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024