Current Report Filing (8-k)

January 20 2016 - 4:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 20, 2016 (January 19, 2016)

Allegheny Technologies Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-12001 |

|

25-1792394 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 1000 Six PPG Place, Pittsburgh, Pennsylvania |

|

15222-5479 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (412) 394-2800

N/A

(Former name or

former address, if changed since last report).

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On January 19, 2016, Allegheny

Technologies Incorporated issued a press release announcing impairment and other charges that will affect fourth quarter 2015 financial results. A copy of the press release is attached hereto as Exhibit 99.1.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit 99.1 |

|

Press release dated January 19, 2016 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| ALLEGHENY TECHNOLOGIES INCORPORATED |

|

|

| By: |

|

/s/ Elliot S. Davis |

|

|

Elliot S. Davis |

|

|

Senior Vice President, General Counsel, Chief

Compliance Officer and Corporate Secretary |

Dated: January 20, 2016

Exhibit 99.1

|

|

|

|

|

NEWS RELEASE |

|

|

| Allegheny Technologies Incorporated |

|

Contact: |

| Corporate Headquarters |

|

Dan L. Greenfield |

| 1000 Six PPG Place |

|

412-394-3004 |

| Pittsburgh, PA 15222-5479 U.S.A.

www.ATImetals.com |

|

|

ATI Announces Flat Rolled Products Impairment and Other Charges

Pittsburgh, PA, January 19, 2016 – Allegheny Technologies Incorporated (NYSE: ATI) today announced that fourth quarter 2015 results will include

approximately $267 million in pre-tax charges, including approximately $181 million of non-cash, long-lived asset impairment charges for its Flat Rolled Products (FRP) business, and $76 million of non-cash inventory charges.

Asset impairment charges include the write off of all $127 million of goodwill in the FRP business. As previously announced, ATI is taking rightsizing actions

to better align its FRP operations to the challenging market conditions for its commodity products. These actions include:

| |

• |

|

Idling the standard stainless melt shop and sheet finishing operations at the Midland, PA facility, which is expected to be completed in January 2016. |

| |

• |

|

Idling grain-oriented electrical steel (GOES) operations, including the Bagdad, PA facility, which is expected to be completed by April 2016. |

As a result of these actions, fourth quarter results will include a non-cash impairment charge of approximately $54 million to reduce the carrying value of

long-lived assets at the Midland, PA facility and GOES operations, and a $4 million charge for idling costs. The future restart of the Midland and GOES operations, respectively, will depend on future business conditions and ATI’s ability to

earn an acceptable return on invested capital on products produced at these operations.

Fourth quarter 2015 results will also include $51 million in

non-cash Net Realizable Value inventory reserves that offset LIFO Reserve benefits in the fourth quarter due to falling raw material prices, a $25 million non-cash charge to revalue non-Premium Quality grades of titanium sponge inventory to current

market prices, and $6 million for previously-announced severance charges for a salaried workforce reduction in both the High Performance Materials and Components Segment and at ATI’s headquarters.

ATI will report fourth quarter 2015 results on Tuesday, January 26, 2016.

This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

are based on management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which we are unable to predict or control, that may cause our actual results, performance or achievements to materially

differ from those expressed or implied in the forward-looking statements. Additional information concerning factors that could cause actual results to differ materially from those projected in the forward-looking statements is contained in our

filings with the Securities and Exchange Commission. We assume no duty to update our forward-looking statements.

Creating Value Thru Relentless Innovation®

Allegheny Technologies Incorporated is one of the largest and most diversified specialty materials and components producers in the world with revenues of

approximately $4.0 billion for the twelve months ended September 30, 2015. At September 30, 2015, ATI had approximately 9,500 full-time employees world-wide who use innovative technologies to offer global markets a wide range of specialty

materials solutions. Our major markets are aerospace and defense, oil & gas/chemical and hydrocarbon process industry, electrical energy, medical, automotive, food equipment and appliance, and construction and mining. The ATI website is

www.ATImetals.com.

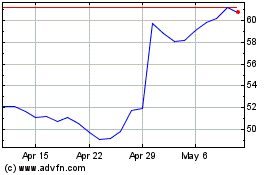

ATI (NYSE:ATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

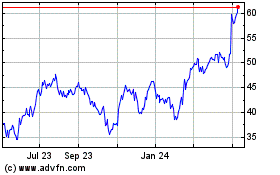

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024