Allegheny Technologies to Book $267 Million in Charges

January 19 2016 - 9:20AM

Dow Jones News

Allegheny Technologies Inc. said it would book $267 million in

charges in its recently-ended fourth quarter, mostly to write down

the value of its flat-rolled products business and idle some

operations.

ATI, which manufactures specialty materials for such industries

as defense and aerospace, has been focused on reducing costs to

help offset weak demand. In December, the company slashed its

quarterly dividend by 56%.

The Pittsburgh-based company said it will write off $127 million

in goodwill for its flat-rolled products business, which makes

stainless steels and electrical steels. ATI has recently announced

plans to shrink that business in light of "challenging market

conditions for its commodity products."

It is idling its Midland, Pa., facility by the end of the month

and its Bagdad, Pa. electrical steel operations by April.

It will book about $54 million in impairment charges to reduce

the carrying value of assets at those facilities and a $4 million

idling charge.

In addition, ATI will take $76 million in inventory charges in

the fourth quarter related to commodity pricing and a $6 million

severance charge.

ATI will report results for the fourth quarter on Jan. 26.

Shares of ATI, inactive premarket, are down 71% in the past 12

months.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

January 19, 2016 09:05 ET (14:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

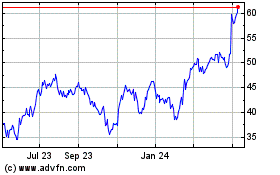

ATI (NYSE:ATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

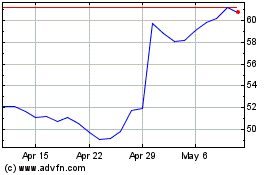

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024