UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant To Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant x Filed by

a Party other than the Registrant ¨

Check the appropriate box:

|

|

|

|

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

|

|

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| x |

|

Definitive Proxy Statement |

|

|

| ¨ |

|

Definitive Additional Materials |

|

|

| ¨ |

|

Soliciting Material Pursuant to §240.14a-12 |

|

|

|

|

Allegheny Technologies Incorporated |

|

|

|

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

|

|

| x |

|

No fee required. |

|

|

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5) |

|

Total fee paid:

|

|

|

|

|

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials. |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3) |

|

Filing Party:

|

|

|

|

|

|

|

|

(4) |

|

Date Filed:

|

|

|

|

|

|

1000 Six PPG Place

Pittsburgh, PA 15222-5479

March 20, 2015

To our Stockholders:

We are pleased to invite you to attend

Allegheny Technologies Incorporated’s 2015 Annual Meeting of Stockholders. The meeting will be held on Friday, May 1, 2015, at 11:00 a.m. Eastern Time in the State Suites of The Fairmont Copley Plaza Hotel, 138 St. James Avenue, Boston,

Massachusetts 02116. The location is accessible to disabled persons.

This booklet includes the notice of meeting as well as the Company’s Proxy

Statement. Also enclosed are:

| • |

|

a proxy or voting instruction card (including a return envelope for the card) and instructions for telephone and Internet voting; and

|

| • |

|

the Company’s 2014 Annual Report. |

Your

Board of Directors recommends that you vote:

| |

(1) |

FOR the election of the four director nominees named in the Proxy Statement (Item 1); |

| |

(2) |

FOR the approval of the Company’s 2015 Incentive Plan (Item 2); |

| |

(3) |

FOR the advisory vote to approve the compensation of the Company’s named executive officers (Item 3); and |

| |

(4) |

FOR the ratification of the selection of Ernst & Young LLP to serve as the Company’s independent auditors for 2015 (Item 4). |

The Proxy Statement also outlines corporate governance practices at ATI, discusses our compensation practices and philosophy, and describes the Audit

Committee’s recommendation to the Board regarding our 2014 financial statements. We encourage you to read these materials carefully.

We urge you to

vote promptly, whether or not you expect to attend the meeting.

Thank you for your continued support of ATI. We look forward to seeing you in Boston.

Sincerely,

Richard J. Harshman

Chairman,

President and Chief Executive Officer

ALLEGHENY TECHNOLOGIES INCORPORATED

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

|

|

| Meeting Date: |

|

Friday, May 1, 2015 |

|

|

| Time: |

|

11:00 a.m. Eastern Time |

|

|

| Place: |

|

State Suites The Fairmont Copley Plaza

Hotel 138 St. James Avenue Boston, Massachusetts

02116 |

|

|

| Record Date: |

|

March 9, 2015 |

AGENDA:

| 1) |

Election of four directors; |

| 2) |

Approval of the Company’s 2015 Incentive Plan; |

| 3) |

Advisory vote to approve the compensation of the Company’s named executive officers; and |

| 4) |

Ratification of the selection of Ernst & Young LLP as independent auditors for 2015. |

ADMISSION TO THE MEETING

Only

holders of ATI common stock or their authorized representatives by proxy may attend the meeting. If you are a stockholder of record and plan to attend the meeting, please mark the appropriate box on the proxy card, or enter the appropriate

information when voting by telephone or Internet, so that we can send an admission ticket to you before the meeting. If your shares are held through an intermediary such as a broker or a bank, you will need to present proof of your ownership as of

the record date for admission to the meeting. Proof of ownership could include a proxy card from your bank or broker or a copy of your account statement. All attendees will need to present valid photo identification for admission to the meeting.

The approximate date of the mailing of this Proxy Statement, proxy card, and ATI’s 2014 Annual Report is March 20, 2015. For further

information about ATI, please visit our website at www.atimetals.com.

On behalf of the Board of Directors:

Elliot S. Davis

Corporate

Secretary

Dated: March 20, 2015

TABLE OF CONTENTS

|

| YOUR VOTE IS IMPORTANT

Please vote as soon as possible. You can help the Company reduce expenses by voting your shares by telephone or Internet; your proxy card or voting instruction card contains the instructions. Or complete, sign and date your proxy card or voting

instruction card and return it as soon as possible in the enclosed postage-paid envelope. IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ATI ANNUAL

MEETING OF STOCKHOLDERS TO BE HELD ON

FRIDAY, MAY 1, 2015.

The proxy statement, proxy card and 2014 annual report of Allegheny

Technologies

Incorporated are available for review at: http://www.envisionreports.com/ATI |

|

|

FORWARD-LOOKING STATEMENTS

In this Proxy Statement, the Company has made certain

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Certain statements in this Proxy Statement relate to future events and expectations and, as such, constitute forward-looking

statements. Forward-looking statements include those containing such words as “anticipates,” “believes,” “estimates,” “expects,” “would,” “should,” “will,” “will likely

result,” “forecast,” “outlook,” “projects,” and similar expressions. Such forward-looking statements are based on management’s current expectations and include known and unknown risks, uncertainties and other

factors, many of which the Company is unable to predict or control, that may cause our actual results or performance to materially differ from any future results or performance expressed or implied by such statements. Various of these factors are

described in Item 1A, Risk Factors, of the Company’s Annual Report on Form 10-K for its fiscal year ended December 31, 2014 and will be described from time-to-time in the Company other filings with the SEC, including the

Company’s subsequent reports filed with the SEC on Form 10-Q and Form 8-K, which are available on the SEC’s website at www.sec.gov and on the Company’s website at www.atimetals.com. We assume no duty to update our

forward-looking statements. |

2015 PROXY STATEMENT SUMMARY

This summary highlights information that is contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should

consider, so you should carefully read this Proxy Statement in its entirety before voting.

Annual Meeting of Stockholders

|

|

|

| Meeting Date: |

|

Friday, May 1, 2015 |

|

|

| Time: |

|

11:00 a.m. Eastern Time |

|

|

| Place: |

|

State Suites The Fairmont Copley Plaza

Hotel 138 St. James Avenue Boston, Massachusetts

02116 |

|

|

| Record Date: |

|

March 9, 2015 |

|

|

| Voting: |

|

ATI stockholders as of the record date are entitled to vote on the matters presented at the meeting. Each share of common stock of the Company is entitled to one vote for each

director nominee and one vote on each other matter presented. |

Agenda for Annual Meeting and Voting

|

|

|

|

|

| Matters for Consideration by Stockholders |

|

Board’s

Recommendation |

|

|

|

| Item 1 |

|

Election of four directors |

|

FOR |

|

|

|

| Item 2 |

|

Approval of the Company’s 2015 Incentive Plan |

|

FOR |

|

|

|

| Item 3 |

|

Advisory vote to approve the compensation of the Company’s named executive officers |

|

FOR |

|

|

|

| Item 4 |

|

Ratification of the selection of Ernst & Young LLP as the Company’s independent auditors for 2015 |

|

FOR |

|

|

|

| — |

|

Any other business that may come before the meeting |

|

— |

Director Nominees

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Class |

|

Term to Expire |

|

Director Since |

|

Experience and Qualifications |

|

ATI Board Committee Memberships |

| Diane C. Creel* |

|

I |

|

2018 |

|

1996 |

|

Leadership; Industry |

|

Finance; Nominating and Governance; Personnel and Compensation |

| John R. Pipski |

|

I |

|

2018 |

|

2011 |

|

Industry; Accounting |

|

Audit; Finance; Technology |

| JamesE. Rohr |

|

I |

|

2018 |

|

1996 |

|

Leadership; Finance |

|

Personnel and Compensation |

| David J. Morehouse |

|

III |

|

2017 |

|

2015 |

|

Operations; Marketing |

|

Audit; Technology |

| * |

Ms. Creel serves as Lead Independent Director. |

ATI

2014 Performance and Accomplishments

Since 2004, ATI has been executing a long-term strategy to transform the Company to a diversified specialty

materials business that is focused on differentiated products serving global growth markets. The objective of this strategy is to better position the Company for long-term profitable growth and enhance the opportunities to create value for our

stockholders through business cycles. To accomplish this objective, our Board of Directors and management believe that, to compete effectively in global markets primarily as a U.S.-based manufacturer, ATI must have the most advanced specialty

materials technologies, offer innovative products that create value for customers, utilize unsurpassed manufacturing capabilities, and maintain a competitive cost structure.

1

Throughout 2014, we focused on improving our market position and completing our strategic investments to enhance

ATI’s position as a leading global specialty materials and components producer. These actions are aimed at improving our future performance and positioning ATI to benefit from long-term growth opportunities. Our major strategic accomplishments

during 2014 include:

| • |

|

Successfully reaching several long-term agreements (LTAs) with strategic aerospace customers during 2014 and early 2015 valued at over $4 billion. These

agreements secure significant growth on next-generation and legacy airplanes and are enabled by the capital investments, acquisitions, and technology innovations we have made during the past several years. |

| • |

|

Completing the product commissioning of our ATI Flat Rolled Products segment Hot-Rolling and Processing Facility (HRPF) at the end of 2014. The HRPF is a

critical part of our strategy to transform our flat rolled products business into a more competitive and consistently profitable business. It is designed to significantly expand our product offering capabilities, shorten manufacturing cycle times,

reduce inventory requirements, and improve the cost structure of our flat rolled products business. We expect to realize sales growth and cost reduction benefits as we increase production volume during 2015. |

| • |

|

Our Rowley, UT titanium sponge facility becoming approved as a premium-quality (PQ) aero-engine supplier in December 2014. The PQ qualification process for our

products used in jet engine rotating parts made with our sponge is expected to be completed by mid-2015. We continue to achieve improvements in key operational areas and expect to steadily increase production rates, and realize lower titanium

production costs per pound, as we progress through 2015. |

| • |

|

Acquiring two businesses that expand our value-added capabilities to provide components and near-net shape parts. ATI Flowform Products adds precision

flowforming process technologies to ATI’s capabilities. ATI Cast Products Salem Operations adds precision machining capability. |

| • |

|

Making several significant changes to our retirement benefit programs. These changes are part of ATI’s ongoing initiatives to create an aligned and

integrated business with a market competitive, cost competitive, and consistent health, welfare and retirement benefit structure across our operations. As a result of these changes, which are expected to gradually improve our ability to control our

retirement benefit obligations, we expect to incur lower retirement benefit expense in future years. |

| • |

|

Paying down $414.9 million of debt, including $397.5 million paid at maturity on our 2014 convertible notes. |

| • |

|

Maintaining a solid liquidity position, with approximately $270 million in cash on hand and no borrowings outstanding under our $400 million domestic borrowing

facility at the end of the year. Total debt to total capital was 37.0% at December 31, 2014, compared to 40.2% at the end of 2013. We have no significant debt maturities for the next four years. |

| • |

|

Continuing our focus on safety, with our 2014 OSHA Total Recordable Incident Rate and Lost Time Case Rate improving to 2.07 and 0.39, respectively, which we

believe to be competitive with world-class performance in our industry. |

In addition, we are near the end of our multi-year cycle of

capital expenditures on major strategic investments.

Management was able to accomplish these objectives while maintaining a focus on relentless

innovation, new product development, cost reductions and productivity improvements, safety and environmental compliance, and values-based leadership.

2

Investor Outreach and the 2014 Say-On-Pay Vote

We believe in active dialogue with our stockholders. As part of our investor relations program, we regularly communicate with our investors and actively engage

with them on topics of importance to them. In addition, we solicit their feedback on corporate governance topics and ATI’s executive compensation program. Our objective is to be responsive to our stockholders and to ensure that we

understand and, to the extent practicable, address our stockholders’ concerns and observations. The results of our engagement are reflected in the changes that we have made to our corporate governance practices and our executive compensation

program in recent years. We have welcomed the feedback received from our stockholders, and we intend to continue our practice of engaging with our stockholders on important topics.

At our 2014 Annual Meeting, our stockholders expressed a high level of support for our executive compensation program, with over 97% of the votes cast having been for the approval of our Say-On-Pay proposal. In

particular, we believe that our stockholders have recognized our efforts to enhance the alignment of our pay and performance.

Approval

of the Company’s 2015 Incentive Plan

The Board of Directors recommends that the stockholders approve the Company’s 2015 Incentive Plan. The

principal reasons that the Board of Directors believes that the proposed plan is in the best interests of the Company and its stockholders are as follows:

| • |

|

Equity compensation awards are a critical recruitment and retention tool. |

| • |

|

Our compensation programs are aligned with stockholder interests. |

| • |

|

Approval of the 2015 Incentive Plan would avoid disruption in our compensation program. |

| • |

|

The Company has demonstrated commitment to sound equity compensation practices and pay-for-performance. |

Overall Compensation Philosophy

The Personnel and

Compensation Committee (the “Committee”) of the Board of Directors believes that the Company’s executive compensation program reflects the Committee’s pay-for-performance philosophy, is designed to reward executive management

based on Company performance, and is effective in achieving the Company’s underlying compensation goals, including the creation of long-term stockholder value and the retention and acquisition of key employees.

The overriding principle in designing ATI’s executive compensation program is to drive the Board’s and management’s long-term strategic vision for

the Company, and to ensure that the program is aligned with the appropriate pay-for-performance philosophy and stockholder value creation over the long-term.

3

Recent Executive Compensation Program Actions

Over the last several years, we have engaged with our stockholders and implemented changes to our executive compensation program in light of the feedback received,

while balancing the issue of maintaining compensation plans that are competitive to enable the retention and acquisition of key executives and employees. As a result, we have made a number of substantive changes to our executive compensation

program, which are summarized as follows and were effective beginning with the plan year indicated:

|

|

|

|

|

|

|

|

|

| |

|

PRSP |

|

TSRP |

|

KEPP |

|

Other

Compensation Practices |

| 2014 |

|

No changes. |

|

New awards were discontinued. |

|

New awards were discontinued. |

|

Adopted the Long-Term

Performance Plan, with two components, to replace new awards under TSRP and KEPP.

Froze the Supplemental Pension Plan effective December 31, 2014.

Increased CEO’s stock ownership guideline |

| |

|

|

|

|

| 2013 |

|

Further reduced CEO’s target award opportunity. |

|

Further reduced CEO’s target award opportunity.

Increased the minimum (threshold) level of Company performance required for payout to be

35th percentile relative to peer group (from 25th percentile). |

|

Reduced maximum payout opportunity under Level I by half to 5X, while preserving rigorous performance

goals. Discontinued Level II. |

|

Eliminated the excise tax gross-up provision from the CEO’s change in control

agreement. Eliminated excise tax gross-up provision from new or modified change in

control agreements. Restructured the benchmarking peer group to eliminate

substantially larger and smaller companies. Eliminated remaining

gross-ups. Formalized long-standing policy to prohibit hedging and pledging of stock

by officers and directors. |

| |

|

|

|

|

| 2012 |

|

Maintained CEO target award opportunity at a reduced level. |

|

Maintained CEO target award opportunity at a reduced level.

Reduced the maximum payout opportunity to 200% of base salary (from 300%). |

|

Changed structure of Level I performance targets to be incrementally more challenging between target and maximum

levels. |

|

Eliminated perquisites of personal use of corporate

aircraft, payment of club dues, and related gross-ups. Revised executive stock

ownership guidelines to apply deeper into organization and require retention of stock until guidelines are met. |

4

These changes and modifications were prospective at the time of implementation and will not be fully reflected in

the compensation of our named executive officers until the applicable long-term incentive plans fully mature. These changes and modifications made in 2014, 2013 and 2012 are having the intended impact, given the fact that CEO total direct

compensation increased modestly in 2014 and is projected to increase in 2015 in line with ATI performance. The Committee was advised by its compensation consultant of the median target total direct CEO compensation for the Company’s

benchmarking peer group. At year-end 2014, our CEO’s target total direct compensation approximated the benchmarking peer group median as a result of the changes discussed above, which were intended to better align it with the market and our

compensation philosophy.

For the 2014 plan year, the Committee discontinued new awards under the Key Executive Performance Plan

(“KEPP”) and the separate Total Shareholder Return Incentive Compensation Program (“TSRP”), and adopted the Long-Term Performance Plan (“LTPP”). The LTPP is comprised of two performance components: (1) a component

measuring total shareholder return (“TSR”), and (2) the Long-Term Shareholder Value (“LTSV”) component, under which three-year performance restricted stock is granted to members of the management Executive Council and will

vest in whole or in part subject to achievement of strategic operational goals that are expected to create stockholder value over the long-term.

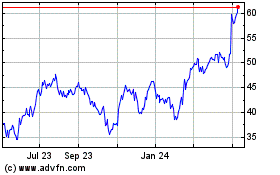

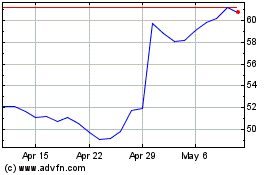

Pay for Performance Alignment

ATI’s compensation philosophy is that a substantial portion of the

named executive officers’ compensation should be at risk, and that total compensation for the CEO should target the median of peer group compensation. Alignment of CEO compensation with Company performance is evidenced by the following chart,

which illustrates how our three-year total stockholder return aligns with the total compensation paid to our CEO during that time. Total stockholder return assumes that $100 was invested in ATI stock at December 31, 2011. The chart below also

illustrates the effects of the compensation changes initiated by the Committee over the past three years.

5

Total Realized Compensation

The following table shows, for each of the Company’s named executive officers who were officers of the Company as of December 31, 2014, total compensation realized in 2014, compared to 2013:

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Position |

|

2013 Total

Realized

Compensation |

|

|

2014 Total

Realized

Compensation |

|

| Richard J. Harshman |

|

Chairman, President and Chief Executive Officer |

|

$ |

2,763,169 |

|

|

$ |

3,289,353 |

|

| Patrick J. DeCourcy(1) |

|

Senior Vice President, Finance and Chief Financial Officer |

|

$ |

337,148 |

|

|

$ |

895,137 |

|

| Hunter R. Dalton |

|

Executive Vice President, ATI High Performance Specialty Materials Group |

|

$ |

1,116,933 |

|

|

$ |

1,330,309 |

|

| John D. Sims |

|

Executive Vice President, ATI High Performance Components Group |

|

$ |

1,012,568 |

|

|

$ |

1,246,772 |

(2)

|

| Terry L.

Dunlap(3) |

|

Former Executive Vice President, ATI Flat-Rolled Products Group |

|

$ |

1,285,817 |

|

|

$ |

1,140,318 |

|

| (1) |

Mr. DeCourcy became Senior Vice President, Finance and Chief Financial Officer in December 2013. Mr. DeCourcy participated in the long-term

compensation plans for the performance measurement periods beginning in 2012 and 2013 at a lower level and did not participate in the KEPP for any period. |

| (2) |

Amount for Mr. Sims excludes relocation costs that are included in the “All Other Compensation” column of the Summary Compensation Table.

|

| (3) |

Mr. Dunlap retired from the Company effective December 31, 2014. |

When making determinations and awards under the plans, the Committee looks to the actual dollar value of awards to be delivered to the officers in any given year, as illustrated by the Total Realized Compensation

figures summarized in the prior table. The Committee views the amounts set forth in the Summary Compensation Table, as shown on page 67, as one measure of the compensation opportunity for each named executive officer under the executive compensation

program. Stockholders are encouraged to read the section of this Proxy Statement titled “Executive Compensation” beginning on page 39 for more information about ATI’s executive compensation program.

Ratification of Selection of Independent Auditors

We are requesting that stockholders ratify the selection of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending

December 31, 2015. The table below shows the fees paid to Ernst & Young LLP in 2014.

|

|

|

|

|

| Service |

|

2014 |

|

| Audit fees |

|

$ |

3,592,000 |

|

| Audit-related fees |

|

|

14,000 |

|

| Tax fees |

|

|

0 |

|

| All other fees |

|

|

2,000 |

|

| Total |

|

$ |

3,608,000 |

|

6

PROXY STATEMENT FOR

2015 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS

You can help the Company save money by electing to receive

future proxy statements and annual reports over the Internet instead of by mail. See question 15.

| 1. |

WHERE IS THE 2015 ANNUAL MEETING BEING HELD?

|

The 2015 Annual Meeting of Stockholders will be held on Friday, May 1, 2015, at 11:00 a.m. Eastern Time in the State Suites of

The Fairmont Copley Plaza Hotel,138 St. James Avenue, Boston, Massachusetts, 02116. The Company is holding the annual meeting in Boston because the ATI Flowform Products business is located in nearby Billerica, Massachusetts.

| 2. |

WHO IS ENTITLED TO VOTE AT THE ANNUAL

MEETING? |

If you held shares of Allegheny Technologies Incorporated (“ATI” or the “Company”) common

stock, par value $0.10 per share (“Common Stock”), at the close of business on March 9, 2015, you may vote your shares at the annual meeting. On that day, 109,204,465 shares of Common Stock were outstanding.

In order to vote, you must follow the instruction provided on your proxy card to designate a proxy to vote on your behalf or attend the meeting and vote your shares

in person. The ATI Board of Directors (the “Board”) requests your return proxy as soon as possible to ensure that your shares are represented and will be voted at the meeting, whether or not you plan to attend the meeting.

| 3. |

HOW DO I CAST MY VOTE? |

There are four different ways you may cast your vote. You may vote by:

| • |

|

telephone, using the toll-free number listed on each proxy or voting instruction card; |

| • |

|

the Internet, at the web address provided on each proxy or voting instruction card; |

| • |

|

marking, signing, dating and mailing each proxy or voting instruction card and returning it in the postage-paid envelope provided. If you return your

signed proxy card, but do not mark the boxes showing how you wish to vote on any particular item, your shares will be voted as the Board of Directors recommends for any such items; or |

| • |

|

attending the meeting and voting your shares in person, if you are a stockholder of record (that is, your shares are registered directly in your name on

the Company’s books and are not held in “street name” through a broker, bank or other nominee). |

If you are a

stockholder of record wishing to vote by telephone or electronically through the Internet, you will need to use the individual control number that is printed on your proxy card in order to authenticate your ownership. The deadline for voting by

telephone or the Internet is 11:59 p.m. Eastern Time on April 30, 2015.

If your shares are held in “street name” (that is, they are held

in the name of broker, bank or other nominee), or if your shares are held in one of the Company’s savings or retirement plans, you will receive instructions with your materials that you must follow in order to have your shares voted. For voting

procedures for shares held in the Company’s savings or retirement plans, see the response to question 13 below.

| 4. |

WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES

AS A STOCKHOLDER OF RECORD AND AS A BENEFICIAL OWNER? |

Most of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some

differences between shares held of record and those owned beneficially.

7

Stockholders of Record. If your shares are registered directly in your name with our transfer agent,

Computershare Shareowner Services, you are considered to be the stockholder of record with respect to those shares, and the Notice of Annual Meeting and proxy materials are being sent directly to you. As the stockholder of record, you have the right

to grant your voting proxy directly, to vote electronically, or to vote in person at the Annual Meeting. If you have requested printed proxy materials, we have enclosed a proxy card for you to use.

Beneficial Owners. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner

of shares held in “street name,” and the Notice of Annual Meeting and these proxy materials are being forwarded to you by your broker, bank or nominee who is considered to be the stockholder of record with respect to those shares. As the

beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual

Meeting, unless you request, complete and deliver a legal voting proxy from your broker, bank or nominee. If you requested printed proxy materials, your broker, bank or nominee has enclosed a voting instruction card for you to use in directing the

broker, bank or nominee regarding how to vote your shares.

| 5. |

HOW MANY VOTES CAN BE CAST BY ALL

STOCKHOLDERS? |

Each share of ATI Common Stock is entitled to one vote. There is no cumulative voting. We had 109,204,465

shares of Common Stock outstanding and entitled to vote on the record date.

| 6. |

HOW MANY VOTES MUST BE PRESENT TO HOLD

THE ANNUAL MEETING? |

A majority of the shares entitled to vote as of the record date must

be present in person or by proxy at the Annual Meeting in order to hold the Annual Meeting and conduct business. This is called a “quorum.” Your shares will be counted as present at the Annual Meeting if you properly cast your vote in

person, electronically or telephonically, or a proxy card has been properly submitted by you or on your behalf. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum.

| 7. |

HOW MANY VOTES ARE REQUIRED TO ELECT

DIRECTORS (ITEM 1)? |

Directors are elected by a plurality of the votes cast. This means that the four

individuals nominated for election to the Board of Directors who receive the most “FOR” votes (among votes properly cast in person, electronically, telephonically or by proxy) will be elected.

While directors are elected by a plurality of votes cast, our Bylaws include a director resignation policy. This policy states that in an uncontested election, any

director nominee who receives a greater number of votes “WITHHELD” from his or her election, as compared to votes “FOR” such election, must tender his or her resignation. The Nominating and Governance Committee of the Board is

required to make recommendations to the Board of Directors with respect to any such tendered resignation. The Board of Directors will act on the tendered resignation within 90 days from the certification of the vote and will publicly disclose its

decision, including its rationale.

Only votes “FOR” or “WITHHELD” are counted in determining whether a plurality has been cast in

favor of a director nominee; abstentions are not counted for purposes of the election of directors. If you withhold authority to vote with respect to the election of some or all of the nominees, your shares will not be voted with respect to those

nominees indicated. For a “WITHHOLD” vote, your shares will be counted for purposes of determining whether there is a quorum and will have a similar effect as a vote against that director nominee for purposes of our director resignation

policy.

Full details of our director resignation policy are set forth in our Bylaws available on our website at www.atimetals.com.

8

| 8. |

HOW MANY VOTES ARE REQUIRED TO ADOPT

THE OTHER PROPOSALS (ITEMS 2, 3 AND 4)? |

All of the other

proposals will be approved if such items receive the affirmative vote of at least a majority of the shares of ATI Common Stock represented at the Annual Meeting and entitled to vote on the matter. If your shares are represented at the Annual Meeting

but you abstain from voting on any of these matters, your shares will be counted as present and entitled to vote on a particular matter for purposes of establishing a quorum, and the abstention will have the same effect as a vote against that

proposal.

Your vote on Item 3 (executive compensation) is advisory, which means the result of the vote is non-binding. Although non-binding, the

Board and its committees value the opinions of our stockholders and will review and consider the voting result when making future decisions regarding executive compensation.

| 9. |

WHAT IF I DON’T GIVE SPECIFIC VOTING

INSTRUCTIONS? |

Stockholders of Record. If you are a stockholder of record and you indicate when voting by

Internet or by telephone that you wish to vote as recommended by our Board of Directors, or if you return a signed proxy card but do not indicate how you wish to vote, then your shares will be voted:

| • |

|

in accordance with the recommendations of the Board of Directors on all matters presented in this Proxy Statement; and |

| • |

|

as the proxy holders may determine in their discretion regarding any other matters properly presented for a vote at the meeting. |

If you indicate a choice with respect to any matter to be acted upon on your proxy card, the shares will be voted in accordance with your instructions on such

matter.

Beneficial Owners. If you are a beneficial owner and hold your shares in street name and do not provide the organization that

holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. In very limited circumstances, brokers have the discretion to vote on matters deemed to be

routine. Under applicable law and the rules of the New York Stock Exchange, brokers generally do not have discretion to vote on most matters. For example, if you do not provide voting instructions to your broker, the broker could vote your shares in

its discretion with respect to the proposal to ratify the selection of Ernst & Young LLP as our independent auditors for 2015 (Item 4) because that is deemed to be a routine matter, but the broker likely could not vote your shares for any

of the other proposals on the agenda for the Annual Meeting. We encourage you to provide instructions to your broker regarding the voting of your shares.

If you do not provide voting instructions to your broker and the broker has indicated that it does not have discretionary authority to vote on a particular

proposal, your shares will be considered “broker non-votes” with regard to that matter. Broker non-votes will be considered as represented for purposes of determining a quorum. Broker non-votes are not counted for purposes of determining

the number of votes cast with respect to a particular proposal and are not considered to be shares entitled to vote on non-routine matters. Thus, a broker non-vote will make a quorum more readily obtainable, but the broker non-vote will not

otherwise affect the outcome of the vote on Items 2, 3 and 4, which each require the affirmative vote of a majority of the shares present and entitled to vote.

| 10. |

HOW DO I REVOKE OR CHANGE MY VOTE?

|

You may revoke your proxy or change your vote at any time before it is voted at the meeting by:

| • |

|

notifying the Corporate Secretary at the Company’s executive office; |

| • |

|

transmitting a proxy dated later than your prior proxy, either by mail, telephone or Internet; or |

| • |

|

attending the meeting and voting in person or by proxy (except for shares held in “street name” through a broker, bank or other nominee, or in the

Company’s savings or retirement plans). |

9

The latest-dated, timely, properly completed proxy that you submit, whether by mail, telephone or the Internet, will

count as your vote. If a vote has been recorded for your shares and you subsequently submit a proxy card that is not properly signed and dated, the previously recorded vote will stand.

| 11. |

WHAT SHARES ARE INCLUDED ON THE PROXY

OR VOTING INSTRUCTION CARD? |

The shares indicated on your proxy or voting

instruction card represent those shares registered directly in your name, those held on account in the Company’s dividend reinvestment plan and shares held in the Company’s savings or retirement plans. If you do not cast your vote, your

shares (except those held in the Company’s savings or retirement plans) will not be voted. See question 13 for an explanation of the voting procedures for shares in the Company’s savings or retirement plans.

| 12. |

WHAT DOES IT MEAN IF I RECEIVE MORE

THAN ONE PROXY OR VOTING INSTRUCTION CARD? |

If your shares are registered differently and are in more than one account, you will receive more than one card. Please complete and return all of the proxy or voting instruction cards you receive (or vote by

telephone or the Internet all of the shares on each of the proxy or voting instruction cards you receive) in order to ensure that all of your shares are voted.

| 13. |

HOW ARE SHARES THAT I HOLD IN A COMPANY

SAVINGS OR RETIREMENT PLAN VOTED? |

If you hold ATI Common

Stock in one of the Company’s savings or retirement plans, you may tell the plan trustee how to vote the shares of Common Stock allocated to your account. You may either sign and return the voting instruction card provided by the plan trustee

or transmit your instructions by telephone or the Internet. If you do not transmit instructions, your plan shares will be voted as the plan administrator directs or as otherwise provided in the plan.

The deadline for voting the shares you hold in the Company’s savings or retirement plans by telephone or the Internet is 11:59 p.m. Eastern Time on

April 27, 2015.

| 14. |

IS MY VOTE CONFIDENTIAL? |

The Company maintains a policy of keeping stockholder votes confidential.

| 15. |

CAN I, IN THE FUTURE, RECEIVE MY PROXY

STATEMENT AND ANNUAL REPORT OVER THE INTERNET? |

Stockholders can elect to view future Company proxy statements and annual reports over the Internet instead of receiving paper copies in the mail and thus can save the Company the cost of producing and mailing

these documents. Costs normally associated with electronic access, such as usage and telephonic charges, will be borne by you.

If you are a stockholder

of record and you choose to vote over the Internet, you can choose to receive future annual reports and proxy statements electronically by following the prompt on the voting page when you vote using the Internet. If you hold your Company stock in

street name (such as through a broker, bank or other nominee account), check the information provided by your nominee for instructions on how to elect to view future proxy statements and annual reports over the Internet.

Stockholders who choose to view future proxy statements and annual reports over the Internet will receive instructions electronically that contain the Internet

address for those materials, as well as voting instructions, approximately six weeks before future meetings.

If you enroll to view the Company’s

future annual reports and proxy statements electronically and vote over the Internet, your enrollment will remain in effect for all future stockholders’ meetings unless you cancel it. To cancel, stockholders of record should access

www.computershare.com/investor and follow

10

the instructions to cancel your enrollment. You should retain your control number appearing on your enclosed proxy or voting instruction card. If you hold your Company stock in “street

name,” check the information provided by your nominee holder for instructions on how to cancel your enrollment.

If at any time you would like to

receive a paper copy of the annual report or proxy statement, please write to the Corporate Secretary, Allegheny Technologies Incorporated, 1000 Six PPG Place, Pittsburgh, Pennsylvania 15222-5479.

ATI CORPORATE GOVERNANCE AT A GLANCE

Presented below are some highlights of the ATI corporate governance program. You can find details about these and other corporate governance policies and practices in the following pages of the Proxy Statement and

in the “Corporate Governance” section of the “About ATI” page of our website at www.atimetals.com.

| • |

|

Independent Board. The Board of Directors is comprised of eleven directors – ten independent directors and Richard J. Harshman, who is Chairman,

President and Chief Executive Officer. Mr. Harshman is the only ATI officer on the Board and is the only non-independent director. Under our Corporate Governance Guidelines, at least 75% of our directors must be independent. Our Corporate

Governance Guidelines are posted on our website. |

| • |

|

Strong Lead Independent Director Role. Diane C. Creel serves as the Lead Independent Director. Independent directors meet in regularly scheduled executive

sessions, led by the Lead Independent Director, without the presence of management. Stockholders can communicate with the independent directors through the Lead Independent Director. |

| • |

|

Independent Board Committees. All of the standing committees of the Board of Directors are composed entirely of independent directors, and each has a

written charter that is reviewed and reassessed annually and is posted on our website. We have an annual self-evaluation process for the Board and each standing committee. |

| • |

|

Majority Voting/Director Resignation Policy. The Company’s director resignation policy is contained in the Company’s Bylaws and provides that

any nominee for director in an uncontested election who receives a greater number of votes “withheld” than votes “for” such nominee’s election shall promptly tender his or her resignation to the Board for the Board’s

consideration. |

| • |

|

Director Nominees. Our Board evaluates individual directors whose terms are nearing expiration but who may be proposed for re-election. Our Nominating and

Governance Committee will consider director candidates recommended by stockholders. Stockholder-recommended candidates will be evaluated on the same basis as other candidates. |

| • |

|

Audit Committee Features. The Board has designated John R. Pipski, Chair of the Audit Committee, as an “audit committee financial expert.” Our

internal audit function reports directly to the Audit Committee. Stockholders are asked to ratify the Audit Committee’s selection of independent auditors annually. |

| • |

|

Executive Compensation Features. The Company has determined to hold its “Say-on-Pay” advisory vote every year until the next stockholder vote on

the frequency of such advisory vote, which we expect to be in 2017. We have robust stock ownership guidelines applicable to directors and executives. |

| • |

|

Ethics and Other Features. Our Corporate Guidelines for Business Conduct and Ethics, as well as the Company’s attention to environmental,

social and governance issues, are disclosed on our website. |

11

ITEM 1 – ELECTION OF DIRECTORS

The Board of Directors has nominated four directors for election. Diane C. Creel, John R. Pipski and James E. Rohr are standing for election to the Board as Class I directors for a three-year term expiring in 2018.

David J. Morehouse is standing for election as a Class III director for a term expiring in 2017. Upon the retirement of Mr. Thomas from the Board at the completion of his current term at the Company’s 2017 Annual Meeting of Stockholders in

accordance with the Company’s mandatory retirement policy for directors, or his earlier departure from the Board, Mr. Morehouse will become the director on the ATI Board designated by the United Steelworkers.

Directors are elected by a plurality of the votes cast. This means that the four individuals nominated for election to the Board of Directors who receive the most

“FOR” votes (among votes properly cast in person, electronically, telephonically or by proxy) will be elected.

While directors are elected by

a plurality of the votes cast, our Bylaws include a director resignation policy. This policy states that in an uncontested election, if any director nominee receives a greater number of votes “WITHHELD” from his or her election, as

compared to votes “FOR” such election, the director nominee must tender his or her resignation. The Nominating and Governance Committee of the Board is required to make recommendations to the Board of Directors with respect to any such

tendered resignation. The Board of Directors will act on the tendered resignation within 90 days from the certification of the vote and will publicly disclose its decision, including its rationale.

Only votes “FOR” or “WITHHELD” are counted in determining whether a plurality has been cast in favor of a director nominee; abstentions are not

counted for purposes of the election of directors. If you withhold authority to vote with respect to the election of some or all of the nominees, your shares will not be voted with respect to those nominees indicated. For a “WITHHOLD”

vote, your shares will be counted for purposes of determining whether there is a quorum and will have a similar effect as a vote against that director nominee for purposes of our director resignation policy.

If a nominee becomes unable to serve, the proxies will vote for a Board-designated substitute or the Board may reduce the number of directors. The Company has no

reason to believe that any of the nominees for election will be unable to serve.

The Board of Directors determined that each of the nominees qualifies

for election under the criteria for evaluation of directors described under “Identification and Evaluation of Candidates for Director.” The Board of Directors determined that each of Ms. Creel and Messrs. Pipski, Rohr, and Morehouse

qualify as independent directors under applicable rules and regulations and the Company’s categorical Board independence standards. See information contained in the “Identification and Evaluation of Candidates for Director” and

“Number and Independence of Directors” sections of this Proxy Statement.

All of our directors bring to our Board a wealth of leadership

experience derived from their service in executive and managerial roles and also extensive board experience. Background information about the nominees and the continuing directors, including their business experience and directorships held during

the past five years, and certain individual qualifications and skills of our directors that contribute to the Board’s effectiveness as a whole, are described in the following paragraphs.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

FOR

THE ELECTION OF THE FOUR DIRECTOR NOMINEES.

12

NOMINEES – CLASS I – TERM

TO EXPIRE AT THE 2018 ANNUAL MEETING

|

|

|

|

|

| Diane C. Creel |

|

Prior to her retirement

in 2008, Ms. Creel served as Chairman, Chief Executive Officer and President of Ecovation, Inc., a subsidiary of Ecolab Inc. and a waste stream technology company using patented technologies, beginning in 2003. Ecovation, Inc. became a

subsidiary of Ecolab Inc. in 2008. Previously, Ms. Creel served as Chief Executive Officer and President of Earth Tech, an international consulting engineering firm, from 1992 to 2003.

Ms. Creel has served on the ATI Board of Directors since 1996 and as Lead Independent

Director since the position was established in 2011. Ms. Creel is Chair of the Nominating and Governance Committee and a member of each of the Finance Committee and the Personnel and Compensation Committee. The Board believes that

Ms. Creel’s qualifications include her experience as a chief executive officer of various companies and her entrepreneurial, management and technical experience.

Ms. Creel is also a member of the Boards of Directors of TimkenSteel Corporation (since

2014) and Enpro Industries, Inc. (since 2009). Recently, she has also served on the Boards of Directors of The Timken Company from 2012 to 2014, URS Corporation in 2014, and Goodrich Corporation from 1997 to 2012.

|

| Age 66

|

|

|

|

| John R. Pipski |

|

Mr. Pipski was a tax partner of Ernst & Young LLP, a public accounting firm, until

his retirement in 2001. Thereafter, he provided business advisory and financial and tax accounting services through his own firm until 2013.

Mr. Pipski joined the ATI Board of Directors in December 2011. Mr. Pipski is Chair of the Audit Committee and a member of each of the Finance Committee and the

Technology Committee. The Board believes that Mr. Pipski’s qualifications include his expertise in financial and tax accounting for public companies, including those in the metals and mining industries, and his general business

experience. Mr. Pipski served on the Board of Directors of CNX Gas Corporation

from 2005 to 2010 and was Chairman of its Audit Committee. |

| Age 67

|

|

|

|

| James E. Rohr |

|

Mr. Rohr served as Executive Chairman of The PNC Financial Services Group, Inc., a

diversified financial services organization, from May 2013 until his retirement in April 2014; previously, he was Chairman from 2001 until April 2013 and Chief Executive Officer from 2000 until April 2013. He served as President of The PNC Financial

Services Group from 1990 to 2002. Mr. Rohr has served on the ATI Board of

Directors since 1996 and is Chair of the Personnel and Compensation Committee. The Board believes that Mr. Rohr’s qualifications include his significant leadership and management experience from his years of serving as a chief executive

officer of a large, publicly traded company and his expertise in capital markets and financial matters. Mr. Rohr serves on the Boards of Directors of EQT Corporation (since 1996), Marathon Petroleum Corporation (since 2013) and General Electric Company (since 2013). Previously, he had served on the Boards of

Directors of The PNC Financial Services Group, Inc., from 1990 through April 2014, and BlackRock Inc. from 1999 through April 2014. |

| Age 66

|

|

13

NOMINEE – CLASS III – TERM TO

EXPIRE AT THE 2017 ANNUAL MEETING

|

|

|

| |

|

| David J. Morehouse |

|

Mr. Morehouse is Chief Executive Officer and President of Pittsburgh Penguins LLC, which owns

and operates the Pittsburgh Penguins National Hockey League team. He was named President of the Pittsburgh Penguins in April 2007 and has also served as Chief Executive Officer since September 2010. He joined the Pittsburgh Penguins in 2004 as a

consultant for special projects, including the team’s new arena. Mr. Morehouse

joined the ATI Board of Directors in February 2015, and is a member of each of the Audit Committee and the Technology Committee. The Board believes that Mr. Morehouse’s qualifications include his leadership, strategic planning and development,

operations, branding and marketing, and government experience. |

| Age 54

|

|

CONTINUING DIRECTORS – CLASS II – TERM

TO EXPIRE AT THE 2016 ANNUAL MEETING

|

|

|

|

|

| Richard J. Harshman

Age 58

|

|

Mr. Harshman became Chairman, President and Chief Executive Officer in May 2011. He was President and

Chief Operating Officer from August 2010 until May 2011. Prior to that, he served as Executive Vice President, Finance and Chief Financial Officer from 2003 to August 2010. Mr. Harshman joined the Company in 1978 and served in several financial

management roles for the Company. The Board believes that Mr. Harshman’s

qualifications include his experience in senior leadership positions, his intimate knowledge of the industry and ATI’s business given his tenure with the Company, and his financial expertise. Furthermore, the Board believes that Mr.

Harshman’s current position as Chairman, President and Chief Executive Officer provides a unified vision for ATI. Mr. Harshman currently serves on the Board of Directors of Ameren Corporation, since 2013. |

|

|

| Carolyn Corvi

Age 63

|

|

Upon her retirement in 2008, Ms. Corvi concluded a 34-year career with The Boeing Company, a diversified

aerospace company, where she most recently served as Vice President, General Manager of Airplane Programs, Boeing Commercial Airplanes, a position she held from 2005 until her retirement.

Ms. Corvi has served on the ATI Board of Directors since September 2012. She is a member of

each of the Audit Committee and the Technology Committee. The Board believes that Ms. Corvi’s qualifications include her extensive experience in the aerospace industry (ATI’s largest end market) and her knowledge of and experience in

manufacturing. Ms. Corvi currently serves on the Board of Directors of Hyster-Yale

Materials Handling, Inc. (since 2012) and United Continental Holdings, Inc. (since 2010). Ms. Corvi served on the Board of Directors of Goodrich Corporation from 2009 until 2012 and Continental Airlines, Inc. from 2009 to 2010.

|

14

|

|

|

| |

|

| Barbara S. Jeremiah |

|

Prior to her retirement in 2009, Ms. Jeremiah served as Executive Vice President of

Alcoa, Inc., a leading aluminum producer, from 2002 until 2008, when she also assumed the position of Chairman’s Counsel.

Ms. Jeremiah was elected to the ATI Board of Directors in 2008 and currently serves on each of the Finance Committee and Technology Committee. The Board

believes that Ms. Jeremiah’s qualifications include her strong background in the metals industry and significant strategic development and international experience.

Ms. Jeremiah served on the Board of Directors of Boart Longyear Limited from 2011 until

March 2015 and was Chair of its Board of Directors from March 2013 until March 2015. Ms. Jeremiah served on the Board of Directors of EQT Corporation from 2003 to 2012 and First Niagara Financial Group, Inc. from 2010 to 2013.

|

| Age 63

|

|

| |

|

| John D. Turner |

|

Mr. Turner served as Chairman and Chief Executive Officer of Copperweld Corporation, a

manufacturer of tubular and bimetallic wire products, from 2001 until his retirement in 2003. Mr. Turner joined the ATI Board of Directors in 2004. He currently serves as the Chair of the Technology Committee and is a member of each of the Finance Committee and the Nominating and Governance Committee.

The Board believes that Mr. Turner’s qualifications include his experience in executive oversight and senior leadership positions, background in the manufacturing sector, and familiarity with industrial and technical matters.

Mr. Turner has served on the Board of Directors of Matthews International Corporation

since 1999 and as its Chairman since February 2010. |

| Age 69

|

|

CONTINUING DIRECTORS – CLASS III – TERM

TO EXPIRE AT THE 2017 ANNUAL MEETING

|

|

|

|

|

| James C. Diggs |

|

Prior to his retirement in July 2010, Mr. Diggs was Senior Vice President and General

Counsel of PPG Industries, Inc., a producer of coatings, glass and chemicals, since 1997. He held the position of Secretary from 2004 to 2009.

Mr. Diggs has served on the ATI Board of Directors since 2001. He is Chair of the Finance Committee and also serves on each of the Audit Committee and the

Nominating and Governance Committee. The Board believes that Mr. Diggs’s qualifications include his experience with industry and legal matters, his senior leadership at a global public company, and his experience with domestic and

international operations. Mr. Diggs also serves on the Board of Directors of

Brandywine Realty Trust (since 2011). |

| Age 66

|

|

15

|

|

|

| |

|

| J. Brett Harvey |

|

Mr. Harvey is Chairman of CONSOL Energy Inc., a leading diversified energy company in the

United States, a position he has held since June 2010. He was Executive Chairman from May 2014 to January 2015. Mr. Harvey was Chief Executive Officer of CONSOL Energy Inc. from 1998 until May 2014. He also served as President from 1998 until

February 2011. Mr. Harvey was Chief Executive Officer of CNX Gas Corporation, a subsidiary of CONSOL Energy, Inc., from 2009 to 2010.

Mr. Harvey was elected to the ATI Board of Directors in 2007 and currently serves on each of the Nominating and Governance Committee and the Personnel and

Compensation Committee. The Board believes that Mr. Harvey’s qualifications include his significant oversight experience from serving as chief executive officer of public companies, his industry experience in the oil and gas market (a

large end market for ATI), and his operational expertise. Mr. Harvey has served

on the Boards of Directors of CONSOL Energy Inc. (since 1998) and Barrick Gold Corporation (since 2005). He also served on the Board of Directors of CNX Gas Corporation from 2005 to 2010 and as its Chairman from 2009 to 2010.

|

| Age 64

|

|

|

|

| Louis J. Thomas |

|

Mr. Thomas served as Director, District 4, United Steelworkers of America for the

Northeastern United States and Puerto Rico, prior to his retirement in 2004.

Mr. Thomas was elected to the ATI Board of Directors in 2004 and is a member of each of the Audit Committee and Technology Committee. The United Steelworkers

(“USW”) initially proposed the nomination of Mr. Thomas in connection with the 2004 labor negotiations with Allegheny Ludlum, an ATI company. At that time, the Company agreed that the International President of the USW can propose to

the Company’s Chairman a nominee for director. The USW nominee is to be a prominent individual with experience in public service, labor, education or business who meets the qualifications review required of all Company directors. Upon

recommendation by the Nominating and Governance Committee and election to the Board by the stockholders, the USW nominee is expected to serve for a term as would any other director. The Board believes that Mr. Thomas’s qualifications

include his broad experience with labor relations and the industrial and technical matters affecting our business. |

| Age 72

|

|

16

OUR CORPORATE GOVERNANCE

CORPORATE GOVERNANCE GUIDELINES

ATI’s Board of Directors has adopted Corporate Governance Guidelines, which are designed to assist the Board in the exercise of its duties and responsibilities to the Company. They reflect the Board’s

commitment to monitor the effectiveness of decision making at the Board and management level with a view of achieving ATI’s strategic objectives. They are subject to modification by the Board from time to time. You can find the Company’s

Corporate Governance Guidelines on our website, www.atimetals.com, at “About ATI – Corporate Governance.”

NUMBER AND INDEPENDENCE OF DIRECTORS

The Board of Directors

determines the number of directors. The Board currently consists of eleven members: Richard J. Harshman (Chairman), Carolyn Corvi, Diane C. Creel, James C. Diggs, J. Brett Harvey, Barbara S. Jeremiah, David J. Morehouse, John R. Pipski, James E.

Rohr, Louis J. Thomas and John D. Turner.

In accordance with the Corporate Governance Guidelines, at least 75% of the Company’s directors are, and

at least a substantial majority of its directors will be, “independent” under the guidelines set forth in the listing standards of the New York Stock Exchange (“NYSE”) and the Company’s categorical Board independence

standards, which are set forth in the Corporate Governance Guidelines. A director is “independent” only if the director is a non-management director and, in the Board’s judgment, does not have a material relationship with the Company

or its management. The Board does not consider Richard J. Harshman, Chairman, President and Chief Executive Officer of the Company, to be independent.

The Board, at its February 26, 2015 meeting, affirmatively determined that the remaining ten of the Company’s current directors, Carolyn Corvi, Diane C.

Creel, James C. Diggs, J. Brett Harvey, Barbara S. Jeremiah, David J. Morehouse, John R. Pipski, James E. Rohr, Louis J. Thomas and John D. Turner, are independent in accordance with the foregoing standards. These directors have no relationships

with ATI other than as directors and stockholders of the Company.

David J. Morehouse serves as the Chief Executive Officer and President of Pittsburgh

Penguins LLC, which owns and operates the Pittsburgh Penguins National Hockey League team, and Pittsburgh Arena Operating LLC (collectively, the “Entities”) and other affiliated entities. The Company is a party to a sponsorship agreement

(the “Sponsorship Agreement”) with Pittsburgh Penguins LLC, pursuant to which the Company pays an annual fee to Pittsburgh Penguins LLC in exchange for sponsorship opportunities associated with the Pittsburgh Penguins National Hockey

League franchise. The Company is party to an arena executive suite license agreement (the “License Agreement” and with the Sponsorship Agreement, the “Agreements”) with an entity that is affiliated with Pittsburgh Arena Operating

LLC. The annual fees paid by the Company to the Entities represents a de minimis portion of both the Company’s revenues and the revenues of the Entities, and, therefore, all amounts were substantially less than the thresholds set forth

in the NYSE’s listing standards which disqualify a director from being independent. Mr. Morehouse’s compensation is not affected by the fees that the Company pays pursuant to the Agreements. The Board has determined that (A) the

Agreements (i) provide for commercial transactions carried out at arm’s length in the ordinary course of business, (ii) are not material to the Entities or to Mr. Morehouse, (iii) do not and would not potentially influence

Mr. Morehouse’s objectivity as a member of the Company’s Board of Directors in a manner that would have a meaningful impact on his ability to satisfy requisite fiduciary standards on behalf of the Company and its stockholders, and

(iv) do not preclude a determination that Mr. Morehouse’s relationship with the Company in his capacity as Chief Executive Officer and President of the Entities is immaterial, and (B) Mr. Morehouse is an independent director

under NYSE existing guidelines and the Company’s categorical Board independence standards.

Audit Committee members must meet additional

independence standards under NYSE listing standards and rules of the Securities and Exchange Commission (“SEC”); specifically, Audit Committee members may not receive any compensation from the Company other than their directors’

compensation. The

17

Board has determined that each member of the Audit Committee satisfies the enhanced standards of independence applicable to Audit Committee members under NYSE listing standards and SEC rules.

BOARD LEADERSHIP

Under the Company’s Certificate of Incorporation, Bylaws, and Corporate Governance Guidelines, the Board of Directors has the flexibility to determine whether

it is in the best interests of the Company and its stockholders to separate or combine the roles of Chairman and Chief Executive Officer of the Company at any given time. Whenever a Chairman and/or Chief Executive Officer is appointed, the Board of

Directors assesses whether the roles should be separated or combined based upon its evaluation of, among other things, the existing composition of the Board of Directors and the circumstances at the time. The Board has considered the roles and

responsibilities of the Chairman and the Chief Executive Officer, and, while it retains the discretion to separate the roles in the future as it deems appropriate and acknowledges that there is no single best organizational model that is most

effective in all circumstances, it currently believes that the Company and its stockholders are best served by having Mr. Harshman serve concurrently as Chairman and Chief Executive Officer. The Board of Directors believes that

Mr. Harshman’s service in both capacities promotes unified leadership and direction for the Company and allows for a single, clear focus on the efficient implementation of the Company’s strategies to maximize stockholder value over

the long-term. In addition, the Board of Directors believes that Mr. Harshman, serving in both capacities, has been an effective bridge between the Board and the Company’s management.

Ms. Creel, one of our independent directors, has been elected to serve as the Company’s Lead Independent Director. The Lead Independent Director is the

principal liaison between the independent directors and the Chairman on Board-wide issues. The Lead Independent Director has the authority to preside at meetings of the Board in the absence of the Chairman, including executive sessions of the

independent directors. The Lead Independent Director also has the authority to call meetings of the independent directors when necessary and appropriate. Other responsibilities of the Lead Independent Director include (i) communicating with,

and appropriately facilitating communication among, independent directors between meetings, when appropriate; (ii) advising the Chairman regarding schedules, agendas and the quantity, quality and timeliness of information for Board and

Committee meetings; (iii) serving as a contact for the Company’s stockholders wishing to communicate with the Board other than through the Chairman, when appropriate, and communicating with other external constituencies, as needed;

(iv) advising and consulting with the Chairman on matters related to corporate governance and Board performance; and (v) generally serving as a resource for, and counsel to, the Chairman.

The Board of Directors believes that this leadership structure is appropriate for the Company and in the best interests of the Company’s stockholders at this

time. Through governance features such as (i) the establishment of a Lead Independent Director position with the responsibilities described above; (ii) the appointment of only independent directors to the standing committees of the Board

of Directors, including the Audit Committee, Nominating and Governance Committee, and Personnel and Compensation Committee; and (iii) the regular use of executive sessions of the independent directors, the Board is able to maintain appropriate

independent oversight of our business strategies and activities. These governance features have been effective in promoting a full and free discussion and analysis at the Board level of issues important to the Company. At the same time, the Board of

Directors is able to take advantage of the blend of leadership, experience and extensive knowledge of the Company, our industry and the markets in which we compete that Mr. Harshman brings to the combined roles of Chairman and Chief Executive

Officer.

BOARD’S ROLE IN

RISK OVERSIGHT

The Board of Directors as a whole actively oversees the risk management of the Company. Enterprise

risks – the specific financial, operational, business and strategic risks that the Company faces, whether internal or external – are identified and prioritized by the Board and management together, and then each specific risk is assigned

to the full Board or a Board committee for oversight. The Nominating and Governance Committee periodically evaluates whether the identified risks are assigned to the appropriate Board committee (or to the Board) for oversight. Certain strategic and

business risks, such as those

18

relating to our products, markets and capital investments, are overseen by the entire Board. The Audit Committee and the Finance Committee oversee management of market and operational risks that

could have a financial impact, such as those relating to internal controls, liquidity or raw material availability. The Nominating and Governance Committee manages the risks associated with governance issues, such as the independence of the Board,

and the Personnel and Compensation Committee is responsible for managing the risks relating to the Company’s executive compensation plans and policies and, in conjunction with the Board, key executive succession.

Management regularly reports to the Board or relevant Committee on actions that the Company is taking to manage these risks. The Board and management periodically

review, evaluate and assess the risks relevant to the Company.

DIRECTOR

TERMS

The directors are divided into three classes and the directors in each class generally serve for a three-year term unless the

director is unable to serve due to death, retirement or disability. The term of one class of directors currently expires each year at the annual meeting of stockholders. The Board may fill a vacancy by electing a new director to the same class as

the director being replaced or by reassigning a director from another class. The Board may also create a new director position in any class and elect a director to hold the newly created position. It is expected that new directors elected to the

Board will stand for election by the stockholders at the next annual meeting.

COMMITTEES

OF THE BOARD OF DIRECTORS

The Board of Directors has the following five

standing committees: Audit Committee, Finance Committee, Nominating and Governance Committee, Personnel and Compensation Committee, and Technology Committee.

Only independent directors, as independence is determined in accordance with NYSE rules, are permitted to serve on the Audit Committee, the Nominating and Governance Committee, and the Personnel and Compensation

Committee. All of the standing committees of the Board of Directors are comprised entirely of independent directors.

Each committee has a written

charter that describes its responsibilities. Each of the Audit Committee, the Nominating and Governance Committee and the Personnel and Compensation Committee has the authority, as it deems appropriate, to independently engage outside legal,

accounting or other advisors or consultants. In addition, each committee annually conducts a review and evaluation of its performance and reviews and reassesses its charter. You can find the current charters of each committee on our website

www.atimetals.com, at “About ATI – Corporate Governance-Governance Highlights-Committee Charters.”

Audit Committee

The current members of the Audit Committee are John R. Pipski (Chair), Carolyn Corvi, James C. Diggs, David J. Morehouse, and Louis J. Thomas. The

Board of Directors has determined that these committee members have no financial or personal ties to the Company (other than director compensation and equity ownership as described in this Proxy Statement) and that they meet the NYSE and SEC

standards for independence. The Board of Directors has also determined that Mr. Pipski meets the SEC criteria to be deemed an “audit committee financial expert” and meets the NYSE standard of having accounting or related financial

management expertise. Mr. Pipski has over 40 years of financial and tax accounting experience and served as a tax partner at Ernst & Young LLP until his retirement in 2001; thereafter, Mr. Pipski provided business advisory and

financial and tax accounting services through his own firm until 2013.

The Audit Committee assists the Board in its oversight of the integrity of the

Company’s financial statements, compliance with legal and regulatory requirements, the qualifications and independence of the Company’s independent auditors, and the performance of the Company’s internal audit function and independent

auditors. The Committee has the authority and responsibility for the appointment, retention,

19

compensation and oversight of ATI’s independent auditors, including pre-approval of all audit and non-audit services to be performed by the independent auditors. The independent auditors and

the internal auditors have full access to the Committee and meet with the Committee with, and on a routine basis without, management being present.

The

Audit Committee is also responsible for reviewing, approving and ratifying any related party transaction. For more information, see the “Certain Transactions” section of this Proxy Statement.

See also the Audit Committee Report in this Proxy Statement.

Finance Committee

The Finance Committee makes

recommendations and provides guidance to the Board regarding major financial policies and actions of the Company. It also serves as named fiduciary of the employee benefit plans maintained by the Company.

Nominating and Governance Committee

The Nominating and

Governance Committee is responsible for overseeing corporate governance matters. It oversees the annual evaluation of the Company’s Board and its committees. It also recommends to the Board individuals to be nominated as directors, which

process includes evaluation of new candidates as well as an individual evaluation of current directors who are being considered for re-election. In addition, this Committee is responsible for administering ATI’s director compensation program.