Report of Foreign Issuer (6-k)

March 17 2016 - 6:12AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

March 17,

2016

|

Commission File Number 001-16125

|

| |

|

| |

|

|

Advanced Semiconductor Engineering, Inc.

|

|

( Exact name of Registrant as specified in its charter)

|

| |

|

|

26 Chin Third Road

Nantze Export Processing Zone

Kaoshiung, Taiwan

Republic of China

|

|

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

ADVANCED SEMICONDUCTOR

ENGINEERING, INC.

|

|

| |

|

|

|

| |

|

|

|

|

Date:

March 17,

2016

|

By:

|

/s/ Joseph Tung

|

|

| |

Name:

|

Joseph Tung

|

|

| |

Title:

|

Chief Financial Officer

|

|

| Advanced

Semiconductor Engineering, Inc. |

|

Investor

Relations Contact:

Iris Wu,

Manager

irissh_wu@aseglobal.com

Tel: +886.2.6636.5678

http://www.aseglobal.com

March 17,

2016

ASE Inc.

Press Release

Taipei, Taiwan,

R.O.C., March 17, 2016 – Advanced Semiconductor Engineering, Inc. (TWSE Code: 2311, NYSE Code: ASX) (“ASE”)

announced today that the tender offer by ASE for common shares (including common shares represented by American depositary shares)

of Siliconware Precision Industries Co., Ltd. (“SPIL”), launched on December 29, 2015, was unsuccessful due

to failure to satisfy the tender offer conditions, as ASE did not receive approval from the Taiwan Fair Trade Commission (“FTC”)

for the proposed combination between ASE and SPIL before the expiration of the tender offer. Over 27.57% of SPIL shareholders

participated in this tender offer. ASE sincerely thanks all members of various fields who supported this tender offer, particularly

all SPIL shareholders who participated in this tender offer. ASE deeply regrets not being able to purchase shares from all participating

SPIL shareholders due to the FTC not approving the proposed combination before the expiration date of this tender offer. ASE has

instructed its tender agents to return all shares to participating SPIL shareholders as soon as possible.

Currently,

the Taiwanese semiconductor packaging and testing industry is facing an unprecedented and intense challenge. Semiconductor businesses

of other countries and regions – both integrated device manufacturers (“IDMs”) and outsourced assembly

and test (“OSAT”) companies – have dramatically improved their global competitiveness through large-scale

mergers and acquisitions, and certain players have arisen in the global market with significant support from the government. ASE

deeply believes that, only if Taiwanese packaging and testing peers form a national team to face numerous current challenges through

the active integration of resources and response to government policies, can the Taiwanese packaging and testing industry maintain

its competitive advantage. ASE’s acquisition of an equity interest in SPIL was aimed at seeking cooperation with SPIL in

order to consolidate both parties’ resources and excellent teams. In so doing, both parties could grasp the opportunity

of next-generation packaging and testing technologies, welcome the arrival of the “Internet of things” and miniaturization,

and jointly create a new blue ocean for the Taiwanese packaging and testing industry against a backdrop of intensifying competition

in the global semiconductor industry from IDMs and OSATs.

During the

tender offer period, ASE listened with an open mind to the opinions and recommendations expressed by individuals from all walks

of society, and hereby makes the following four statements:

| 1. | ASE’s

determination to seek integration with SPIL has not changed; after obtaining the FTC’s

approval, ASE expects to continue seeking the support of SPIL shareholders in order to

complete the acquisition of 100% equity interest in SPIL. |

| 2. | ASE’s

promise to maintain SPIL’s legal entity status, legal entity name, current employee

benefits, work conditions and personnel regulations, and retain the current SPIL management

team and all employees with the utmost good faith to protect their employment right,

has not changed. |

| 3. | In

order to realize ASE’s promise to maintain its roots in Taiwan, integrate the industry,

innovate technology, and look after SPIL employees, suppliers and industry partners,

concurrent with the acquisition of SPIL, ASE will plan to establish an industrial holding

company in Taiwan. In the future, the industrial holding company will separately hold

100% equity interests in both ASE and SPIL, both of which shall retain their legal entity

status, allowing ASE and SPIL to become parallel sibling companies under the same holding

company, and at the same time jointly creating a platform for mutual benefit that maintains

the current operating model of the two companies. The newly established industrial holding

company will be listed in Taiwan (and the American depositary shares of the new holding

company will be listed in the U.S.) and all current operations of ASE and SPIL in Taiwan

will be maintained. ASE will invite, in utmost good faith, Chairman Lin and President

Tsai of SPIL to join the board of the industrial holding company and jointly manage the

industrial holding company with ASE’s management team. In addition, they will continue

to serve as chairman and president of SPIL, respectively, and lead the current SPIL management

team to look after all SPIL employees as well partners in the up-, mid- and downstream

industry chain. |

| 4. | Driven

by the twin engines of ASE and SPIL’s packaging and testing, the newly established

industrial holding company can be expected to strengthen resource consolidation in Taiwan’s

current semiconductor packaging and testing and related industries and become a new innovation

platform for the industry. By drawing on the strength of up-, mid- and downstream businesses

in the semiconductor packaging and testing industry, it can face the challenges posed

by intense changes in the global semiconductor landscape. |

| Advanced

Semiconductor Engineering, Inc. |

|

Faced

with new competition in the greater environment and the major decision of the industry’s future development, ASE

sincerely calls upon individuals from all walks of domestic society to adopt a macro perspective and soberly view the impact

of development trends in the global semiconductor industry on the Taiwanese packaging and testing industry. Integration of

the Taiwanese packaging and testing industry is both necessary and timely. The merger between ASE and SPIL is neither a fight

for management rights nor an act of impulse, but rather a critical question of survival for the entire Taiwanese

semiconductor packaging and testing supply chain. Founding a business is not easy, but conserving what has been established

is even more difficult. ASE’s management team deeply believes that simply maintaining the status quo and reaping the

fruit of our predecessor’s labor is not a currently acceptable option.

Based on

our determination for sustained operation in Taiwan, as well as our promise to look after the families of tens of thousands of

Taiwanese employees, ASE chose to take the first step in integration. We also hoped our tender offer could stimulate the industry’s

integration, generate complementary synergy, and help the future development of the Taiwanese semiconductor industry reach a new

high point in terms of enhanced efficiency, economic scale, and depth of research and development and innovation. Even though

the process of integration has its challenges and difficulties, building on past success is our joint responsibility and society’s

expectation. ASE sincerely hopes that SPIL and ASE can jointly create the glory of Taiwan, so that a brighter day may soon arrive

for the next generation of the Taiwanese semiconductor packaging and testing industry.

SAFE

HARBOR NOTICE

This press

release contains "forward-looking statements" within the meaning of Section 27A of the United States Securities Act

of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended, including statements regarding

our future results of operations and business prospects. Although these forward-looking statements, which may include statements

regarding our future results of operations, financial condition or business prospects, are based on our own information and information

from other sources we believe to be reliable, you should not place undue reliance on these forward-looking statements, which apply

only as of the date of this press release. The words “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “plan” and similar expressions, as they relate to us, are intended to

identify these forward-looking statements in this press release. Our actual results of operations, financial condition or business

prospects may differ materially from those expressed or implied in these forward-looking statements for a variety of reasons,

including risks associated with cyclicality and market conditions in the semiconductor or electronic industry; changes in our

regulatory environment, including our ability to comply with new or stricter environmental regulations and to resolve environmental

liabilities; demand for the outsourced semiconductor packaging, testing and electronic manufacturing services we offer and for

such outsourced services generally; the highly competitive semiconductor or manufacturing industry we are involved in; our ability

to introduce new technologies in order to remain competitive; international business activities; our business strategy; our future

expansion plans and capital expenditures; the strained relationship between the Republic of China and the People’s Republic

of China; general economic and political conditions; the recent global economic crisis; possible disruptions in commercial activities

caused by natural or human-induced disasters; fluctuations in foreign currency exchange rates; and other factors. For a discussion

of these risks and other factors, please see the documents we file from time to time with the Securities and Exchange Commission,

including our 2014 Annual Report on Form 20-F filed on March 18, 2015.

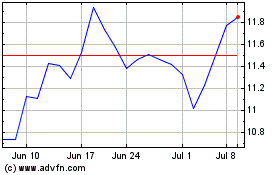

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

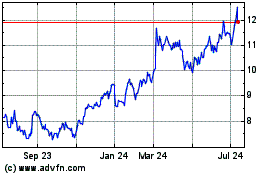

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024