UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_________________________

Advanced Semiconductor Engineering,

Inc.

(Exact Name of Registrant as Specified in

Its Charter)

| Republic of China |

|

N/A |

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.) |

| |

26 Chin Third Road

Nantze Export Processing Zone

Nantze, Kaohsiung, Taiwan

Republic of China

|

|

| (Address of Principal Executive Offices) |

| |

|

Advanced Semiconductor Engineering, Inc.

2015 Employee Stock Option Plan

(Full Title of the Plan)

|

| |

C T Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 590-9070

(Name, Address, Including Zip Code, and

Telephone Number, Including Area Code, of Agent for Service)

|

|

| Copy to: |

| |

James

C. Lin, Esq.

Davis Polk & Wardwell LLP

c/o 18th Floor, The Hong Kong

Club Building

3A Chater Road

Hong Kong

(852) 2533-3300

|

|

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x |

Accelerated filer o |

| |

|

| Non-accelerated filer o(Do not check if a smaller reporting company) |

Smaller reporting company o |

| CALCULATION OF REGISTRATION FEE |

| Title

Of Each Class Of Securities To Be Registered |

Amount

To Be Registered(1) |

Proposed

Maximum Offering

Price

Per Share |

Proposed

Maximum Aggregate

Offering

Price

|

Amount

Of

Registration

Fee(4) |

| Common Shares, par value NT$10.00 per share |

|

|

|

|

| |

94,270,000(2) |

US$1.12(2) |

US$105,582,400 |

|

| |

5,730,000(3) |

US$1.10(3) |

US$6,303,000 |

|

| TOTAL |

100,000,000 |

- |

US$111,885,400 |

US$11,267 |

| |

|

| (1) |

This Registration Statement on Form S-8 (this “Registration Statement”) covers Common Shares, par value NT$10.00 per share (the “Shares”) of Advanced Semiconductor Engineering, Inc. (the “Company” or the “Registrant”) (i) issuable pursuant to the Advanced Semiconductor Engineering, Inc. 2015 Employee Stock Option Plan (the “Plan”) and (ii) pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), any additional Shares that become issuable under the Plan by reason of any stock dividend, stock split, or other similar transaction. |

| |

|

| (2) |

These Common Shares to be registered represent shares of currently outstanding options under the Plan. The per share and aggregate offering prices are estimated pursuant to Rule 457(h) under the Securities Act solely for the purpose of calculating the amount of the registration fee, based on NT$36.50, which is the exercise price of options already granted. For the purpose of calculating the per share and aggregate offering prices, New Taiwan dollar amounts were translated into U.S. dollars at a rate of NT$32.49 to US$1.00, the exchange rate as set forth in the H.10 weekly statistical release of the Federal Reserve System of the United States on November 20, 2015. |

| |

|

| (3) |

These Common Shares to be registered are reserved for future grants under the Plan. The per share and aggregate offering prices are estimated pursuant to Rule 457(h) under the Securities Act solely for the purpose of calculating the amount of the registration fee, based on the average of the high price of NT$36.30 and the low price of NT$35.00 of the Registrant’s Common Shares reported on the Taiwan Stock Exchange on November 25, 2015, in accordance with Rule 457(c) under the Securities Act. For the purpose of calculating the per share and aggregate offering prices, New Taiwan dollar amounts were translated into U.S. dollars at a rate of NT$32.49 to US$1.00, the exchange rate as set forth in the H.10 weekly statistical release of the Federal Reserve System of the United States on November 20, 2015. |

| |

|

| (4) |

Rounded up to the nearest penny. |

PART I

INFORMATION REQUIRED IN THE SECTION 10(a)

PROSPECTUS

Information required by Item 1 and Item

2 of Part I to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with

the provisions of Rule 428 under the Securities Act and the introductory note to Part I of Form S-8. The documents containing

the information specified in Part I have been or will be delivered to the participants in the Plan as required by Rule 428(b).

These documents, which include the statement of availability required by Item 2 of Part I, and the documents incorporated by reference

in this Registration Statement pursuant to Item 3 of Part II, taken together, constitute a prospectus that meets the requirements

of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

Item 3. INCORPORATION OF DOCUMENTS BY REFERENCE

The following documents of the Registrant

filed with the Securities and Exchange Commission (the “Commission”) are incorporated herein by reference:

(a) the Registrant’s annual report

on Form 20-F under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for the fiscal year ended

December 31, 2014 filed with the Commission on March 18, 2015; and

(b) the description of the Shares

contained in the Registrant’s registration statement on Form 8-A under the Exchange Act (File No. 001-16125) filed with the

Commission on September 20, 2000, including any amendment or report filed for the purpose of updating such description.

In addition, all documents subsequently

filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective

amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining

unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing

of such documents.

Any statement contained herein or in a

document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes

hereof or of the related prospectus to the extent that a statement contained herein, (or in any other subsequently filed document

which is also incorporated or deemed to be incorporated by reference herein), modifies or supersedes such statement. Any

such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this

Registration Statement.

Item 4. DESCRIPTION OF SECURITIES

Not applicable.

Item 5. INTERESTS OF NAMED EXPERTS AND COUNSEL

Not applicable.

Item 6. INDEMNIFICATION OF DIRECTORS AND OFFICERS

The relationship between the Registrant

and its directors and officers is governed by the Republic of China (“ROC”) Civil Code, the ROC Company Law and the

Registrant’s Articles of Incorporation. There is no written contract between the Registrant and its directors

and officers governing the rights and obligations of such parties. Under Section 10, Chapter 2, Book II of the ROC Civil

Code, each person who was or is a party or is threatened to be made a party to, or is involved in any threatened, pending or completed

action, suit or proceeding by reason of the fact that such person is or was a director or officer of the Registrant, in the absence

of willful misconduct or negligence on the part of such person in connection with such person’s performance of duties as

a director or officer, as the case may be, may be indemnified and held harmless by the Registrant to the fullest extent permitted

by applicable law. In addition, the Registrant has obtained an insurance policy which provides liability coverage, including

coverage for liabilities arising under the U.S. federal securities laws, for directors and officers and which contains certain

exceptions and exclusions.

Item 7. EXEMPTION FROM REGISTRATION CLAIMED

Not applicable.

Item 8. EXHIBITS

See Exhibit Index.

Item 9. UNDERTAKINGS

(a) The undersigned Registrant hereby

undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in this Registration Statement;

(iii) To

include any material information with respect to the Plan not previously disclosed in this Registration Statement or any material

change to such information in this Registration Statement;

provided, however,

that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13

or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(b) The undersigned

Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s

annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee

benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this Registration

Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as

indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the

Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the

Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense

of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in

Taipei, Taiwan, Republic of China, on December 1, 2015.

| |

ADVANCED SEMICONDUCTOR ENGINEERING, INC. |

|

| |

|

|

| |

|

|

| |

By: |

/s/ Jason C.S. Chang |

|

| |

|

Jason C.S. Chang |

|

| |

|

Chairman and Chief Executive Officer |

|

POWER OF ATTORNEY

Know all persons by these presents, that

each person whose signature appears below, constitutes and appoints each of Jason C.S. Chang and Joseph Tung as his or her true

and lawful attorney-in-fact and agent, upon the action of such appointee, with full power of substitution and resubstitution, to

do any and all acts and things and execute, in the name of the undersigned, any and all instruments which each of said attorneys-in-fact

and agents may deem necessary or advisable in order to enable Advanced Semiconductor Engineering, Inc. to comply with the Securities

Act of 1933, as amended (the “Securities Act”), and any requirements of the Securities and Exchange Commission (the

“Commission”) in respect thereof, in connection with the filing with the Commission of this Registration Statement

under the Securities Act, including specifically but without limitation, power and authority to sign the name of the undersigned

to such Registration Statement, and any amendments to such Registration Statement (including post-effective amendments), and to

file the same with all exhibits thereto and other documents in connection therewith, with the Commission, to sign any and all applications,

registration statements, notices or other documents necessary or advisable to comply with applicable state securities laws, and

to file the same, together with other documents in connection therewith with the appropriate state securities authorities, granting

unto each of said attorneys-in-fact and agents full power and authority to do and to perform each and every act and thing requisite

or necessary to be done in and about the premises, as fully and to all intents and purposes as the undersigned might or could do

in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agents may lawfully do or cause to be done

by virtue hereof.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

| Signature |

Title |

Date |

|

/s/ Jason C.S. Chang

|

Director, Chairman of the Board of Directors and Chief Executive Officer |

December 1, 2015 |

| Jason C.S. Chang |

(principal executive officer) |

|

| |

|

|

| /s/ Richard H.P. Chung |

Director, Vice Chairman of the Board of Directors and President |

December 1, 2015 |

| Richard H.P. Chung |

|

|

| |

|

|

| /s/ Rutherford Chang |

Director and General Manager of China Region |

December 1, 2015 |

| Rutherford Chang |

|

|

| |

|

|

|

/s/ Tien Wu

|

Director and Chief Operating Officer |

December 1, 2015 |

| Tien Wu |

|

|

| |

|

|

|

/s/ Joseph Tung

|

Director and Chief Financial Officer |

December 1, 2015 |

| Joseph Tung |

(principal financial officer) |

|

| |

|

|

|

/s/ Raymond Lo

|

Director and General Manager, Kaohsiung Packaging Facility |

December 1, 2015 |

| Raymond Lo |

|

|

| |

|

|

|

/s/ Tien-Szu Chen

|

Director and General Manager of ASE Inc. Chung Li Branch |

December 1, 2015 |

| Tien-Szu Chen |

|

|

| |

|

|

|

/s/ Jeffrey Chen

|

Director and General Manager of Corporate Affairs and Strategy of China Region |

December 1, 2015 |

| Jeffrey Chen |

|

|

| |

|

|

|

/s/ Shen-Fu Yu

|

Independent Director |

December 1, 2015 |

| Shen-Fu Yu |

|

|

| |

|

|

|

/s/ Ta-Lin Hsu

|

Independent Director |

December 1, 2015 |

| Ta-Lin Hsu |

|

|

| |

|

|

|

/s/ Mei-Yueh Ho

|

Independent Director |

December 1, 2015 |

| Mei-Yueh Ho |

|

|

| |

|

|

|

/s/ Murphy Kuo

|

Vice President |

December 1, 2015 |

| Murphy Kuo |

(principal accounting officer) |

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE

OF THE REGISTRANT

Pursuant to the Securities Act, the undersigned,

the duly authorized representative in the United States of the Registrant, has signed this Registration Statement or amendment

thereto in Newark, Delaware, on December 1, 2015.

| |

PUGLISI & ASSOCIATES |

|

| |

|

|

| |

|

|

| |

By: |

/s/ Donald J. Puglisi |

|

| |

|

Name: Donald J. Puglisi |

|

| |

|

Title: Managing Director |

|

EXHIBIT INDEX

| Exhibit No. |

Description |

| |

|

| 4.1 |

Articles of Incorporation of the Registrant (English translation) (incorporating all amendments as of June 23, 2015). |

| |

|

| 5.1 |

Opinion of Lee and Li, ROC counsel to the Registrant, as to the legality of the securities being registered. |

| |

|

| 23.1 |

Consent of Deloitte & Touche, independent registered public accounting firm. |

| |

|

| 23.2 |

Consent of Lee and Li (included in Exhibit 5.1). |

| |

|

| 24.1 |

Power of Attorney (included in the signature pages hereof). |

| |

|

| 99.1 |

Advanced Semiconductor Engineering, Inc. 2015 Employee Stock Option Plan (English translation). |

Exhibit 4.1

Advanced Semiconductor Engineering,

Inc.

Articles of Incorporation

(Translation)

Chapter One: General Principles

Article

1. The Company is called 日月光半導體製造股份有限公司, and is registered as a company limited by shares according to the Company Act. The English name of the Company is

Advanced Semiconductor Engineering, Inc.

Article

2. The Company is engaged in the following businesses:

| (1) | The manufacture, assembly, processing, test and export of various types of integrated circuitry; |

| (2) | The research, development, design and manufacture, assembly, processing, test and export of various

computers, electronics, communications, information products and their peripheral products; |

| (3) | General import and export trading business (excluding the approved businesses requiring special

permits); |

| (4) | CC01080 Electronic parts and components manufacture business; |

| (5) | CC01990 Other mechanical, electronic and mechanical devices manufacture businesses (integrated

circuit lead frame, ball grid array substrate and flip chip substrate); |

| (6) | F119010 Electronic material wholesale business; |

| (7) | F219010 Electronic material retail business; |

| (8) | I199990 Other consulting service businesses (technical and counseling service for integrated circuit

lead frame, ball grid array substrate and flip chip substrate); |

| (9) | JE01010 Leasing business; and |

| (10) | ZZ99999 All other businesses not prohibited or restricted by laws and regulations except businesses

requiring special permits. |

Article 3. The

investment made by the Company in other companies as limited liability shareholder thereof is not subject to the limitation that

such investment shall not exceed a certain percentage of the paid-in capital as set forth in the Company Act.

Article 4. The

Company may provide guaranty.

Article 5. The

Company's headquarter is located in the Nantze Export Processing Zone, Kaohsiung, Taiwan, R.O.C. and may set up domestic or foreign

branch offices as resolved by the Board of Directors, if necessary.

Chapter Two: Shares

Article 6. The

Company's total capital is NT$100 billion divided into 10 billion shares with a par value of NT$10 per share. Stock options worth

of NT$8 billion are set aside for employee subscription. The Board of Directors is authorized to issue the unissued shares in installments

if deemed necessary for business purposes.

Article 7. The

share certificates shall be in registered form and have the signatures or seals of at least three directors of the Company and

shall be legally authenticated before issuance. In accordance with the provisions set forth in Article 162.2 of the Company Act,

the Company may choose to not provide share certificates in print form.

Article 8. No

registration of share transfer shall be made within sixty days before each ordinary shareholders’ meeting, or within thirty

days before each extraordinary shareholders’ meeting or five days before the record date for dividends, bonuses or other

distributions as determined by the Company.

Article 9. The

rules governing stock affairs of the Company shall be made pursuant to the laws and the regulations of the relevant authorities.

Chapter Three: Shareholders’

Meeting

Article 10. Shareholders’

meetings include ordinary meetings and extraordinary meetings. Ordinary meetings shall be convened by the Board of Directors once

annually within 6 months after the end of each fiscal year. Extraordinary meetings will be held according to the law whenever necessary.

Article 11. Shareholders’

meetings shall be convened by written notice stating the date, place and purpose dispatched to each shareholder at least 30 days,

in the case of ordinary meetings, and 15 days, in the case of extraordinary meetings, prior to the date set for such meeting.

Article 12. Unless

otherwise required by the Company Act, shareholders’ resolutions shall be adopted by at least a majority of the votes of

shareholders present at a shareholders’ meeting who hold a majority of all issued and outstanding shares of the Company.

Article 13. Each

shareholder of the Company shall have one vote per share, unless otherwise provided by Article 179 of the Company Act.

Article 14. Any

shareholder, who for any reason is unable to attend shareholders’ meetings, may execute a proxy printed by the Company, in

which the authorized matters shall be expressly stated, to authorize a proxy to attend the meeting for him/her. Such proxy shall

be submitted to the Company at least 5 days prior to the shareholders’ meeting.

Article 15. The

shareholders’ meeting shall be convened by the Board of Directors unless otherwise stipulated in the Company Act, and the

person presiding over the meeting will be the Chairman of the Board of Directors (the “Chairman”). If the Chairman

is on leave or for any reason can not discharge his duty, Paragraph 3 of Article 208 of the Company Act should apply. If the shareholders’

meeting is called by a person entitled to do so other than the Chairman, that person shall act as the Chairman. If two or more

persons are entitled to call the shareholders’ meeting, those persons shall elect one to act as the Chairman.

Chapter Four: Directors

Article 16. The

Company shall have 11 to 15 directors, of which there shall be three independent directors and eight to 12 non-independent directors.

Each director shall hold office for a term of three years, and may continue to serve if re-elected. Election of directors should

be handled according to Article 198 of the Company Act and applicable laws and regulations. When handling the aforementioned election

of directors, the election of independent directors and non-independent directors should be held concurrently, with the names

of the elected separately calculated, and those that receive the ballots representing the greatest number of voting rights will

be elected as independent directors or non-independent directors. The supervisors shall be replaced by an audit committee that

the Company would establish in accordance with Article 14-4 of the Securities and Exchange Act. The Audit Committee shall be responsible

for exercising the powers of supervisors under the Company Act, the Securities and Exchange Act, and other applicable laws. The

Audit Committee shall consist of all independent directors and its powers and related matters shall be devised by the Board of

Directors in accordance with the applicable laws.

Article 16 (1): The election of the

Company’s independent directors uses the candidate nomination system. Shareholders who hold 1% or more of the Company’s

issued shares and the board of directors shall nominate a list of candidates for independent directors. After the Board of Directors

examines the qualifications of the candidate(s) for serving as an independent director, the name(s) is/are sent to the shareholders’

meeting for election. If the shareholders’ meeting is convened by another person with the authority to convene the meeting,

after such person examines the qualifications of the candidate(s) for serving as an independent director, the names are sent to

the shareholders’ meeting for election. All matters regarding the acceptance method and announcement of the nomination of

candidates for independent directors will be handled according to the Company Act, the Securities and Exchange Act, and other relevant

laws and regulations.

Article 16 (2): The remuneration

of the Company’s independent directors is set at NT$2 million per person annually. For those that do not serve a full year,

the remuneration will be calculated in proportion to the number of days of the term that were actually served. The additional remuneration

of the Company’s independent directors who are also the members of the Company’s Compensation Committee is set at NT$360

thousand per person annually. For those that do not serve a full year, the additional remuneration will be calculated in proportion

to the number of days of the term that were actually served.

Article 17. The Board of

Directors is constituted by directors. Their powers and duties are as follows:

| (1). | Preparing business plans; |

| (2). | Preparing surplus distribution or loss make-up proposals; |

| (3). | Preparing proposals to increase or decrease capital; |

| (4). | Reviewing material internal rules and contracts; |

| (5). | Hiring and discharging the general manager; |

| (6). | Establishing and dissolving branch offices; |

| (7). | Reviewing budgets and audited financial statements; and |

(8). Other

duties and powers granted by or in accordance with the Company Act or shareholders’ resolutions.

Article 18. The

Board of Directors is constituted by directors, and the Chairman and Vice Chairman are elected by the majority of the directors

at a board meeting at which over two-thirds of the directors are present. If the Chairman is on leave or for any reason can not

discharge his duties, his/her acting proxy shall be elected in accordance with Article 208 of the Company Act.

Article 19. Board of Directors

meetings shall be convened by the Chairman, unless otherwise stipulated by the Company Act. Board of Directors meetings can be

held at the place that the Company is headquartered, or at any place that is convenient for the directors to attend and appropriate

for the meeting to be convened, or via teleconference.

Article 19.1 Directors shall

be notified of board meetings in writing via email or facsimile seven days prior to the meeting. However, in case of any emergency,

a board meeting may be convened at any time.

Article 20. A

director may execute a proxy to appoint another director to attend the Board of Directors meeting and to exercise the voting right,

but a director can accept only one proxy.

Chapter Five: Managers

Article 21. The

Company has one general manager. The appointment, discharge and salary of the general manager shall be managed in accordance with

Article 29 of the Company Act.

Chapter Six: Accounting

Article 22. The

fiscal year of the Company starts from January 1 and ends on December 31 every year. At the end of each fiscal year, the Board

of Directors shall prepare financial and accounting books in accordance with the Company Act and submit them to the ordinary shareholders’

meeting for recognition.

Article 23. The

annual net income ("Income") shall not be distributed before:

| (1) | Making up for losses, if any; |

| (2) | 10% being set aside as legal reserve; |

| (3) | A special reserve being set aside or for reversal pursuant to the laws or regulation of governmental

authority; |

| (4) | Setting aside a special reserve equal to the (unrealized) investment income under equity method

for long-term investment, excluding cash dividends (the realized income shall be classified as earnings for distribution); and |

(5) The

additions or deductions of the portion of retained earnings that belong to equity investment gains or losses that have been realized

through other comprehensive income or losses measured at fair value.

If any Income

remains, it shall be distributed as follows:

| (6) | Not more than 1% of the balance (i.e., the Income deducting (1) to (5) above) as compensation to

directors; |

| (7) | Not less than 7% and not more than 11% of the balance (i.e. the Income deducting (1) to (5) above)

as bonus to employees (the 7% portion being distributed to all employees in the form of stock bonus in accordance with the employee

bonus rules, while the portion exceeding 7% being distributed to individual employees (having special contributions) in accordance

with the rules made by the board of directors with the authority granted hereby); and |

| (8) | The remainder is distributed in proportion to the aggregate amount of outstanding shares proposed

by the board. |

"Employees"

referred to in subparagraph (7) above include employees of subsidiaries who meet certain qualifications. Such qualifications are

to be determined by the Board of Directors.

Article 24 The

Company is at the stage of stable growth. In order to accommodate the capital demand for the present and future business development

and satisfy the shareholder's demand for the cash, the Residual Dividend Policy is adopted for the dividend distribution of the

Company. The ratio for cash dividends shall be no less than 30% of the total dividends; and the residual dividends shall be distributed

in form of stocks in accordance with the distribution plan proposed by the board and resolved by the shareholders’ meeting.

Chapter Seven: Appendix

Article

25. The constitutive rules and the operation rules of the Company shall be stipulated otherwise.

Article

26. Any matter not covered by these Articles of Incorporation shall be subject to the Company Act.

Article

27. These Articles of Incorporation were enacted on March 31, 1984 as approved by all the promoters.

The first amendment

was made on May 3, 1984.

The second amendment

was made on June 11, 1984.

The third amendment

was made on June 25, 1984.

The fourth amendment

was made on May 28, 1986.

The fifth amendment

was made on July 10, 1986.

The sixth amendment

was made on August 15, 1987.

The seventh amendment

was made on May 28, 1988.

The eighth amendment

was made on July 18, 1988.

The ninth amendment

was made on September 1, 1988.

The tenth amendment

was made on October 30, 1988.

The eleventh amendment

was made on November 24, 1988.

The twelfth amendment

was made on December 5, 1988.

The thirteenth amendment

was made on February 21, 1989.

The fourteenth

amendment was made on December 11, 1989.

The fifteenth amendment

was made on March 31, 1990.

The sixteenth amendment

was made on March 30, 1991.

The seventeenth amendment

was made on April 11, 1992.

The eighteenth amendment

was made on April 28, 1993.

The nineteenth amendment

was made on March 21, 1994.

The twentieth amendment

was made on March 21, 1995.

The twenty-first amendment

was made on April 8, 1996.

The twenty-second amendment

was made on April 12, 1997.

The twenty-third amendment

was made on March 21, 1998.

The twenty-fourth

amendment was made on June 9, 1999.

The twenty-fifth

amendment was made on 11 July 2000.

The twenty-sixth

amendment was made on June 1, 2001.

The twenty-seventh

amendment was made on June 21, 2002.

The twenty-eighth

amendment was made on June 21, 2002.

The twenty-ninth

amendment was made on June 19, 2003.

The thirtieth

amendment was made on June 19, 2003.

The thirty-first

amendment was made on June 15, 2004.

The thirty-second

amendment was made on June 30, 2005.

The thirty-third

amendment was made on June 21, 2006.

The thirty-fourth

amendment was made on June 28, 2007.

The thirty-fifth

amendment was made on June 19, 2008.

The thirty-sixth

amendment was made on June 25, 2009.

The thirty-seventh

amendment was made on June 14, 2010.

The thirty-eighth amendment was made on June 28, 2011.

The thirty-ninth amendment was made on June 21, 2012.

The fortieth

amendment was made on June 26, 2013.

The forty-first

amendment was made on June 26, 2014.

The forty-second

amendment was made on June 23, 2015.

Exhibit 5.1

[LETTERHEAD OF LEE AND LI]

December 1, 2015

Advanced Semiconductor Engineering, Inc.

Rm.1901, 19F, No.333, Sec. 1

Keelung Road, Taipei 110

Republic of China

Re: Advanced Semiconductor Engineering,

Inc.

2015 Employee Stock Option Plan

Ladies and Gentlemen:

We act as special counsel in the Republic

of China (the "ROC") for Advanced Semiconductor Engineering, Inc. (the "Company"), a company limited by shares

organized under the laws of the ROC, in connection with the registration of 100,000,000 common shares of the Company, par value

NT$10 per share (the "Common Shares"), under the United States Securities Act of 1933, as amended (the "Act"),

as described in the registration statement of Form S-8 (the "Registration Statement") filed with the United States Securities

and Exchange Commission on the date hereof, for issuance under the Advanced Semiconductor Engineering, Inc. 2015 Employee Stock

Option Plan.

We have examined originals or copies, certified

or otherwise identified to our satisfaction, of such documents and records of the Company as we have deemed necessary as a basis

for the opinions hereinafter expressed. In such examination, we have assumed the genuineness of all signatures, the authenticity

and completeness of all documents submitted to us as originals, the accuracy and completeness of all documents submitted to us

as copies and the authenticity of the originals of such latter documents. As to matters of fact material to this opinion, we have

made due inquiries with officers and other representatives of the Company, sources of publicly available records and others, and,

without independent verification, relied on the statements of such officers and other representatives of the Company.

Based upon the foregoing, we are of the

opinion that:

| 1. | The Company has been duly incorporated and is validly existing as a company limited by shares under

the laws of the ROC. |

| 2. | The Common Shares have been duly authorized, and when issued, delivered and paid for in the manner

described in the Registration Statement, will be validly issued, fully paid and non-assessable. |

We hereby consent to the use of this opinion

in, and the filing hereof as an Exhibit to, the Registration Statement. In giving such consent, we do not thereby admit that we

come within the category of person whose consent is required under Section 7 of the Act or the regulations promulgated thereunder.

Sincerely yours,

LEE AND LI

/s/ C.T. Chang___

C.T. Chang

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration

Statement on Form S-8 of our reports relating to the consolidated financial statements of Advanced Semiconductor Engineering, Inc.

and its subsidiaries (the “Group”) (which report expresses an unqualified opinion and includes explanatory paragraphs

relating to the convenience translation of New Taiwan dollar amounts into U.S. dollar amounts) and the effectiveness of the Group’s

internal control over financial reporting dated March 11, 2015, appearing in the Annual Report on Form 20-F of the Company for

the year ended December 31, 2014.

/s/ Deloitte & Touche

Deloitte & Touche

Taipei, Taiwan

The Republic of China

December 1, 2015

Exhibit 99.1

Advanced Semiconductor Engineering,

Inc.

2015 Employee Stock Option Plan

(Translation of Chinese)

The

2015 Employee Stock Option Plan (the “Plan”) of Advanced Semiconductor Engineering, Inc. (the “Company”)

is made for the purposes of attracting professionals needed by the Company, encouraging employees, increasing employees' recognition

of the Company and creating more profits for the Company and its shareholders. The Plan is made in compliance with article 28-3

of the Securities and Exchange Law, the Guidelines for Handling Issuance and Offer of Securities by Issuers issued by the Financial

Supervisory Commission, and relevant laws and regulations.

Within one (1) year from the

date on which the report of the Plan is filed with the competent authority becomes effective (the "Effective Date"),

the Company may, depending on actual needs, issue the options covered herein (the "Options") in one or more tranches.

The actual issue date(s) will be determined by the Chairman of the Board of Directors of the Company (the "Chairman").

| 3. | Qualifications of Employees |

The Plan applies only to full-time

employees of the Company or its domestic or foreign subsidiaries. The Chairman shall nominate and submit to the Board of Directors

for approval the employees who are entitled to Options and the number of the Options to be granted to him/her based on his/her

seniority, ranking, performance, over-all contribution (including possible contribution in the future), special achievement, etc.

The total number of Options granted

to any employee in any tranche shall not exceed one percent (1%) of the total issued and outstanding common shares of the Company.

| 4. | Total Number of Options to be Granted |

The total number of Options to

be issued under the Plan shall be one hundred million (100,000,000). Each Option is entitled to subscribe one (1) new common share

of the Company. The total number of new common shares of the Company to be reserved for the Options shall be one hundred million

(100,000,000) shares.

The

exercise price of the Options shall be at least no less than the closing price of the Company's common shares on the date that

the Options are issued and Chairman is authorized with full power to determine the exercise price per unit of option.

The Options will expire at the

end of the tenth year from the issue date (the "Expiry Date"). The Options may not be transferred, except by inheritance.

If the employee or his/her inheritor is unable to exercise the Options before the Expiry Date, such Options shall elapse and be

cancelled.

The Options shall become exercisable

from the date two (2) years after the issue date thereof (the "Waiting Period"), and the percentage of exercisable Options

in different time periods are set forth below.

| Numbers of Years after the Issue Date |

Accumulated Percentage of Options Exercisable |

| 2 years |

40% |

| 2.5 years |

50% |

| 3 years |

60% |

| 3.5 years |

70% |

| 4 years |

80% |

| 4.5 years |

90% |

| 5 years |

100% |

| (3) | The Company shall have the right to revoke and cancel any Option, which is not exercisable, granted

to an employee if he/she violates the employment contract or codes of the Company. |

| (4) | Type of Shares Underlying the Options |

The underlying shares of the Options

should be the common share of the Company.

| (5) | Termination of Employment |

If an employee's employment is

terminated, he/she shall exercise options in accordance with the following provisions:

| a. | Voluntary Resignation, Lay-off and Unemployment |

Exercisable Options can be still

exercised within three (3) months after the termination of employment relationship. Non-exercisable Options shall be cancelled

immediately on the termination date.

Exercisable Options can be exercised

before the Expiry Date of the Options. Non-exercisable Options shall be cancelled immediately on the retirement date.

In case the employee is approved

to be on leave without pay, exercisable Options can be exercised within three (3) months from the effective date of the leave.

If Options are not exercised within such three-month period, the Options cannot be exercised until the employee's reinstatement.

With respect to non-exercisable Options, the calculation of years and percentages as set forth in Paragraph 5(2) above shall suspend

during the period of leave and shall be resumed after the employee's reinstatement, subject to the ten-year period set forth in

Paragraph 5(2) above.

If the employee's employment with

the Company or its subsidiaries is terminated by reason of death, the employee's heir(s) shall have the right to exercise the Options

having been granted to the said employee. Except being subject to the Waiting Period, all such Options are exercisable, regardless

of the schedule set forth in Paragraph 5(2) above.

| e. | Death or Disability Caused by Injury in Work |

| (a) | Except being subject to the Waiting Period, all Options are exercisable upon the unemployment of

the employee due to any disability caused by injury in work, regardless of the schedule set forth in Paragraph 5(2) above. |

| (b) | Except being subject to the Waiting Period, all Options are exercisable by the heir(s) upon the

death of the employee caused by injury in work, regardless of the schedule set forth in Paragraph 5(2) above. |

In case the employee is transferred

to an affiliate of the Company due to business requirements, the rights and obligations of the Options having been granted to such

employee shall not be affected by such transfer.

| g. | If the employee or his/her heir(s) fail to exercise the Options within the periods set forth above,

the unexercised Options shall expire and become invalid. |

Any Option that elapses shall be

cancelled.

The Company will issue new common

shares as the underlying shares.

| 7. | Adjustments of the Exercise Price |

| (1) | The exercise price of the Options shall be subject to

adjustment in accordance with the following formula (to the nearest NT$0.1 with NT$0.05 being rounded up to the next NT$0.1) upon

any changes in Company's paid-in capital resulting from capitalization of retained earnings or capital reserves: |

NEP = OEP x [N] / [N + n]

| Where | NEP = New Exercise Price, the exercise price after adjustment |

| | OEP = Old Exercise Price, the exercise price before adjustment |

| | N = the number of outstanding common shares |

| | n = the number of new common shares |

| (2) | The exercise price of the Options shall be subject to

adjustment in accordance with the following formula (to the nearest NT$0.1 with NT$0.05 being rounded up to the next NT$0.1) upon

any decrease in Company's common shares resulting from the capital reduction (except for those in connection with the cancellation

of treasury stocks): |

NEP = OEP x [N of pre-capital reduction]

/ [N of post-capital reduction]

| Where | NEP = New Exercise Price, the exercise price after adjustment |

| | OEP = Old Exercise Price, the exercise price before adjustment |

| | N = the number of outstanding common shares |

* The number

of outstanding common shares shall not include outstanding convertible bonds, and shall deduct the number of treasury stocks yet

to be transferred or cancelled.

* Except in the circumstances set

forth in Paragraphs 7(1) and 7(2) above, the exercise price shall not be subject to adjustment in the case of issue of new common

shares in accordance with other means.

| 8. | Procedures for Exercising Options |

| (1) | Except during a period in which the Company's shareholders' registry is closed as required by relevant

laws and regulations and three (3) business days prior to the record date as announced by the Company to close Company's shareholders'

registry for distribution of free stock dividends, distribution of cash dividends or subscription for new shares in rights issue,

employees may exercise the Options in accordance with the schedule set forth in Paragraph 5(2) above by submitting a written notice

(the "Exercise |

Notice")

to the Company.

| (2) | The Company shall inform the employee to make payments for the exercised Options to a designated

bank upon the receipt of the Exercise Notice. The Exercise Notice shall not be withdrawn once the payment has been made. |

| (3) | The Company shall, upon confirmation of payment(s), instruct its stock affairs agent to register

the employee and the number of shares subscribed by him/her by way of exercise of the Options onto the Company's shareholders'

registry and shall, within five (5) business days, issue common shares to such employee through central depositary clearance system. |

| (4) | The common shares are tradable on the Taiwan Stock Exchange upon delivery to the employee. |

| (5) | The Company will register change of capital for exercised options with the competent authority

in fifteen (15) days following the end of each quarter. |

| 9. | Rights and Obligations after Exercising Options |

Common shares delivered after

exercising the Options shall have the same rights, obligations and privileges as holders of common shares of the Company.

Unless otherwise requested by

the competent authorities or laws and regulations, employees shall keep confidential the information relating to the Options or

its content. In case of violation of the confidentiality liability, the Company may act in accordance with Paragraph 5(3) above.

The Company will notify the

employee under separate cover with regards to the number of Options granted to him/her and procedures related to exercises of Options

and payments thereof.

| (1) | The Plan, and its amendments before issuance, shall be effective upon obtaining approval from the

Company's Board of Directors and the effective registration with the competent authority. |

| (2) | Any other matter not set forth in the Plan shall be dealt with in accordance with the applicable

laws and regulations. |

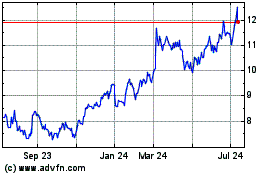

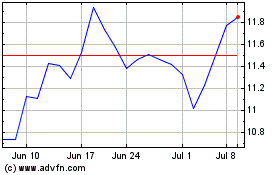

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024