Hon Hai Loses Battle to Control Chip Company

October 15 2015 - 8:20AM

Dow Jones News

HONG KONG—Hon Hai Precision Industry Co. lost a struggle to gain

the most influence in a Taiwanese semiconductor company that is

developing a key technology used in the latest iPhones and

smartwatches, in a setback to its diversification efforts.

Shareholders of the Taiwan-based chip assembly firm Siliconware

Precision Industries Co.—known as SPIL—voted down the company's

plan to increase its share capital Thursday, which would have

allowed Hon Hai to become the largest shareholder in SPIL.

Hon Hai, also known as Foxconn Technology Group, has been locked

in a fierce battle for the past two months with the world's largest

chip packaging firm, Advanced Semiconductor Engineering Inc., to

gain control of SPIL, the world's No. 3 chip packaging and testing

company by market share.

SPIL is planning to expand in the market for system-in-package

or SiP technology, which squeezes additional components into a tiny

chip. That allows smartphones and wearable devices to be thinner,

more energy efficient and more powerful. SiP design is used in the

iPhone 6S and the Apple Watch, and analysts said Hon Hai, Advanced

Semiconductor and SPIL are targeting billions in dollars in

potential revenue and new orders from Apple.

In August, Advanced Semiconductor, the No. 1 player in the chip

packaging industry, made a $1 billion tender offer for shares in

SPIL and subsequently obtained a 25% stake, becoming its largest

shareholder. The tender offer was an attempt to take control of

rival SPIL after competition intensified in the chip packaging

industry as fast-growing Chinese competitor Jiangsu Changjiang

Electronics Technology Co. acquired No. 4 ranked STATSChipPAC Ltd.

earlier this year, analysts said.

To fend off what was seen as hostile takeover bid from Advanced

Semiconductor, SPIL announced an alliance with Hon Hai a week later

and disclosed plans for a share swap that would have given Hon Hai

a 21.2% stake in SPIL. A successful alliance with Hon Hai—which

assembles the majority of the world's iPhones—would have diluted

Advanced Semiconductor's stake in SPIL to 19.7%, knocking it down

from its top shareholder status.

The alliance with SPIL was an important step for Hon Hai as it

seeks new growth engines. Over the past decade, Hon Hai has been

expanding in new markets beyond the labor-intensive device assembly

by setting up several semiconductor units including

printed-circuit-board maker Zhen Ding Technology Holding Ltd. and

chip-packaging provider ShunSin Technology Holdings Ltd.

SPIL, which failed to get enough shareholder votes to approve

its share swap with Hon Hai, said Thursday it would continue to

collaborate with Hon Hai to win new orders in the SiP market. The

company's founders also plan to increase their stake in SPIL to

fend off Advanced Semiconductor's influence on its business

strategy.

Advanced Semiconductor said it respects the outcome of the

meeting. Hon Hai wasn't immediately available for comment.

Write to Lorraine Luk at lorraine.luk@wsj.com

Access Investor Kit for "Apple, Inc."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US0378331005

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 15, 2015 08:05 ET (12:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

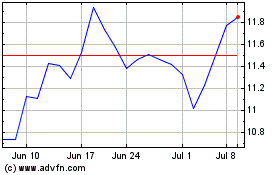

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

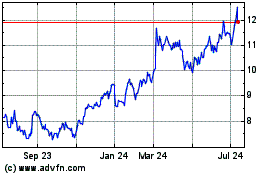

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024