UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

SD

Specialized

Disclosure Report

ADVANCED

SEMICONDUCTOR ENGINEERING, INC.

Taiwan,

Republic of China

Jurisdiction

of incorporation |

|

001-16125

Commission

File Number |

26

Chin Third Road

Nantze

Export Processing Zone

Nantze,

Kaohsiung, Taiwan

Republic

of China

Joseph

Tung

Chief

Financial Officer

886-2-8780-5489

X

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1

to December 31, 2014.

Section

1 — Conflict Minerals Disclosure

Item

1.01 and 1.02 Conflict Minerals Disclosure and Report, Exhibit

Conflict

Minerals Disclosure

Our

Form SD and our Conflict Minerals Report for the year ended December 31, 2014 filed as Exhibit 1.01 to this Form SD are available

at http://www.aseglobal.com/en/Csr/SupplyChainDevelopment.asp.

Section

2 – Exhibits

Item

2.01 Exhibits

Exhibit

1.01 – Conflict Minerals Report for the reporting period January 1, 2014 to December 31, 2014

*

* * * *

SIGNATURE

Advanced

Semiconductor Engineering, Inc.

| By:

|

/s/

Jason C.S. Chang

Jason

C.S. Chang

Chief

Executive Officer |

Date:

May 31, 2015 |

EXHIBIT

INDEX

| Exhibit

|

|

|

| Number |

|

Description |

| 1.01 |

|

Conflict Minerals

Report for the reporting period January 1, 2014 to December 31, 2014 |

Exhibit

1.01

Advanced

Semiconductor Engineering, Inc.

Conflict

Minerals Report

For

the year ended December 31, 2014

Corporate

Overview and Product Scope

Advanced

Semiconductor Engineering, Inc. (“ASE”, “we”, “our”, “us”) is the world’s

largest independent provider of semiconductor packaging and materials services based on 2014 revenues. Our services include semiconductor

packaging, production of interconnect materials, front-end engineering testing, wafer probing and final testing services, as well

as integrated solutions for electronic manufacturing services in relation to computers, peripherals, communications, industrial,

automotive, and storage and server applications. We utilize gold, tantalum, tin and tungsten which are necessary to deliver our

packaging, materials and electronic manufacturing services.

We

have twelve facilities located in Taiwan, China, Malaysia, Japan, Singapore and Korea that provide packaging, testing and materials

services to many semiconductor companies around the world. A typical customer engagement involves receiving consigned silicon

wafers from the customer, performing a series of manufacturing services to the wafers, and delivering a completed, packaged integrated

circuit back to the customer. In the performance of packaging and materials services, we typically add gold and tin as direct

materials in the manufacturing process, and we occasionally add tungsten and tantalum. We do not use gold, tin, tungsten or tantalum

in our testing services.

Since

our acquisition of a controlling interest in Universal Scientific Industrial Co., Ltd. in February 2010, we provide a broad range

of electronic manufacturing services to a global customer base. We have seven facilities located in Taiwan, China and Mexico that

provide electronic manufacturing services. In providing these services, we acquire numerous electronic and non-electronic components,

and assemble them into sub-assemblies and finished products. Typical materials and components which we utilize include solder

(tin based), electrolytic capacitors (tantalum bearing), integrated circuits (gold wire) and high temperature wires (tungsten).

Gold, tin, tungsten and tantalum are essential to our electronic manufacturing services.

All

packaging and materials services and electronic manufacturing services we provide contain one or more of the conflict minerals:

gold, tin, tungsten or tantalum.

Reasonable

Country of Origin Inquiry (RCOI)

For

our packaging and materials services, we purchase gold, tin and tungsten from 101 suppliers. Each of these 101 suppliers has supplied

us with the information required in a Conflict Minerals Reporting Template (CMRT) authored by the Electronic Industry Citizenship

Coalition, Incorporated & Global e-Sustainability Initiative, or EICC-GeSI, with an accounting of their conflict mineral Smelters

or Refiners (SoRs). Each of these 101 suppliers is in receipt of our conflict minerals policy, and each has confirmed their understanding

of its principles and their willingness to comply.

For

our electronic manufacturing services, we performed a supplier assessment of all 1,194 suppliers who provided us with gold, tin,

tungsten or tantalum in 2014. We organized the list by annual purchase volume (purchase expenditure in dollars) from largest to

smallest and made a determination that for our 2014 Conflict Minerals Report we would analyze suppliers supplying us a purchase

volume of greater than $1 million. The purchase volume of the resulting 232 companies accounted for 95% of our total purchase

volume in 2014.

Below

are the results of our Reasonable Country of Origin Inquiry, or RCOI.

Gold

– Packaging and Materials Services

| 1. | During

2014, we purchased gold for our packaging and materials services from a total of 53 suppliers.

None of these suppliers are SoRs, and all these suppliers purchased gold from SoRs or

from third parties. Based on data we collected, we identified a total of 58 SoRs from

which we indirectly purchased gold in 2014 for our packaging and materials services.

All 53 of our gold suppliers for our packaging and materials services responded to our

request, representing 100% of our total expenditure for gold during 2014 for our packaging

and materials services. |

| 2. | Based

on an inspection of the list available at www.conflictfreesourcinginitiative.org conducted

on December 31, 2014, 48 of the SoRs from which we indirectly purchased gold in 2014

for our packaging and materials services are participants in the Conflict-Free Smelter

Program, or CFSP, operated by the Conflict-Free Sourcing Initiative, or CFSI. |

| 3. | The

following table summarizes our RCOI results for gold purchased for our packaging and

materials services in 2014. |

| Companies

supplying gold for our packaging and materials services |

Number |

% |

| Companies

from which we purchased gold |

53 |

100% |

| Companies

that provided SoR source information |

53 |

100% |

| Companies

that were not able provide SoR source information |

0 |

0% |

| |

|

|

| SoRs

of gold for our packaging and materials services |

|

|

| SoRs

from which we indirectly purchased gold |

58 |

100% |

| SoRs

with Smelter ID, CFSI Compliant |

42 |

73% |

| SoRs

with Smelter ID, CFSI Active |

6 |

10% |

| SORs

not involved in CFSP |

10 |

17% |

Gold

– Electronic Manufacturing Services

| 1. | During

2014, we purchased gold for our electronic manufacturing services from a total of 180

suppliers. None of these suppliers are SoRs, and all these suppliers purchased gold from

SoRs or from other third parties. Based on data collected, 122 SoRs were identified from

which we indirectly purchased gold in 2014 for our electronic manufacturing services.

One-hundred seventy-two of our gold suppliers for our electronic manufacturing services

responded to our request to identify the SoRs for gold during 2014. Eight did not respond. |

| 2. | Based

on an inspection of the list available at www.conflictfreesourcinginitiative.org conducted

on December 31, 2014, 62 of the SoRs from which we indirectly purchased gold in 2014

for our electronic manufacturing services are participants in the CFSP operated by the

CFSI. |

| 3. | The

following table summarizes our RCOI results for gold purchased for our electronic manufacturing

services in 2014. |

| Companies

supplying gold for our electronic manufacturing services |

Number |

% |

| Companies

from which we purchased gold |

180 |

100% |

| Companies

that provided SoR source information |

172 |

95% |

| Companies

that were not able provide SoR source information |

8 |

5% |

| |

|

|

| SoRs

of gold for our electronic manufacturing services |

|

|

| SoRs

from which we indirectly purchased gold |

122 |

100% |

| SoRs

with Smelter ID, CFSI Compliant |

53 |

43% |

| SoRs

with Smelter ID,CFSI Active |

9 |

7% |

| SORs

not involved in CFSP |

60 |

50% |

Tin

– Packaging and Materials Services

| 1. | During

2014, we purchased tin for our packaging and materials services from a total of 67 suppliers.

None of these suppliers are SoRs, and all of these suppliers purchased tin from SoRs

or from other third parties. Based on the data we collected, we identified a total of

46 SoRs from which we indirectly purchased tin in 2014 for our packaging and materials

services. All 67 of our tin suppliers for our packaging and materials services responded

to our request, representing 100% of our total expenditure for tin during 2014 for our

packaging and materials services. |

| 2. | Based

on an inspection of the list available at www.conflictfreesourcinginitiative.org conducted

on December 31, 2014, 38 of the SoRs from which we indirectly purchased tin in 2014 for

our packaging and materials services are participants in the CFSP operated by the CFSI. |

| 3. | The

following table summarizes our RCOI results for tin purchased for our packaging and materials

services in 2014. |

| Companies

supplying tin for our packaging and materials services |

Number |

% |

| Companies

from which we purchased tin |

67 |

100% |

| Companies

that provided SoR source information |

67 |

100% |

| Companies

that were not able provide SoR source information |

0 |

0% |

| |

|

|

| SoRs

of tin for our packaging and materials services |

|

|

| SoRs

from which we indirectly purchased tin |

46 |

100% |

| SoRs

with Smelter ID, CFSI Compliant |

20 |

44% |

| SoRs

with Smelter ID, CFSI Active |

18 |

39% |

| SORs

not involved in CFSP |

8 |

17% |

Tin

– Electronic Manufacturing Services

| 1. | During

2014, we purchased tin for our electronic manufacturing services from a total of 189

suppliers. None of these suppliers are SoRs and all these suppliers purchased tin from

SoRs or from other third parties. Based on data collected, 102 SoRs were identified from

which we indirectly purchased tin for our electronic manufacturing services in 2014.

One-hundred eighty one of our tin suppliers for our electronic manufacturing services

responded to our request to identify the SoRs for tin during 2014. Eight did not respond. |

| 2. | Based

on an inspection of the list available at www.conflictfreesourcinginitiative.org conducted

on December 31, 2014, 46 of the SoRs from which we indirectly purchased tin for our electronic

manufacturing services in 2014 are participants in the CFSP operated by the CFSI. |

| 3. | The

following table summarizes our RCOI results for tin purchased for our electronic manufacturing

services in 2014. |

| Companies

supplying tin for our electronic manufacturing services |

Number |

% |

| Companies

from which we purchased tin |

189 |

100% |

| Companies

that provided SoR source information |

181 |

96% |

| Companies

that were not able provide SoR source information |

8 |

4% |

| |

|

|

| SoRs

of tin for our electronic manufacturing services |

|

|

| SoRs

from which we indirectly purchased tin |

102 |

100% |

| SoRs

with Smelter ID, CFSI Compliant |

23 |

22% |

| SoRs

with Smelter ID, CFSI Active |

23 |

22% |

| SoRs

not involved in CFSP |

56 |

56% |

Tungsten

– Packaging and Materials Services

| 1. | During

2014, we purchased tungsten for our packaging and materials services from a total of

2 suppliers. None of these suppliers are SoRs, and did purchase tungsten from a SoR or

another third party. Based on data we collected, we identified 2 SoRs from which we indirectly

purchased tungsten for our packaging and materials services in 2014. Our 2 tungsten suppliers

for our packaging and materials services responded to our request, representing 100%

of our total expenditure for tungsten for our packaging and materials services during

2014. |

| 2. | Based

on an inspection of the list available at www.conflictfreesourcinginitiative.org conducted

on December 31, 2014, the 2 SoRs from which we indirectly purchased tungsten for our

packaging and materials services in 2014 are participants in the CFSP operated by CFSI

or participants in the Tungsten Industry—Conflict Minerals Council, or TI-CMC. |

| 3. | The

following table summarizes our RCOI results for tungsten purchased for our packaging

and materials services in 2014. |

| Companies

supplying tungsten for our packaging and materials services |

Number |

% |

| Companies

from which we purchased tungsten |

2 |

100% |

| Companies

that provided SoR source information |

2 |

100% |

| Companies

that were not able provide SoR source information |

0 |

0% |

| |

|

|

| SoRs

of tungsten for our packaging and materials services |

|

|

| SoRs

from which we indirectly purchased tungsten |

2 |

100% |

| SoRs

with Smelter ID, CFSI Compliant |

2 |

100% |

| SoRs

with Smelter ID, CFSI Active or TI-CMC Progressing |

0 |

0% |

| SoRs

not involved in CFSP or TI-CMC |

0 |

0% |

Tungsten

– Electronic Manufacturing Services

| 1. | During

2014, we purchased tungsten for our electronic manufacturing services from a total of

114 suppliers. None of these suppliers are SoRs and all these suppliers purchased tungsten

from SoRs or from other third parties. Based on data collected, 36 SoRs were identified

from which we indirectly purchased tungsten for our electronic manufacturing services

in 2014. One hundred six of our tungsten suppliers for our electronic manufacturing services

responded to our request to identify the SoRs for tungsten during 2014. Eight did not

reply. |

| 2. | Based

on an inspection of the list available at www.conflictfreesourcinginitiative.org conducted

on December 31, 2014, 9 of the SoRs from which we indirectly purchased tungsten for our

electronic manufacturing services in 2014 are participants in either the CFSP operated

by the CFSI or the TI-CMC program. |

| 3. | The

following table summarizes our RCOI results for tungsten purchased for our electronic

manufacturing services in 2014. |

| Companies

supplying tungsten for our electronic manufacturing services |

Number |

% |

| Companies

from which we purchased tungsten |

114 |

100% |

| Companies

that provided SoR source information |

106 |

93% |

| Companies

that were not able provide SoR source information |

8 |

7% |

| |

|

|

| SoRs

of tungsten for our electronic manufacturing services |

|

|

| SoRs

from which we indirectly purchased tungsten |

36 |

100% |

| SoRs

with Smelter ID, CFSI Compliant |

8 |

22% |

| SoRs

with Smelter ID, CFSI Active or TI-CMC Progressing |

1 |

3% |

| SoRs

not involved in CFSP or TI-CMC |

27 |

75% |

Tantalum

– Packaging and Materials Services

| 1. | During

2014, we purchased tantalum for our packaging and materials services from 1 supplier.

This supplier is not an SoR, and it purchased tantalum from an SoR or from third party.

Based on data we collected, we identified a total of 1 SoR from which we indirectly purchased

tantalum in 2014 for our packaging and materials services. Our tantalum supplier for

our packaging and materials services responded to our request, representing 100% of our

total expenditure for tantalum during 2014 for our packaging and materials services. |

| 2. | Based

on an inspection of the list available at www.conflictfreesourcinginitiative.org conducted

on December 31, 2014, the SoR from which we indirectly purchased tantalum in 2014 for

our packaging and materials services is a participant in the CFSP operated by the CFSI. |

| 3. | The

following table summarizes our RCOI results for tantalum purchased for our packaging

and materials services in 2014. |

| Companies

supplying tantalum for our packaging and materials services |

Number |

% |

| Companies

from which we purchased tantalum |

1 |

100% |

| Companies

that provided SoR source information |

1 |

100% |

| Companies

that were not able provide SoR source information |

0 |

0% |

| |

|

|

| SoRs

of tantalum for our packaging and materials services |

|

|

| SoRs

from which we indirectly purchased tantalum |

1 |

100% |

| SoRs

with Smelter ID, CFSI Compliant |

1 |

100% |

| SoRs

with Smelter ID, CFSI Active |

0 |

0% |

| SORs

not involved in CFSP |

0 |

0% |

Tantalum

– Electronic Manufacturing Services

| 1. | During

2014, we purchased tantalum for our electronic manufacturing services from a total of

86 suppliers. None of these suppliers are SoRs, and all these suppliers purchased tantalum

from SoRs or from other third parties. Based on the data collected, 41 SoRs were identified

from which we indirectly purchased tantalum for our electronic manufacturing services

in 2014. Seventy-eight of our tantalum suppliers for our electronic manufacturing services

responded to our request to identify the SoRs for tantalum during 2014. Eight did not

reply. |

| 2. | Based

on an inspection of the list available at www.conflictfreesourcinginitiative.org conducted

on December 31, 2014, 38 of the SoRs from which we indirectly purchased tantalum for

our electronic manufacturing services in 2014 are participants in the CFSP operated by

the CFSI. |

| 3. | The

following table summarizes our RCOI results for tantalum purchased for our electronic

manufacturing services in 2014. |

| Companies

supplying tantalum for our electronic manufacturing services |

Number |

% |

| Companies

from which we purchased tantalum |

86 |

100% |

| Companies

that provided SoR source information |

78 |

91% |

| Companies

that were not able provide SoR source information |

8 |

9% |

| |

|

|

| SoRs

of tantalum for electronic manufacturing services |

|

|

| SoRs

from which we indirectly purchased tantalum |

41 |

100% |

| SoRs

with Smelter ID, CFSI Compliant |

38 |

93% |

| SoRs

with Smelter ID, CFSI Active |

0 |

0% |

| SORs

not involved in CFSP |

3 |

7% |

Part

I. Due Diligence

Design

of Due Diligence

ASE designed

its due diligence measures to conform to the Organization for Economic Co-operation and Development (OECD) Due Diligence Guidance

for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas: Second Edition, including the related supplements

on tantalum, tin, tungsten, and gold.

Due

Diligence Measures Performed

| OECD

Step 1 |

Establish

strong company management systems |

A.

Adopt and clearly communicate to suppliers and public |

The

ASE Group Corporate Policy for Sourcing Conflict Minerals is posted on our website (and attached here as Annex

A) as well as distributed to each of our suppliers of conflict minerals who must agree in writing that the policy will

be complied with.

Additionally,

we require each supplier to certify they understand our conflict minerals policy and will comply with its covenants.

Finally,

every factory manager must certify they comply with our conflict minerals policy. They are also responsible for communicating

the policy throughout their organizations and implementing procedures to ensure compliance.

|

B.

Structure internal management to support due diligence |

Our

conflict minerals management team is a comprehensive cross-functional team under the direction of our Chief Operating Officer. The

team provides planning, analysis, management, tracking, monitoring and communication for the business wide initiative. They

hold regular and frequent meetings to ensure progress against requirements. |

C.

Establish a system of controls and transparency over the mineral supply chain |

Conflict

minerals procedures are documented in our specifications system and managed by our quality control organization. The bills-of-materials

required for different customer products across all manufacturing operations are controlled by our manufacturing execution

system software.

The

primary method for gathering conflict mineral data is through the deployment and gathering of Conflict Free Sourcing Initiative

(CFSI) Conflict Minerals Reporting Templates (CMRTs). We store this data on a comprehensive filing system that supports

ensuring the currency of the data.

|

D.

Strengthen company engagement with suppliers |

In

addition to formal written documentation, ASE is building person-to-person links between employees and suppliers to improve

the quality and consistency of vendor communications. ASE is beginning to hold supplier orientation and training

sessions to enable our manufacturing partners to better

understand and serve our needs. |

| E.

Establish grievance mechanism |

ASE

encourages suppliers and employees to have open and honest dialog on issues of mutual interest. |

| OECD

Step 2 |

Identify

and assess risk in the supply chain |

A.

Identify risks in the supply chain |

Our

process for identifying conflict minerals risk in the supply chain is as follows:

(a) Identify

all direct materials and components in the supply chain that contain conflict minerals.

(b) Identify

suppliers of materials and components that contain conflict minerals.

(c) Gather

CMRTs from our suppliers of conflict minerals.

(d)

Depending on the enormity and complexity of the supply chain:

• Assess

the value of the annual purchase volume of all conflict minerals.

• Prioritize

conflict mineral sources by dollar volume to leverage impact from available analytical resources.

|

| B.

Assess risks of adverse impacts |

(a) Assess

data gathered on templates to identify potential inconsistencies or “red flags.”

(b)

Follow up as appropriate to resolve items of concern. |

| OECD

Step 3 |

Design

and implement a strategy to respond to identified risks |

| A.

Report finding to designated senior management |

Periodic

reviews are held among team members and with senior management to ensure they are aware of current conflict minerals compliance

status. |

B.

Devise and adopt a risk management plan |

In

2014, we began selectively tracking below the smelter level using data contained in the CFSI RCOI database. In

2015, we will begin supplier audits to validate declarations provided to us. |

C.

Implement the risk management plan, monitor and track performance of risk mitigation efforts and report back to designated

senior management |

Our

packaging and materials services mitigate supply chain risk to conflict minerals in two ways:

(a) We

work with non-compliant suppliers to obtain CFSP certification, or an equivalent. Suppliers unwilling or incapable of

achieving such certification are replaced with compliant suppliers.

(b) For

compliance year 2014, we received CMRTs from 100% of our conflict mineral suppliers.

|

| |

Our

electronic manufacturing services mitigate supply chain risk to conflict minerals in two ways:

(a) We

work with non-compliant suppliers to obtain CFSP certification, or an equivalent. Suppliers unwilling or incapable of

achieving such certification are replaced with compliant suppliers.

(b)

For compliance year 2014, our electronic manufacturing services identified 232 suppliers that accounted

for 95% of our conflict minerals content. In 2015, we will increase the number of suppliers in order to further reduce

our risk. |

| D.

Undertake additional fact and risk assessments for risks requiring mitigation, or after a change of circumstances |

We

have begun supplier audits to assess the accuracy of data and statements made by larger suppliers. This program will be

broadened over time.

ASE

has joined the EICC, which provides access to RCOI data in the CFSI database.

|

| OECD

Step 4 |

Carry

out independent third-party audit of supply chain due diligence at

identified points in the supply chain |

| |

For

CY 2014, ASE has undertaken an Independent Private Sector Audit (IPSA) of our Conflict Minerals Report in compliance with

the requirements set forth in the SEC Conflict Minerals Final Rule and subsequent SEC Guidance.

In

addition, as a member of CFSI, we leverage the due diligence conducted on smelters by the CFSP which uses independent

third-party auditors to audit the source of the conflict minerals used by smelters.

|

| OECD

Step 5 |

Report

on supply chain due diligence. |

| |

ASE

filed a Form SD and Conflict Minerals Report for Compliance Year 2014 with the US Securities and Exchange Commission on or

before the June 1, 2015 deadline in compliance with the SEC Conflict Minerals Final Rule and subsequent guidance. |

Part

II. Due Diligence Determination and Product Declaration

Product

Declaration

Based

on the RCOI analysis and due diligence process for both ASE’s packaging and materials services and electronic manufacturing

services, we made the following product determinations.

| |

DRC

Conflict Free |

DRC

Conflict Undeterminable |

Not

found to be DRC Conflict Free |

| Packaging

and Materials Services products |

Packaging

(wafer bumping) and materials services (substrate) |

All

other packaging services |

No

services fall in this category |

Electronic

Manufacturing

Services

products |

No

services fall in this category |

All

electronic manufacturing services |

No

services fall in this category |

Facilities

used to Process Conflict Minerals

A list

of Smelters and Refiners that sourced conflict minerals utilized in our services is provided in Annex D.

Conflict

Minerals Country of Origin

A list

of countries where conflict minerals were mined or extracted is listed in Annex E. These minerals may have been smelted or refined

in the country of extraction or in facilities around the world.

Glossary

A glossary

of abbreviations and terms is included in Annex C.

Part

III – Independent Private Sector Audit

We

obtained an independent private sector audit by KPMG. This report is set forth in “Annex B”.

Annex

A – ASE Group Corporate Policy for Sourcing Conflict Minerals

The mining

and distribution of “conflict minerals”1

originating from the Democratic Republic of the Congo are sometimes controlled by violent organizations in order to fund conflict

in that country and adjacent regions. Our industry supply chains are inadvertently subject to metals derived from these conflict

minerals which can be introduced through the metals we use such as gold, tin, tantalum and tungsten. ASE Group is dedicated to

the elimination of these conflict minerals in our supply chain, and to use only conflict-free minerals2 responsibly

sourced around the world. It is also our objective to support the continued use of conflict-free minerals from the DRC and the

adjacent regions such that responsible mining is not diminished.

All

suppliers to ASE Group must support this policy by:

| (a) | being

diligent in their assessment and validation of their supply chains to ensure ASE Group’s

objectives of a transparent supply chain, and conflict-free purchases as inputs to the

services and products we produce. |

| (b) | at

all times be in compliance with all regional and international regulations for conflict

minerals. |

| (c) | at

all times be in compliance with industry standards for the sourcing and reporting of

conflict minerals. |

| (d) | being

diligent and accurate in their formal assurances of conflict-free minerals provided to

us. |

1

Conflict minerals are columbite-tantalite (coltan), cassiterite,

gold, wolframite, or their derivatives as defined in the Dodd-Frank Act section 1502 and SEC Rule 13p-1 under the Securities Exchange

Act of 1934.

2

Conflict-free minerals are conflict minerals that through

their distribution directly or indirectly do not benefit violent organizations in the Democratic Republic of the Congo and its

adjacent regions.

Annex

B – Report of Independent Accountants

Independent

Accountants Report

To

the Supervisory Board and Shareholders of Advanced Semiconductor Engineering Inc.:

We

have examined:

| • | whether

the design of the due diligence framework of Advanced Semiconductor Engineering Inc.

(the “Company”) as set forth in the section titled “Part I. Due Diligence”

of the Company’s Conflict Minerals Report for the reporting period from January

1 to December 31, 2014, is in conformity, in all material respects, with the criteria

set forth in the Organisation of Economic Co-operation and Development Due Diligence

Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and

High-Risk Areas, Second Edition 2013 (“OECD Due Diligence Guidance”),

and |

| • | whether

the Company’s description of the due diligence measures it performed, as set forth

in the section titled “Part I. Due Diligence” of the Company’s Conflict

Minerals Report for the reporting period from January 1 to December 31, 2014, is consistent,

in all material respects, with the due diligence process that the Company undertook. |

Management

from the Company is responsible for the design of the Company’s due diligence framework and the description of the Company’s

due diligence measures set forth in the Conflict Minerals Report, and performance of the due diligence measures. Our responsibility

is to express an opinion on the design of the Company’s due diligence framework and on the description of the due diligence

measures the Company performed, based on our examination.

Our

examination was conducted in accordance with attestation standards established by the American Institute of Certified Public Accountants

and the standards applicable to attestation engagements contained in Government Auditing Standards, issued by the

Comptroller General of the United States, and, accordingly, included examining, on a test basis, evidence about the design of

the Company’s due diligence framework and the description of the due diligence measures the Company performed, and performing

such other procedures as we considered necessary in the circumstances. We believe that our examination provides a reasonable basis

for our opinion.

Our

examination was not conducted for the purpose of evaluating:

| • | The

consistency of the due diligence measures that the Company performed with either the

design of the Company’s due diligence framework or the OECD Due Diligence Guidance; |

| • | The

completeness of the Company’s description of the due diligence measures performed; |

| • | The

suitability of the design or operating effectiveness of the Company’s due diligence

process; |

| • | Whether

a third party can determine from the Conflict Minerals Report if the due diligence measures

the Company performed are consistent with the OECD Due Diligence Guidance; |

| • | The

Company’s reasonable country of origin inquiry (RCOI), including the suitability

of the design of the RCOI, its operating effectiveness, or the results thereof;

or |

| • | The

Company’s conclusions about the source or chain of custody of its conflict minerals,

those products subject to due diligence, or the DRC Conflict Free status of its products. |

Accordingly,

we do not express an opinion or any other form of assurance on the aforementioned matters or any other matters included in any

section of the Conflict Minerals Report other than the section titled “Part I. Due Diligence.”

In

our opinion,

| • | the

design of the Company’s due diligence framework for the reporting period from January

1 to December 31, 2014, as set forth in the Company’s Conflict Minerals Report

is in conformity, in all material respects, with the OECD Due Diligence Guidance, and |

| • | the

Company’s description of the due diligence measures it performed as set forth in

its Conflict Minerals Report for the reporting period from January 1 to December 31,

2014, is consistent, in all material respects, with the due diligence process that the

Company undertook. |

/s/

KPMG

Taipei,

Taiwan (the Republic of China)

May

29, 2015

Annex

C – Glossary

| Term |

Explanation

|

| ASE |

Advanced

Semiconductor Engineering, Inc. |

| CFSI |

Conflict

Free Sourcing Initiative |

| CFSP |

Conflict

Free Sourcing Program |

| DRC

Conflict Free |

DRC

Conflict-free minerals are conflict minerals that, through their mining or distribution, directly or indirectly, do not benefit

violent organizations in the Democratic Republic of the Congo and its adjacent regions. |

| EICC |

Electronic

Industry Citizenship Coalition |

| GeSI |

Global

eSustainability Initiative |

| OECD |

Organisation

for Economic Co-operation and Development |

| RCOI |

Reasonable

Country of Origin Inquiry |

| SoR |

Smelter

or Refiner |

| TI-CMC |

Tungsten

Industry—Conflict Minerals Council |

Annex

D – Smelter List – Combined

Entity

Legend

A+M

Packaging and Materials Services

EMS

Electronic Manufacturing Services

| Material |

CFSI

ID |

Smelter

or Refiner Name |

Entity |

SoR

Country Location |

| Gold |

CID000009 |

Acade

Noble Metal (Zhao Yuan) Corporation |

EMS |

CHINA |

| Gold |

CID000019 |

Aida

Chemical Industries Co. Ltd. |

A+M,

EMS |

JAPAN |

| Gold |

CID000035 |

Allgemeine

Gold-und Silberscheideanstalt A.G. |

A+M,

EMS |

GERMANY |

| Gold |

CID000041 |

Almalyk

Mining and Metallurgical Complex (AMMC) |

EMS |

UZBEKISTAN |

| Gold |

CID000058 |

AngloGold

Ashanti Córrego do Sítio Minerção |

A+M,

EMS |

BRAZIL |

| Gold |

CID000077 |

Argor-Heraeus

SA |

A+M,

EMS |

SWITZERLAND |

| Gold |

CID000082 |

Asahi

Pretec Corporation |

A+M,

EMS |

JAPAN |

| Gold |

CID000090 |

Asaka

Riken Co Ltd |

A+M,

EMS |

JAPAN |

| Gold |

CID000103 |

Atasay

Kuyumculuk Sanayi Ve Ticaret A.S. |

A+M,

EMS |

TURKEY |

| Gold |

CID000113 |

Aurubis

AG |

A+M,

EMS |

GERMANY |

| Gold |

CID002716 |

Austin

Powder |

EMS |

UNKNOWN |

| Gold |

CID000128 |

Bangko

Sentral ng Pilipinas (Central Bank Philippines) |

A+M,

EMS |

PHILIPPINES |

| Gold |

CID000141 |

Bauer

Walser AG |

EMS |

GERMANY |

| Gold |

CID000157 |

Boliden

AB |

A+M,

EMS |

SWEDEN |

| Gold |

CID000176 |

C.

Hafner GmbH + Co. KG |

A+M,

EMS |

GERMANY |

| Gold |

CID000180 |

Caridad |

A+M,

EMS |

MEXICO |

| Gold |

CID000185 |

CCR

Refinery – Glencore Canada Corporation (Xstrata) |

A+M,

EMS |

CANADA |

| Gold |

CID000189 |

Cendres

+ Métaux SA |

EMS |

SWITZERLAND |

| Gold |

CID000233 |

Chimet

S.p.A. |

A+M,

EMS |

ITALY |

| Gold |

CID000242 |

China

National Gold Group Corporation |

EMS |

CHINA |

| Gold |

CID000264 |

Chugai

Mining |

A+M,

EMS |

JAPAN |

| Gold |

CID000272 |

Cloud

Hunan |

EMS |

CHINA |

| Gold |

CID000288 |

Colt

Refining |

EMS |

USA |

| Gold |

CID000328 |

Daejin

Indus Co. Ltd |

EMS |

KOREA,

ROK |

| Gold |

CID000343 |

Daye

Non-Ferrous Metals Mining Ltd. |

EMS |

CHINA |

| Gold |

CID000359 |

Do

Sung Corporation |

EMS |

KOREA,

ROK |

| Gold |

CID000362 |

Doduco |

EMS |

GERMANY |

| Gold |

CID000392 |

Dongguan

Standard Electronic Material Co.,Ltd. |

EMS |

CHINA |

| Gold |

CID000393 |

Dongguanshi

Sutande Dianzi Cailiao Youxiangongsi |

EMS |

CHINA |

| Gold |

CID000401 |

Dowa |

A+M,

EMS |

JAPAN |

| Gold |

CID000425 |

Eco-System

Recycling Co., Ltd. |

A+M,

EMS |

JAPAN |

| Gold |

|

Faggi

Enrico SPA |

EMC |

UNKNOWN |

| Gold |

CID000465 |

Feinhutte

Halsbrucke Gmbh |

EMC |

GERMANY |

| Gold |

CID000493 |

FSE

Novosibirsk Refinery |

EMS |

RUSSIAN

FED |

| Gold |

CID000522 |

Gansu

Seemine Material Hi-Tech Co Ltd |

EMS |

CHINA |

| Gold |

CID000523 |

Gansu-based

Baiyin Nonferrous Metals Corporation (BNMC) |

EMS |

CHINA |

| Gold |

CID002459 |

Geib

Refining Corporation |

EMS |

USA |

| Gold |

CID002312 |

Guangdong

Jinding Gold Limited |

A+M,

EMS |

CHINA |

| Gold |

CID000671 |

Hangzhou

Fuchunjiang Smelting Co., Ltd. |

EMS |

CHINA |

| Gold |

CID000694 |

Heimerle

+ Meule GmbH |

A+M,

EMS |

GERMANY |

| Gold |

CID000707 |

Heraeus

Ltd. Hong Kong |

A+M,

EMS |

HONG

KONG |

| Gold |

CID000711 |

Heraeus

Precious Metals GmbH & Co. KG |

A+M,

EMS |

GERMANY |

| Gold |

CID000767 |

Hunan

Chenzhou Mining Industry Group |

EMS |

CHINA |

| Gold |

CID000778 |

Hwasung

CJ Co. Ltd |

EMS |

KOREA,

ROK |

| Gold |

CID000801 |

Inner

Mongolia Qiankun Gold and Silver Refinery Share |

A+M,

EMS |

CHINA |

| Gold |

CID000807 |

Ishifuku

Metal Industry Co., Ltd. |

A+M,

EMS |

JAPAN |

| Gold |

CID000814 |

Istanbul

Gold Refinery |

EMS |

TURKEY |

| Gold |

CID000823 |

Japan

Mint |

EMS |

JAPAN |

| Gold |

CID000855 |

Jiangxi

Copper Company Limited |

EMS |

CHINA |

| Gold |

CID000920 |

Johnson

Matthey Inc |

A+M,

EMS |

USA |

| Gold |

CID000924 |

Johnson

Matthey Ltd |

A+M,

EMS |

CANADA |

| Gold |

CID000927 |

JSC

Ekaterinburg Non-Ferrous Metal Processing Plant |

EMS |

RUSSIAN

FED |

| Gold |

CID000929 |

JSC

Uralectromed |

EMS |

RUSSIAN

FED |

| Gold |

CID000937 |

JX

Nippon Mining & Metals Co., Ltd. |

A+M,

EMS |

JAPAN |

| Gold |

CID000957 |

KazZinc

Ltd |

EMS |

KAZAKHSTAN |

| Gold |

CID000969 |

Kennecott

Utah Copper LLC |

A+M,

EMS |

USA |

| Gold |

CID000981 |

Kojima

Chemicals Co., Ltd |

A+M,

EMS |

JAPAN |

| Gold |

CID000988 |

Korea

Metal Co. Ltd |

EMS |

KOREA,

ROK |

| Gold |

CID001009 |

Kunshan

Jinli Chemical Industry Reagents Co., Ltd. |

EMS |

CHINA |

| Gold |

CID001029 |

Kyrgyzaltyn

JSC |

EMS |

KYRGYZSTAN |

| Gold |

CID001032 |

L'

azurde Company For Jewelry |

EMS |

SAUDI

ARABIA |

| Gold |

CID001056 |

Lingbao

Gold Company Limited |

EMS |

CHINA |

| Gold |

CID001058 |

Lingbao

Jinyuan Tonghui Refinery Co. Ltd. |

EMS |

CHINA |

| Gold |

CID001078 |

LS-NIKKO

Copper Inc. |

A+M,

EMS |

KOREA,

ROK |

| Gold |

CID001093 |

Luoyang

Zijin Yinhui Metal Smelt Co Ltd |

EMS |

CHINA |

| Gold |

CID001113 |

Materion |

A+M,

EMS |

USA |

| Gold |

CID001119 |

Matsuda

Sangyo Co., Ltd. |

A+M,

EMS |

JAPAN |

| Gold |

CID001149 |

Metalor

Technologies (Hong Kong) Ltd |

A+M,

EMS |

HONG

KONG |

| Gold |

CID001152 |

Metalor

Technologies (Singapore) Pte. Ltd. |

EMS |

SINGAPORE |

| Gold |

CID001147 |

Metalor

Technologies Ltd. (Suzhou) |

EMS |

CHINA |

| Gold |

CID001153 |

Metalor

Technologies SA |

A+M,

EMS |

SWITZERLAND |

| Gold |

CID001157 |

Metalor

USA Refining Corporation |

A+M,

EMS |

USA |

| Gold |

CID001161 |

Met-Mex

Penoles, S.A. de C.V. |

EMS |

MEXICO |

| Gold |

CID001188 |

Mitsubishi

Materials Corporation |

A+M,

EMS |

JAPAN |

| Gold |

CID001193 |

Mitsui

Mining and Smelting Co., Ltd. |

A+M,

EMS |

JAPAN |

| Gold |

CID001204 |

Moscow

Special Alloys Processing Plant |

EMS |

RUSSIAN

FED |

| Gold |

CID001220 |

Nadir

Metal Rafineri San. Ve Tic. A.Ş. |

A+M,

EMS |

TURKEY |

| Gold |

CID001236 |

Navoi

Mining and Metallurgical Combinat |

A+M,

EMS |

UZBEKISTAN |

| Gold |

CID001259 |

Nihon

Material Co. LTD |

A+M,

EMS |

JAPAN |

| Gold |

CID001322 |

Ohio

Precious Metals, LLC |

A+M,

EMS |

USA |

| Gold |

CID001325 |

Ohura

Precious Metal Industry Co., Ltd |

EMS |

JAPAN |

| Gold |

CID001326 |

OJSC

“The Gulidov Krasnoyarsk Non-Ferrous Metals” |

EMS |

RUSSIAN

FED |

| Gold |

CID001328 |

OJSC

Kolyma Refinery |

EMS |

RUSSIAN

FED |

| Gold |

CID001352 |

PAMP

SA - Produits Artistiques de Metaus Precieux SA |

A+M,

EMS |

SWITZERLAND |

| Gold |

CID001362 |

Penglai

Penggang Gold Industry Co Ltd |

EMS |

CHINA |

| Gold |

CID001386 |

Prioksky

Plant of Non-Ferrous Metals |

EMS |

RUSSIAN

FED |

| Gold |

CID001397 |

PT

Aneka Tambang (Persero) Tbk |

EMS |

INDONESIA |

| Gold |

CID001498 |

PX

Précinox SA |

EMS |

SWITZERLAND |

| Gold |

CID001512 |

Rand

Refinery (Pty) Ltd |

A+M,

EMS |

SO

AFRICA |

| Gold |

CID001916 |

Refinery

of Shandong Gold Mining |

A+M,

EMS |

CHINA |

| Gold |

CID001534 |

Royal

Canadian Mint |

A+M,

EMS |

CANADA |

| Gold |

CID001546 |

Sabin

Metal Corp. |

EMS |

USA |

| Gold |

CID001562 |

Samwon

Metals Corp. |

EMS |

KOREA,

ROK |

| Gold |

CID001573 |

Schone

Edelmetaal |

EMS |

NETHERLAND |

| Gold |

CID001585 |

SEMPSA

Joyería Platería SA |

A+M,

EMS |

SPAIN |

| Gold |

CID001619 |

Shandong

Tiancheng Biological Gold Industrial Co., Ltd. |

EMS |

CHINA |

| Gold |

CID001622 |

Shandong

Zhaojin Gold & Silver Refinery Co. Ltd |

A+M,

EMS |

CHINA |

| Gold |

CID001754 |

So

Accurate Group, Inc. |

EMS |

USA |

| Gold |

CID001756 |

SOE

Shyolkovsky Factory of Secondary Precious Metals |

EMS |

RUSSIAN

FED |

| Gold |

CID001761 |

Solar

Applied Materials Technology Corp. |

A+M,

EMS |

TAIWAN |

| Gold |

CID001798 |

Sumitomo

Metal Mining Co., Ltd. |

A+M,

EMS |

JAPAN |

| Gold |

CID001810 |

Super

Dragon Technology Co., Ltd. |

EMS |

CHINA |

| Gold |

CID001843 |

Tai

Zhou Chang San Jiao Electron Co., Ltd. |

EMS |

CHINA |

| Gold |

CID001875 |

Tanaka

Kikinzoku Kogyo K.K. |

A+M,

EMS |

JAPAN |

| Gold |

CID001909 |

The

Great Wall Gold and Silver Refinery of China |

EMS |

CHINA |

| Gold |

CID001938 |

Tokuriki

Honten Co., Ltd |

A+M,

EMS |

JAPAN |

| Gold |

CID001947 |

Tongling

Nonferrous Metals Group Co.,Ltd |

EMS |

CHINA |

| Gold |

CID001955 |

Torecom |

EMS |

KOREA,

ROK |

| Gold |

CID001977 |

Umicore

Brasil Ltda |

EMS |

BRAZIL |

| Gold |

CID002314 |

Umicore

Precious Metals Thailand |

EMS |

THAILAND |

| Gold |

CID001980 |

Umicore

SA Business Unit Precious Metals Refining |

A+M,

EMS |

BELGIUM |

| Gold |

CID001993 |

United

Precious Metal Refining, Inc. |

A+M,

EMS |

USA |

| Gold |

CID002003 |

Valcambi

SA |

A+M,

EMS |

SWITZERLAND |

| Gold |

CID002030 |

Western

Australian Mint trading as The Perth Mint |

A+M,

EMS |

AUSTRALIA |

| Gold |

CID002100 |

Yamamoto

Precious Metal Co., Ltd. |

A+M,

EMS |

JAPAN |

| Gold |

CID002559 |

Yantai

Zhaojin lufu |

EMS |

UNKNOWN |

| Gold |

CID002129 |

Yokohama

Metal Co Ltd |

A+M,

EMS |

JAPAN |

| Gold |

CID000197 |

Yunnan

Copper Industry Co., Ltd. |

EMS |

CHINA |

| Gold |

CID002204 |

Zhaojin

Mining Industry Co., Ltd. |

EMS |

CHINA |

| Gold |

CID002221 |

Zhongshan

Poison Material Monopoly Co. |

EMS |

CHINA |

| Gold |

CID002224 |

Zhongyuan

Gold Smelter of Zhongjin Gold Corporation |

A+M,

EMS |

CHINA |

| Gold |

CID002243 |

Zijin

Mining Group Co. Ltd |

A+M,

EMS |

CHINA |

| Tantalum |

CID000211 |

Changsha

South Tantalum Niobium Co., Ltd. |

EMS |

CHINA |

| Tantalum |

CID000291 |

Conghua

Tantalum and Niobium Smeltry |

EMS |

CHINA |

| Tantalum |

CID000410 |

Duoluoshan |

EMS |

CHINA |

| Tantalum |

CID000456 |

Exotech

Inc. |

EMS |

USA |

| Tantalum |

CID000460 |

F&X

Electro-Materials Ltd. |

EMS |

CHINA |

| Tantalum |

CID002558 |

Global

Advanced Metals Aizu |

EMS |

JAPAN |

| Tantalum |

CID002557 |

Global

Advanced Metals Boyertown |

EMS |

USA |

| Tantalum |

CID000616 |

Guangdong

Zhiyuan New Material Co., Ltd. |

EMS |

CHINA |

| Tantalum |

CID002501 |

Guizhou

Zhenhua Xinyun Technology Ltd, Kaili branch |

EMS |

CHINA |

| Tantalum |

CID002544 |

H.C.

Starck Co., Ltd. |

EMS |

THAILAND |

| Tantalum |

CID002545 |

H.C.

Starck GmbH Goslar |

EMS |

GERMANY |

| Tantalum |

CID002546 |

H.C.

Starck GmbH Laufenburch |

EMS |

GERMANY |

| Tantalum |

CID002547 |

H.C.

Starck Hermsdorf GmbH |

EMS |

GERMANY |

| Tantalum |

CID002548 |

H.C.

Starck Inc. |

EMS |

USA |

| Tantalum |

CID002549 |

H.C.

Starck Ltd. |

EMS |

JAPAN |

| Tantalum |

CID002550 |

H.C.

Starck Smelting GmbH & Co.KG |

EMS |

GERMANY |

| Tantalum |

CID002492 |

Hengyang

King Xing Lifeng New Materials Co., Ltd. |

EMS |

CHINA |

| Tantalum |

CID000731 |

High

Temp Specialty Metals |

EMS |

USA |

| Tantalum |

CID000914 |

JiuJiang

JinXin Nonferrous Metals Co., Ltd. |

EMS |

CHINA |

| Tantalum |

CID000917 |

Jiujiang

Tanbre Co., Ltd. |

EMS |

CHINA |

| Tantalum |

CID002539 |

KEMET

Blue Metals |

EMS |

MEXICO |

| Tantalum |

CID002568 |

KEMET

Blue Powder |

EMS |

USA |

| Tantalum |

CID000973 |

King-Tan

Tantalum Industry Ltd |

EMS |

CHINA |

| Tantalum |

CID001076 |

LSM

Brasil S.A. |

EMS |

BRAZIL |

| Tantalum |

CID001163 |

Metallurgical

Products India (Pvt.) Ltd. |

EMS |

INDIA |

| Tantalum |

CID001175 |

Mineração

Taboca S.A. |

EMS |

BRAZIL |

| Tantalum |

CID001192 |

Mitsui

Mining & Smelting |

EMS |

JAPAN |

| Tantalum |

CID001200 |

Molycorp

Silmet A.S. |

EMS |

ESTONIA |

| Tantalum |

CID001277 |

Ningxia

Orient Tantalum Industry Co., Ltd. |

EMS |

CHINA |

| Tantalum |

CID002540 |

Plansee

SE Liezen |

EMS |

AUSTRIA |

| Tantalum |

CID002556 |

Plansee

SE Reutte |

EMS |

AUSTRIA |

| Tantalum |

CID001508 |

QuantumClean |

EMS |

USA |

| Tantalum |

CID001522 |

RFH

Tantalum Smeltry Co., Ltd |

EMS |

CHINA |

| Tantalum |

CID001634 |

Shanghai

Jiangxi Metals Co. Ltd |

EMS |

CHINA |

| Tantalum |

CID001769 |

Solikamsk

Magnesium Works OAO - Metal Works |

EMS |

RUSSIAN

FED |

| Tantalum |

CID001869 |

Taki

Chemicals |

EMS |

JAPAN |

| Tantalum |

CID001879 |

Tantalite

Resources |

EMS |

SO

AFRICA |

| Tantalum |

CID001891 |

Telex |

EMS |

USA |

| Tantalum |

CID001969 |

Ulba

Metallurgical Plant |

A+M,

EMS |

KAZAKHSTAN |

| Tantalum |

CID002307 |

Yichun

Jin Yang Rare Metal Co., Ltd |

EMS |

CHINA |

| Tantalum |

CID002232 |

Zhuzhou

Cement Carbide |

EMS |

CHINA |

| Tantalum |

CID002307 |

Yichun

Jin Yang Rare Metal Co., Ltd |

EMS |

CHINA |

| Tin |

CID002662 |

5N

Plus |

EMS |

UNKNOWN |

| Tin |

CID000292 |

Alpha

(ATI Tungsten Materials) |

A+M,

EMS |

USA |

| Tin |

CID000151 |

Best

Metals |

EMS |

BRAZIL |

| Tin |

CID002673 |

Cendres

& Metaux SA |

EMS |

SWITZERLAND |

| Tin |

CID000228 |

Chenzhou

Yun Xiang Mining Smelting Co., Ltd. |

EMS |

CHINA |

| Tin |

CID000244 |

China

Rare Metal Materials Company |

EMS |

CHINA |

| Tin |

CID001070 |

China

Tin Group Co., Ltd. |

A+M,

EMS |

CHINA |

| Tin |

CID000278 |

CNMC

(Guangxi) PGMA Co. Ltd. |

A+M,

EMS |

CHINA |

| Tin |

CID000295 |

Cooper

Santa |

A+M,

EMS |

BRAZIL |

| Tin |

CID000306 |

CV

Gita Pesona |

EMS |

INDONESIA |

| Tin |

CID000307 |

CV

JusTindo |

EMS |

INDONESIA |

| Tin |

CID000308 |

CV

Makmur Jaya |

EMS |

INDONESIA |

| Tin |

CID000309 |

CV

Nurjanah |

EMS |

INDONESIA |

| Tin |

CID000313 |

CV

Serumpun Sebalai |

A+M,

EMS |

INDONESIA |

| Tin |

CID000315 |

CV

United Smelting |

A+M,

EMS |

INDONESIA |

| Tin |

CID000402 |

Dowa |

EMS |

JAPAN |

| Tin |

CID002270 |

Dr.

Soldering Tin Products Co., Ltd |

EMS |

CHINA |

| Tin |

CID000438 |

Empresa

Metalurgica Vinto (Government (100%) |

A+M,

EMS |

BOLIVIA |

| Tin |

CID000448 |

Estanho

de Rondônia S.A. |

EMS |

BRAZIL |

| Tin |

CID000466 |

Feinhutte

Halsbrucke GmbH |

EMS |

GERMANY |

| Tin |

CID000468 |

Fenix

Metals |

A+M,

EMS |

POLAND |

| Tin |

CID000545 |

Gejiu

Gold Smelter Minerals Co., Ltd. |

EMS |

CHINA |

| Tin |

CID000538 |

Gejiu

Non-Ferrous Metal Processing Co. Ltd. |

A+M,

EMS |

CHINA |

| Tin |

CID000555 |

Gejiu

Zi-Li |

A+M,

EMS |

CHINA |

| Tin |

CID000712 |

Heraeus

Precious Metals GmbH & Co. KG |

EMS |

GERMANY |

| Tin |

CID000760 |

Huichang

Jinshunda Tin Co. Ltd |

A+M,

EMS |

CHINA |

| Tin |

CID000864 |

Jiangxi

Nanshan |

A+M,

EMS |

CHINA |

| Tin |

CID000942 |

Kai

Unita Trade Limited Liability Company |

A+M,

EMS |

CHINA |

| Tin |

CID000986 |

Koki

Japan |

EMS |

THAILAND |

| Tin |

CID000992 |

Kovohute

Pribram Nastupickna a.s. |

EMS |

CZECH

REPUBLIC |

| Tin |

CID002467 |

Kurt

J Lesker Company |

EMS |

UNKNOWN |

| Tin |

CID001063 |

Linwu

Xianggui Smelter Co |

A+M,

EMS |

CHINA |

| Tin |

CID001082 |

Lubeck

GmbH |

EMS |

GERMANY |

| Tin |

CID002468 |

Magnu's

Minerais Metais e Ligas LTDA |

A+M,

EMS |

BRAZIL |

| Tin |

CID001105 |

Malaysia

Smelting Corporation (MSC) |

A+M,

EMS |

MALAYSIA |

| Tin |

CID001112 |

Materials

Eco-Refining Co., Ltd. |

EMS |

JAPAN |

| Tin |

CID002500 |

Melt

Metais e Ligas S/A |

EMS |

BRAZIL |

| Tin |

CID001136 |

Metahub

Industries Sdn. Bhd. |

EMS |

MALAYSIA |

| Tin |

CID001142 |

Metallic

Resources Inc. |

EMS |

USA |

| Tin |

CID001143 |

Metallo

Chimique |

A+M,

EMS |

BELGIUM |

| Tin |

CID001173 |

Mineração

Taboca S.A. |

A+M,

EMS |

BRAZIL |

| Tin |

CID001177 |

Ming

Li Jia Smelt Metal Factory |

EMS |

CHINA |

| Tin |

CID001182 |

Minsur |

A+M,

EMS |

PERU |

| Tin |

CID001191 |

Mitsubishi

Materials Corporation |

A+M,

EMS |

JAPAN |

| Tin |

CID002573 |

Nghe

Tin Non-Ferrous Metal |

EMS |

VIETNAM |

| Tin |

CID001305 |

Novosibirsk

Integrated Tin Works |

A+M,

EMS |

RUSSIAN

FED |

| Tin |

CID001314 |

O.M.

Manufacturing (Thailand) Co., Ltd. |

A+M,

EMS |

THAILAND |

| Tin |

CID002517 |

O.M.

Manufacturing Philippines, Inc. |

EMS |

PHILIPPINES |

| Tin |

CID001337 |

Operaciones

Metalurgica SA (OMSA) |

A+M,

EMS |

BOLIVIA |

| Tin |

CID001393 |

PT

Alam Lestari Kencana |

EMS |

INDONESIA |

| Tin |

CID001399 |

PT

Artha Cipta Langgeng |

A+M,

EMS |

INDONESIA |

| Tin |

CID002503 |

PT

ATD Makmur Mandiri Jaya |

EMS |

INDONESIA |

| Tin |

CID001402 |

PT

Babel Inti Perkasa |

A+M,

EMS |

INDONESIA |

| Tin |

CID001406 |

PT

Babel Surya Alam Lestari |

EMS |

INDONESIA |

| Tin |

CID001409 |

PT

Bangka Kudai Tin |

EMS |

INDONESIA |

| Tin |

CID001412 |

PT

Bangka Putra Karya |

A+M,

EMS |

INDONESIA |

| Tin |

CID001416 |

PT

Bangka Timah Utama Sejahtera |

EMS |

INDONESIA |

| Tin |

CID001419 |

PT

Bangka Tin Industry |

A+M,

EMS |

INDONESIA |

| Tin |

CID001421 |

PT

Belitung Industri Sejahtera |

A+M,

EMS |

INDONESIA |

| Tin |

CID001424 |

PT

BilliTin Makmur Lestari |

EMS |

INDONESIA |

| Tin |

CID001428 |

PT

Bukit Timah Tbk |

A+M,

EMS |

INDONESIA |

| Tin |

CID001434 |

PT

DS Jaya Abadi |

A+M,

EMS |

INDONESIA |

| Tin |

CID001438 |

PT

Eunindo Usaha Mandiri |

A+M,

EMS |

INDONESIA |

| Tin |

CID001442 |

PT

Fang Di MulTindo |

EMS |

INDONESIA |

| Tin |

CID002287 |

PT

Hanjaya Perkasa Metals |

EMS |

INDONESIA |

| Tin |

CID001445 |

PT

HP Metals Indonesia |

EMS |

INDONESIA |

| Tin |

CID002530 |

PT

Inti Stania Prima |

EMS |

INDONESIA |

| Tin |

CID001448 |

PT

Karimun Mining |

A+M,

EMS |

INDONESIA |

| Tin |

CID001449 |

PT

Koba Tin |

EMS |

INDONESIA |

| Tin |

CID001453 |

PT

Mitra Stania Prima |

A+M,

EMS |

INDONESIA |

| Tin |

CID001457 |

PT

Panca Mega Persada |

EMS |

INDONESIA |

| Tin |

CID001458 |

PT

Prima Timah Utama |

A+M,

EMS |

INDONESIA |

| Tin |

CID001460 |

PT

Refined Bangka Tin |

A+M,

EMS |

INDONESIA |

| Tin |

CID001463 |

PT

Sariwiguna Binasentosa |

A+M,

EMS |

INDONESIA |

| Tin |

CID001466 |

PT

Seirama Tin investment |

EMS |

INDONESIA |

| Tin |

CID001468 |

PT

Stanindo Inti Perkasa |

A+M,

EMS |

INDONESIA |

| Tin |

CID001471 |

PT

Sumber Jaya Indah |

EMS |

INDONESIA |

| Tin |

CID001476 |

PT

Supra Sukses Trinusa |

EMS |

INDONESIA |

| Tin |

CID001477 |

PT

Tambang Timah |

A+M,

EMS |

INDONESIA |

| Tin |

CID001482 |

PT

Timah (Persero), Tbk |

A+M,

EMS |

INDONESIA |

| Tin |

CID001486 |

PT

Timah Nusantara Tbk (Pelat) |

EMS |

INDONESIA |

| Tin |

CID001490 |

PT

Tinindo Inter Nusa |

A+M,

EMS |

INDONESIA |

| Tin |

CID001493 |

PT

Tommy Utama |

EMS |

INDONESIA |

| Tin |

CID001494 |

PT

Yinchendo Mining Industry |

EMS |

INDONESIA |

| Tin |

CID001539 |

Rui

Da Hung |

A+M,

EMS |

TAIWAN |

| Tin |

CID001606 |

Shan

Tou Shi Yong Yuan Jin Shu Zai Sheng Co., Ltd. |

EMS |

CHINA |

| Tin |

CID001758 |

Soft

Metais, Ltd. |

A+M,

EMS |

BRAZIL |

| Tin |

CID001845 |

Taicang

City Nancang Metal Material Co., Ltd. |

EMS |

CHINA |

| Tin |

CID001898 |

Thaisarco |

A+M,

EMS |

THAILAND |

| Tin |

CID001946 |

Tongding

Metal Material Co., Ltd |

EMS |

CHINA |

| Tin |

CID001986 |

Uniforce

Metal Industrial Corp. |

EMS |

TIAWAN |

| Tin |

CID002486 |

Vertex

Metals Incorporated |

EMS |

TAIWAN |

| Tin |

CID002035 |

Westfalenzinn |

EMS |

GERMANY |

| Tin |

CID002036 |

White

Solder Metalurgia e Mineração Ltda. |

A+M,

EMS |

BRAZIL |

| Tin |

CID002054 |

Wu

Xi Shi Yi Zheng Ji Xie She Bei |

EMS |

CHINA |

| Tin |

CID002430 |

Xin

Tongding |

EMS |

UNKNOWN |

| Tin |

CID002559 |

Yantai

ZhaoJin Kasfort Precious Incorporated Company |

EMS |

CHINA |

| Tin |

CID002121 |

Yifeng

Tin Industry (Chenzhou) Co., Ltd. |

EMS |

CHINA |

| Tin |

CID002158 |

Yunnan

Chengfeng Non-ferrous Metals Co.,Ltd. |

A+M,

EMS |

CHINA |

| Tin |

CID002180 |

Yunnan

Tin Company, Ltd. |

A+M,

EMS |

CHINA |

| Tin |

|

Zhuzhou

Smelter Group Co., Ltd |

EMS |

CHINA |

| Tin |

CID002229 |

Zhuhai

Horyison Solder Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID000004 |

A.L.M.T.

Corp. |

EMS |

JAPAN |

| Tungsten |

CID002344 |

Chengdu

Hongbo Industrial Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID002513 |

Chenzhou

Diamond Tungsten Products Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID000258 |

Chongyi

Zhangyuan Tungsten Co Ltd |

EMS |

CHINA |

| Tungsten |

CID000345 |

Dayu

Weiliang Tungsten Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID000499 |

Fujian

Jinxin Tungsten Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID000875 |

Ganzhou

Huaxing Tungsten Products Co. Ltd. |

EMS |

CHINA |

| Tungsten |

CID002315 |

Ganzhou

Jiangwu Ferrotungsten Co. Ltd. |

EMS |

CHINA |

| Tungsten |

CID000868 |

Ganzhou

Non-ferrous Metals Smelting Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID002494 |

Ganzhou

Seadragon W & Mo Co., Ltd |

EMS |

CHINA |

| Tungsten |

CID000568 |

Global

Tungsten & Powders Corp. |

A+M,

EMS |

USA |

| Tungsten |

CID000218 |

Guangdong

XiangLu Tungsten Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID002541 |

H.C.

Starck GmbH |

EMS |

GERMANY |

| Tungsten |

CID002542 |

H.C.

Starck Smelting GmbH & Co. KG |

EMS |

GERMANY |

| Tungsten |

CID000766 |

Hunan

Chenzhou Mining Group Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID000769 |

Hunan

Chunchang Nonferrous Metals Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID000825 |

Japan

New Metals Co., Ltd. |

EMS |

JAPAN |

| Tungsten |

CID002551 |

Jiangwu

H.C. Starck Tungsten Products Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID002321 |

Jiangxi

Gan Bei Tungsten Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID002313 |

Jiangxi

Minmetals Gao'an Non-ferrous Metals Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID002493 |

Jiangxi

Richsea New Material Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID002318 |

Jiangxi

Tonggu Non-ferrous Metallurgical & Chem Co., |

EMS |

CHINA |

| Tungsten |

CID002317 |

Jiangxi

Xinsheng Tungsten Industry Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID000966 |

Kennametal

Fallon |

EMS |

USA |

| Tungsten |

CID000105 |

Kennametal

Inc. (previously ATI Alldyne) Huntsville |

EMS |

USA |

| Tungsten |

CID002319 |

Malipo

Haiyu Tungsten Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID001277 |

Ningxia

Orient Tantalum Industry Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID002543 |

Nui

Phao H.C. Starck Tungsten Chemicals Manufacturing LLC |

EMS |

VIETNAM |

| Tungsten |

CID002532 |

Pobedit |

EMS |

RUSSIAN

FED |

| Tungsten |

CID001889 |

Tejing

(Vietnam) Tungsten Co., Ltd. |

EMS |

VIETNAM |

| Tungsten |

CID002011 |

Vietnam

Youngsun Tungsten Industry Co., Ltd |

EMS |

VIETNAM |

| Tungsten |

CID002044 |

Wolfram

Bergbau und Hütten AG (Sandvik AB, 100%) |

EMS |

AUSTRIA |

| Tungsten |

CID002047 |

Wolfram

Company CJSC |

EMS |

RUSSIAN

FED |

| Tungsten |

CID002320 |

Xiamen

Tungsten (H.C.) Co., Ltd. |

EMS |

CHINA |

| Tungsten |

CID002082 |

Xiamen

Tungsten Co., Ltd. (CXTC) |

A+M,

EMS |

CHINA |

| Tungsten |

CID002095 |

Xinhai

Rendan Shaoguan Tungsten Co., Ltd. |

EMS |

CHINA |

Annex

E – Countries of Origin of Conflict Minerals

It

is likely that we used conflict minerals from many of the following sources as well as some that are not identified.

| Angola |

Argentina |

Australia |

Austria |

| Belgium |

Bolivia |

Brazil |

Burundi |

| Canada |

Central African

Republic |

Chile |

China |

| Columbia |

Cote

d ’Ivor |

Czech

Republic |

Democratic

Republic of the Congo |

| Djibouti |

Egypt |

Estonia |

Ethiopia |

| France |

Germany |

Guyana |

Hungary |

| India |

Indonesia |

Ireland |

Israel |

| Japan |

Kazakhstan |

Kenya |

Laos |

| Luxembourg |

Madagascar |

Malaysia |

Mongolia |

| Mozambique |

Myanmar |

Namibia |

Netherlands |

| Nigeria |

Peru |

Portugal |

Republic

of the Congo |

| Russia |

Rwanda |

Sierra

Leone |

Singapore |

| Slovakia |

South

Africa |

South

Korea |

South

Sudan |

| Spain |

Suriname |

Switzerland |

Taiwan |

| Tanzania |

Thailand |

Uganda |

United

Kingdom |

| United

States |

Vietnam |

Zambia |

Zimbabwe |

| Recycle/Scrap |

|

|

|

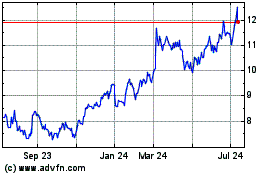

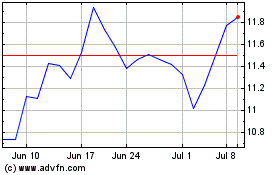

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024