Air Products Reports Higher Profit On Lower Costs

October 29 2015 - 7:33AM

Dow Jones News

By Ezequiel Minaya

Air Products & Chemicals Inc. reported better-than-expected

earnings on Thursday, despite a decline in sales, as the industrial

gas company completed a restructuring of operations that eliminated

about 2,000 jobs during the year but increased profitability.

Operating margin for the fourth quarter of the company's 2015

fiscal year reached 19.3%, up from 5.4% during the same period last

year. Earnings also got a boost from the sale of land that helped

propel profit up to $344.5 million from $102.5 million a year

earlier.

For the current quarter, the first of the 2016 fiscal year, Air

Products expects per-share earnings between $1.65 and $1.75, up 6%

to 13% from the previous year. For the year, the company plans on

earnings per share of $7.25 to $7.50, up 10% to 14% from the prior

year.

In the fourth quarter, the company's per-share earnings rose to

$1.58 from 47 cents. On an adjusted basis, per-share earnings

increased to $1.82 up from $1.66.

The company's cost of sales fell to $1.7 billion from $1.93

billion, and its selling and administrative expenses declined to

$200.4 million from $243 million.

Revenue declined 8.5% to $2.45 billion, as the company faced

currency headwinds and global slowdown in industrial markets.

Industrial gas sales decreased across all regions except for Asia,

which climbed 7%. Sales in the company's materials segment fell 13%

to $490 million.

During the quarter, the company said it intends to spin-off its

Materials Technologies business.

Write to Ezequiel Minaya at Ezequiel.Minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 07:18 ET (11:18 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

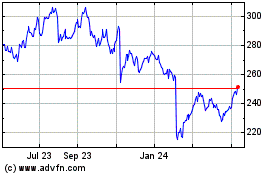

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Mar 2024 to Apr 2024

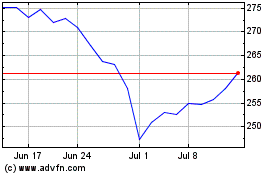

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Apr 2023 to Apr 2024