UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of

1934

Date of Report (Date of earliest event reported) July 30, 2015

Air Products and Chemicals, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

1-4534 |

|

23-1274455 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 7201 Hamilton Boulevard, Allentown, Pennsylvania |

|

18195-1501 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(610) 481-4911

Registrant’s telephone number, including area code

not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2.

below):

| ¨ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On July 30, 2015, the company issued a press release announcing its earnings for the third quarter of fiscal year 2015. A copy of the press release

is attached as Exhibit 99.1 to this Form 8-K. The press release, including all financial statements, is furnished and is not deemed to be filed.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

| 99.1 |

|

Press Release dated July 30, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Air Products and Chemicals, Inc. |

|

|

|

|

(Registrant) |

|

|

|

|

| Dated: July 30, 2015 |

|

|

|

By: |

|

/s/ M. Scott Crocco |

|

|

|

|

|

|

M. Scott Crocco |

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer |

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated July 30, 2015. |

Exhibit 99.1

Air Products and Chemicals, Inc.

7201 Hamilton Boulevard

Allentown, PA 18195-1501

www.airproducts.com

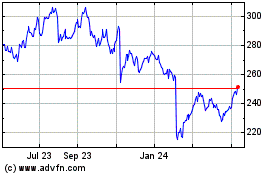

Air Products Reports Fiscal 2015 Third Quarter EPS Up 13 Percent*

| |

• |

|

EPS of $1.65*, up 13 percent* versus prior year on a non-GAAP diluted basis despite significant currency headwinds |

| |

• |

|

Adjusted EBITDA margin of 30.7* percent up 430* basis points versus prior year |

| |

• |

|

Accelerating benefits from restructuring, enabled by the new organization |

| |

• |

|

Awarded major gases supply contract for new semiconductor giga fab in South Korea |

| |

• |

|

EPS of $1.47 versus prior year of $1.46 on a GAAP diluted basis |

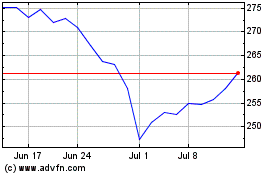

LEHIGH VALLEY, Pa. (July 30, 2015) – Air Products (NYSE: APD) today reported net income of $359 million*, up 14 percent* versus prior year, and diluted earnings per share (EPS) of $1.65*, up

13 percent* versus prior year for its fiscal third quarter ended June 30, 2015.

On a GAAP basis, net income and diluted EPS from

continuing operations were $319 million and $1.47, respectively, for the quarter.

* The results and guidance in this release, unless

otherwise indicated, are based on non-GAAP continuing operations. A reconciliation of GAAP to non-GAAP results can be found at the end of this release.

Third quarter sales of $2,470 million decreased six percent versus prior year, as underlying sales growth of four percent was offset by unfavorable currency and lower energy pass-through. Volumes

increased three percent, primarily in Industrial Gases–Asia, Materials Technologies and the LNG business, and pricing was up one percent.

Operating income of $482 million increased 17 percent versus prior year, and operating margin of 19.5 percent improved 380 basis points, driven by cost

performance, higher pricing and higher volumes. Adjusted EBITDA of $758 million increased nine percent over prior year, and EBITDA margin of 30.7 percent improved 430 basis points, reflecting strong operating leverage.

Commenting on the quarter, Seifi Ghasemi, chairman, president and chief executive officer, said, “The Air Products team delivered another quarter of

great results, with particular strength in our regional Industrial Gases segments, while Materials Technologies continued to improve. We again showed strong improvement in safety, and despite significant currency headwinds and stagnant economic

conditions around the globe, our earnings per share were up by 13 percent, EBITDA margins increased to more than 30 percent, and this quarter’s operating margin is the highest in more than 25 years. This significant improvement is a direct

result of our people executing our five-point strategy. As a result, we have again increased our full year guidance to $6.50-$6.60, which at midpoint is up 13% over last year.”

-more-

Page 2 of 14

Third Quarter Results by Business Segment:

| |

• |

|

Industrial Gases – Americas sales of $898 million decreased 16 percent versus prior year on 13 percent lower energy pass-through and three

percent unfavorable currency. Underlying sales were flat, as higher pricing offset lower volumes. Operating income of $207 million increased nine percent. Operating margin of 23 percent improved 520 basis points over prior year, driven by cost

performance, lower energy pass-through, and higher pricing. Adjusted EBITDA of $328 million increased six percent, and EBITDA margin of 36.5 percent improved 740 basis points over prior year. Sequentially, operating income increased 13 percent on

higher volumes and price and lower costs. |

| |

• |

|

Industrial Gases – Europe, Middle East, and Africa (EMEA) sales of $455 million declined 15 percent versus last year, driven by 16 percent

unfavorable currency. Volumes and pricing were both up one percent. Operating income of $88 million increased two percent as strong cost performance was largely offset by unfavorable currency, while record operating margin of 19.2 percent increased

330 basis points. Adjusted EBITDA of $147 million decreased five percent versus prior year, and record EBITDA margin of 32.2 percent increased 350 basis points. |

| |

• |

|

Industrial Gases – Asia sales of $418 million increased 14 percent versus prior year, primarily on 11 percent volume growth mainly from new

plants. Unfavorable currency impacts reduced sales by three percent. Operating income of $101 million increased 20 percent, and operating margin of 24.2 percent improved 130 basis points over prior year due to higher volumes from the new plants and

strong cost performance overcoming negative pricing. Adjusted EBITDA of $166 million increased 12 percent. Sequentially, operating income increased 19 percent on strong cost performance and higher seasonal volumes. |

| |

• |

|

Materials Technologies sales of $540 million increased three percent over the prior year. Underlying sales were up seven percent on four percent

higher volume growth and three percent positive pricing, partially offset by unfavorable currency of four percent. On a constant currency basis, Electronics Materials sales were up 18 percent on strong volume growth and positive price. On a constant

currency basis, Performance Materials sales declined two percent from the prior year on softer volumes. Record operating income of $132 million increased 36 percent, and record operating margin of 24.4 percent improved 600 basis points versus prior

year, primarily due to higher pricing and volumes. Record adjusted EBITDA of $155 million increased 27 percent, and record EBITDA margin of 28.6 percent improved 540 basis points over prior year. |

Non-GAAP results for the company exclude a pre-tax charge of $59.8 million, or $0.18 per share, for business restructuring and pension settlement.

Outlook

Looking ahead,

Air Products expects fourth quarter EPS from continuing operations to be between $1.75 and $1.85 per share. For the full fiscal year, the Company is raising its guidance from continuing operations to $6.50 to $6.60 per share, which at the midpoint,

represents a 13 percent increase over fiscal 2014.

Subsequent Event

Earlier in July, Air Products acquired 30.5 percent of the outstanding shares of Indura-an industrial gas business in Latin America-increasing its ownership position to 97.8 percent. The valuation was

agreed at the time of initial purchase in 2012 and will be a use of cash of $278 million in the company’s fiscal fourth quarter.

-more-

Page 3 of 14

Access the Q3 earnings teleconference scheduled for 10:00 a.m. Eastern Time on July 30 by calling

888-500-6954 (domestic) or 719-457-2715 (international) and entering passcode 1083893, or access the Event Details page on Air Products’ Investor Relations web site.

About Air Products

Air Products (NYSE:APD) is a leading industrial gases company.

For nearly 75 years, the Company has provided atmospheric, process and specialty gases, and related equipment to manufacturing markets, including metals, food and beverage, refining and petrochemical, and natural gas liquefaction. Air Products’

Materials Technologies segment serves the semiconductor, polyurethanes, cleaning and coatings, and adhesives industries. Over 20,000 employees in 50 countries are working to make Air Products the world’s safest and best performing industrial

gases company, providing sustainable offerings and excellent service to all customers. In fiscal 2014, Air Products had sales of $10.4 billion and was ranked number 276 on the Fortune 500 annual list of public companies. For more information, visit

www.airproducts.com.

NOTE: This release contains “forward-looking statements” within the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995, including statements about earnings guidance and business outlook. These forward-looking statements are based on management’s reasonable expectations and assumptions as of the date of

this release. Actual performance and financial results may differ materially from projections and estimates expressed in the forward-looking statements because of many factors not anticipated by management, including, without limitation, global or

regional economic conditions and supply and demand dynamics in market segments into which the Company sells; significant fluctuations in interest rates and foreign currencies from that currently anticipated; future financial and operating

performance of major customers; unanticipated contract terminations or customer cancellations or postponement of projects and sales; asset impairments due to economic conditions or specific events; the impact of competitive products and pricing;

challenges of implementing new technologies; ability to protect and enforce the Company’s intellectual property rights; unexpected changes in raw material supply and markets; the impact of price fluctuations in natural gas and disruptions in

markets and the economy due to oil price volatility; the ability to recover increased energy and raw material costs from customers; costs and outcomes of litigation or regulatory investigations; the impact of management and organizational changes;

the success of productivity and cost reduction programs; the timing, impact, and other uncertainties of future acquisitions or divestitures; political risks, including the risks of unanticipated government actions; acts of war or terrorism; the

impact of changes in environmental, tax or other legislation and regulatory activities in jurisdictions in which the Company and its affiliates operate; and other risk factors described in the Company’s Form 10-K for its fiscal year ended

September 30, 2014. The Company disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this release to reflect any change in the Company’s assumptions, beliefs or

expectations or any change in events, conditions, or circumstances upon which any such forward-looking statements are based.

#

# #

Media

Inquiries:

Katie McDonald, tel: (610) 481-3673; email: mcdonace@airproducts.com

Investor Inquiries:

Simon Moore, tel: (610) 481-7461; email: mooresr@airproducts.com

-more-

Page 4 of 14

* Presented below are reconciliations of the reported GAAP results to the non-GAAP measures.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Millions of dollars unless otherwise indicated, except for share data)

The discussion of third

quarter and year-to-date results includes comparisons to non-GAAP financial measures, including Adjusted EBITDA and non-GAAP Capital Expenditures. The presentation of non-GAAP measures is intended to enhance

the usefulness of financial information by providing measures which management uses internally to evaluate our operating performance and manage our capital expenditures.

We use non-GAAP measures to assess our operating performance by excluding certain disclosed items that we believe are not representative of our underlying business. We believe non-GAAP financial measures

provide investors with meaningful information to understand our underlying operating results and to analyze financial and business trends. Non-GAAP financial measures, including Adjusted EBITDA, should not be viewed in isolation, are not a

substitute for GAAP measures, and have limitations which include but are not limited to:

| |

• |

|

Our measure excludes certain disclosed items, which we do not consider to be representative of underlying business operations. However, these disclosed

items represent costs (benefits) to the Company. |

| |

• |

|

Though not business operating costs, interest expense and income tax provision represent ongoing costs of the Company. |

| |

• |

|

Depreciation, amortization, and impairment charges represent the wear and tear and/or reduction in value of the plant, equipment, and intangible assets

which permit us to manufacture and/or market our products. |

| |

• |

|

Other companies may define non-GAAP measures differently than we do, limiting their usefulness as comparative measures. |

A reader may find any one or all of these items important in evaluating our performance. Management compensates for the limitations of using non-GAAP

financial measures by using them only to supplement our GAAP results to provide a more complete understanding of the factors and trends affecting our business. In evaluating these financial measures, the reader should be aware that we may incur

expenses similar to those eliminated in this presentation in the future.

CONSOLIDATED RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Continuing Operations |

| |

|

Q3 |

|

YTD |

| 2015 Q3 vs. 2014 Q3 |

|

Operating

Income |

|

Operating

Margin |

|

Net

Income |

|

Diluted

EPS |

|

Operating

Income |

|

Operating

Margin |

|

Net

Income |

|

Diluted

EPS |

| 2015 Q3 GAAP |

|

|

$ |

422.5 |

|

|

|

|

17.1 |

% |

|

|

$ |

318.8 |

|

|

|

$ |

1.47 |

|

|

|

$ |

1,226.9 |

|

|

|

|

16.5 |

% |

|

|

$ |

933.4 |

|

|

|

$ |

4.30 |

|

| 2014 Q3 GAAP |

|

|

|

413.8 |

|

|

|

|

15.7 |

% |

|

|

|

314.0 |

|

|

|

|

1.46 |

|

|

|

|

1,184.1 |

|

|

|

|

15.3 |

% |

|

|

|

884.6 |

|

|

|

|

4.12 |

|

| Change GAAP |

|

|

$ |

8.7 |

|

|

|

|

140 |

bp |

|

|

$ |

4.8 |

|

|

|

$ |

.01 |

|

|

|

$ |

42.8 |

|

|

|

|

120 |

bp |

|

|

$ |

48.8 |

|

|

|

$ |

.18 |

|

| % Change GAAP |

|

|

|

2 |

% |

|

|

|

|

|

|

|

|

2 |

% |

|

|

|

1 |

% |

|

|

|

4 |

% |

|

|

|

|

|

|

|

|

6 |

% |

|

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

| 2015 Q3 GAAP |

|

|

$ |

422.5 |

|

|

|

|

17.1 |

% |

|

|

$ |

318.8 |

|

|

|

$ |

1.47 |

|

|

|

$ |

1,226.9 |

|

|

|

|

16.5 |

% |

|

|

$ |

933.4 |

|

|

|

$ |

4.30 |

|

| Business restructuring and cost reduction actions (tax impact $19.4 and $47.3) |

|

|

|

58.2 |

|

|

|

|

2.4 |

% |

|

|

|

38.8 |

|

|

|

|

.18 |

|

|

|

|

146.0 |

|

|

|

|

2.0 |

% |

|

|

|

98.7 |

|

|

|

|

.45 |

|

| Pension settlement loss (tax impact $.6 and $5.3) |

|

|

|

1.6 |

|

|

|

|

— |

|

|

|

|

1.0 |

|

|

|

|

— |

|

|

|

|

14.2 |

|

|

|

|

.2 |

% |

|

|

|

8.9 |

|

|

|

|

.04 |

|

| Gain on previously held equity interest (tax impact $6.7) |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

(17.9 |

) |

|

|

|

(.3 |

)% |

|

|

|

(11.2 |

) |

|

|

|

(.05 |

) |

| 2015 Q3 Non-GAAP Measure |

|

|

$ |

482.3 |

|

|

|

|

19.5 |

% |

|

|

$ |

358.6 |

|

|

|

$ |

1.65 |

|

|

|

$ |

1,369.2 |

|

|

|

|

18.4 |

% |

|

|

$ |

1,029.8 |

|

|

|

$ |

4.74 |

|

|

|

|

|

|

|

|

|

|

| 2014 Q3 GAAP |

|

|

$ |

413.8 |

|

|

|

|

15.7 |

% |

|

|

$ |

314.0 |

|

|

|

$ |

1.46 |

|

|

|

$ |

1,184.1 |

|

|

|

|

15.3 |

% |

|

|

$ |

884.6 |

|

|

|

$ |

4.12 |

|

| 2014 Q3 Non-GAAP Measure |

|

|

$ |

413.8 |

|

|

|

|

15.7 |

% |

|

|

$ |

314.0 |

|

|

|

$ |

1.46 |

|

|

|

$ |

1,184.1 |

|

|

|

|

15.3 |

% |

|

|

$ |

884.6 |

|

|

|

$ |

4.12 |

|

|

|

|

|

|

|

|

|

|

| Change Non-GAAP Measure |

|

|

$ |

68.5 |

|

|

|

|

380 |

bp |

|

|

$ |

44.6 |

|

|

|

$ |

.19 |

|

|

|

$ |

185.1 |

|

|

|

|

310 |

bp |

|

|

$ |

145.2 |

|

|

|

$ |

.62 |

|

|

% Change Non-GAAP Measure |

|

|

|

17 |

% |

|

|

|

|

|

|

|

|

14 |

% |

|

|

|

13 |

% |

|

|

|

16 |

% |

|

|

|

|

|

|

|

|

16 |

% |

|

|

|

15 |

% |

-more-

Page 5 of 14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

QTD |

| 2015 Q3 vs. 2015 Q2 |

|

Operating

Income |

|

Operating

Margin |

|

Net

Income |

|

Diluted

EPS |

| 2015 Q3 GAAP |

|

|

$ |

422.5 |

|

|

|

|

17.1 |

% |

|

|

$ |

318.8 |

|

|

|

$ |

1.47 |

|

| 2015 Q2 GAAP |

|

|

|

374.4 |

|

|

|

|

15.5 |

% |

|

|

|

290.0 |

|

|

|

|

1.33 |

|

| Change GAAP |

|

|

$ |

48.1 |

|

|

|

|

160 |

bp |

|

|

$ |

28.8 |

|

|

|

$ |

.14 |

|

| % Change GAAP |

|

|

|

13 |

% |

|

|

|

|

|

|

|

|

10 |

% |

|

|

|

11 |

% |

|

|

|

|

|

| 2015 Q3 GAAP |

|

|

$ |

422.5 |

|

|

|

|

17.1 |

% |

|

|

$ |

318.8 |

|

|

|

$ |

1.47 |

|

| Business restructuring and cost reduction actions (tax impact $19.4) |

|

|

|

58.2 |

|

|

|

|

2.4 |

% |

|

|

|

38.8 |

|

|

|

|

.18 |

|

| Pension settlement loss (tax impact $.6) |

|

|

|

1.6 |

|

|

|

|

— |

|

|

|

|

1.0 |

|

|

|

|

— |

|

| 2015 Q3 Non-GAAP Measure |

|

|

$ |

482.3 |

|

|

|

|

19.5 |

% |

|

|

$ |

358.6 |

|

|

|

$ |

1.65 |

|

|

|

|

|

|

| 2015 Q2 GAAP |

|

|

$ |

374.4 |

|

|

|

|

15.5 |

% |

|

|

$ |

290.0 |

|

|

|

$ |

1.33 |

|

| Business restructuring and cost reduction actions (tax impact $17.2) |

|

|

|

55.4 |

|

|

|

|

2.3 |

% |

|

|

|

38.2 |

|

|

|

|

.18 |

|

| Pension settlement loss (tax impact

$4.7) |

|

|

|

12.6 |

|

|

|

|

.5 |

% |

|

|

|

7.9 |

|

|

|

|

.04 |

|

| 2015 Q2 Non-GAAP Measure |

|

|

$ |

442.4 |

|

|

|

|

18.3 |

% |

|

|

$ |

336.1 |

|

|

|

$ |

1.55 |

|

| Change Non-GAAP Measure |

|

|

$ |

39.9 |

|

|

|

|

120 |

bp |

|

|

$ |

22.5 |

|

|

|

$ |

.10 |

|

| % Change Non-GAAP Measure |

|

|

|

9 |

% |

|

|

|

|

|

|

|

|

7 |

% |

|

|

|

6 |

% |

-more-

Page 6 of 14

ADJUSTED EBITDA

We define Adjusted EBITDA as income from continuing operations (including noncontrolling interests) excluding certain disclosed items, which the Company does not believe to be indicative of underlying

business trends, before interest expense, income tax provision, and depreciation and amortization expense. Adjusted EBITDA provides a useful metric for management to assess operating performance.

Below is a reconciliation of Income from Continuing Operations on a GAAP basis to Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Q3 YTD |

| 2015 |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Total |

| Income from Continuing Operations (A) |

|

|

$ |

337.5 |

|

|

|

$ |

296.9 |

|

|

|

$ |

333.2 |

|

|

|

|

|

|

|

|

$ |

967.6 |

|

| Add: Interest expense |

|

|

|

29.1 |

|

|

|

|

23.4 |

|

|

|

|

28.2 |

|

|

|

|

|

|

|

|

|

80.7 |

|

| Add: Income tax provision |

|

|

|

106.5 |

|

|

|

|

87.1 |

|

|

|

|

103.5 |

|

|

|

|

|

|

|

|

|

297.1 |

|

| Add: Depreciation and amortization |

|

|

|

235.5 |

|

|

|

|

233.3 |

|

|

|

|

233.0 |

|

|

|

|

|

|

|

|

|

701.8 |

|

| Add: Business restructuring and cost reduction actions |

|

|

|

32.4 |

|

|

|

|

55.4 |

|

|

|

|

58.2 |

|

|

|

|

|

|

|

|

|

146.0 |

|

| Add: Pension settlement loss |

|

|

|

— |

|

|

|

|

12.6 |

|

|

|

|

1.6 |

|

|

|

|

|

|

|

|

|

14.2 |

|

| Less: Gain on previously held equity interest |

|

|

|

17.9 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

17.9 |

|

| Adjusted EBITDA |

|

|

$ |

723.1 |

|

|

|

$ |

708.7 |

|

|

|

$ |

757.7 |

|

|

|

|

|

|

|

|

$ |

2,189.5 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Q3 YTD |

| 2014 |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Total |

| Income from Continuing Operations (A) |

|

|

$ |

296.0 |

|

|

|

$ |

291.5 |

|

|

|

$ |

323.5 |

|

|

|

$ |

77.5 |

|

|

|

$ |

911.0 |

|

| Add: Interest expense |

|

|

|

33.3 |

|

|

|

|

31.5 |

|

|

|

|

31.3 |

|

|

|

|

29.0 |

|

|

|

|

96.1 |

|

| Add: Income tax provision |

|

|

|

94.5 |

|

|

|

|

92.1 |

|

|

|

|

102.1 |

|

|

|

|

77.3 |

(B) |

|

|

|

288.7 |

|

| Add: Depreciation and amortization |

|

|

|

234.2 |

|

|

|

|

229.1 |

|

|

|

|

239.0 |

|

|

|

|

254.6 |

|

|

|

|

702.3 |

|

| Add: Business restructuring and cost reduction actions |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

12.7 |

|

|

|

|

— |

|

| Add: Pension settlement loss |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

5.5 |

|

|

|

|

— |

|

| Add: Goodwill and intangible asset impairment charge |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

310.1 |

|

|

|

|

— |

|

| Adjusted EBITDA |

|

|

$ |

658.0 |

|

|

|

$ |

644.2 |

|

|

|

$ |

695.9 |

|

|

|

$ |

766.7 |

|

|

|

$ |

1,998.1 |

|

| (A) |

Includes net income attributable to noncontrolling interests. |

| (B) |

Includes an income

tax benefit of $51.6 from the favorable impact of a tax election in a non-U.S. subsidiary partially offset by $20.6 of income tax expense from Chilean tax reform. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2015 vs. 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA change |

|

|

$ |

65.1 |

|

|

|

$ |

64.5 |

|

|

|

$ |

61.8 |

|

|

|

|

|

|

|

$ |

191.4 |

|

| Adjusted EBITDA % change |

|

|

|

10 |

% |

|

|

|

10 |

% |

|

|

|

9 |

% |

|

|

|

|

|

|

|

10 |

% |

|

|

|

|

|

|

|

| 2015 Q3 vs. 2015 Q2 |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA change |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

49.0 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA % change |

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

-more-

Page 7 of 14

Below is a reconciliation of segment Operating Income to Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Industrial

Gases–

Americas |

|

Industrial

Gases–

EMEA |

|

Industrial

Gases–

Asia |

|

Industrial

Gases–

Global |

|

Materials

Technologies |

|

Energy-

from-

Waste |

|

Corporate

and other |

|

Segment

Total |

| Three Months Ended 30 June 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

$ |

206.5 |

|

|

|

$ |

87.6 |

|

|

|

$ |

100.9 |

|

|

|

$ |

(24.1 |

) |

|

|

$ |

131.5 |

|

|

|

$ |

(2.5 |

) |

|

|

$ |

(17.6 |

) |

|

|

$ |

482.3 |

|

| Add: Depreciation and amortization |

|

|

|

103.9 |

|

|

|

|

47.0 |

|

|

|

|

51.9 |

|

|

|

|

4.2 |

|

|

|

|

22.7 |

|

|

|

|

— |

|

|

|

|

3.3 |

|

|

|

|

233.0 |

|

| Add: Equity affiliates’ income |

|

|

|

17.3 |

|

|

|

|

12.1 |

|

|

|

|

12.7 |

|

|

|

|

— |

|

|

|

|

.3 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

42.4 |

|

| Adjusted EBITDA |

|

|

$ |

327.7 |

|

|

|

$ |

146.7 |

|

|

|

$ |

165.5 |

|

|

|

$ |

(19.9 |

) |

|

|

$ |

154.5 |

|

|

|

$ |

(2.5 |

) |

|

|

$ |

(14.3 |

) |

|

|

$ |

757.7 |

|

| Adjusted EBITDA margin |

|

|

|

36.5 |

% |

|

|

|

32.2 |

% |

|

|

|

39.6 |

% |

|

|

|

|

|

|

|

|

28.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

30.7 |

% |

|

|

|

|

|

|

|

|

|

| Three Months Ended 30 June 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

$ |

188.9 |

|

|

|

$ |

85.7 |

|

|

|

$ |

83.8 |

|

|

|

$ |

(14.4 |

) |

|

|

$ |

96.6 |

|

|

|

$ |

(3.2 |

) |

|

|

$ |

(23.6 |

) |

|

|

$ |

413.8 |

|

| Add: Depreciation and amortization |

|

|

|

105.6 |

|

|

|

|

54.9 |

|

|

|

|

50.0 |

|

|

|

|

1.7 |

|

|

|

|

24.5 |

|

|

|

|

— |

|

|

|

|

2.3 |

|

|

|

|

239.0 |

|

| Add: Equity affiliates’ income |

|

|

|

14.7 |

|

|

|

|

13.5 |

|

|

|

|

13.4 |

|

|

|

|

.7 |

|

|

|

|

.8 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

43.1 |

|

| Adjusted EBITDA |

|

|

$ |

309.2 |

|

|

|

$ |

154.1 |

|

|

|

$ |

147.2 |

|

|

|

$ |

(12.0 |

) |

|

|

$ |

121.9 |

|

|

|

$ |

(3.2 |

) |

|

|

$ |

(21.3 |

) |

|

|

$ |

695.9 |

|

| Adjusted EBITDA margin |

|

|

|

29.1 |

% |

|

|

|

28.7 |

% |

|

|

|

40.2 |

% |

|

|

|

|

|

|

|

|

23.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

26.4 |

% |

| Adjusted EBITDA change |

|

|

$ |

18.5 |

|

|

|

$ |

(7.4 |

) |

|

|

$ |

18.3 |

|

|

|

$ |

(7.9 |

) |

|

|

$ |

32.6 |

|

|

|

$ |

.7 |

|

|

|

$ |

7.0 |

|

|

|

$ |

61.8 |

|

| Adjusted EBITDA % change |

|

|

|

6 |

% |

|

|

|

(5 |

)% |

|

|

|

12 |

% |

|

|

|

(66 |

)% |

|

|

|

27 |

% |

|

|

|

22 |

% |

|

|

|

33 |

% |

|

|

|

9 |

% |

| Adjusted EBITDA margin change |

|

|

|

740 |

bp |

|

|

|

350 |

bp |

|

|

|

(60 |

bp) |

|

|

|

|

|

|

|

|

540 |

bp |

|

|

|

|

|

|

|

|

|

|

|

|

|

430 |

bp |

|

|

|

|

|

|

|

|

|

| Nine Months Ended 30 June 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

$ |

599.7 |

|

|

|

$ |

239.9 |

|

|

|

$ |

276.1 |

|

|

|

$ |

(49.9 |

) |

|

|

$ |

360.3 |

|

|

|

$ |

(7.8 |

) |

|

|

$ |

(49.1 |

) |

|

|

$ |

1,369.2 |

|

| Add: Depreciation and amortization |

|

|

|

310.8 |

|

|

|

|

145.7 |

|

|

|

|

151.8 |

|

|

|

|

14.0 |

|

|

|

|

70.0 |

|

|

|

|

— |

|

|

|

|

9.5 |

|

|

|

|

701.8 |

|

| Add: Equity affiliates’ income |

|

|

|

49.6 |

|

|

|

|

30.4 |

|

|

|

|

36.7 |

|

|

|

|

.2 |

|

|

|

|

1.6 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

118.5 |

|

| Adjusted EBITDA |

|

|

$ |

960.1 |

|

|

|

$ |

416.0 |

|

|

|

$ |

464.6 |

|

|

|

$ |

(35.7 |

) |

|

|

$ |

431.9 |

|

|

|

$ |

(7.8 |

) |

|

|

$ |

(39.6 |

) |

|

|

$ |

2,189.5 |

|

| Adjusted EBITDA margin |

|

|

|

34.4 |

% |

|

|

|

29.6 |

% |

|

|

|

38.4 |

% |

|

|

|

|

|

|

|

|

27.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

29.4 |

% |

|

|

|

|

|

|

|

|

|

| Nine Months Ended 30 June 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

$ |

543.0 |

|

|

|

$ |

258.4 |

|

|

|

$ |

237.7 |

|

|

|

$ |

(39.3 |

) |

|

|

$ |

254.7 |

|

|

|

$ |

(9.6 |

) |

|

|

$ |

(60.8 |

) |

|

|

$ |

1,184.1 |

|

| Add: Depreciation and amortization |

|

|

|

309.0 |

|

|

|

|

164.8 |

|

|

|

|

144.5 |

|

|

|

|

5.0 |

|

|

|

|

71.7 |

|

|

|

|

— |

|

|

|

|

7.3 |

|

|

|

|

702.3 |

|

| Add: Equity affiliates’ income |

|

|

|

44.9 |

|

|

|

|

32.5 |

|

|

|

|

30.6 |

|

|

|

|

1.7 |

|

|

|

|

2.0 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

111.7 |

|

| Adjusted EBITDA |

|

|

$ |

896.9 |

|

|

|

$ |

455.7 |

|

|

|

$ |

412.8 |

|

|

|

$ |

(32.6 |

) |

|

|

$ |

328.4 |

|

|

|

$ |

(9.6 |

) |

|

|

$ |

(53.5 |

) |

|

|

$ |

1,998.1 |

|

| Adjusted EBITDA margin |

|

|

|

29.5 |

% |

|

|

|

28.0 |

% |

|

|

|

36.6 |

% |

|

|

|

|

|

|

|

|

21.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

25.7 |

% |

| Adjusted EBITDA change |

|

|

$ |

63.2 |

|

|

|

$ |

(39.7 |

) |

|

|

$ |

51.8 |

|

|

|

$ |

(3.1 |

) |

|

|

$ |

103.5 |

|

|

|

$ |

1.8 |

|

|

|

$ |

13.9 |

|

|

|

$ |

191.4 |

|

| Adjusted EBITDA % change |

|

|

|

7 |

% |

|

|

|

(9 |

)% |

|

|

|

13 |

% |

|

|

|

(10 |

)% |

|

|

|

32 |

% |

|

|

|

19 |

% |

|

|

|

26 |

% |

|

|

|

10 |

% |

| Adjusted EBITDA margin change |

|

|

|

490 |

bp |

|

|

|

160 |

bp |

|

|

|

180 |

bp |

|

|

|

|

|

|

|

|

520 |

bp |

|

|

|

|

|

|

|

|

|

|

|

|

|

370 |

bp |

-more-

Page 8 of 14

CAPITAL EXPENDITURES

We utilize a non-GAAP measure in the computation of capital expenditures and include spending associated with facilities accounted for as capital leases and purchases of noncontrolling interests. Certain

contracts associated with facilities that are built to provide product to a specific customer are required to be accounted for as leases and such spending is reflected as a use of cash within cash provided by operating activities, if the arrangement

qualifies as a capital lease. Additionally, the purchase of noncontrolling interests in a subsidiary is accounted for as an equity transaction and is reflected as a financing activity in the statement of cash flows.

Below is a reconciliation of capital expenditures on a GAAP basis to a non-GAAP measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

30 June |

|

Nine Months Ended

30 June |

| |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

| Capital expenditures – GAAP basis |

|

|

$ |

401.4 |

|

|

|

$ |

460.4 |

|

|

|

$ |

1,253.5 |

|

|

|

$ |

1,262.6 |

|

| Capital lease expenditures |

|

|

|

31.8 |

|

|

|

|

57.7 |

|

|

|

|

79.0 |

|

|

|

|

156.8 |

|

| Purchase of noncontrolling interests in a subsidiary |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

.5 |

|

| Capital expenditures – Non-GAAP basis |

|

|

$ |

433.2 |

|

|

|

$ |

518.1 |

|

|

|

$ |

1,332.5 |

|

|

|

$ |

1,419.9 |

|

|

|

|

|

|

|

| |

|

FY2015

Forecast |

| Capital expenditures – GAAP basis |

|

|

$ |

1,650-1,700 |

|

| Capital lease expenditures |

|

|

|

50-100 |

|

| Purchase of noncontrolling interest |

|

|

|

280 |

|

| Capital expenditures – Non-GAAP basis |

|

|

$ |

1,980-2,080 |

|

OUTLOOK

Guidance provided is on a non-GAAP basis, which excludes the impact of certain items that we believe are not representative of our underlying business.

|

|

|

|

|

|

| |

|

Diluted EPS |

| 2014 Non-GAAP |

|

|

$ |

5.78 |

|

| 2015 Non-GAAP Outlook |

|

|

|

6.50–6.60 |

|

| Change Non-GAAP |

|

|

$ |

.72–.82 |

|

| % Change Non-GAAP |

|

|

|

12%–14 |

% |

-more-

Page 9 of 14

AIR PRODUCTS AND CHEMICALS, INC. and Subsidiaries

CONSOLIDATED INCOME STATEMENTS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

30 June |

|

Nine Months Ended

30 June |

| (Millions of dollars, except for share data) |

|

2015 |

|

2014 |

|

2015 |

|

2014 |

| Sales |

|

|

$ |

2,470.2 |

|

|

|

$ |

2,634.6 |

|

|

|

$ |

7,445.5 |

|

|

|

$ |

7,762.0 |

|

| Cost of sales |

|

|

|

1,716.4 |

|

|

|

|

1,918.7 |

|

|

|

|

5,247.0 |

|

|

|

|

5,702.2 |

|

| Selling and administrative |

|

|

|

242.2 |

|

|

|

|

272.0 |

|

|

|

|

741.3 |

|

|

|

|

816.3 |

|

| Research and development |

|

|

|

33.8 |

|

|

|

|

33.8 |

|

|

|

|

105.5 |

|

|

|

|

100.5 |

|

| Business restructuring and cost reduction actions |

|

|

|

58.2 |

|

|

|

|

— |

|

|

|

|

146.0 |

|

|

|

|

— |

|

| Pension settlement loss |

|

|

|

1.6 |

|

|

|

|

— |

|

|

|

|

14.2 |

|

|

|

|

— |

|

| Gain on previously held equity interest |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

17.9 |

|

|

|

|

— |

|

| Other income (expense), net |

|

|

|

4.5 |

|

|

|

|

3.7 |

|

|

|

|

17.5 |

|

|

|

|

41.1 |

|

| Operating Income |

|

|

|

422.5 |

|

|

|

|

413.8 |

|

|

|

|

1,226.9 |

|

|

|

|

1,184.1 |

|

| Equity affiliates’ income |

|

|

|

42.4 |

|

|

|

|

43.1 |

|

|

|

|

118.5 |

|

|

|

|

111.7 |

|

| Interest expense |

|

|

|

28.2 |

|

|

|

|

31.3 |

|

|

|

|

80.7 |

|

|

|

|

96.1 |

|

| Income from Continuing Operations before Taxes |

|

|

|

436.7 |

|

|

|

|

425.6 |

|

|

|

|

1,264.7 |

|

|

|

|

1,199.7 |

|

| Income tax provision |

|

|

|

103.5 |

|

|

|

|

102.1 |

|

|

|

|

297.1 |

|

|

|

|

288.7 |

|

| Income from Continuing Operations |

|

|

|

333.2 |

|

|

|

|

323.5 |

|

|

|

|

967.6 |

|

|

|

|

911.0 |

|

| Income from Discontinued Operations, net of tax |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

3.1 |

|

| Net Income |

|

|

|

333.2 |

|

|

|

|

323.5 |

|

|

|

|

967.6 |

|

|

|

|

914.1 |

|

| Less: Net Income Attributable to Noncontrolling Interests |

|

|

|

14.4 |

|

|

|

|

9.5 |

|

|

|

|

34.2 |

|

|

|

|

26.4 |

|

| Net Income Attributable to Air Products |

|

|

$ |

318.8 |

|

|

|

$ |

314.0 |

|

|

|

$ |

933.4 |

|

|

|

$ |

887.7 |

|

|

|

| Net Income Attributable to Air Products |

|

|

|

|

|

|

| Income from continuing operations |

|

|

$ |

318.8 |

|

|

|

$ |

314.0 |

|

|

|

$ |

933.4 |

|

|

|

$ |

884.6 |

|

| Income from discontinued operations |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

3.1 |

|

| Net Income Attributable to Air Products |

|

|

$ |

318.8 |

|

|

|

$ |

314.0 |

|

|

|

$ |

933.4 |

|

|

|

$ |

887.7 |

|

|

|

| Basic Earnings Per Common Share Attributable to Air Products |

|

|

|

|

|

|

| Income from continuing operations |

|

|

$ |

1.48 |

|

|

|

$ |

1.47 |

|

|

|

$ |

4.35 |

|

|

|

$ |

4.17 |

|

| Income from discontinued operations |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

.01 |

|

| Net Income Attributable to Air Products |

|

|

$ |

1.48 |

|

|

|

$ |

1.47 |

|

|

|

$ |

4.35 |

|

|

|

$ |

4.18 |

|

|

|

| Diluted Earnings Per Common Share Attributable to Air Products |

|

|

|

|

|

|

| Income from continuing operations |

|

|

$ |

1.47 |

|

|

|

$ |

1.46 |

|

|

|

$ |

4.30 |

|

|

|

$ |

4.12 |

|

| Income from discontinued operations |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

.01 |

|

| Net Income Attributable to Air Products |

|

|

$ |

1.47 |

|

|

|

$ |

1.46 |

|

|

|

$ |

4.30 |

|

|

|

$ |

4.13 |

|

|

|

|

|

|

| Weighted Average Common Shares – Basic (in millions) |

|

|

|

215.2 |

|

|

|

|

212.9 |

|

|

|

|

214.8 |

|

|

|

|

212.4 |

|

| Weighted Average Common Shares – Diluted (in millions) |

|

|

|

217.4 |

|

|

|

|

215.4 |

|

|

|

|

217.2 |

|

|

|

|

214.9 |

|

| Dividends Declared Per Common Share – Cash |

|

|

$ |

.81 |

|

|

|

$ |

.77 |

|

|

|

$ |

2.39 |

|

|

|

$ |

2.25 |

|

|

|

| Other Data from Continuing Operations |

|

|

|

|

|

|

| Depreciation and amortization |

|

|

$ |

233.0 |

|

|

|

$ |

239.0 |

|

|

|

$ |

701.8 |

|

|

|

$ |

702.3 |

|

| Capital expenditures on a Non-GAAP basis |

|

|

|

433.2 |

|

|

|

|

518.1 |

|

|

|

|

1,332.5 |

|

|

|

|

1,419.9 |

|

| (see page 8 for reconciliation) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-more-

Page 10 of 14

AIR PRODUCTS AND CHEMICALS, INC. and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| (Millions of dollars) |

|

30 June

2015 |

|

30 September

2014 |

| Assets |

|

|

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

|

| Cash and cash items |

|

|

$ |

215.3 |

|

|

|

$ |

336.6 |

|

| Trade receivables, net |

|

|

|

1,440.8 |

|

|

|

|

1,486.0 |

|

| Inventories |

|

|

|

681.9 |

|

|

|

|

706.0 |

|

| Contracts in progress, less progress billings |

|

|

|

149.0 |

|

|

|

|

155.4 |

|

| Prepaid expenses |

|

|

|

63.4 |

|

|

|

|

87.8 |

|

| Other receivables and current assets |

|

|

|

551.9 |

|

|

|

|

523.0 |

|

| Total Current Assets |

|

|

|

3,102.3 |

|

|

|

|

3,294.8 |

|

| Investment in net assets of and advances to equity affiliates |

|

|

|

1,244.2 |

|

|

|

|

1,257.9 |

|

| Plant and equipment, at cost |

|

|

|

20,472.4 |

|

|

|

|

20,223.5 |

|

| Less: accumulated depreciation |

|

|

|

10,751.6 |

|

|

|

|

10,691.4 |

|

| Plant and equipment, net |

|

|

|

9,720.8 |

|

|

|

|

9,532.1 |

|

| Goodwill, net |

|

|

|

1,163.8 |

|

|

|

|

1,237.3 |

|

| Intangible assets, net |

|

|

|

541.5 |

|

|

|

|

615.8 |

|

| Noncurrent capital lease receivables |

|

|

|

1,375.1 |

|

|

|

|

1,414.9 |

|

| Other noncurrent assets |

|

|

|

523.8 |

|

|

|

|

426.3 |

|

| Total Noncurrent Assets |

|

|

|

14,569.2 |

|

|

|

|

14,484.3 |

|

| Total Assets |

|

|

$ |

17,671.5 |

|

|

|

$ |

17,779.1 |

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

|

| Payables and accrued liabilities |

|

|

$ |

1,700.6 |

|

|

|

$ |

1,591.0 |

|

| Accrued income taxes |

|

|

|

45.6 |

|

|

|

|

78.0 |

|

| Short-term borrowings |

|

|

|

1,087.8 |

|

|

|

|

1,228.7 |

|

| Current portion of long-term debt |

|

|

|

84.9 |

|

|

|

|

65.3 |

|

| Total Current Liabilities |

|

|

|

2,918.9 |

|

|

|

|

2,963.0 |

|

| Long-term debt |

|

|

|

4,690.5 |

|

|

|

|

4,824.5 |

|

| Other noncurrent liabilities |

|

|

|

1,022.5 |

|

|

|

|

1,187.5 |

|

| Deferred income taxes |

|

|

|

1,030.4 |

|

|

|

|

995.5 |

|

| Total Noncurrent Liabilities |

|

|

|

6,743.4 |

|

|

|

|

7,007.5 |

|

| Total Liabilities |

|

|

|

9,662.3 |

|

|

|

|

9,970.5 |

|

|

|

|

| Redeemable Noncontrolling Interest |

|

|

|

277.9 |

|

|

|

|

287.2 |

|

|

|

|

| Air Products Shareholders’ Equity |

|

|

|

7,586.0 |

|

|

|

|

7,365.8 |

|

| Noncontrolling Interests |

|

|

|

145.3 |

|

|

|

|

155.6 |

|

| Total Equity |

|

|

|

7,731.3 |

|

|

|

|

7,521.4 |

|

| Total Liabilities and Equity |

|

|

$ |

17,671.5 |

|

|

|

$ |

17,779.1 |

|

-more-

Page 11 of 14

AIR PRODUCTS AND CHEMICALS, INC. and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended

30 June |

| (Millions of dollars) |

|

2015 |

|

2014 |

| Operating Activities |

|

| Net Income |

|

|

$ |

967.6 |

|

|

|

$ |

914.1 |

|

| Less: Net income attributable to noncontrolling interests |

|

|

|

34.2 |

|

|

|

|

26.4 |

|

| Net income attributable to Air Products |

|

|

|

933.4 |

|

|

|

|

887.7 |

|

| Income from discontinued operations |

|

|

|

— |

|

|

|

|

(3.1 |

) |

| Income from continuing operations attributable to Air Products |

|

|

|

933.4 |

|

|

|

|

884.6 |

|

| Adjustments to reconcile income to cash provided by operating activities: |

|

| Depreciation and amortization |

|

|

|

701.8 |

|

|

|

|

702.3 |

|

| Deferred income taxes |

|

|

|

18.5 |

|

|

|

|

69.8 |

|

| Gain on previously held equity interest |

|

|

|

(17.9 |

) |

|

|

|

— |

|

| Undistributed earnings of unconsolidated affiliates |

|

|

|

(74.6 |

) |

|

|

|

(36.7 |

) |

| Share-based compensation |

|

|

|

37.3 |

|

|

|

|

32.5 |

|

| Noncurrent capital lease receivables |

|

|

|

(3.9 |

) |

|

|

|

11.8 |

|

| Write-down of long-lived assets associated with restructuring |

|

|

|

27.8 |

|

|

|

|

— |

|

| Other adjustments |

|

|

|

(62.9 |

) |

|

|

|

102.8 |

|

| Working capital changes that provided (used) cash, excluding effects of acquisitions and

divestitures: |

|

| Trade receivables |

|

|

|

(25.6 |

) |

|

|

|

(77.1 |

) |

| Inventories |

|

|

|

2.4 |

|

|

|

|

12.6 |

|

| Contracts in progress, less progress billings |

|

|

|

.9 |

|

|

|

|

(1.1 |

) |

| Other receivables |

|

|

|

(52.3 |

) |

|

|

|

(3.1 |

) |

| Payables and accrued liabilities |

|

|

|

178.9 |

|

|

|

|

(125.6 |

) |

| Other working capital |

|

|

|

(5.9 |

) |

|

|

|

11.2 |

|

| Cash Provided by Operating Activities |

|

|

|

1,657.9 |

|

|

|

|

1,584.0 |

|

| Investing Activities |

|

| Additions to plant and equipment |

|

|

|

(1,214.7 |

) |

|

|

|

(1,264.9 |

) |

| Acquisitions, less cash acquired |

|

|

|

(34.5 |

) |

|

|

|

— |

|

| Investment in and advances to unconsolidated affiliates |

|

|

|

(4.3 |

) |

|

|

|

2.3 |

|

| Proceeds from sale of assets and investments |

|

|

|

15.1 |

|

|

|

|

34.0 |

|

| Other investing activities |

|

|

|

(.6 |

) |

|

|

|

(1.5 |

) |

| Cash Used for Investing Activities |

|

|

|

(1,239.0 |

) |

|

|

|

(1,230.1 |

) |

| Financing Activities |

|

| Long-term debt proceeds |

|

|

|

338.0 |

|

|

|

|

57.3 |

|

| Payments on long-term debt |

|

|

|

(559.2 |

) |

|

|

|

(591.7 |

) |

| Net increase in commercial paper and short-term borrowings |

|

|

|

122.0 |

|

|

|

|

422.7 |

|

| Dividends paid to shareholders |

|

|

|

(503.4 |

) |

|

|

|

(463.7 |

) |

| Proceeds from stock option exercises |

|

|

|

92.5 |

|

|

|

|

106.5 |

|

| Excess tax benefit from share-based compensation |

|

|

|

26.7 |

|

|

|

|

22.5 |

|

| Other financing activities |

|

|

|

(45.3 |

) |

|

|

|

(36.3 |

) |

| Cash Used for Financing Activities |

|

|

|

(528.7 |

) |

|

|

|

(482.7 |

) |

| Discontinued Operations |

|

| Cash provided by operating activities |

|

|

|

— |

|

|

|

|

.7 |

|

| Cash provided by investing activities |

|

|

|

— |

|

|

|

|

9.8 |

|

| Cash used for financing activities |

|

|

|

— |

|

|

|

|

— |

|

| Cash Provided by Discontinued Operations |

|

|

|

— |

|

|

|

|

10.5 |

|

| Effect of Exchange Rate Changes on Cash |

|

|

|

(11.5 |

) |

|

|

|

5.5 |

|

| Decrease in Cash and Cash Items |

|

|

|

(121.3 |

) |

|

|

|

(112.8 |

) |

| Cash and Cash Items – Beginning of Year |

|

|

|

336.6 |

|

|

|

|

450.4 |

|

| Cash and Cash Items – End of Period |

|

|

$ |

215.3 |

|

|

|

$ |

337.6 |

|

|

Supplemental Cash Flow Information |

|

| Cash paid for taxes (net of cash refunds) |

|

|

$ |

261.9 |

|

|

|

$ |

118.3 |

|

-more-

Page 12 of 14

AIR PRODUCTS AND CHEMICALS, INC. and Subsidiaries

SUMMARY BY BUSINESS SEGMENTS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Millions of dollars) |

|

Industrial

Gases–

Americas |

|

Industrial

Gases–

EMEA |

|

Industrial

Gases–

Asia |

|

Industrial

Gases–

Global |

|

Materials

Technologies |

|

Energy-

from-

Waste |

|

Corporate

and other |

|

Segment

Total |

| Three Months Ended 30 June 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

|

$ |

898.2 |

|

|

|

$ |

455.2 |

|

|

|

$ |

417.6 |

|

|

|

$ |

71.3 |

|

|

|

$ |

539.8 |

|

|

|

$ |

— |

|

|

|

$ |

88.1 |

|

|

|

$ |

2,470.2 |

|

| Operating income (loss) |

|

|

|

206.5 |

|

|

|

|

87.6 |

|

|

|

|

100.9 |

|

|

|

|

(24.1 |

) |

|

|

|

131.5 |

|

|

|

|

(2.5 |

) |

|

|

|

(17.6 |

) |

|

|

|

482.3 |

|

| Depreciation and amortization |

|

|

|

103.9 |

|

|

|

|

47.0 |

|

|

|

|

51.9 |

|

|

|

|

4.2 |

|

|

|

|

22.7 |

|

|

|

|

— |

|

|

|

|

3.3 |

|

|

|

|

233.0 |

|

| Equity affiliates’ income |

|

|

|

17.3 |

|

|

|

|

12.1 |

|

|

|

|

12.7 |

|

|

|

|

— |

|

|

|

|

.3 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

42.4 |

|

|

|

|

|

|

|

|

|

|

| Three Months Ended 30 June 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

|

$ |

1,064.0 |

|

|

|

$ |

537.4 |

|

|

|

$ |

366.2 |

|

|

|

$ |

70.8 |

|

|

|

$ |

524.7 |

|

|

|

$ |

— |

|

|

|

$ |

71.5 |

|

|

|

$ |

2,634.6 |

|

| Operating income (loss) |

|

|

|

188.9 |

|

|

|

|

85.7 |

|

|

|

|

83.8 |

|

|

|

|

(14.4 |

) |

|

|

|

96.6 |

|

|

|

|

(3.2 |

) |

|

|

|

(23.6 |

) |

|

|

|

413.8 |

|

| Depreciation and amortization |

|

|

|

105.6 |

|

|

|

|

54.9 |

|

|

|

|

50.0 |

|

|

|

|

1.7 |

|

|

|

|

24.5 |

|

|

|

|

— |

|

|

|

|

2.3 |

|

|

|

|

239.0 |

|

| Equity affiliates’ income |

|

|

|

14.7 |

|

|

|

|

13.5 |

|

|

|

|

13.4 |

|

|

|

|

.7 |

|

|

|

|

.8 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

43.1 |

|

|

|

|

|

|

|

|

|

|

| Nine Months Ended 30 June 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

|