The second sentence in the dividend section of the release dated

March 2, 2016, should read: The dividend will be paid on April 29,

2016 to shareholders of record on April 15, 2016. (instead of The

dividend will be paid on April 30, 2016 to shareholders of record

on April 15, 2016.)

The corrected release reads:

AMPCO-PITTSBURGH

ANNOUNCES 2015 EARNINGS

Ampco-Pittsburgh Corporation (NYSE: AP) announces sales for the

three and twelve months ended December 31, 2015 of $55,326,000 and

$238,480,000, respectively, against $74,587,000 and $272,858,000

for the comparable prior year periods.

Income from operations for the three months ended December 31,

2015 equaled $7,708,000 and included (1) proceeds received from an

insurance carrier in rehabilitation of approximately $14,000,000

and (2) costs incurred related to potential acquisitions of

approximately $3,000,000. Income from operations for the twelve

months ended December 31, 2015 equaled $5,047,000 and included (1)

proceeds received from insurance carriers in rehabilitation of

approximately $14,333,000, (2) costs incurred related to potential

acquisitions of approximately $3,400,000 and (3) charges associated

with curtailment of a significant portion of the Corporation’s U.S.

Defined Benefit plan of roughly $1,300,000. Income (loss) from

operations for the three and twelve months ended December 31, 2014

equaled $(2,757,000) and $80,000, respectively, and included a

charge of $4,487,000 for the estimated increase in the cost of

asbestos-related litigation net of estimated insurance

recoveries.

Net income for the three months ended December 31, 2015 was

$3,332,000 or $0.32 per common share and included an after-tax

credit of $6,140,000 or $0.59 per common share for the net benefit

of proceeds received from an insurance carrier in rehabilitation

offset by acquisition-related costs. Net income for the twelve

months ended December 31, 2015 was $1,373,000 or $0.13 per common

share and included an after-tax credit of $5,088,000 or $0.49 per

common share for the net benefit of proceeds received from

insurance carriers in rehabilitation offset by acquisition-related

costs and curtailment charges. By comparison, net loss for the

three and twelve months ended December 31, 2014 was $(2,043,000) or

$(0.20) per common share and $(1,187,000) or $(0.11) per common

share, respectively, and included an after-tax charge of $2,916,000

or $0.28 per common share for the estimated increase in the cost of

asbestos-related litigation net of estimated insurance

recoveries.

Sales and operating results for the Forged and Cast Engineered

Products segment for each of the periods were less than the

comparable prior year periods. Sales fell primarily as a result of

a lower volume of traditional roll shipments and were impacted by a

lower weighted-average exchange rate used to translate sales of our

UK operations from the British pound to the U.S. dollar. Operating

results for the three and twelve months ended December 31, 2015

were less than the same periods of the prior year due to the lower

volume of shipments, weaker margins and an under-recovery of fixed

costs resulting from lower production levels. Cost-cutting

measures, while significant, were only able to offset some of the

effects of the depressed global market conditions this segment, and

its customers, are experiencing.

Although sales for the Air and Liquid Processing group for the

three and twelve months ended December 31, 2015 were less than the

same periods of the prior year, operating income, excluding the

asbestos-related activity discussed above, remained comparable

benefitting from a better product mix and cost containment efforts.

From a product-line perspective, net sales of heat exchange coils

declined for each of the periods when compared to the same periods

of the prior year due to a lower volume of shipments to the

fossil-fueled utility and industrial markets. Net sales of air

handling units improved for the quarter against the prior year

quarter as a result of strong bookings over the summer but, for the

year, remained slightly below prior year levels. Net sales of pumps

decreased the last three months of the year due to timing of

customer delivery requirements but, for the year, exceeded

2014.

John Stanik, Ampco-Pittsburgh’s Chief Executive Officer

commented, “During the year, we have made substantial positive

changes throughout our organization and I am pleased with the

progress we have made to date. Unfortunately, the fruits of our

labor have been masked by the depressed business conditions of the

global markets we serve. We believe our financial performance will

improve since many of the costs associated with our 2015 efforts

are behind us and as the Akers acquisition is integrated and our

strategic action plans take hold.”

Investor-related Information

The Corporation will conduct its quarterly conference call to

review fourth quarter earnings on Thursday, March 3, at 10:30 a.m.

Eastern Standard Time. To listen to the call, please visit our

website at www.ampcopgh.com, and click on “Upcoming Webcasts” under

the “Investors” section.

Dividend

The Board of Directors of the Corporation announced a

declaration of a dividend of nine cents ($0.09) per share on the

common stock of the Corporation which compares to $0.18 per share

in the prior quarter. The dividend will be paid on April 29, 2016

to shareholders of record on April 15, 2016. The cash savings

generated from the reduction in the dividend rate will allow the

Corporation to strategically invest into its businesses and explore

other opportunities which may present themselves. The Board of

Directors will continue to review the dividend quarterly to

determine if adjustments (up or down) are appropriate.

Retirement

Mr. Robert A. Paul announced his resignation from the Board of

Directors of the Corporation, including the position of the

Chairman of the Board, effective March 2, 2016. Mr. Paul will

continue to serve as Chairman and Director Emeritus of the

Corporation. Mr. Stanik remarked, “On behalf of the Board, the

employees of Ampco and myself, I want to personally thank Mr. Paul

for his many years of dedicated service and innumerable valuable

contributions to the Corporation. I look forward to continuing to

work closely with him in his new role.”

The Private Securities Litigation Reform Act of 1995 (the “Act”)

provides a safe harbor for forward-looking statements made by or on

our behalf. This news release may contain forward-looking

statements that reflect our current views with respect to future

events and financial performance. All statements in this document

other than statements of historical fact are statements that are,

or could be, deemed forward-looking statements within the meaning

of the Act. In this document, statements regarding future financial

position, sales, costs, earnings, cash flows, other measures of

results of operations, capital expenditures or debt levels and

plans, objectives, outlook, targets, guidance or goals are

forward-looking statements. Words such as “may,” “intend,”

“believe,” “expect,” “anticipate,” “estimate,” “project,”

“forecast” and other terms of similar meaning that indicate future

events and trends are also generally intended to identify

forward-looking statements. Forward-looking statements speak only

as of the date on which such statements are made, are not

guarantees of future performance or expectations, and involve risks

and uncertainties. For Ampco-Pittsburgh, these risks and

uncertainties include, but are not limited to, those described

under Item 1A, Risk Factors, of Ampco-Pittsburgh’s Annual

Report on Form 10-K. In addition, there may be events in the future

that we are not able to predict accurately or control which may

cause actual results to differ materially from expectations

expressed or implied by forward-looking statements. Except as

required by applicable law, we assume no obligation, and disclaim

any obligation, to update forward-looking statements whether as a

result of new information, events or otherwise.

AMPCO-PITTSBURGH

CORPORATION

FINANCIAL SUMMARY

(in 000s)

Three Months Ended Year Ended December 31, December 31,

2015 2014 2015

2014 Sales

$ 55,326

$ 74,587 $

238,480 $ 272,858

Cost of products sold (excl depreciation) 47,195

59,882 196,091 218,597 Selling and administrative 11,863 9,955

39,510 37,380 Depreciation and amortization 2,512 2,811 11,787

11,818 (Credit) charge for asbestos litigation (1) (14,000 ) 4,487

(14,333 ) 4,487 Loss on disposal of assets

48

209 378

496 Total operating expense

47,618 77,344

233,433 272,778

Income (loss) from operations(1) 7,708 (2,757 ) 5,047

80 Other expense – net

(316 )

(584 ) (527

) (972 )

Income (loss) before income taxes 7,392 (3,341 ) 4,520 (892 )

Income tax (expense) benefit (3,785 ) 1,539 (2,633 ) 766 Equity

loss in Chinese joint venture

(275

) (241 )

(514 ) (1,061

) Net income (loss) (2)

$

3,332 $ (2,043

) $ 1,373

$ (1,187 ) Earnings (loss)

per common share: Basic (2)

$ 0.32

$ (0.20 ) $

0.13 $ (0.11

) Diluted (2)

$ 0.32

$ (0.20 ) $

0.13 $ (0.11

) Weighted-average number of common shares

outstanding: Basic

10,440

10,426 10,435

10,405 Diluted

10,440

10,426 10,447

10,405 (1)

For the three months ended December 31, 2015, includes

proceeds received from an insurance carrier in rehabilitation of

$14,000 offset by costs incurred related to potential acquisitions

of approximately $3,000. For the year ended December 31, 2015,

includes proceeds received from insurance carriers in

rehabilitation of $14,333 offset by costs incurred related to

potential acquisitions of approximately $3,400 and charges

associated with curtailment of a significant portion of the

Corporation’s U.S. Defined Benefit plan of roughly $1,300. The 2014

periods include a charge of $4,487 for the estimated increase in

the cost of asbestos-related litigation net of estimated insurance

recoveries. (2) For the three months ended December 31,

2015, includes an after-tax credit of $6,140 or $0.59 per share for

the net benefit of proceeds received from an insurance carrier in

rehabilitation offset by acquisition-related costs. For the year

ended December 31, 2015, includes an after-tax credit of $5,088 or

$0.49 per share for the net benefit of proceeds received from

insurance carriers in rehabilitation offset by acquisition-related

costs and curtailment charges. The 2014 periods include an

after-tax charge of $2,916 or $0.28 per common share for the

estimated increase in the cost of asbestos-related litigation net

of estimated insurance recoveries.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160302006572/en/

Ampco-Pittsburgh CorporationDee Ann JohnsonChief Financial

Officer and Treasurer412-456-4410dajohnson@ampcopgh.com

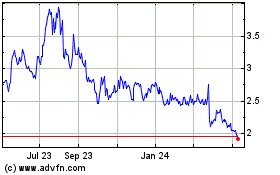

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024