SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15 (d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 2, 2015

Ampco-Pittsburgh Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Pennsylvania |

|

1-898 |

|

25-1117717 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 726 Bell Avenue, Suite 301, Carnegie, PA |

|

15106 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (412) 456-4400

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry into a Material Definitive Agreement. |

As previously announced, on

December 2, 2015, Ampco-Pittsburgh Corporation, a Pennsylvania corporation (“Ampco”), and Ampco UES Sub, Inc., a Delaware corporation and an indirect wholly-owned subsidiary of Ampco (collectively, “Buyers”), entered into a

Share Sale and Purchase Agreement (the “Purchase Agreement”) with Altor Fund II GP Limited, a company duly incorporated and organized under the laws of Jersey (“Altor”), and Åkers Holding AB, a company limited by shares

incorporated in Sweden (“Seller”). Pursuant to the Purchase Agreement, Buyers agreed to acquire from Seller (the “Acquisition”) all of the outstanding stock of Åkers AB, a company limited by shares incorporated in Sweden

(“ÅAB”), Åkers Sweden AB, a company limited by shares incorporated in Sweden, Rolls Technology, Inc., a Delaware corporation, Åkers Valji Ravne d.o.o., a private limited liability company incorporated in Slovenia, and

each of their respective subsidiaries (together, the “Acquired Companies”). The Acquired Companies are engaged in the businesses of manufacturing cast and forged steel rolls.

The Purchase Agreement provides for the payment of aggregate consideration of $80,000,000, subject to certain adjustments (the “Purchase

Price”), including, but not limited to, a net working capital adjustment. The Purchase Price will be used, in part, to repay debt owed by ÅAB and Seller to Svenska Handelsbanken AB (publ) (“SHB”). The Purchase Price will consist

of: (i) $30,000,000 in cash; (ii) a $20,000,000 converting note (the “Converting Note”); and (iii) two subordinated promissory notes in the aggregate initial principal balance of $30,000,000 (the “Notes”) to be

issued at the closing of the Acquisition (the “Closing”).

The Purchase Price is expected to be funded through a combination of

cash on hand and bank debt, including borrowings on new or existing revolving credit facilities. Buyers’ obligations under the Purchase Agreement are not conditioned on the receipt of financing.

The Closing is expected to occur in the first quarter of 2016, subject to the satisfaction of customary closing conditions, including, but not

limited to, obtaining merger control clearance for the Acquisition (although the parties may agree to waive this condition).

Upon the

Closing, (i) both of the Notes will be issued to SHB, and SHB will then immediately endorse and transfer one of the Notes to Altor and (ii) the Converting Note will be issued to SHB, and SHB will then immediately endorse and transfer the

Converting Note to Altor.

Immediately upon the endorsement and transfer of the Converting Note to Altor, the initial principal amount of

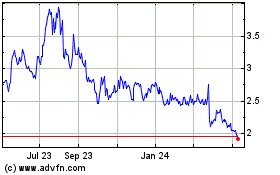

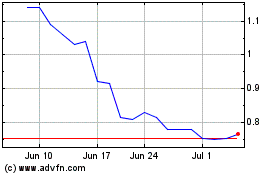

the Converting Note will automatically convert into the number of shares of Ampco’s common stock, par value $1.00 per share (the “Common Stock”), determined by dividing $20,000,000 by the daily volume weighted average price of the

Common Stock on the New York Stock Exchange (“NYSE”) on each of the ten consecutive trading days prior to December 2, 2015 and each of the ten consecutive trading days after December 2, 2015, provided that in no event may the

number of shares exceed the maximum number of shares that may be issued by Ampco without the approval of Ampco’s shareholders under the applicable United States securities laws and the rules of the NYSE (the “Consideration Shares”).

To the extent the value of the Consideration Shares is less than $20,000,000, the difference will be added to the initial principal balance of the Notes.

The Consideration Shares are expected to be subject to a Shareholder Support Agreement, to be entered into by and between Ampco and Altor at

the Closing and pursuant to which, among other things, it is expected that: (i) Altor will have the right to designate one nominee and one observer to Ampco’s board of directors; (ii) the Consideration Shares will be subject to

customary transfer restrictions and limited standstill provisions; and (iii) Altor will have customary registration rights with respect to the Consideration Shares.

The Purchase Agreement contains customary representations and warranties of Buyers and Seller.

Each party has agreed to various covenants and agreements, including, among others, in the case of Seller to conduct its business in the ordinary course of business during the period between the execution of the Purchase Agreement and the completion

of the Acquisition. The Purchase Agreement also provides that Seller will indemnify Buyers for certain liabilities associated with the business of the Acquired Companies and contains other indemnification provisions which are believed to be

customary for a transaction of this type. The parties’ respective indemnification obligations are subject to various limitations, including, among other things, deductibles, caps, and time limitations. Buyers have obtained “representation

and warranty” insurance, which provides coverage for certain breaches of representations and warranties of Seller and Altor contained in the Purchase Agreement, subject to exclusions, deductibles, and other terms and conditions. Buyers would be

required to make certain indemnification claims under the representations and warranties insurance policy prior to making claims against Seller or Altor.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the

Purchase Agreement, which is incorporated herein by reference as Exhibit 2.1. The Purchase Agreement has been included as an exhibit hereto solely to provide investors and security holders with information regarding its terms. It is not intended to

be a source of financial, business, or operational information about the Buyers, Seller, or Altor. The representations, warranties, and covenants contained in the Purchase Agreement are made only for purposes of the Purchase Agreement and are made

as of specific dates; are solely for the benefit of the parties; may be subject to qualifications and limitations agreed upon by the parties in connection with negotiating the terms of the Purchase Agreement, including being qualified by

confidential disclosures made for the purpose of allocating contractual risk between the parties rather than establishing matters as facts; and may be subject to standards of materiality applicable to the contracting parties that differ from those

applicable to investors or security holders. Investors and security holders should not rely on the representations, warranties, and covenants or any description thereof as characterizations of the actual state of facts or condition of the Buyers,

Seller, or Altor. Moreover, information concerning the subject matter of the representations, warranties, and covenants may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in public

disclosures.

| Item 3.02. |

Unregistered Sale of Equity Securities. |

The information contained in Item 1.01 is

hereby incorporated by reference into this Item 3.02.

The proposed issuance of the Converting Note and Consideration Shares, in

accordance with the terms and conditions of the Purchase Agreement described in Item 1.01 above, is expected to occur pursuant to the exemption from registration provided by Section 4(a)(2) of the U.S. Securities Act of 1933, as amended

(“Securities Act”), and the rules and regulations of the Securities and Exchange Commission promulgated thereunder and applicable state blue sky laws. We made this determination based on representations to be made by Altor in the

Shareholder Support Agreement, including that Altor is an “accredited investor” as that term is defined in Rule 501 of Regulation D under the Securities Act.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits. The following material is filed

as an exhibit to this Current Report on Form 8-K:

|

|

|

| Exhibit

Number |

|

|

|

|

| 2.1 |

|

Share Sale and Purchase Agreement, dated December 2, 2015, between Ampco-Pittsburgh Corporation, Ampco UES Sub, Inc., Altor Fund II GP Limited, and Åkers Holding AB.* |

| * |

Schedules and Exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. Ampco-Pittsburgh Corporation agrees to furnish supplementally a copy of any omitted schedules and exhibits to the SEC upon

request; provided, however, that Ampco-Pittsburgh Corporation reserves the right to request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or exhibit so furnished.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| AMPCO-PITTSBURGH CORPORATION |

|

|

| By: |

|

/s/ Marliss D. Johnson |

|

|

Marliss D. Johnson |

|

|

Chief Financial Officer and Treasurer |

Dated: December 8, 2015

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 2.1 |

|

Share Sale and Purchase Agreement, dated December 2, 2015, between Ampco-Pittsburgh Corporation, Ampco UES Sub, Inc., Altor Fund II GP Limited, and Åkers Holding AB.* |

| * |

Schedules and Exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. Ampco-Pittsburgh Corporation agrees to furnish supplementally a copy of any omitted schedules and exhibits to the SEC upon

request; provided, however, that Ampco-Pittsburgh Corporation reserves the right to request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or exhibit so furnished.

|

Exhibit 2.1

|

|

|

|

|

EXECUTION COPY |

SHARE SALE AND PURCHASE AGREEMENT

between

inter alia

Åkers Holding AB

(as

Seller)

and

Ampco-Pittsburgh Corporation

(as

Buyer)

|

|

|

|

|

|

|

| 1. |

|

Background |

|

|

1 |

|

|

|

|

| 2. |

|

Definitions |

|

|

2 |

|

|

|

|

| 3. |

|

Sale and purchase of the Transferred Shares |

|

|

19 |

|

|

|

|

| 4. |

|

Purchase Price |

|

|

19 |

|

|

|

|

| 5. |

|

Conditions to Closing |

|

|

22 |

|

|

|

|

| 6. |

|

Seller’s covenants |

|

|

24 |

|

|

|

|

| 7. |

|

Closing |

|

|

27 |

|

|

|

|

| 8. |

|

Purchase Price adjustment |

|

|

30 |

|

|

|

|

| 9. |

|

Buyers’ covenants |

|

|

32 |

|

|

|

|

| 10. |

|

Warranties of Seller |

|

|

33 |

|

|

|

|

| 11. |

|

Warranties of Buyers |

|

|

49 |

|

|

|

|

| 12. |

|

Altor’s Warranties |

|

|

52 |

|

|

|

|

| 13. |

|

Seller’s indemnification and limitation of liability |

|

|

53 |

|

|

|

|

| 14. |

|

Specific indemnifications |

|

|

59 |

|

|

|

|

| 15. |

|

Conduct of Third Party Claims |

|

|

60 |

|

|

|

|

| 16. |

|

Buyers’ indemnification |

|

|

62 |

|

|

|

|

| 17. |

|

Altor’s indemnification |

|

|

63 |

|

|

|

|

| 18. |

|

Restrictions on Seller |

|

|

64 |

|

|

|

|

| 19. |

|

Tax Matters |

|

|

65 |

|

|

|

|

| 20. |

|

Announcements and confidentiality restrictions |

|

|

69 |

|

|

|

|

| 21. |

|

Miscellaneous |

|

|

69 |

|

|

|

|

| 22. |

|

Disputes and governing law |

|

|

71 |

|

|

|

|

| 23. |

|

Seller’s Representative |

|

|

72 |

|

Schedules

|

|

|

| Schedule 1.3 |

|

R&W Insurance |

| Schedule 1.5 |

|

Restructuring |

| Schedule 2.1(a) |

|

Accounts |

| Schedule 2.1(b) |

|

Acquired Companies |

| Schedule 2.1(c) |

|

Post-closing adjustment |

| Schedule 2.1(d) |

|

Data Room Documents |

| Schedule 2.1(e) |

|

Excluded Warranties |

| Schedule 2.1(f) |

|

NOLs |

| Schedule 2.1(g) |

|

Pro Forma Accounts |

| Schedule 2.1(h) |

|

Transaction Bonuses |

| Schedule 4.2.1(a)(i) |

|

Form for Estimated Net Working Capital |

| Schedule 4.2.1(a)(ii) |

|

Form for Estimated Cash |

| Schedule 5.2(a) |

|

Certain conditions to Closing |

| Schedule 5.2(e) |

|

Amount of Excluded Loss |

|

|

|

| Schedule 6.1(y) |

|

Specified covenants of Seller |

| Schedule 6.5 |

|

Surviving Liabilities |

| Schedule 6.6.2 |

|

Requirement for Carve-Out Audited Financial Statements |

| Schedule 7.3.2(g) |

|

R&W Insurance invoice |

| Schedule 9.3 |

|

Commitments |

| Schedule 9.5 |

|

Engineering study |

| Schedule 10.3.3 |

|

Joint ventures, consortiums and partnerships |

| Schedule 10.3.8 |

|

Insolvency |

| Schedule 10.4.6 |

|

Receivables |

| Schedule 10.4.9(e) |

|

Material Contracts |

| Schedule 10.5.1 |

|

Tax filings |

| Schedule 10.5.2 |

|

Tax deductions and withholdings |

| Schedule 10.5.8 |

|

Transfer pricing documentation |

| Schedule 10.6.1 |

|

Key Employees |

| Schedule 10.6.2 |

|

Incentive schemes |

| Schedule 10.6.4 |

|

Collective bargaining and trade union agreements |

| Schedule 10.6.9 |

|

PRI |

| Schedule 10.7.1 |

|

Real property |

| Schedule 10.7.2 |

|

Encumbrances on real property |

| Schedule 10.7.4 |

|

Leased real property |

| Schedule 10.8.1 |

|

Registered Intellectual Property Rights |

| Schedule 10.8.2 |

|

Used Intellectual Property Rights |

| Schedule 10.9.2 |

|

Encumbrances on other assets |

| Schedule 10.10 |

|

Inventory |

| Schedule 10.11.5 |

|

Change of control |

| Schedule 10.12.7 |

|

Remedial Actions |

| Schedule 10.12.8 |

|

Pollution, contamination and hazardous substances |

| Schedule 10.14.4 |

|

Disputes |

| Schedule 10.14.6 |

|

Product guarantees, warranties and indemnities |

| Schedule 10.15.1 |

|

Contracts with Seller |

| Schedule 10.15.2 |

|

Intra-group indebtedness and guarantees |

| Schedule 10.17.5 |

|

Seller’s Sanctions |

| Schedule 13.2.3 |

|

Buyers’ Knowledge |

| Schedule 14.1.1(b) |

|

Specific indemnities |

| Schedule 14.3.1 |

|

Specific environmental issues |

| Exhibits

|

|

|

| Exhibit A |

|

Notes |

| Exhibit B |

|

Converting Note |

| Exhibit C |

|

Note Sale and Purchase Agreement |

| Exhibit D |

|

Shareholder Support Agreement |

SHARE SALE AND PURCHASE AGREEMENT

This share sale and purchase agreement (the “Agreement”) has been made on December 2, 2015 by and between:

| 1. |

Altor Fund II GP Limited, a company duly incorporated and organized under the laws of Jersey, having its principal office at 11-15 Seaton Place, St Helier, Jersey JE4 0QH Channel Islands, as general partner of Altor

Fund II (No. 1) Limited Partnership, Altor Fund II (No. 2) Limited Partnership, Altor Fund II (No. 3) Limited Partnership and as investment manager to Altor Fund II (No. 4) Limited (“Altor”); |

| 2. |

Åkers Holding AB, a company limited by shares incorporated in Sweden under company registration number 556754-1585 having its principal office at 647 83 Åkers Styckebruk, Sweden (“ÅHAB” or

“Seller”); |

| 3. |

Ampco-Pittsburgh Corporation, a Pennsylvania corporation, having its principal office at 726 Bell Avenue, Suite 301, P.O. Box 457, Carnegie, PA 15106, USA, or any of its Affiliates it may designate (“Ampco” or

the “Buyer”); and |

| 4. |

Ampco UES Sub, Inc., a Delaware corporation, having its principal office at 103 Foulk Road, Suite 202, Wilmington, Delaware 19803, USA (“US Buyer”). |

Buyer and the US Buyer are below jointly referred to as Buyers. Buyers, Altor and Seller are jointly referred to as the “Parties”. Other capitalized

terms in this Agreement shall have the meaning ascribed to them in Clause 2 (Definitions) and all capitalized terms shall be equally applicable to the singular and plural forms of such terms. Unless otherwise stated, the term

“including” means “including without limitation”.

| 1.1 |

Åkers AB is a company limited by shares incorporated in Sweden under company registration number 556153-4792 (“ÅAB”). The Transferred Business comprises manufacturing and sales of cast and forged

steel rolls and related products and services for the steel industry. |

| 1.2 |

Seller owns all 1,400,000 shares in ÅAB equal to the entire issued, paid and registered share capital in ÅAB (the “ÅAB Shares”). Following the Restructuring, Seller will own all 1,000,000

shares (the “ÅSAB Shares”) in Åkers Sweden AB, a company limited by shares incorporated in Sweden under company registration number 556031-8080 (“ÅSAB”), all 3,000 shares (the “RTI Shares”) in Rolls

Technology Inc., a Delaware corporation in the United States (“RTI”) and one share (“Åkers Slovenia Share”) in Åkers Valji Ravne d.o.o. (“Åkers Slovenia”), a private limited liability company

incorporated in Slovenia. |

| 1.3 |

Buyers have arranged for a representation and warranties insurance in the name of Buyers on the terms and conditions set forth in Schedule 1.3 (“R&W Insurance”). |

1

| 1.4 |

Buyers have agreed to purchase, directly or indirectly, the Transferred Shares and procure repayment of the Bank Pay-Off Amount (as adjusted in accordance with Clause 8) as repayment of bank debt on behalf of ÅAB.

Seller, Buyers and SHB have agreed that the Cash Purchase Price (as defined below) shall be paid by Buyer to SHB and that the Converting Note and the Notes (each as defined below) shall be issued by Buyer to SHB, in each case as repayment of bank

debt on behalf of Seller. Pursuant to the terms of the Note Sale and Purchase Agreement (as defined below), SHB will then immediately endorse and transfer the Altor Note and the Converting Note to Altor and the Converting Note will then

automatically convert into the Consideration Shares (as defined below). Altor and SHB have agreed to allocate the Bank Pay-Off Amount (as adjusted in accordance with Clause 8), Cash Purchase Price, Consideration Shares and Notes (as adjusted in

accordance with Clause 8) and the liability under the Seller’s Warranties between themselves in accordance with a separate agreement. |

| 1.5 |

Prior to Closing, Seller will effect a restructuring (the “Restructuring”) designed to divest from the Acquired Companies all those assets and liabilities not included in the Transferred Business (such assets

and liabilities, together with any other assets, liabilities, or businesses of Seller and its other Affiliates, the “Excluded Business”), and to transfer to the Acquired Companies certain assets of Seller and certain of its other

Subsidiaries or Affiliates that are used in or otherwise related to the Transferred Business, all as described in more detail on Schedule 1.5. |

| 1.6 |

Seller desires to sell and Buyers desire to buy, directly or indirectly, the Transferred Shares on the terms and conditions set forth in the Agreement. |

|

|

|

| “Accounting Principles” |

|

means Sweden’s Annual Accounts Act (Sw. årsredovisningslagen), the Swedish Bookkeeping Board’s general advice BFNAR 2012:1 Annual Reports and Group Annual Reports (K3) including the related accounting principles and

the accounting rules, policies, practices, procedures, assessments and methods applied by Seller’s Group in the Accounts and in the underlying accounting of Seller’s Group based on which the Accounts have been prepared. |

|

|

| “Accounts” |

|

means the audited statutory consolidated annual accounts for Seller’s Group for the financial year ending on the Accounts Date, set forth in Schedule

2.1(a). |

2

|

|

|

| “Accounts Date” |

|

means December 31, 2014. |

|

|

| “Acquired Companies” |

|

means each of ÅAB, ÅSAB, RTI, Åkers Slovenia and each of their respective Subsidiaries and Affiliates as of the date US Buyer acquires the ÅAB Shares, the ÅSAB Shares, the Åkers Slovenia Share,

and the RTI Shares as listed in Schedule 2.1(b). |

|

|

| “Acquired Companies Shares” |

|

means the shares in the respective Acquired Company equal to the entire issued, paid and registered share capital in the Acquired Companies. |

|

|

| “Adjustment Date” |

|

means the date on which the process described in Clause 3, Part 1 of Schedule 2.1(c) for the preparation of the Closing Statement is complete. |

|

|

| “Affiliate” |

|

of any Person means any other Person, from time to time, controlling, controlled by or under common control with such first-mentioned Person, whereby “control” for this purpose means the ability, directly or indirectly, to

direct the direction of the management or policies of a Person, whether through ownership or otherwise, and the term “controlling” shall have a meaning correlative to the foregoing. |

|

|

| “Agreement” |

|

has the meaning ascribed to it in the introductory paragraph. |

|

|

| “Aggregate Initial Principal Balance” |

|

has the meaning ascribed to it in Clause 4.2.1(b). |

|

|

| “Altor” |

|

has the meaning ascribed to it in the introductory paragraph. |

|

|

| “Altor Fund II” |

|

means Altor Fund II (No. 1) Limited Partnership, Altor Fund II (No. 2) Limited Partnership, Altor Fund II (No. 3) Limited Partnership and Altor Fund II (No. 4) Limited. |

|

|

| “Altor Note” |

|

means the promissory note in the principal amount notified by Seller or Altor in accordance with Clause 4.2.1(b) issued by Buyer to SHB on Closing on the terms and conditions set forth in Exhibit

A. |

3

|

|

|

| “Altor’s Warranties” |

|

has the meaning ascribed to it in Clause 12. |

|

|

| “Ampco” |

|

has the meaning ascribed to it in the introductory paragraph. |

|

|

| “Ampco Common Stock” |

|

means Ampco’s shares of Common Stock, par value $1.00 per share. |

|

|

| “Ampco SEC Documents” |

|

has the meaning ascribed to it in Clause 11.2.1. |

|

|

| “Anti-Bribery Laws” |

|

means any laws, rules, regulations concerning bribery, corruption or similar activities in any jurisdiction, including, but not limited to, the United States Foreign Corrupt Practices Act of 1977, as amended and the United

Kingdom’s Bribery Act of 2010, applicable from time to time to the Acquired Companies. |

|

|

| “Applicable Ampco Stock Price” |

|

means the arithmetic mean over 20 consecutive Trading Days of the daily volume weighted average price of the Ampco Common Stock on the New York Stock Exchange (the “NYSE”) (as reported by Bloomberg L.P. or, if not reported

therein, in another authoritative source mutually selected by the parties) on each of the ten (10) consecutive Trading Days prior to the date of this Agreement, and each of the ten (10) consecutive Trading Days after the date of this Agreement. For

purposes of this Agreement, “Trading Day” shall mean a day on which shares of Ampco Common Stock are traded on the NYSE. |

|

|

| “Appointment Notice” |

|

has the meaning ascribed to it in Clause 3.2, Part 1 of Schedule 2.1(c). |

|

|

| “Assets” |

|

means the assets and properties of the Acquired Companies to the extent used in the Transferred Business. |

|

|

| “Associated Person” |

|

means in relation to each Acquired Company, any officer, employee, joint venture, agent, or other third party representative who performs services for any of the Acquired Companies

or |

4

|

|

|

|

|

on its own behalf, and in respect of whose actions or inactions any of the Acquired Companies may be liable under Anti-Bribery Laws. |

|

|

| “Associated Buyer Person” |

|

means in relation to each Buyer and each Buyers’ Affiliate, any officer, employee, joint venture, agent, or other third party representative who performs services for any of Buyers or any Buyers’ Affiliate or on its own

behalf, and in respect of whose actions or inactions any of Buyers or any Buyers’ Affiliate may be liable under Anti-Bribery Laws. |

|

|

| “Bank Account” |

|

means such bank account notified by Seller to Buyers no later than five (5) Business Days prior to the Closing Date. |

|

|

| “Bank Pay-Off Amount” |

|

has the meaning ascribed to it in Clause 4.2.3. |

|

|

| “Bid Value” |

|

has the meaning ascribed to it in Clause 4.1.1. |

|

|

| “Bring-Down Certificate” |

|

has the meaning ascribed to it in Clause 6.4. |

|

|

| “Bring-Down of Disclosures” |

|

means a review of Seller’s Warranties with Fredrik Strömholm, Johan Blomquist, Martin Ivert, Anders Ullberg, Claes Ahrengart, Sven Bäckström and Guido Jeifetz immediately prior to the Closing Date to identify any

facts or circumstances (relating to the period between the date of this Agreement and the Closing Date) constituting a breach of any of Seller’s Warranties, as required by the R&W Insurance Company. |

|

|

| “Business Day” |

|

means a day, excluding any Saturday, Sunday and public holiday, when commercial banks are open for general banking business (other than over the Internet or telephone only) in Sweden and in the USA. |

|

|

| “Buyers” |

|

have the meaning ascribed to it in the introductory paragraph. |

|

|

| “Buyers’ Disagreement Notice” |

|

has the meaning ascribed to it in Clause 3.3, Part 1 of Schedule 2.1(c). |

|

|

| “Buyers’ Knowledge” |

|

has the meaning ascribed to it in Clause 13.2.3. |

5

|

|

|

| “Buyers’ Warranties” |

|

has the meaning ascribed to it in Clause 11. |

|

|

| “Carve-Out Audited Financial Statements” |

|

has the meaning ascribed to it in Clause 6.6.1. |

|

|

| “Cash” |

|

means the amount in SEK calculated as set out in Schedule 4.2.1(a)(ii).

The amounts of all “Cash” items with respect to Shanxi Åkers TISCO Roll

Co. Ltd., Taiyan (China JV) shall each be multiplied by 0.60 before being aggregated. For the avoidance of doubt “Cash” shall include all of Acquired Companies’ cash (whether in hand or credited to any account with any banking,

financial, acceptance credit, lending or other similar institution or organization) and their cash equivalents (i.e. having a maturity of ninety (90) days or less), including any and all interest accrued thereon (but excluding for the avoidance of

doubt any cash of the Acquired Companies that is not or cannot be made immediately available in full, e.g., cash on deposit with third parties that cannot be withdrawn from such deposit without restrictions or obligations to substitute therefore

(including any amounts set aside or deposited for the payment of Taxes), other form of collateral or credit support, and similarly “trapped cash” including cash of any Acquired Company that cannot be distributed free of withholding

Taxes). |

|

|

| “Cash Amount” |

|

has the meaning ascribed to it in Clause 4.1.2(a). |

|

|

| “Cash Purchase Price” |

|

has the meaning ascribed to it in Clause 4.2.2. |

|

|

| “Closing” |

|

means the consummation of the sale and purchase of the Transferred Shares, including the transfer of full ownership of the Transferred Shares, and other actions to be taken pursuant to Clause 7. |

|

|

| “Closing Date” |

|

means the last Business Day of the month in which the conditions set forth in Clause 5 are fulfilled (or waived), provided that if such date is not at least three (3) Business Days after fulfilment (or waiver) of all conditions set

forth in |

6

|

|

|

|

|

Clause 5 then the Closing Date shall be the last Business Day of the following month (or such other date as the Parties may agree on in writing), being the date on which Closing shall take place. |

|

|

| “Closing Cash” |

|

means the Cash as shown in the Closing Statement. |

|

|

| “Closing Net Working Capital” |

|

means the Net Working Capital as shown in the Closing Statement. |

|

|

| “Closing Statement” |

|

means the statement set out in Part 2 of Schedule 2.1(c). |

|

|

| “Code” |

|

means the United States Internal Revenue Code of 1986, as amended. |

|

|

| “Commitments” |

|

has the meaning ascribed to it in Clause 9.3. |

|

|

| “Confidential Information” |

|

has the meaning ascribed to it in Clause 18.4. |

|

|

| “Consideration Shares” |

|

has the meaning ascribed to it in Clause 4.1.2(b). |

|

|

| “Contract” |

|

means any agreement, contract, obligation, undertaking, commitment, lease, purchase order, sale order, bid, proposal, letter of intent, comfort letter, service arrangement, understanding or offer which any Acquired Company is a

party to or is bound by, whether written or oral, or explicit or implicit. |

|

|

| “Converting Note” |

|

means the converting note issued by Buyer on Closing which upon endorsement and transfer by SHB to Altor, in accordance with the terms of the Note Sale and Purchase Agreement, automatically will convert, without any action by any

person or entity, into the Consideration Shares on the terms and conditions set forth in Exhibit B. |

|

|

| “Data Room Documents” |

|

means an image of the documents and information made available to Buyers and their advisors in the course of the due diligence (including the Q&A Log) and provided in the virtual data room for Project Newark hosted by Merrill

Corporation as of 9:30 pm (CET) on the Business Day prior to the date of the Agreement, a DVD copy |

7

|

|

|

|

|

of which image is (or will be as soon as reasonably possible following the date of the Agreement) attached hereto as Schedule 2.1(d) made available to Buyers and their advisors in the course of the due diligence. |

|

|

| “Debtors” |

|

mean ÅHAB and ÅAB. |

|

|

| “Draft Closing Statement” |

|

has the meaning ascribed to it in Clause 8.1. |

|

|

| “Encumbrance” |

|

means any claim, mortgage, charge, pledge, lien, option, hypothecation, usufruct, retention of title, condition regarding prior consent (Sw. samtyckesförbehåll), right of first refusal (Sw.

förköpsrätt), pre-emption right (Sw. hembud) or other third party right or security interest of any kind or a Contract to create any of the foregoing. |

|

|

| “Environmental Laws” |

|

means all (according to civil, criminal, common and administrative laws) acts, ordinances, regulations, statutes, guidelines and other laws which relates to people’s and other living creature’s health or safety, the

environment, including air water, and land, work conditions or the generating, use, transportation, storage, release or disposal of hazardous or toxic substances, wastes, or chemicals, and the similar in effect on Closing Date. |

|

|

| “Environmental Permits” |

|

means all permits, licenses, consents, notifications, exemptions, waivers, authorizations, other approvals and the similar relating to Environmental Laws. |

|

|

| “Estimated Cash” |

|

has the meaning ascribed to it in Clause 4.2.1(a)(ii). |

|

|

| “Estimated Net Working Capital” |

|

has the meaning ascribed to it in Clause 4.2.1(a)(i). |

|

|

| “Exchange Rate” |

|

means the exchange rates specified at www.oanda.com. |

|

|

| “Excluded Business” |

|

has the meaning ascribed to it in Clause 1.5. |

|

|

| “Excluded Loss” |

|

means any Loss relating to or arising out of (a) the Restructuring (including for the avoidance of doubt (i) liquidation of Åkers France and any |

8

|

|

|

|

|

compensation payable to any previous or existing employee of Åkers France, (ii) any environmental issues related to Åkers France, and (iii) the conduct of business in any Sanctioned Country), including any Taxes

attributable to or arising from the Restructuring (including all Transfer Taxes and payroll Taxes attributable to or arising from the Restructuring); (b) any Taxes and Losses attributable to or arising from a lender’s waiver or cancellation, in

connection with the Restructuring or the transactions contemplated by this Agreement, of debt existing during some or all of the Pre-Closing Tax Period in relation to an Acquired Company; (c) any business, ownership, or operation of Seller or the

Acquired Companies other than the Transferred Business; (d) companies, businesses, and properties divested, sold, or dissolved prior to Closing; (e) manufacturing facilities closed before Closing; (f) any Unpaid Transaction Expenses (including any

Taxes and Losses attributable to the payment of the Transaction Bonuses) which have not been deducted from the Bank Pay-Off Amount in accordance with Clause 4.2.3(c); (g) any guarantees, indemnities and other obligations given or incurred by the

Acquired Companies in favor of Åkers France; (h) any Tax and Losses attributable to required changes in Accounting Principles or methods of accounting for Tax purposes by reason of the Restructuring; or (i) the excess of the cost for

purchasing insurance from Alecta pensionsförsäkring, ömsesidigt over the liability recorded in the books of the Acquired Companies in relation to pension liabilities guaranteed by Försäkringsbolaget PRI Pensionsgaranti

(“PRI”) as a result of PRI not approving of the guarantee to be issued on Closing by US Buyer or, at PRI’s request, by Ampco or its Affiliates, such guarantee on no less favorable terms and conditions than the current guarantee issued

by Seller, but excluding, in each case, (x) any effects on Buyers or the Acquired Companies relating to or arising out of any loss of synergies, revenues |

9

|

|

|

|

|

or profits from the Excluded Business as a result of the Restructuring or the transactions contemplated by this Agreement, and (y) the payment in the amount of EUR 600,000 in relation to the divestment of the manufacturing

facilities of Åkers Sedan S.A.S.. For the avoidance of doubt, environmental issues not related to Åkers France are excluded from Excluded Loss. |

|

|

| “Excluded Warranties” |

|

means the Seller’s Warranties set forth in Schedule 2.1(e). |

|

|

| “Existing Facilities” |

|

means the facilities made available to the Debtors pursuant to the facilities agreement entered into between, inter alios, the Debtors and SHB, dated 2 July 2008 (as amended and restated on 15 February 2010, 21 December 2011 and 20

December 2012, as supplemented on 20 December 2013, as amended and restated on 1 April 2014, as amended by a side letter dated 23 July 2015, as amended and restated on 18 September 2015 and as further amended and/or amended and restated from time to

time) and any documents ancillary thereto. |

|

|

| “FIRPTA Certificate” |

|

has the meaning ascribed to it in Clause 7.3.1(k). |

|

|

| “Fundamental Warranties” |

|

has the meaning ascribed to it in Clause 13.1.3(a). |

|

|

| “Intellectual Property Rights” |

|

means all inventions, patents, trademarks, trade names, logos, domain names, copyrights, design rights, design trademarks, utility models, database rights, trade secrets, know-how and other intellectual property rights, including,

where any such rights are obtained or enhanced by registration, all registrations of such rights and applications and rights to apply for such registrations, in any jurisdiction. |

|

|

| “Inventory” |

|

has the meaning ascribed to it in Clause 10.10. |

|

|

| “Key Employees” |

|

means the persons set forth in Schedule 10.6.1. |

|

|

| “Long Stop Date” |

|

means February 29, 2016 unless the UK Competition and Markets Authority (“CMA”) initiates a Phase II investigation in which case it shall mean fifteen (15) Business Days after CMA’s decision following the Phase II

investigation. |

10

|

|

|

| “Loss” |

|

means any direct loss, claim, deficit, damage, penalty, fine, cost, Tax, liability, expense or the similar and any reasonably foreseeable indirect loss, claim, deficit, damage, penalty, fine, cost, Tax, liability, expense or the

similar incurred by a Buyer and/or any Acquired Company, excluding for the avoidance of doubt losses relating to liabilities or costs incurred or profits or revenues lost, under the Buyers’ or their Affiliates’ existing contracts or under

contracts that the Buyers or their Affiliates expect to, or will, enter into with any Person. |

|

|

| “Marks” |

|

means Names that include (in whole or in part) the term “Åkers” or the “Åkers” design (logotype) or any derivative thereof or any other Name which is confusingly similar thereto or dilutive

thereof. |

|

|

| “Material Adverse Effect” |

|

means an event or occurrence that has had a material adverse effect on the business, financial condition, trading or results of operation of the Acquired Companies (taken as a whole), provided, however, that in no event shall any

such effect arising out of any of the following events constitute a Material Adverse Effect: (i) effects resulting from changes in the global economy generally; (ii) effects resulting from changes in the economy of any of the Acquired

Companies’ respective jurisdictions; (iii) effects resulting from an Acquired Company’s industry generally; (iv) effects resulting from the transactions contemplated by this Agreement; or (v) effects on Buyers or the Acquired Companies

relating to or arising out of any loss of synergies, revenues or profits from the Excluded Business as a result of the Restructuring or any Excluded Loss. |

|

|

| “Material Contracts” |

|

means all Contracts which are material to an Acquired Company or to the Acquired Companies or to the business of an Acquired Company or to

the Acquired Companies including without limitation of the following: (i) any Contract

having a longer term than one year and which cannot be terminated by the relevant Acquired Company with a maximum of three months’ notice, without cost or compensation and without triggering the right to damages or contractual penalties or the

similar; |

11

|

|

|

|

|

(ii) any Contract for capital expenditures or the acquisition or construction of fixed assets requiring the payment by any Acquired Company

of an amount in excess of USD 250,000; (iii) any Contract relating to the borrowing of

money or to mortgaging, pledging shares on any of the Acquired Companies, or otherwise placing an encumbrance on any of the material Assets; and

(iv) any joint venture or partnership Contract of any Acquired Company or any other Contract providing for the sharing of any profits by any Acquired

Company. |

|

|

| “Names” |

|

means names, trademarks, service marks, business names, company names, corporate names, logos, insignia, slogans, emblems, symbols, designs, URLs or domain names. |

|

|

| “Net Working Capital” |

|

means the amount in SEK equal to Acquired Companies’ aggregate net working capital calculated as set out in Schedule

4.2.1(a)(i). Notwithstanding the foregoing, the amounts of all “Net Working

Capital” items with respect to Shanxi Åkers TISCO Roll Co. Ltd., Taiyuan (China JV) shall each be multiplied by 0.60 before being added or subtracted, respectively, in the calculation of Net Working Capital. When calculating Net Working

Capital any amounts taken into account in the calculation of Cash or the Unpaid Transaction Expenses shall be excluded. In the calculation of Net Working Capital, accounts/trade receivables in ÅAB shall exclude accounts/trade receivables

related to Åkers |

12

|

|

|

|

|

France and accounts/trade payables in ÅAB shall exclude accounts/trade payables related to Åkers France. Accounts/trade receivables and payables in all other entities related to Åkers France shall be

included. |

|

|

| “NOLs” |

|

means the net operating losses remaining in ÅSAB and ÅSR immediately following Closing in the amount of at least SEK 141,545,108 as detailed in Schedule 2.1(f). |

|

|

| “non-Seller’s Group Tax Return” |

|

has the meaning ascribed to it in Clause 19.1. |

|

|

| “Normalized Net Working Capital” |

|

means SEK 220,000,000. |

|

|

| “Note Sale and Purchase Agreement” |

|

means the Note Sale and Purchase Agreement to be entered into between Ampco, Altor and SHB in relation to the issue by Ampco to SHB of the Converting Note set forth in Exhibit C. |

|

|

| “Notes” |

|

means the Altor Note and the SHB Note. |

|

|

| “Notice” |

|

has the meaning ascribed to it in Clause 21.6. |

|

|

| “Inventory” |

|

has the meaning ascribed to it in Clause 10.10. |

|

|

| “Owned Intellectual Property Rights” |

|

has the meaning ascribed to it in Clause 10.8.2. |

|

|

| “Party” and “Parties” |

|

has the meaning ascribed to it in the introductory paragraph. |

|

|

| “Permits” |

|

means all permits, licenses, consents, notifications, exemptions, waivers, authorizations, other approvals and the similar. |

|

|

| “Person” |

|

means any individual, legal entity, partnership, governmental authority, court or any other entity having legal personality. |

|

|

| “Post-Closing Tax Period” |

|

means with respect to any Acquired Company, (a) any Tax period starting after the Closing Date with respect to such Acquired Company, and (b) with respect to a Tax period that commences before but ends after such Closing Date, the

portion of such period beginning on the day after the applicable Closing Date. |

13

|

|

|

| “Pre-Closing Tax Period” |

|

means with respect to any Acquired Company, (a) any Tax period ending on or before the Closing Date with respect to such Acquired Company, and (b) with respect to a Tax period that commences before but ends after such Closing Date,

the portion of such period up to and including the applicable Closing Date. |

|

|

| “Preliminary Purchase Price” |

|

means USD 62,500,000. |

|

|

| “Pro Forma Accounts” |

|

means the unaudited combined statement of profit and loss for the Acquired Companies relating to the period from 1 January 2015 up and until the Pro Forma Accounts Date and the unaudited combined statement of the balance sheet for

the Acquired Companies as of the Pro Forma Accounts Date reflecting the financial position in the Acquired Companies set forth in Schedule 2.1(g). |

|

|

| “Pro Forma Accounts Date |

|

means 30 September 2015. |

|

|

| “Purchase Price” |

|

means the sum of (i) the Cash Amount, (ii) the sum of the Consideration Shares multiplied by the Applicable Ampco Stock Price and (iii) the Aggregate Initial Principal Balance of the Notes as adjusted in accordance with Clause

8. |

|

|

| “Recent SEC Reports” |

|

has the meaning ascribed to it in Clause 11. |

|

|

| “Remedial Action” |

|

means any material investigations, monitoring, prevention, cleaning up, removal, response or similar required pursuant to any Environmental Law in relation to the use of any property prior to Closing. |

|

|

| “Remedies” |

|

has the meaning ascribed to it in Clause 5.5. |

|

|

| “Reporting Accountants” |

|

means the firm of accountants referred to in Clause 3.3, Part 1 of Schedule 2.1(c). |

|

|

| “Restructuring” |

|

has the meaning ascribed to it in Clause 1.5. |

|

|

| “RTI” |

|

has the meaning ascribed to it in Clause 1.2. |

|

|

| “RTI Shares” |

|

has the meaning ascribed to it in Clause 1.2. |

14

|

|

|

| “RTI Tax Return” |

|

has the meaning ascribed to it in Clause 19.1.4. |

|

|

| “R&W Insurance” |

|

has the meaning ascribed to it in Clause 1.3. |

|

|

| “R&W Insurance Company” |

|

means Allied World Assurance Company (Europe) Limited. |

|

|

| “R&W Insurance Premium Amount” |

|

means the insurance premium set out in the R&W Insurance. |

|

|

| “Sanctions” |

|

means economic, financial and/or trade sanctions pursuant to sanction lists issued from time to time by the US, the United Nations, United Kingdom or the European Union. |

|

|

| “Sanctioned Country” |

|

means Cuba and Iran. |

|

|

| “Sanctioned Country Government” |

|

means any government of a Sanctioned Country, even if such government is not identified on a list of Sanctioned Persons. |

|

|

| “Sanctioned Person” |

|

means any Person subject to Sanctions, or any entity owned or controlled directly or indirectly by a Sanctioned Person, and shall include a Sanctioned Country Government. |

|

|

| “SCC Institute” |

|

has the meaning ascribed to it in Clause 22.1. |

|

|

| “SEK” |

|

means the currency Swedish kronor. |

|

|

| “Seller’s Disagreement Notice” |

|

has the meaning ascribed to it in Clause 3.2, Part 1 of Schedule 2.1(c). |

|

|

| “Seller’s Group” |

|

means any consolidated, combined or unitary group of which an Acquired Company, on the one hand, and ÅHAB or any of its Affiliates (excluding the Acquired Companies, Altor and SHB) are members for US federal, state, local or

foreign Tax purposes. |

|

|

| “Seller’s Group Tax Return” |

|

means any tax return of any Seller’s Group, except for any tax return that includes any portion of a Post-Closing Tax Period that contains any Tax item, from a Post-Closing Tax Period, of an Acquired Company. |

|

|

| “Seller’s Knowledge” |

|

or any similar expression in the context of any of Seller’s Warranties means the actual knowledge |

15

|

|

|

|

|

of Fredrik Strömholm, Johan Blomquist, Martin Ivert and Anders Ullberg and such knowledge that each of them would have after due and careful enquiry in relation to the relevant Seller’s Warranty with each Key

Employee. |

|

|

| “Seller’s Representative” |

|

means Altor as authorised pursuant to Clause 23. |

|

|

| “Seller’s Warranties” |

|

has the meaning ascribed to it in Clause 10. |

|

|

| “Shareholder Support Agreement” |

|

means the undertaking made by Altor with respect to the Consideration Shares set forth in Exhibit D. |

|

|

| “SHB” |

|

means Svenska Handelsbanken AB (publ), a company limited by shares incorporated in Sweden under company registration number 502007-7862 having its principal office at Kungsträdgårdsgatan 2, 111 47 Stockholm, Sweden and

its Affiliates. |

|

|

| “SHB Note” |

|

means the secured note in the principal amount notified by Seller or Altor in accordance with Clause 4.2.1(b) issued by Buyer on Closing on the terms and conditions set forth in Exhibit A. |

|

|

| “Standard Terms and Conditions” |

|

has the meaning ascribed to it in Clause 11.14.5. |

|

|

| “Straddle Period” |

|

means, with respect to an Acquired Company, any taxable period that includes (but does not end on) the Closing Date with respect to such Acquired Company. |

|

|

| “Subsidiary” |

|

means, with respect to any Person, any corporation, partnership, association or other business entity of which (a) if a corporation, a majority of the total voting power of shares of stock entitled (without regard to the occurrence

of any contingency) to vote in the election of directors, managers or trustees thereof is at the time owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof, or

(b) if a partnership, association or other business entity, a majority of the partnership or other similar ownership interests thereof is at the time owned |

16

|

|

|

|

|

or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof. For purposes hereof, a Person or Persons shall be deemed to have a majority ownership interest

in a partnership, association or other business entity if such Person or Persons shall be allocated a majority of partnership, association or other business entity gains or losses or shall be or control the managing director, managing member,

general partner or other managing Person of such partnership, association or other business entity. |

|

|

| “Taxes” |

|

means all forms of taxes whether direct or indirect, whether preliminary or final, whether computed on separate or consolidated, or unitary or combined basis or in any manner, and whether levied by reference to income, profits,

gains, net wealth, asset values, turnover, sales, customs, use, registration, added value, pensions, real estate or other reference and statutory, governmental, state, provincial, local or municipal impositions, duties, contributions, rates and

levies (including without limitation social security contributions and any other payroll taxes), whenever and wherever imposed (whether imposed by way of a withholding or deduction for or on account of tax or otherwise) and in respect of any person

and all penalties, charges and interest relating thereto. |

|

|

| “Tax Warranties” |

|

means the Seller’s Warranties set forth in Clause 10.5. |

|

|

| “Third Party Claim” |

|

has the meaning ascribed to it in Clause 15.1. |

|

|

| “Transferred Business” |

|

means the business of the Acquired Companies after giving effect to the Restructuring. |

|

|

| “Transfer Taxes” |

|

has the meaning ascribed to it in Clause 19.2. |

|

|

| “Transaction Bonuses” |

|

means 50% of the amount of bonuses payable by an Acquired Company upon Closing to certain employees as further specified in Schedule 2.1(j) (including any payroll Taxes and any other Tax liabilities incurred by an Acquired

Company in connection therewith). |

17

|

|

|

| “Transferred Shares” |

|

means the ÅAB Shares, the ÅSAB Shares, the Åkers Slovenia Share and RTI Shares jointly. |

|

|

| “Unpaid Transaction Expenses” |

|

means (a) the fees and disbursements payable to legal counsel, financial advisors, accountants, and other agents of Seller or the Acquired Companies which are due or payable (i) in connection with the transactions contemplated by

this Agreement, including the Restructuring, (ii) 50% of the fees and disbursements for the preparation and delivery of each of the Carve-Out Audited Financial Statements up to an aggregate amount of fees of USD 1,250,000 (in which case USD 625,000

will be included in the Unpaid Transaction Expenses) and any amount of such fees and disbursements exceeding said USD 1,250,000 and (iii) the fees and disbursements for the preparation of the FIRPTA Certificate up to an aggregate amount of USD

30,000 and 50% of any amount of such fees and disbursements exceeding said USD 30,000 up to an aggregate amount of fees and disbursements of USD 104,000 and any amount of such fees and disbursements exceeding said USD 104,000, (b) the Transaction

Bonuses, (c) all other miscellaneous expenses or costs, in each case, incurred by an Acquired Company or Seller, which are payable by an Acquired Company in connection with the transactions contemplated by this Agreement but only to the extent they

have not been paid by the Acquired Companies in cash on or prior to the close of business on the day immediately preceding the Closing and (d) any unpaid management fees due to Altor or its Affiliates. |

|

|

| “US Buyer” |

|

has the meaning ascribed to it in the introductory paragraph. |

|

|

| “US GAAP” |

|

means United States generally accepted accounting principles as in effect on the date hereof, applied in a manner consistent with those used in preparing the Accounts but only to the

extent |

18

|

|

|

|

|

that such applications are in compliance with United States generally accepted accounting principles. |

|

|

| “USD” |

|

means the currency United States of America dollars. |

|

|

| “US Treasury Regulations” |

|

means the regulations promulgated under the Code. |

|

|

| “ÅAB” |

|

has the meaning ascribed to it in the introductory paragraph. |

|

|

| “ÅAB Shares” |

|

has the meaning ascribed to it in Clause 1.2. |

|

|

| “ÅHAB” |

|

has the meaning ascribed to it in the introductory paragraph. |

|

|

| “Åkers France” |

|

means Åkers France S.A.S., Åkers Berlaimont S.A.S., AFT S.A.S., Åkers Sedan S.A.S., Åkers Fraisses S.A.S. and Åkers Belgium S.A. |

|

|

| “ÅSAB” |

|

has the meaning ascribed to it in Clause 1.2. |

|

|

| “ÅSAB Shares” |

|

has the meaning ascribed to it in Clause 1.2. |

|

|

| “ÅSR” |

|

means Åkers Specialty Rolls AB. |

| 3. |

Sale and purchase of the Transferred Shares |

| 3.1 |

Upon the terms and subject to the conditions set forth in the Agreement, Seller agrees to sell and US Buyer agrees to purchase the ÅAB Shares, the ÅSAB Shares, the RTI Shares and the Åkers Slovenia

Share together with all rights attached thereto. |

| 3.2 |

The ÅAB Shares, the ÅSAB Shares, the RTI Shares and the Åkers Slovenia Share together with all rights attached thereto shall be transferred to US Buyer on the Closing Date, free and clear of all

Encumbrances. |

| 3.3 |

The sale and purchase by US Buyer of the shares of each of ÅAB, ÅSAB, RTI and Åkers Slovenia set forth in this Clause 3 shall all form one single transaction for the purposes of this Agreement.

|

| 4.1.1 |

The Bid Value for the Transferred Shares on a cash and bank debt-free basis is equal to USD 80,000,000 (the “Bid Value”), under the assumption that the Closing Net Working Capital according to the Closing

Statement will be equal to the Normalized Net Working Capital. |

19

| 4.1.2 |

The Bid Value consists of: |

| |

(a) |

USD 30 million in cash (the “Cash Amount”); |

| |

(b) |

such number of shares of Ampco Common Stock determined by dividing USD 20 million by the Applicable Ampco Stock Price, provided that in no event can the number of shares exceed the maximum number of shares that may

be issued by Ampco without the approval of Ampco’s shareholders under the applicable United States securities law and the rules of the NYSE (“Consideration Shares”). To the extent that the value of the Consideration Shares is less

than USD 20 million, the difference between the value of the Consideration Shares and USD 20 million will be added to the aggregate initial principal balance of the Notes; and |

| |

(c) |

the Notes in the aggregate initial principal balance of USD 30 million. |

| 4.2 |

Payment of the Purchase Price |

| 4.2.1 |

At least three (3) Business Days prior to the Closing Date, Seller or Altor shall deliver to Buyers a statement that sets forth: |

| |

(a) |

its good faith and reasonable best estimates of: |

| |

(i) |

the Net Working Capital as of the Closing Date, as calculated and presented on Schedule 4.2.1(a)(i) attached hereto (the “Estimated Net Working Capital”); and |

| |

(ii) |

the Cash as of the Closing Date, as calculated and presented on Schedule 4.2.1(a)(ii) attached hereto (the “Estimated Cash”); and |

| |

(b) |

the allocation between the Altor Note and the SHB Note of the aggregate initial principal balance in the amount of USD 30 million less an amount equal to the difference between the Estimated Net Working Capital and

the Normalized Net Working Capital on a USD by USD basis if the Estimated Net Working Capital is less than the Normalized Net Working Capital (the “Aggregate Initial Principal Balance”). |

| 4.2.2 |

The cash purchase price to be paid by Buyers to Seller on Closing for the Transferred Shares (the “Cash Purchase Price”) shall be an amount in USD corresponding to the Preliminary Purchase Price

|

| |

(a) |

less the sum of the Consideration Shares multiplied by the Applicable Ampco Stock Price; and |

| |

(b) |

less the Aggregate Initial Principal Balance of the Notes. |

20

| 4.2.3 |

The amount to be repaid by Buyers to SHB on Closing as repayment on behalf of ÅAB of the outstanding principal, interest and other amounts due and owing with respect to the Existing Facilities (the “Bank

Pay-Off Amount”) shall be an amount in USD corresponding to the Cash Amount |

| |

(a) |

plus an amount equal to the difference between the Estimated Net Working Capital and the Normalized Net Working Capital on a USD by USD basis if the Estimated Net Working Capital exceeds the Normalized Net Working

Capital provided that such amount shall not exceed SEK 20,000,000; |

| |

(b) |

plus the Estimated Cash; |

| |

(c) |

less the Unpaid Transaction Expenses; |

| |

(d) |

less the Cash Purchase Price; |

| |

(e) |

less the lower of (i) the R&W Insurance Premium and (ii) USD 300,000; and |

| |

(f) |

plus any other amounts to be paid by Buyers to Seller pursuant to this Agreement. |

| 4.2.4 |

The Bank Pay-Off Amount and the Aggregate Initial Principal Balance are adjusted in accordance with the provisions of Clause 8. |

| 4.2.5 |

Any amounts to be paid by Buyers to Seller after Closing pursuant to this Agreement shall be added to the Bank Pay-Off Amount and be paid to SHB as compensation for cancellation of bank debt. |

| 4.2.6 |

On the Closing Date, the Cash Purchase Price shall be paid by Buyer to SHB and the Converting Note and the Notes shall be issued by Buyer to SHB, in each case as repayment of bank debt on behalf of Seller and for the

benefit of US Buyer, and the Bank Pay-Off Amount shall be paid by Buyer to SHB as repayment of bank debt on behalf of ÅAB and for the benefit of US Buyer. |

| 4.2.7 |

For purposes of determining the Bank Pay-Off Amount pursuant to Clause 4.2.3 amounts in other currencies shall be translated into USD at the Exchange Rates as at four (4) Business Days prior to the Closing Date.

|

Buyers shall procure that for a period of twelve (12) months following

Closing, ÅAB shall pay to SHB as repayment of bank debt, no later than 15 Business Days after the end of the third calendar month after Closing, an amount in cash equal to (i) the sum of all payments received by ÅAB during such

calendar months in respect of trade receivables for rolls produced by Åkers France less (ii) the sum of all payments made by ÅAB to Åkers France during such calendar months in respect of trade payables for rolls produced by

Åkers France and less (iii) any Taxes incurred by ÅAB in respect of such trade receivables, provided that if there are any such trade receivables

21

and/or trade payables still outstanding after such time then such payments shall continue to be made no later than 15 Business Days after the end of each following calendar month. If any such

amount is negative then such amount shall be rolled over and aggregated with the next payment for which such amount is positive. In the event that the aggregate amount when all such trade receivables and trade payables have been paid is still

negative then Seller or such other person designated by the Seller’s Representative shall pay such amount and any Taxes due thereon (as a positive amount) to ÅAB no later than 15 Business Days after the final payment of such trade

receivable or trade payable (as the case may be) has been made. For the avoidance of doubt, after the expiry of the aforementioned 12-month period the Buyers shall not be under the obligation to pay any amount to Seller or to any other recipient on

Seller’s behalf in accordance with this Clause 4.3.

| 5.1 |

Buyers’ obligation to consummate the transactions contemplated by the Agreement is conditional on the Competition and Markets Authority of the United Kingdom having granted or given approval for Closing, and all

applicable waiting periods specified under applicable laws, the expiration of which are necessary for such approvals, having passed. |

| 5.2 |

In addition to Clause 5.1, Buyers’ obligation to consummate the transactions contemplated by the Agreement is conditional on the satisfaction of the following conditions (or their satisfaction subject only to

Closing): |

| |

(a) |

the items set forth in Schedule 5.2(a) having been delivered to Buyers having been delivered to Buyers; |

| |

(b) |

the Restructuring having been unconditionally consummated in accordance with Schedule 1.5; |

| |

(c) |

the Seller shall have delivered the Carve-Out Audited Financial Statements to Buyers in accordance with Clause 6.6.1; |

| |

(d) |

each of Sellers’ Warranties being true and correct at and as of the Closing Date as if given by Seller at and as of the Closing Date in each case except for breaches as to matters that, individually or in the

aggregate, would not reasonably be expected to result in a liability equal to or in excess of USD 12,500,000 or that have been fully remedied as of the Closing Date or that relate to an Excluded Loss; |

| |

(e) |

no Excluded Loss described in subsections (a), (b), or (h) of such definition is reasonably foreseeable or has been incurred as of the Closing Date, except for Excluded Losses that, individually or in the

aggregate, could not reasonably be expected to result in a Loss equal to or in excess of the amount set forth in Schedule 5.2(e) or that have been fully remedied as of the Closing Date; |

22

| |

(f) |

no material breach of the Seller’s obligations in Clause 6 having occurred; and |

| |

(g) |

no Material Adverse Effect having occurred. |

| 5.3 |

Buyers have the right to waive at all times, in whole or in part, any of the conditions set forth in Clause 5.2. |

| 5.4 |

Buyers shall use their reasonable efforts to ensure the satisfaction of the condition set forth in Clause 5.1 as soon as practicably possible after the date of the Agreement and in any event no later than 5 Business

Days after the date of the Agreement. Buyers will prepare the necessary notifications and file such notifications with the relevant competition authorities promptly following the date of this Agreement. Prior to filing, Buyers shall provide Seller

with a reasonable opportunity to provide comments on drafts of any filings or other material documentation prior to their submission to the competition authorities (it being acknowledged that certain such drafts and/or documents may be shared on a

confidential outside counsel to counsel basis only) and to take account of any reasonable comments. Seller shall, and shall procure that the Acquired Companies will, use their reasonable efforts to give all requested information and assistance

reasonably requested by Buyers in order to facilitate Buyers’ preparation of the notifications as well as the satisfaction of the condition set forth in Clause 5.1 above. |

| 5.5 |

If any of the competition authorities is not prepared to give approval or clearance to the transactions contemplated by this Agreement, or any such approval or clearance will only be given upon the fulfilment of

conditions and obligations e.g. the sale, divestiture, license, or disposition of any necessary assets or businesses of Buyer, any of its Affiliates or the Acquired Companies (“Remedies”), Buyers shall accept, and shall cause their

Affiliates to accept Remedies required to obtain approvals or clearances from the competition authorities provided that such Remedies do not result, or is likely to result, in a loss of annual sales exceeding USD 40 million for Buyer, its

Affiliates and/or the Acquired Companies following Closing. |

| 5.6 |

Seller shall take all reasonable actions to ensure the satisfaction of the conditions set forth in Clause 5.2 (a) through (c), as soon as reasonably practicable after the date of the Agreement. Each of the Parties

shall, and Seller shall procure that the Acquired Companies will, give all information and assistance reasonably required in order to facilitate the satisfaction of said conditions. |

| 5.7 |

If the conditions in this Clause 5 have not been fulfilled, or waived by Buyers, on or before the Long Stop Date, Buyers may, in their sole discretion either (i) extend the above longstop date by an additional 20

Business Days, or (ii) immediately terminate the Agreement and the transactions contemplated hereby in which case, subject to Clause 5.8, all obligations of the Parties under the Agreement shall terminate without further liability whatsoever of

any Party against the other and each Party will pay all its own costs and expenses. |

23

| 5.8 |

If the Agreement is terminated by Buyers pursuant to Clause 5.7 as a result of the failure by Seller to fulfil, or to ensure such fulfilment by the Acquired Companies, a condition set forth in this Clause 5 or to

perform a covenant, obligation or undertaking contained in the Agreement, Seller shall be fully liable for all Losses incurred or suffered as a result of that failure or breach. |

| 5.9 |

The provisions of this Clause 5 (Conditions to Closing) and Clauses 20-22 (Announcements and confidentiality restrictions, Miscellaneous and Disputes and governing law) shall survive the termination of the Agreement

pursuant to this Clause 5. |

| 6.1 |

During the period between the date of the Agreement and the Closing Date, Seller shall, unless Buyers have given prior written consent and without prejudice to duties under applicable laws or corporate governance

duties, procure that: |

| |

(a) |

the business of each Acquired Company will be carried on only in the ordinary course and in all material respects consistent with past practices; |

| |

(b) |

no material Assets of an Acquired Company will be disposed of or become the subject of any Encumbrance otherwise than in the ordinary course of business and in all material respects consistent with past practices;

|

| |

(c) |

there will be no change of accounting methods, principles or practices; |

| |

(d) |

none of the Acquired Companies will settle any audit, make or change any Tax election, or file any amended Tax return without written consent from Buyers which consent shall not be unreasonably withheld, conditioned, or

delayed; |

| |

(e) |

none of the Acquired Companies will terminate or make any material changes or additions to any Material Contract; |

| |

(f) |

none of the Acquired companies will materially amend their organizational documents; |

| |

(g) |

none of the Acquired Companies will enter into any agreement, arrangement, transaction or settlement which is not made or undertaken in the ordinary course of business or not wholly on “arm’s length”

terms and conditions (i.e. on such terms as they would have been made if the parties were independent parties); |

| |

(h) |

none of the Acquired Companies will incur any additional borrowings or incur any other indebtedness in excess of USD 250,000 individually or USD 500,000 in the aggregate otherwise than in the ordinary course of business

and in all material respects consistent with past practices; |

| |

(i) |

none of the Acquired Companies will assign, lease, license, mortgage, pledge, or subject to any Encumbrance any of its material Assets; |

24

| |

(j) |

none of the Acquired Companies will enter into any guarantee, indemnity or other arrangement to secure any obligations in excess of USD 100,000 individually or USD 500,000 in the aggregate; |

| |

(k) |

none of the Acquired Companies will forgive, cancel, compromise, waive, or release any debts, claims, or rights in excess of USD 250,000 individually or USD 500,000 in the aggregate; |

| |

(l) |

none of the Acquired Companies will authorize or commit to any capital expenditures, or capital additions or improvements in excess of USD 50,000 individually or USD 100,000 in the aggregate or make any capital

expenditures, or capital additions or improvements in excess of USD 700,000 in the aggregate; |

| |

(m) |

none of the Acquired Companies will adopt a plan of complete or partial liquidation, dissolution, merger, consolidation, restructuring, recapitalization, or other reorganization except for the Restructuring and merger

of ÅSR into ÅSAB; |

| |

(n) |

none of the Acquired Companies will sell, assign, transfer, or otherwise dispose of any portion of its tangible Assets with a value in excess of USD 250,000 in each case or USD 500,000 in the aggregate;

|

| |

(o) |

none of the Acquired Companies will sell, assign, transfer, or otherwise dispose of any Intellectual Property Rights; |

| |

(p) |

none of the Acquired Companies will dismiss any Key Employee; |

| |

(q) |

no dividends or other value transfers (Sw. värdeöverföringar) will be declared, decided, paid or made by any Acquired Company to Seller or its Affiliates or any third party; |

| |

(r) |

none of the Acquired Companies will (i) split, combine, or reclassify its outstanding shares of capital stock or other equity securities, (ii) issue, sell, or transfer any of its capital stock or other equity

securities or securities convertible into its capital stock or other equity securities except for equity issues to Seller for funding purposes, or (iii) issue, sell, grant, or enter into any subscriptions, warrants, options, conversion, or

other rights, agreements, commitments, arrangements, or understandings of any kind, contingent or otherwise, to purchase or otherwise acquire its capital stock or other equity securities, any securities convertible into or exchange for any such

shares, or any bonds or debt securities; |

| |

(s) |

none of the Acquired Companies will make any material capital investment in, or any material loan to, any other Person (other than an Acquired Company); |

| |

(t) |

none of the Acquired Companies will make any material changes or additions to the terms and conditions of employment of any employee (including but

not |

25

| |

limited to adopting any new employee benefit plan, making any changes in its employee benefit plans, or making any changes in wages, salary or other compensation with respect to its officers,

directors or employees, in each case other than changes made in the ordinary course of business or pursuant to existing agreements or as required to comply with applicable law; |

| |

(u) |

none of the Acquired Companies will commence or settle any civil, criminal or administrative litigation or arbitral or other proceedings involving an amount in excess of USD 250,000 for any one case except in relation

to the liquidation of Åkers France; |

| |

(v) |

no management fee or other compensation (including bonuses) will be paid or made payable to Seller or any of their Affiliates or any employee or family associate of any of the foregoing (except for customary salary

payments), nor will any other extraordinary payment be paid or made payable; |

| |

(w) |

all Taxes pertaining to the Acquired Companies will be paid when due; |

| |

(x) |