SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 2, 2015

Ampco-Pittsburgh Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Pennsylvania

(State or other jurisdiction

of incorporation) |

|

1-898

(Commission

File Number) |

|

25-1117717

(IRS Employer

Identification No.) |

|

|

| 726 Bell Avenue, Suite 301, Carnegie, PA |

|

15106 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (412) 456-4400

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. |

Regulation FD Disclosure. |

On December 2, 2015, Ampco-Pittsburgh Corporation

(“Ampco”) announced that it entered into a definitive agreement (the “Purchase Agreement”) with Altor Fund II GP Limited to acquire Åkers AB and certain of its affiliated companies. The Purchase Agreement provides for the

payment of aggregate consideration of $80,000,000, subject to certain adjustments, including, but not limited to, a net working capital adjustment.

The information in this Item 7.01 is being furnished and shall not be deemed “filed” for any purpose, including for the purpose

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in this Item 7.01 shall not be incorporated by reference into any

registration statement or any other filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filing, except to the extent set

forth by specific reference in such a filing.

On December 2, 2015, Ampco issued a press release announcing the

signing of the Purchase Agreement. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 8.01, including the information in Exhibit 99.1 hereto, is being furnished and shall not be deemed

“filed” for any purpose, including for the purpose of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. The information in this Item 8.01 shall not be incorporated by reference into any

registration statement or any other filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filing, except to the extent set

forth by specific reference in such a filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits. The following material is filed

as an exhibit to this Current Report on Form 8-K:

|

|

|

| Exhibit

Number |

|

|

|

|

| 99.1 |

|

Press Release dated December 2, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| AMPCO-PITTSBURGH CORPORATION |

|

|

| By: |

|

/s/ Marliss D. Johnson |

|

|

Marliss D. Johnson |

|

|

Chief Financial Officer and Treasurer |

Dated: December 2, 2015

Exhibit 99.1

Contact:

Gail Gerono

Investor Relations

412-561-2762

ggerono@ampcopgh.com

FOR IMMEDIATE RELEASE

CARNEGIE, PA

December 2, 2015

Ampco-Pittsburgh Corporation to Acquire Åkers AB

Carnegie, PA, December 2, 2015 – Ampco-Pittsburgh Corporation (NYSE: AP), today announced that it has entered into a definitive agreement to acquire

Åkers AB and certain of its affiliated companies (excluding Åkers AB’s operations in France and Belgium), from Altor Fund II GP Limited. The acquisition is expected to approximately double the sales of Union Electric Steel

Corporation, a wholly-owned operating subsidiary of Ampco and a leading producer of forged and cast engineered products for the worldwide steel and aluminum industries. The base purchase price of $80 million (which is subject to certain post-closing

adjustments) is payable $30 million in cash, $30 million in the form of a three-year note, and $20 million in shares of Ampco-Pittsburgh common stock. The stock portion of the consideration is subject to certain transfer and other restrictions. It

is expected that this acquisition will be immediately accretive. The closing of the transaction, which is expected to occur in the first quarter of 2016, is subject to regulatory filings and closing conditions.

Åkers AB has been a leader in the production of cast and forged rolls since 1806 and has a strong presence in the industry with sales and technical

support that span the globe. Manufacturing facilities are located in Europe, North America, and China.

“The acquisition of Åkers is a

significant step in Ampco-Pittsburgh’s ongoing diversification and growth. This strategic move complements and strengthens what customers have come to expect from Union Electric Steel — high-performance products, technical service,

responsiveness, and reliability. Åkers’ manufacturing facilities will expand Ampco-Pittsburgh’s global footprint and position Union Electric Steel to offer a complete product offering to better serve customers in every region of the

world,” commented John Stanik, Ampco-Pittsburgh’s Chief Executive Officer.

Fredrik Strömholm, Partner at Altor Equity Partners and Member

of the Board of Directors of Åkers, stated, “We believe that Åkers has a bright future with Ampco-Pittsburgh Corporation, and we look forward to being a part of this next step in the long history of Åkers.”

Ampco-Pittsburgh will host a conference call with the investment community to discuss the announcement on Friday,

December 4th at 10:00 a.m. EST. If you would like to participate in the conference call, please register at www.ampcopgh.com or dial-in using the information below. The conference ID is:

94581406.

Live Event Dial-In Details:

| |

• |

|

Participant Toll-Free Dial-In Number: (877) 267-7197 |

| |

• |

|

Participant International Dial-In Number: +1 (330) 968-0666 |

To ensure timely access, participants should

dial-in approximately 10 minutes before the call starts. A listen-only webcast will be available on Ampco-Pittsburgh Corporation’s website at www.ampcopgh.com.

A replay of the conference call will be available until December 18, 2015, on Ampco-Pittsburgh Corporation’s website at www.ampcopgh.com.

About Ampco-Pittsburgh Corporation

Ampco-Pittsburgh

Corporation, through its operating subsidiaries, is a leading producer of forged and cast rolls for the worldwide steel and aluminum industries as well as ingot and open die forged products for the oil and gas, aluminum, and plastic

extrusion industries. It is also a producer of air and liquid processing equipment, primarily custom-engineered finned tube heat exchange coils, large custom air handling systems and centrifugal pumps. Ampco-Pittsburgh Corporation operates

manufacturing facilities in the United States and the United Kingdom, with sales offices in the United States, United Kingdom, and Belgium. Corporate headquarters is located in Carnegie, Pennsylvania.

About Åkers

Åkers AB is a leading

producer of cast and forged rolls for the steel and aluminum industries. The company was founded in 1580 and roll production commenced in 1806. The company is headquartered in Åkers Styckebruk, Sweden.

About Altor

The Altor Funds (Altor) are private

equity funds. Altor is advised by Altor Equity Partners. Altor invests in companies in the Nordic region with a focus on value creation through growth initiatives, strategic development, and operational improvements.

Advisors

William Blair and Strata Advisory AB acted

as the financial advisors in connection with the pending acquisition of Åkers AB. K&L Gates LLP acted as lead outside legal counsel to Ampco-Pittsburgh with Setterwalls Advokatbyrå AB acting as local transaction counsel in Sweden.

Certain statements in this press release are “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 and may include, but are not limited to, statements about sales levels, restructuring, profitability and anticipated synergies, expenses and cash outflows. All forward-looking statements involve risks

and uncertainties. All statements contained herein that are not clearly historical in nature are forward-looking, and words such as “believe,” “anticipate,” “expect,” “estimate,” “may,”

“will,” “should,” “continue,” “plans,” “intends,” “likely,” or other similar words or phrases are generally intended to identify forward-looking statements. Any forward-looking statement

contained herein, in other press releases, written statements or documents filed with the Securities and Exchange Commission, or in Ampco-Pittsburgh Corporation communications with and discussions with investors and analysts in the normal course of

business through meetings, phone calls and conference calls, regarding expectations with respect to sales, earnings, cash flows, operating efficiencies, product introduction or expansion, the benefits of acquisitions and divestitures or other

matters as well as financings and repurchases of debt or equity securities, are subject to known and unknown risks, uncertainties and contingencies. Many of these risks, uncertainties and contingencies are beyond our control, and may cause actual

results, performance or achievements to differ materially from anticipated results, performance or achievements. Factors that might affect such forward-looking statements, include, among other things, Ampco-Pittsburgh may not be able to successfully

consummate the Åkers acquisition or, if consummated, integrate the Åkers business or such integration may take longer to accomplish than expected; the expected cost savings and any synergies from the acquisition may not be fully realized

within the expected timeframes; disruption from the acquisition may make it more difficult to maintain relationships with customers or suppliers; the required governmental approvals of the acquisition may not be obtained; general economic and

business conditions, demand for Ampco-Pittsburgh’s goods and services, competitive conditions, interest rate and foreign currency rate fluctuations, availability of key raw materials and unfavorable resolution of claims against the Corporation,

as well as those discussed more fully elsewhere in this release and in documents filed with the Securities and Exchange Commission by Ampco-Pittsburgh, particularly our latest annual report on Form 10-K and subsequent filings. Any forward-looking

statements in this release speak only as of the date of this release, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events.

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

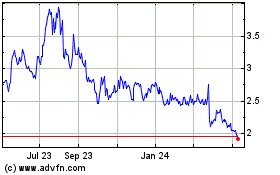

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024