UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) October 30, 2015

AMPCO-PITTSBURGH CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Pennsylvania |

|

1-898 |

|

25-1117717 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

file number) |

|

(I.R.S. Employer

Identification Number) |

|

|

|

|

|

| 726 Bell Avenue, Suite 301, Carnegie PA |

|

15106 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (412) 456-4400

600 Grant Street, Suite 4600, Pittsburgh PA 15219

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.21 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Disclosure of Results of Operations and Financial Condition. |

On October 29,

2015, Ampco-Pittsburgh Corporation issued a press release announcing its results for the three and nine months ended September 30, 2015. A copy of the press release is attached hereto and is being furnished to the SEC.

| Item 9.01. |

Financial Statements and Exhibits |

Exhibit 99.1 – Press release dated October 29, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

| |

|

|

|

AMPCO-PITTSBURGH CORPORATION |

|

|

|

|

| Date: October 30, 2015 |

|

|

|

By: |

|

/s/ Marliss D. Johnson |

|

|

|

|

Marliss D. Johnson |

|

|

|

|

Chief Financial Officer and Treasurer |

CONTACT:

Dee Ann Johnson

Chief Financial Officer and Treasurer

(412) 456-4410

dajohnson@ampcopgh.com

FOR IMMEDIATE RELEASE

CARNEGIE, PA

October 29, 2015

Ampco-Pittsburgh Announces Third Quarter Earnings

Ampco-Pittsburgh Corporation (NYSE: AP) announces sales for the three and nine months ended September 30, 2015 of $58,094,000 and

$183,154,000, respectively, against $65,409,000 and $198,270,000 for the comparable prior year periods. Net (loss) income for the three and nine months ended September 30, 2015 was $(1,511,000) or $(0.14) per share and $(1,959,000) or $(0.19)

per share, respectively, compared to $(343,000) or $(0.03) per share and $856,000 or $0.08 per share for the comparable prior year periods. Loss from operations equaled $(2,357,000) and $(2,661,000) for the three and nine months ended

September 30, 2015, respectively. Income from operations approximated $42,000 and $2,837,000 for the three and nine months ended September 30, 2014, respectively.

Sales and operating results for the Forged and Cast Engineered Products segment for the three and nine months ended September 30, 2015

were less than the comparable prior year periods principally due to a lower volume of traditional roll shipments partially offset by an increase of other forging products. Net sales were also impacted by a lower weighted-average exchange rate used

to translate sales of our UK operations from the British pound sterling to the U.S. dollar. Operating results for the three and nine months ended September 30, 2015 were less than the same periods of the prior year due to the lower volume of

shipments, weaker margins and an under-recovery of costs resulting from lower production levels. Collection of accounts receivables previously written off offset a small portion of the impact from the reduced volume of shipments for the nine month

period ended September 30, 2015. The change in the weighted-average exchange rate did not have a significant impact on operating results for the current quarter or year-to-date period.

Although sales for the Air and Liquid Processing group for each of the periods were slightly less

than the same periods of the prior year, earnings improved primarily due to product mix and cost containment. Specifically, net sales of heat exchange coils declined due to a lower volume of shipments to the fossil-fueled utility and industrial

markets. Net sales of air handling units decreased as a result of low order intake in the latter part of 2014 and first quarter of 2015. Net sales of pumps increased due to a higher volume of shipments of commercial pumps to the power generation

market.

John Stanik, Ampco-Pittsburgh’s Chief Executive Officer commented, “We continue to be negatively affected by our

customers’ market conditions. Our newly-approved strategic plan contemplated this impact and provides action plans which could counter the effect in the future.”

Investor-related Information

The

Corporation will hold its quarterly conference call to review third quarter 2015 results on November 2, 2015 at 10:30 a.m. Eastern Standard Time. Additionally, members of senior management will present a summary of the Corporation’s

three-year Strategic Plan to the investor community at the New York Stock Exchange on November 10, 2015. Please visit our website at www.ampcopgh.com for further information about both of these events.

The Private Securities Litigation Reform Act of 1995 (the “Act”) provides a safe harbor for forward-looking statements made by or on our behalf. This

news release may contain forward-looking statements that reflect our current views with respect to future events and financial performance. All statements in this document other than statements of historical fact are statements that are, or could

be, deemed forward-looking statements within the meaning of the Act. In this document, statements regarding future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels

and plans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “intend,” “believe,” “expect,” “anticipate,” “estimate,” “project,”

“forecast” and other terms of similar meaning that indicate future events and trends are also generally intended to identify forward-looking statements. Forward-looking statements speak only as of the date on which such statements are

made, are not guarantees of future performance or expectations, and involve risks and uncertainties. For Ampco-Pittsburgh, these risks and uncertainties include, but are not limited to, those described under Item 1A, Risk Factors, of

Ampco-Pittsburgh’s Annual Report on Form 10-K. In addition, there may be events in the future that we are not able to predict accurately or control which may cause actual results to differ materially

from expectations expressed or implied by forward-looking statements. Except as required by applicable law, we assume no obligation, and disclaim any obligation, to update forward-looking statements whether as a result of new information, events or

otherwise.

AMPCO-PITTSBURGH CORPORATION

FINANCIAL SUMMARY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September. 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Sales |

|

$ |

58,094,000 |

|

|

$ |

65,409,000 |

|

|

$ |

183,154,000 |

|

|

$ |

198,270,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of products sold

(excl depreciation) |

|

|

48,655,000 |

|

|

|

53,244,000 |

|

|

|

148,896,000 |

|

|

|

158,715,000 |

|

| Selling and administrative |

|

|

8,743,000 |

|

|

|

8,950,000 |

|

|

|

27,314,000 |

|

|

|

27,424,000 |

|

| Depreciation and amortization |

|

|

3,044,000 |

|

|

|

2,941,000 |

|

|

|

9,275,000 |

|

|

|

9,007,000 |

|

| Loss on disposal of assets |

|

|

9,000 |

|

|

|

232,000 |

|

|

|

330,000 |

|

|

|

287,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expense |

|

|

60,451,000 |

|

|

|

65,367,000 |

|

|

|

185,815,000 |

|

|

|

195,433,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income from operations(1) |

|

|

(2,357,000 |

) |

|

|

42,000 |

|

|

|

(2,661,000 |

) |

|

|

2,837,000 |

|

| Other expense – net |

|

|

(2,000 |

) |

|

|

(418,000 |

) |

|

|

(211,000 |

) |

|

|

(388,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income before income taxes |

|

|

(2,359,000 |

) |

|

|

(376,000 |

) |

|

|

(2,872,000 |

) |

|

|

2,449,000 |

|

| Income tax benefit (expense) |

|

|

959,000 |

|

|

|

178,000 |

|

|

|

1,152,000 |

|

|

|

(773,000 |

) |

| Equity loss in Chinese joint venture |

|

|

(111,000 |

) |

|

|

(145,000 |

) |

|

|

(239,000 |

) |

|

|

(820,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(1,511,000 |

) |

|

$ |

(343,000 |

) |

|

$ |

(1,959,000 |

) |

|

$ |

856,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.14 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.19 |

) |

|

$ |

0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

(0.14 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.19 |

) |

|

$ |

0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

10,439,974 |

|

|

|

10,424,287 |

|

|

|

10,433,317 |

|

|

|

10,397,695 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

10,439,974 |

|

|

|

10,424,287 |

|

|

|

10,433,317 |

|

|

|

10,447,739 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

(Loss) income from operations for the nine months ended September 30, 2015 includes a pre-tax curtailment charge of approximately $1,200,000 associated with the partial freezing of the U.S. Defined Benefit Plan

offset by a pre-tax credit of approximately $750,000 relating to the collection of accounts receivable previously written off. |

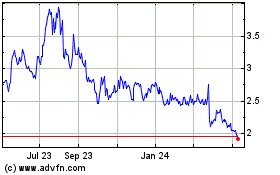

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024