Ampco-Pittsburgh Corporation (NYSE: AP) announces sales for the

three and six months ended June 30, 2015 of $59,973,000 and

$125,060,000, respectively, against $69,949,000 and $132,862,000

for the comparable prior year periods. Net (loss) income for the

three months ended June 30, 2015 and 2014 was $(520,000) or $(0.05)

per share and $1,121,000 or $0.11 per share, respectively, and for

the six months ended June 30, 2015 and 2014 was $(448,000) or

$(0.04) per share and $1,199,000 or $0.12 per share, respectively.

(Loss) income from operations approximated $(806,000) and

$(304,000) for the three and six months ended June 30, 2015,

respectively, against $2,018,000 and $2,795,000 for the same

periods in 2014.

For the Forged and Cast Engineered Products segment, sales and

operating results for the three and six months ended June 30, 2015

were less than the comparable prior year periods principally due to

a lower volume of shipments. Additionally, weaker margins,

particularly for our forged roll company, contributed to the fall

off in earnings as global steel and aluminum customers worked

below capacity, putting pricing pressure on us, their vendors. For

the Air and Liquid Processing group, although sales for each of the

periods were slightly less than the same periods of the prior year,

earnings improved primarily due to product mix and cost

containment.

John Stanik, Ampco-Pittsburgh’s Chief Executive Officer

commented, “Our primary issue in the second quarter was the low

volume of shipments which adversely affected revenue. One of the

greatest challenges for the Corporation continues to be depressed

conditions in the western steel and aluminum markets. Furthermore,

the strong dollar has enabled a significant amount of imported

steel into the United States providing direct competition for our

customers. The same holds true for our European business. The

strength of the British pound has also exacerbated our problems in

Europe as we compete with roll suppliers who utilize a

Euro-currency base. This will affect shipments in future quarters

due to low order intake now.”

“However, we aggressively continued to revitalize the company

during the second quarter. Among many other things, we continued to

reduce costs including a reduction in force within both the salary

and hourly employee groups. Additionally, as has been announced, on

July 29, 2015 we acquired the business and assets of Alloys

Unlimited & Processing, Inc., a supplier of specialty tool,

alloy, and carbon steel round bar, which is a significant step

toward the diversification of our forged and cast product

offerings. Moreover, we made significant progress on our three-year

strategic plan and look forward to sharing our expectations with

the investor community sometime during the fourth quarter.”

The matters discussed herein may contain forward-looking

statements that are subject to risks and uncertainties that could

cause actual results to differ materially from expectations. Some

of these risks are set forth in the Corporation's Annual Report on

Form 10-K as well as the Corporation's other reports filed with the

Securities and Exchange Commission.

AMPCO-PITTSBURGH

CORPORATION

FINANCIAL

SUMMARY

Three Months Ended June 30, Six Months

Ended June 30, 2015

2014 2015

2014

Sales

$ 59,973,000 $

69,949,000 $

125,060,000 $

132,862,000 Cost of products sold (excl

depreciation) 48,197,000 55,408,000 100,241,000 105,471,000 Selling

and administrative 9,175,000 9,469,000 18,571,000 18,475,000

Depreciation 3,089,000 3,008,000 6,231,000 6,066,000 Loss on

disposal of assets

318,000

46,000 321,000

55,000 Total operating expense

60,779,000 67,931,000

125,364,000

130,067,000 (Loss) income from

operations (806,000 ) 2,018,000 (304,000 ) 2,795,000 Other income

(expense) – net

171,000

(88,000 ) (209,000

) 30,000 (Loss)

income before income taxes (635,000 ) 1,930,000 (513,000 )

2,825,000 Income tax benefit (expense) 233,000 (575,000 ) 193,000

(951,000 )

Equity loss in Chinese joint venture

(118,000 )

(234,000 ) (128,000

) (675,000 ) Net

(loss) income

$ (520,000 )

$ 1,121,000 $

(448,000 ) $

1,199,000 (Loss) earnings per common

share: Basic

$ (0.05 )

$ 0.11 $

(0.04 ) $ 0.12

Diluted

$ (0.05 )

$ 0.11 $

(0.04 ) $ 0.12

Weighted-average number of common shares outstanding:

Basic

10,434,156

10,395,154 10,429,933

10,384,178 Diluted

10,434,156 10,448,249

10,429,933

10,436,285

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150730006718/en/

Ampco-Pittsburgh CorporationDee Ann Johnson, 412-456-4410Chief

Financial Officer and Treasurerdajohnson@ampcopgh.com

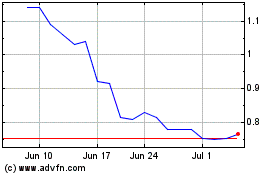

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

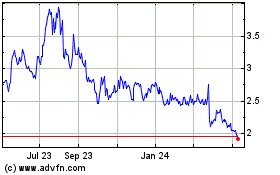

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024