Ampco-Pittsburgh Corporation Announces First Quarter Earnings

May 05 2015 - 4:34PM

Business Wire

Ampco-Pittsburgh Corporation (NYSE: AP) announces sales and net

income for the three months ended March 31, 2015 of $65,087,000 and

$72,000 or $0.01 per common share, respectively, against sales and

net income of $62,913,000 and $78,000 or $0.01 per common share for

the same period in 2014. Income from operations for the first three

months of 2015 of $502,000 compares to $777,000 for the first three

months of 2014. Operating income for 2015 includes a pre-tax

curtailment charge of approximately $1,200,000 associated with a

partial freezing of the U.S. Defined Benefit Plan but benefited

from a pre-tax credit of approximately $750,000 relating to the

collection of accounts receivable previously written off.

For the Forged and Cast Engineered Products segment, sales

increased from a year ago principally due to a higher volume of

shipments of other forging products offset by a decrease in

traditional roll shipments. Operating income improved from a year

ago primarily due to the collection of accounts receivable

previously mentioned. For the Air and Liquid Processing segment,

sales were down slightly from a year ago resulting primarily from a

decline in shipments to the fossil-fueled utility and industrial

markets. Operating income was comparable.

John Stanik, Ampco-Pittsburgh’s Chief Executive Officer

commented, “The curtailment charge related to the partial freezing

of the U.S. Defined Benefit Plan, which is a prudent investment,

and the credit associated with the collection of previously

written-off accounts receivable somewhat cloud the operating

results of the business. Considering the extremely difficult

conditions of the primary markets we serve, I am pleased with our

financial performance.”

“During the first quarter, we made significant strides to

revitalize the Corporation, reduce costs that will bear fruit later

this year and in 2016, and made much progress in our strategic

planning process. While I am concerned about future short-term

revenue because of the ongoing steel industry problems, I am

excited about the progress we have made and the direction of

Ampco-Pittsburgh.”

The matters discussed herein may contain forward-looking

statements that are subject to risks and uncertainties that could

cause actual results to differ materially from expectations. Some

of these risks are set forth in the Corporation's Annual Report on

Form 10-K as well as the Corporation's other reports filed with the

Securities and Exchange Commission.

AMPCO-PITTSBURGH

CORPORATIONFINANCIAL

SUMMARY

Three Months Ended March 31, 2015 2014

Sales

$ 65,087,000 $

62,913,000 Cost of products sold (excl.

depreciation) 52,044,000 50,063,000 Selling and administrative

9,396,000 9,006,000 Depreciation 3,142,000 3,058,000 Loss on

disposal of assets

3,000

9,000 Total operating expense

64,585,000 62,136,000

Income from operations (1) 502,000 777,000 Other

(expense) income – net

(380,000 )

118,000 Income before income

taxes 122,000 895,000 Income tax provision (40,000 ) (376,000 )

Equity losses in Chinese joint venture

(10,000

) (441,000 )

Net income

$ 72,000 $

78,000 Earnings per common share: Basic

$ 0.01 $

0.01 Diluted

$ 0.01

$ 0.01

Weighted-average number of common shares

outstanding:

Basic

10,425,664

10,373,191 Diluted

10,464,088 10,422,880

(1)

2015 includes a pre-tax curtailment charge

of approximately $1,200,000 associated with the

partial freezing of the U.S. Defined

Benefit Plan offset by a pre-tax credit of approximately

$750,000 relating to the collection of

accounts receivable previously written off.

Ampco-Pittsburgh CorporationDee Ann Johnson, 412-456-4410Chief

Financial Officer and Treasurerdajohnson@ampcopgh.com

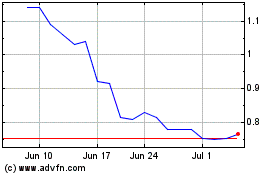

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

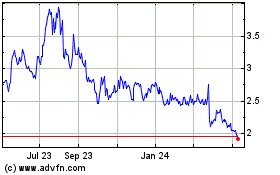

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024