ANF Immobilier Announces the Sale of Two Hotels in Lyon and Marseille

January 23 2017 - 2:15AM

Business Wire

The proceeds of the sale of these assets has

been reinvested in order to reinforce the Group's strategy

Regulatory News:

ANF Immobilier (Paris:ANF) announced the sale of two hotels

located in Lyon and Marseille, finalized on December 21, 2016.

The Carlton Lyon hotel is located on Place de la République.

Under the MGallery banner, the 80-room hotel was fully renovated in

2012. The ANF Immobilier Group had been the hotel's owner since

2008. The Adagio hotel in Marseille is located on Rue Trinquet.

Under the Adagio Aparthotel banner and delivered in 2009, the

establishment has 142 rooms.

These hotels were sold by ANF Immobilier Hôtels “AIH”, a

subsidiary of ANF Immobilier, Eurazeo and Caisse d’Epargne Provence

Alpes-Corse, to SCPI Laffitte PIERRE (NAMI - AEW Europe). The sale

resulted in a premium of €0.2 per share over the Net Asset Value of

ANF Immobilier at June 30, 2016.

The proceeds of the sale of the hotels was reinvested on January

1, 2017 in the joint acquisition, by ANF Immobilier and CEPAC, of

Eurazeo's stake in ANF Immobilier Hôtels. ANF Immobilier thus

increased its stake in ANF Immobilier Hôtels from 51 to 77%. This

operation fits into ANF Immobilier's investment optimization

strategy, which aims to sell mature or valued-enhanced assets and

replace them with new assets with higher yields.

Following the acquisition of the stake in ANF Immobilier Hôtels,

the portfolio now comprises 11 hotels totaling 1,212 rooms, half of

which were delivered in 2015 or 2016 (604 rooms spread across 5

hotels in Marseille, Bègles and Bobigny). The Bordeaux Quai-8.2

hotel – an asset still under construction in the city's new

Euratlantique district – will be among these new assets in

2018.

Ghislaine Seguin, Deputy Chief Operating Officer of ANF

Immobilier made the following statement: "This announcement

demonstrates, once again, our expertise and our know-how in hotel

investment and development optimization. Indeed, the yield spread

between the mature real estate assets sold and the new ones reveals

a compression in rates exceeding 2%. Our strategy is paying

off”.

Counsels:Seller's Notary: Etude Pineau-PeschardBuyer's Notary:

Etude ChevreuxTransaction counsel for the buyer: Gowling

WLGTransaction counsel for the seller: JLL Hôtels

About ANF Immobilier 2017 Annual Results

March 9, 2017 General Meeting May 10,

2017 Results for the 1st quarter 2017 May 10,

2017

ANF Immobilier (ISIN FR0000063091) is a French listed real

estate investment company which owns a diversified portfolio of

French office, retail, hotel and residential property worth €1.1

billion. The Company is transforming and is oriented toward

commercial properties, value creation and the growth of dynamic

regional metropolises. It currently has offices in Bordeaux, Lyon

and Marseille. Listed on Eurolist B of Euronext Paris and included

in the EPRA real estate index, ANF Immobilier is a company of the

Eurazeo Group.

http://www.anf-immobilier.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170122005200/en/

ANF ImmobilierLaurent Milleron, +33 1 44 15 01

11investorrelations@anf-immobilier.comorPress:Renaud

Large, +33 1 58 47 96 30renaud.large@havasww.com

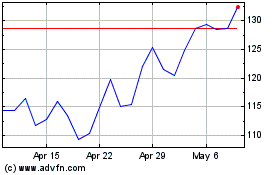

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Mar 2024 to Apr 2024

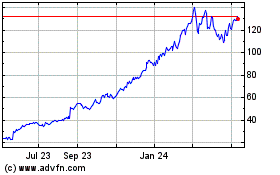

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Apr 2023 to Apr 2024