Development of a programme comprising

offices, hotels, retail units and student accommodation by ANF

Immobilier and VINCI Immobilier

Investment by ANF Immobilier and Foncière

des Régions in all of the offices and retail units, i.e.

31,500 m²

Regulatory News:

ANF IMMOBILIER (Paris:ANF):

The Quai Ilot 8.2 real estate project in Bordeaux is located in

the heart of the Armagnac business hub, planned by the

Etablissement Public d’Aménagement (urban planning public

institution) Bordeaux Euratlantique, close to the forthcoming

high-speed railway station due to be inaugurated in 2017, which

will link Bordeaux to Paris in two hours. It comprises 29,500 m² of

offices, 3,000 m² of retail space, 2 hotels totalling 237 rooms and

a student residence with 125 units, over a total area of 43,000

m².

The land was acquired from Bordeaux Euratlantique by the

promoters ANF Immobilier (50%) and VINCI Immobilier (50%).

Construction started in early September and delivery of the

completed project is foreseen in 2018. This ambitious and

attractive project was designed by the architects Reichen et

Roberts & Associés, Ateliers 2/3/4 and MCVD.

The 43,000 m² project is aiming for both HQE "Excellent" and

BREEAM "Very Good" certification.

An alliance of skills on a large-scale project in the

Bordeaux metropolitan area:

ANF Immobilier, a commercial property investor operating in

Bordeaux, Lyon and Marseille, VINCI Immobilier, a major player in

property promotion in France, and Foncière des Régions, a key

investor and developer in Europe, have teamed up to combine their

expertise on this project.

In late August 2016, ANF Immobilier, as investor, signed a

partnership with Foncière des Régions to acquire offices and retail

units. The two partners acquired these properties off-plan, 30%

pre-let to Orange and Allianz Vie through 9-year firm leases. ANF

Immobilier and Foncière des Régions will retain 65% and 35% of the

investment respectively.

In addition, ANF Immobilier Hotels, a partnership between ANF

Immobilier (51%), Eurazeo (35%) and Caisse d’Epargne Provence-Alpes

Corse (14%), acquired the 126-room 3-star hotel with a commitment

from the operator B&B. The 4-star hotel (111 rooms) will be

operated by the Golden Tulip brand.

Lastly, the student residence will be managed by Student

Factory, a subsidiary of VINCI Immobilier.

The acquisition of the offices, retail units and 3-star hotel

was carried out with financing from Caisse d’Epargne

Provence-Alpes-Corse, Crédit Foncier de France and Caisse d’Epargne

Aquitaine Poitou-Charentes.

Consultants:Transaction: BNP

Paribas, Tourny MeyerLawyers: the firms Fairway, De Pardieu, Kramer

Levin, CMS Lefebvre, and FidalNotarial offices: Wargny Katz,

Uguen/Vidalenc et Associés, Reberat Brandon Leroux Ellenbogen

Lauret

About ANF Immobilier

Financial Agenda 2016

Publication of Q3 216 revenues10 November 2016 (before market

opening)ANF Immobilier (ISIN FR0000063091) is a French listed real

estate investment company which owns a diversified portfolio of

French office, retail, hotel and residential property worth €1,082

million. The Company is transforming and is oriented toward

commercial properties, value creation and the growth of dynamic

regional metropolises. It currently has offices in Bordeaux, Lyon

and Marseille. Listed on Eurolist B of Euronext Paris and included

in the EPRA real estate index, ANF Immobilier is a company of the

Eurazeo Group.http://www.anf-immobilier.com

Foncière des Régions, co-author of real estate

stories

As a key player in real estate, Foncière des Régions has built

its growth and its portfolio on the key and characteristic value of

partnership. With a total portfolio valued at €18Bn (€12Bn in group

share), located in the high-growth markets of France, Germany and

Italy, Foncière des Régions is now the recognised partner of

companies and territories which it supports with its two-fold real

estate strategy: adding value to existing urban property and

designing buildings for the future.

Foncière des Régions mainly works alongside Key Accounts

(Orange, Suez Environnement, EDF, Dassault Systèmes, Thales,

Eiffage, etc) in the Offices market as well as being a pioneering

and astute operator in the two other profitable sectors of the

Residential market in Germany and Hotels in Europe.

www.en.foncieredesregions.fr and follow us on Twitter

@fonciereregions

About VINCI Immobilier

VINCI Immobilier, a subsidiary of the VINCI Group, is one of the

principal players in property promotion in France. With operations

in some 15 cities including Paris and the French regions, VINCI

Immobilier covers the two main market segments: residential

property (housing and managed accommodation) and commercial

property (offices, hotels, retail), thus providing services to

investors, institutions and individuals. VINCI Immobilier also

provides its customers with its consulting and building management

expertise through its "services" division. Thanks to its

multi-product offering and its expertise in carrying out large

complex projects, VINCI Immobilier works with local authorities to

carry out their urban improvement projects and is thereby involved

in developing urban areas.

www.vinci-immobilier.comtwitter.com/vinciimmobilier

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160928006574/en/

ANF ImmobilierLaurent Milleron, +33 1 44 15 01

11investorrelations@anf-immobilier.comorPress:Renaud

Large, +33 1 58 47 96 30renaud.large@havasww.comorFoncière

des Régions:Press RelationsGéraldine Lemoine, +33

1 58 97 51 00geraldine.lemoine@fdr.frorLaetitia Baudon, + 33

1 44 50 58 79laetitia.baudon@shan.frouInvestor

RelationsPaul Arkwright, +33 1 58 97 51 85paul.arkwright@fdr.frorVINCI

Immobilier:Press RelationsVanessa Lattès, +33 1

55 38 79 40vanessa.lattes@vinci-immobilier.com

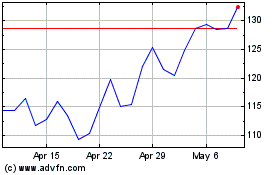

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Mar 2024 to Apr 2024

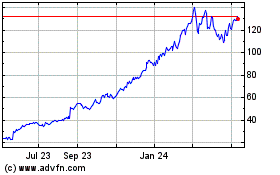

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Apr 2023 to Apr 2024