Abercrombie Profit Jumps on Fewer Discounts

November 20 2015 - 8:10AM

Dow Jones News

Abercrombie & Fitch Co. showed progress in its efforts to

revamp its brand and wean its customers off heavy discounts,

helping the teen retailer post a higher quarterly profit.

Profit more than doubled to $42.3 million in the three months

through Oct. 31, from $18.2 million a year ago.

Sales declined 4% to $878.6 million but were flat excluding

currency fluctuations. Sales excluding newly opened or closed

stores decreased 1%. By that measure, sales were down 5% at the

company's namesake chain, but they were up 3% at Hollister, the

first time that brand has grown same-store sales since January

2012.

Arthur Martinez, Abercrombie's executive chairman, said in an

interview that the results were driven by "a conscious strategy to

wean ourselves off heavy levels of promotions."

"Consumers responded to our full-priced products, and we were

able to reduce the number and intensity of promotions," Mr.

Martinez said. As a result, the gross margin rate increased to

63.7% in the quarter from 62.2% a year ago.

The New Albany, Ohio-based company, which operates more than 900

stores, is trying to refashion its image after its former strategy

of using sex-tinged marketing and an exclusive mind-set to fuel

demand wore thin with consumers.

Shoppers, particularly women, responded to new looks at

Hollister, which included tops with more color, design and fashion,

Mr. Martinez said. He added that Abercrombie continues to struggle

with male shoppers in the U.S., where its image has come under fire

in recent years.

"We are working to reverse trends that were in place for a

relatively long time," Mr. Martinez said.

The company expects sales excluding newly opened or closed

locations to be flat in the fourth quarter, an improvement from

last year, when they fell 10%. Abercrombie's same-store sales have

declined for more than seven quarters.

Still, Mr. Martinez sounded a cautious note on the year-end

holiday season.

"Given that some of our mall-based competitors have seen

inventory back up, our expectation is that the promotional drumbeat

is going to be very intense," he said.

Gap Inc. on Thursday cut its profit projection for the year as

the chain continues to revamp its namesake brand. Gap reported a 2%

decline in same-store sales for the third quarter, including a 12%

decline in its Banana Republic stores.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 20, 2015 07:55 ET (12:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

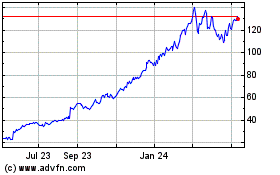

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Mar 2024 to Apr 2024

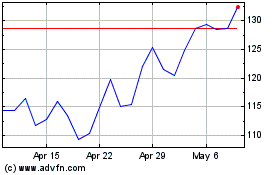

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Apr 2023 to Apr 2024