ANF Immobilier Revenue Q3 2015

November 12 2015 - 2:05AM

Business Wire

Regulatory News:

The 2015 revenue target is confirmed

with 27.5% growth over nine months as rental income is buoyed by

planned acquisitions coming on stream

- Delivery of the largest project of the

year, 36,900 sq.m. of office space in the Carré de Soie district of

Lyon, generating €6.3 million in additional gross annual rental

income from July 1, 2015

- Revenues were up 27.5% in the first

three quarters of 2015: +1.4% on existing properties and +26.1%

from acquisitions

- Commercial real estate now accounts for

82% of ANF Immobilier's rental income, in line with its portfolio

rotation strategy

ANF Immobilier (Paris:ANF) revenues were up significantly

in the first three quarters of 2015, buoyed by a strong investment

strategy. The delivery of 36,900 sq.m. of office space in Lyon,

leased to Alstom, marked another stage of ANF Immobilier's

transformation. Rental incomes totaled €36.3 million, rising from

€28.6 million at September 30, 2014, up 27.5% over the first nine

months of the year.

Of this growth, 1.4% was due to an increase in rental income

from existing properties (on a like-for-like basis) resulting from

the combined effect of the coming on stream of the Ilot 34 project

in Marseille, now fully leased, the delivery of new furnished

housing in Marseille and the increase in variable rental income

from a hotel in Lyon, offset by the decrease in rental income from

retail premises in Marseille (2 units in the process of being

refurbished).

The additional 26.1% growth was rental income from acquisitions.

Over the first three quarters of 2015, this increase was mainly the

result of:

- the acquisition, in late 2014, of

36,000 sq.m. of office space in the Part-Dieu district of

Lyon (+€5.5 million);

- the delivery, in June 2015, of 36,900

sq.m. of office space in the Carré de Soie district of

Lyon (+€1.7 million);

- the delivery, recognized at the end of

2014, of 6,000 sq.m. of office space in the Bassins-à-Flot district

of Bordeaux (+€0.7 million).

Gross rental income 09/30/2015 Change Change

9/30/2014 (Published data, € million Acquisitions

Like-for-like € million IFRS in millions of Disposals euros)

Offices

17.5 97.8% 5.9% 8.6 Retail premises 8.6

-0.4% -7.4% 9.4 Housing 5.3

-4.3% 2.0% 5.4 Hotels 3.6 -17.3%

12.4% 3.8 Other (car parks) 1.3 -2.0%

0.3% 1.3 TOTAL 36.3 26.1% 1.4%

28.6

Rental income breaks down into 48% offices, 24% retail, 15%

residential and 10% hotels with the remainder comprising other

types of land use, mainly car parks. Commercial real estate now

accounts for 82% of the real estate company's rental income.

Outlook

ANF Immobilier is consolidating its strategy, built on three

separate pillars: targeting the most dynamic regional cities,

refocusing on commercial real estate and developing high

value-added projects. It is continuing its investment program with

€94 million invested over the first three quarters and a pipeline

of €230 million in secured transactions (€135 million group share)

which will be delivered between the second half of 2015 and

2017/2019. In order to sustain its growth, ANF Immobilier is

pursuing strategic partnerships such as the one signed with Crédit

Agricole Assurances at the beginning of the year, and targeted

disposals of its historical portfolio.

Current major projects include the Armagnac project in Bordeaux

with 46,000 sq.m. of mixed use space located in the Euratlantique

district, phased delivery of which is expected between 2017 and

2019, and the Banque de France project in Lyon, started in 2013,

delivery of which is scheduled for early 2016.

Thanks to its strong position in commercial real estate

regeneration in regional cities, ANF Immobilier raised its rental

income growth target for the current year to 15% in July 2015. The

positive quarterly figures support this objective.

Financial calendar2015

Annual ResultsMarch 22, 2016 (before the start of

trading)Publication of 2016 Revenues for Q1 2016May 11, 2016

(before the start of trading)Shareholders’ MeetingMay 11, 2016

About ANF Immobilier

ANF Immobilier (ISIN FR0000063091) is a French listed real

estate investment company which owns a diversified portfolio of

office, retail, hotel and residential property worth €1,165

million. It is currently undergoing a major transformation to

concentrate on commercial real estate, and aims to invest in the

regions and promote regional cities. It currently has assets in

Bordeaux, Lyon and Marseille. Listed on Eurolist B of Euronext

Paris and included in the EPRA real estate index, ANF Immobilier is

a company of the Eurazeo Group.

http://www.anf-immobilier.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151111006610/en/

ANF ImmobilierLaurent Milleron, +33 1 44 15 01

11investorrelations@anf-immobilier.comorPress:Perrine

Piat, +33 1 58 47 94 66perrine.piat@havasww.com

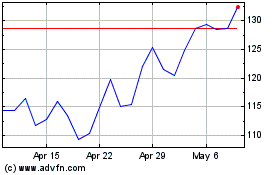

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Mar 2024 to Apr 2024

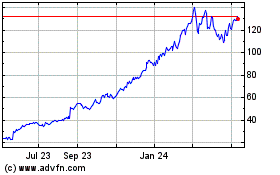

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Apr 2023 to Apr 2024