American Eagle Outfitters Earnings Soar

August 19 2015 - 9:50AM

Dow Jones News

American Eagle Outfitters Inc. reported a stronger-than-expected

profit in its latest quarter as revenue jumped 12%.

Teen retailers such as American Eagle and rivals like

Abercrombie & Fitch Co. have been trying to revive sales after

a long slump. The sector has faced tough competition from

fast-fashion retailers including Forever 21 and H&M that offer

the latest styles at lower prices.

For the quarter ended Aug. 1, American Eagle reported a profit

of $33.3 million, or 17 cents a share, up from $5.8 million, or

three cents a share, a year earlier. The company's earnings

benefited from a favorable income tax settlement that contributed

about $2.5 million.

The company had expected per-share earnings between 11 cents and

14 cents.

Revenue increased to $797.4 million, above analysts'

expectations for $770 million.

Sales excluding newly opened or closed locations rose 11%,

compared with a 7% decrease last year.

For the current quarter, the retailer said it expects adjusted

earnings of 28 cents to 31 cents a share, and comparable sales

growth in the mid single-digit range.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 19, 2015 09:35 ET (13:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

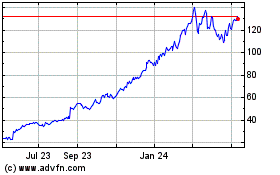

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Mar 2024 to Apr 2024

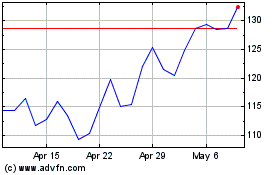

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Apr 2023 to Apr 2024