By Jeffrey Sparshott

A sharp pullback in business investment and weak global demand

dragged down an already-lackluster U.S. economy in the opening

months of 2016, the latest setback in a bumpy expansion entering

its seventh year.

Consumers and the housing market kept the U.S. from sliding

backward, though only barely. Gross domestic product, the broadest

measure of economic output, advanced at a 0.5% seasonally adjusted

annual rate in the first quarter, the Commerce Department said

Thursday. That marked the economy's worst performance in two

years.

Corporate executives and economists say turmoil across global

financial markets in the opening weeks of the year may have

restrained U.S. economic activity, with conditions improving

somewhat after the Federal Reserve scaled back its expectations for

rate increases and commodity prices began stabilizing.

"While all is not well with the U.S. economy, neither is the

economy as moribund as the print on the first-quarter GDP report

implies," said Richard Moody, chief economist at Regions Financial

Corp. "Consumer spending and housing will provide the main support

going forward."

Slow first quarters followed by a rebound have been common in

recent years, leaving hope for better months ahead. The U.S.

economy contracted in the opening quarter of 2014 and barely grew

at the outset of 2015, only to bounce back and leave the economy on

the same staid trajectory seen during much of the expansion. For

all of 2015, GDP advanced 2.4%, the same as 2014.

Yet stronger global headwinds over the past year have served as

an added restraint. Among the forces working against the U.S.

expansion in recent months: Tepid demand from overseas and a strong

dollar have led to a drop in exports, subtracting from growth.

Cheap oil, meanwhile, has thrown business spending into disarray.

Outlays for mining exploration and wells contracted the most on

record in the first quarter.

The latest worry about the global outlook came Thursday when the

Bank of Japan surprised many investors by declining to launch fresh

stimulus measures despite a weak economic outlook. The BOJ and the

European Central Bank have been among the institutions pushing

interest rates into negative territory to boost their economies,

moves that had weakened their currencies and pushed the dollar

higher.

The Fed hasn't budged on interest rates since December, when it

raised its benchmark for the first time in nearly a decade. Fed

officials initially expected to raise interest rates by a full

percentage point this year, but in March downgraded their

expectation to just half a percentage point amid the global

economic turbulence.

After its latest meeting concluded Wednesday, the central bank

highlighted the domestic economy's mixed signals and remained

ambiguous about whether it would move its rate target from a range

of 0.25% to 0.5% in June.

Despite the cause for concern, the outlook isn't entirely bleak.

For example, business investment in computers, software, research

and development and nonenergy structures all rose during the first

quarter.

"In the U.S., just about any market that is away from oil is

doing pretty good," Doug Oberhelman, chairman and chief executive

of Caterpillar Inc., said last week.

Housing has been a particular bright spot, buoyed by low

interest rates and strong demand as more Americans find jobs.

Spending on residential investment, such as new-home construction

and home remodeling, climbed 14.8% in the first quarter, the

fastest pace since the end of 2012.

"All the macroeconomic indicators that we look at for our

business are all green," said Todd Bluedorn, chairman and CEO of

Lennox International Inc., a manufacturer of heating and cooling

systems. "So I think consumers are ready to spend money."

The labor market has been especially robust. U.S. payrolls have

grown by an average of 234,000 a month over the past year, layoffs

are near their lowest level in more than 40 years and wages are

showing some signs of acceleration.

"Do we expect the U.S. economy to perform at higher growth rates

in the quarters ahead? We do," Arne Sorenson, president and CEO of

Marriott International Inc., said Thursday. "It seems reasonably

clear that sentiment was profoundly negative early in this year and

that it has improved significantly since January."

Still, while the first-quarter slowdown was predicted and a

second-quarter rebound is expected, it isn't assured. GDP growth

has deteriorated steadily since hitting a 3.9% pace in the second

quarter of 2015. The economy expanded at a 2% pace in the third

quarter and 1.4% in the fourth quarter of last year.

Consumer spending, which accounts for more than two-thirds of

economic output, has been decelerating for three consecutive

quarters. Relatively low gasoline prices and steady job gains

apparently haven't been enough to spur consumers to splurge instead

of save.

Taken together, those trends have crimped corporate profits. The

S&P 500 is likely to mark a third consecutive quarter of

declining earnings, the longest streak since the financial

crisis.

Business at Vermeer Corp. reflects some of the broader forces

playing out across the global economy. The Pella, Iowa, firm

manufactures equipment used in agriculture and mining, two sectors

buffeted by a precipitous fall in commodity prices.

The company's exports have been crimped by a strong dollar and

slow growth overseas. But domestic demand for machinery used in

waste processing, utility work and home landscaping remains robust

alongside steady gains for the housing market. That should allow

the family-owned firm to remain on steady footing as the economic

ground beneath continues to shift, said Jason Andringa, Vermeer's

president and CEO.

But expectations remain subdued. "I don't think we aspire to

more than moderate growth at this point," Mr. Andringa said.

Write to Jeffrey Sparshott at jeffrey.sparshott@wsj.com

(END) Dow Jones Newswires

April 28, 2016 18:20 ET (22:20 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

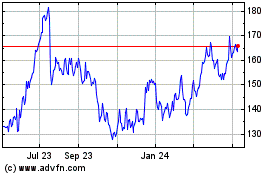

AutoNation (NYSE:AN)

Historical Stock Chart

From Mar 2024 to Apr 2024

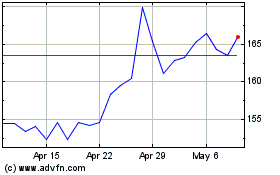

AutoNation (NYSE:AN)

Historical Stock Chart

From Apr 2023 to Apr 2024