Amé rica Mó vil Posts Loss on Weak Currencies

October 19 2015 - 8:40PM

Dow Jones News

MEXICO CITY—Mexican telecommunications company Amé rica Mó vil

SAB reported a net loss for the third quarter as the sharp

depreciation of the Mexican peso and the Brazilian real against the

U.S. dollar led its financial costs to increase almost

fourfold.

The company controlled by billionaire Carlos Slim registered a

net loss of 2.88 billion pesos ($175 million) in the July-September

period, compared with a net profit of 12.62 billion pesos in the

year-earlier quarter.

"The foreign exchange losses incurred have not had an impact on

cash flows. They partly originate in intercompany financing

positions," Amé rica Mó vil said in a release. The foreign exchange

loss of 45.11 billion pesos was partly offset by a drop in other

financial expenses.

Revenue in the quarter rose 1.2 % to 223.6 billion pesos, while

operating cash flow measured by earnings before interest, taxes,

depreciation and amortization, or Ebitda, fell 8.2% to 66.73

billion pesos.

The company's wireless subscriber base decreased by 401,000 in

the quarter as disconnections of customers in Brazil, Ecuador and

Colombia were partially countered by new subscribers in Mexico,

Central America, Argentina and Chile.

Amé rica Mó vil ended the quarter with 288.4 million wireless

subscribers, up 1% from a year earlier. It also had 34.9 million

fixed lines with 23.4 million broadband subscribers and 21.6

million pay TV subscribers.

Except for revenue, the results were below expectations. The

company had been expected to report net profit of 9.2 billion pesos

on sales of 220.7 billion pesos, with Ebitda of 69.3 billion pesos,

according the median estimate of nine equities analysts polled by

The Wall Street Journal.

August marked a year since Mexican mobile unit Telcel was

required to complete incoming calls from competitors without

charge, while still paying to connect outgoing calls to their

networks. The asymmetric regulations on the dominant carrier,

imposed under new telecommunications laws, were among reasons that

encouraged U.S. giant AT&T Inc. to move into Mexico this year

with the purchase of two smaller mobile operators.

Amé rica Mó vil said that both AT&T and Spain's Telefó nica

are "drumming up their investment efforts and presence in the

market," and that Amé rica Mó vil "should not be in a position to

subsidize our competitors by way of asymmetric interconnection

rates and other regulatory asymmetries."

The company also renewed its call to be allowed to offer pay TV

service in Mexico, from which is has been barred.

Amé rica Mó vil shares closed up 2.2% Monday at 14.57 pesos

ahead of the report's release but are down 10% in the past 12

months.

Write to Anthony Harrup at anthony.harrup@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 19, 2015 20:25 ET (00:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

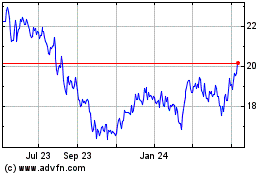

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Apr 2023 to Apr 2024