American Tower Income Sags on Tax Pressure

February 27 2017 - 8:57AM

Dow Jones News

By Ezequiel Minaya

American Tower Corp. said Monday that income slipped slightly in

its latest quarter amid pressure from taxes though revenue jumped

some 20%.

In the fourth quarter, income tax provisions more than double to

be a $60.8 million drag on the bottom line.

For the current fiscal year, the company said it expects net

income between $1.18 billion and $1.25 billion, compared with the

$1.20 billion expected by analysts surveyed by Thomson Reuters. For

the year, the company expects its total property revenue between

$6.21 billion and $6.39 billion, compared with the $5.71 billion

posted in 2016.

Shares of the company inched up 0.10% in premarket trading to

$113.00

For the full year, the Boston company spent $1.4 billion to

acquire over 43,000 communications sites, mostly in international

markets.

The Boston company leases, owns or operates some 147,000

communication towers in the U.S. and other countries.

During its most-recent quarter, revenue in the company's

property segment increased 21.6% to $1.52 billion, which was

partially offset by a 58.9% slide to $18.2 million in the services

business.

For the quarter ended Dec. 31, the company posted a profit of

$202.4 million, or 47 cents a share, down from $205.9 million, or

48 cents a share, a year ago.

Revenue climbed 20.3% to $1.54 billion.

Analysts had forecast 58 cents in per-share earnings on revenue

of $1.54 billion.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

February 27, 2017 08:42 ET (13:42 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

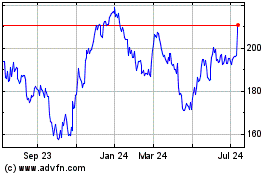

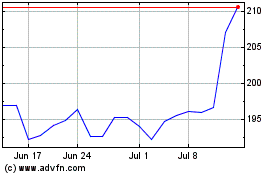

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024