ATC Europe Announces Acquisition of FPS Towers in France

December 19 2016 - 8:00AM

Business Wire

American Tower Corporation (NYSE:AMT) and Dutch pension

fund manager PGGM today announced their entry into a definitive

agreement to acquire FPS Towers, which owns and operates

approximately 2,400 wireless tower sites across France, through

their previously announced joint venture, ATC Europe. American

Tower and PGGM expect to fund the equity portion of the transaction

proportionally to their interests in the joint venture. American

Tower expects to fund the debt portion.

“We are pleased to be continuing our partnership with PGGM by

acquiring FPS Towers, which owns an attractive portfolio of French

wireless telecommunications real estate assets,” said James D.

Taiclet, Jr., American Tower’s Chairman, President and Chief

Executive Officer. “Through this transaction, we expect to elevate

the growth profile of our European operations by entering into a

new market with attractive wireless tower leasing opportunities and

solid long-term growth prospects, while generating immediate

accretion to our AFFO per share.”

Commenting on the transaction, Erik van de Brake, head of

Infrastructure at PGGM, stated, “We are very pleased to expand our

partnership with American Tower to include FPS Towers, which

further enhances PGGM’s ability to invest pension money into the

real economy on behalf of its clients. The FPS towers are part of

an essential infrastructure for mobile communication and this

long-term investment is supporting the European economy and will

bring good and stable returns to the participants of the funds

whose capital we are managing.’’

The transaction is expected to close in the first quarter of

2017, subject to consultation with FPS Towers’ employee

representative body, certain closing conditions and regulatory

approval. HSBC is acting as financial advisor to ATC Europe.

Additional information regarding the transaction can be found on

the American Tower website under the Investor Relations tab.

About American Tower

American Tower, one of the largest global REITs, is a leading

independent owner, operator and developer of multitenant

communications real estate with a portfolio of over 144,000

communications sites. For more information about American Tower,

please visit www.americantower.com.

About PGGM

PGGM is a cooperative Dutch pension fund service provider.

Institutional clients are offered: asset management, pension fund

management, policy advice and management support. On June 30, 2016,

PGGM had EUR 200.2 billion in assets under management. Either alone

or together with strategic partners, PGGM develops future solutions

by linking together pension, care, housing and work.www.pggm.nl

Cautionary Language Regarding Forward-Looking

Statements

This press release contains statements about future events and

expectations, or “forward-looking statements,” all of which are

inherently uncertain. We have based those forward looking

statements on management’s current expectations and assumptions and

not on historical facts. Examples of these statements include, but

are not limited to, statements regarding the proposed closing

of the transaction described above and its anticipated impact on

our consolidated results. These forward-looking statements involve

a number of risks and uncertainties. For important factors that may

cause actual results to differ materially from those indicated in

our forward-looking statements, we refer you to the information

contained in Item 1A of American Tower’s Form 10-K for the

year ended December 31, 2015, under the caption “Risk Factors” and

in other filings American Tower makes with the Securities and

Exchange Commission. American Tower undertakes no obligation to

update the information contained in this press release to reflect

subsequently occurring events or circumstances.

AFFO is a non-GAAP financial measure. For more information, see

American Tower’s Form 10-Q for the quarter ended September 30,

2016 under the captions “Management’s Discussion and Analysis of

Financial Condition and Results of Operations – Non-GAAP Financial

Measures” and “– Results of Operations.” Additionally, AFFO per

share is a non-GAAP measure, and is defined as AFFO divided by the

diluted weighted average common shares outstanding.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161219005574/en/

American Tower Investor Relations Contact:Leah Stearns,

617-375-7500Senior Vice President, Treasurer and Investor

RelationsorPGGM Corporate Communications:Maurice Wilbrink, +31 30

277 1500Maurice.wilbrink@pggm.nl

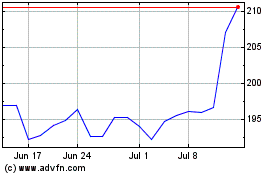

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

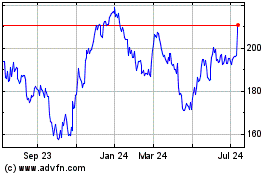

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024